Yield Farming Strategy: How To Defend Your Position using @nansen_ai Smart Alerts?

🧵👇🏼

🧵👇🏼

2/ Once you are exposed to the pool, there are now multiple things that can affect your pnl

- Token price (If pool2)

- Smart contract exploits

- Reward token price

- Token price (If pool2)

- Smart contract exploits

- Reward token price

3/ We will focus this chapter on token price exposure. Both the token used to farm, and the reward token.

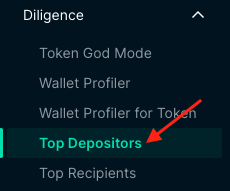

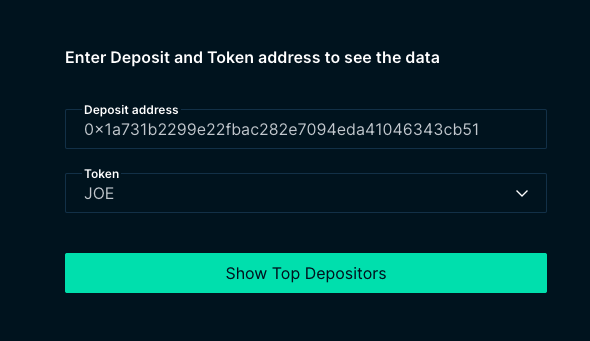

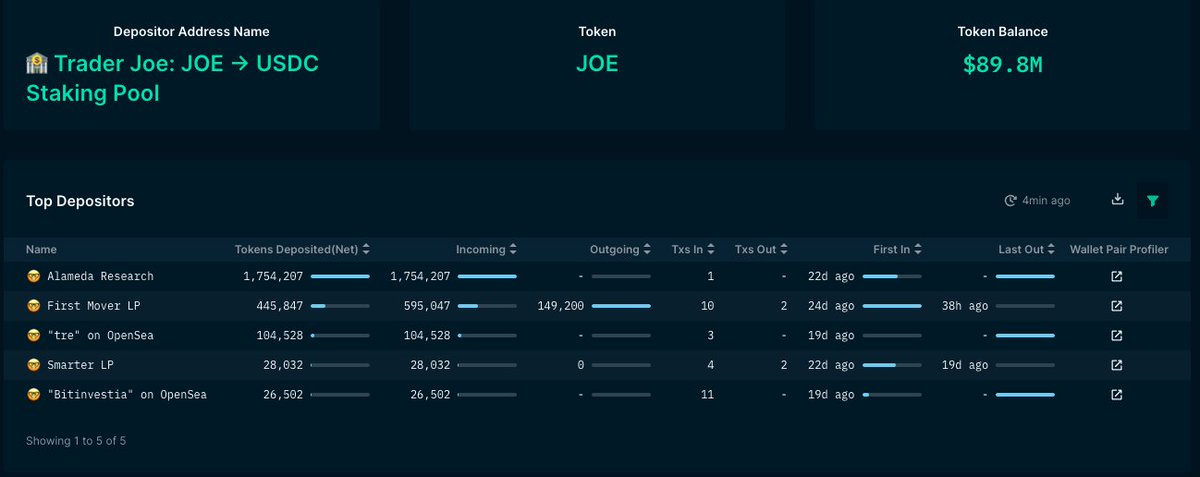

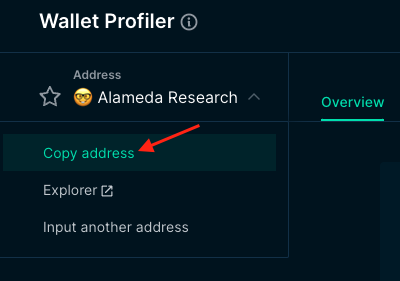

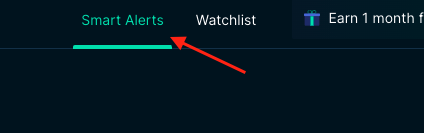

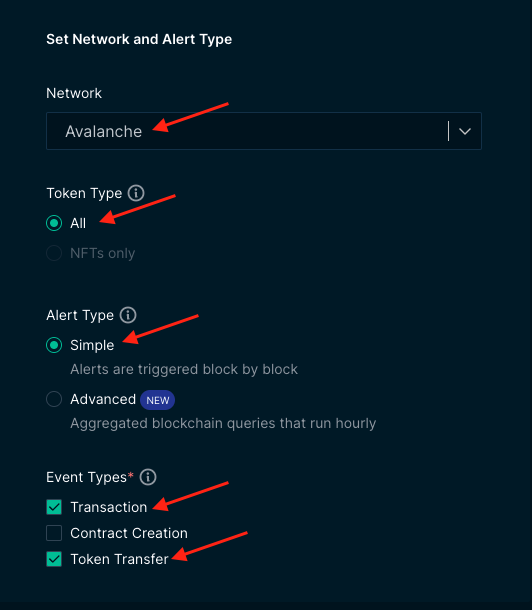

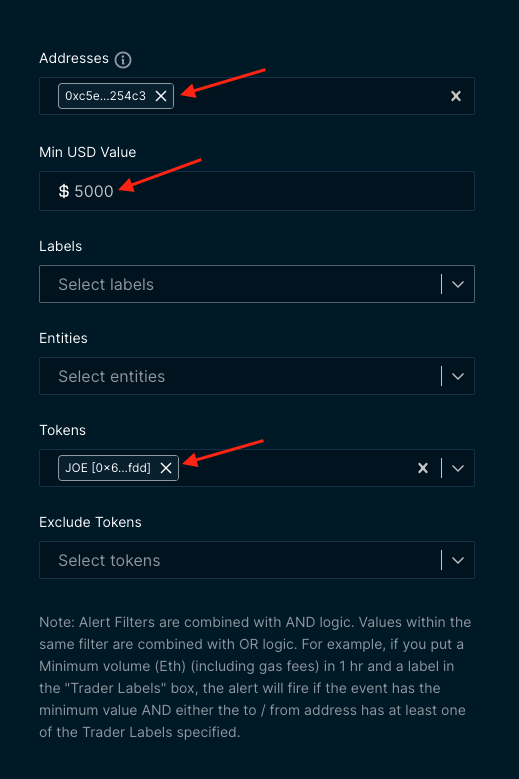

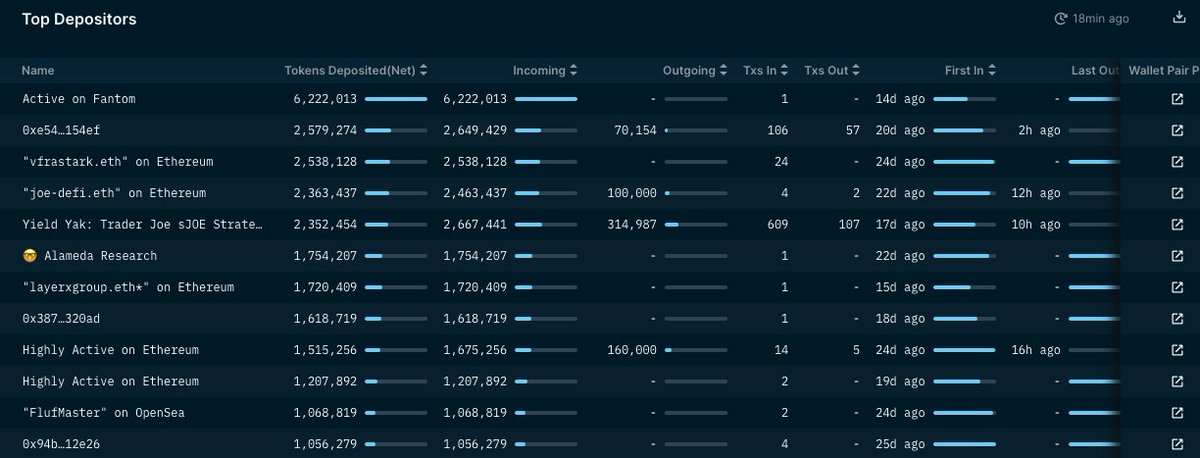

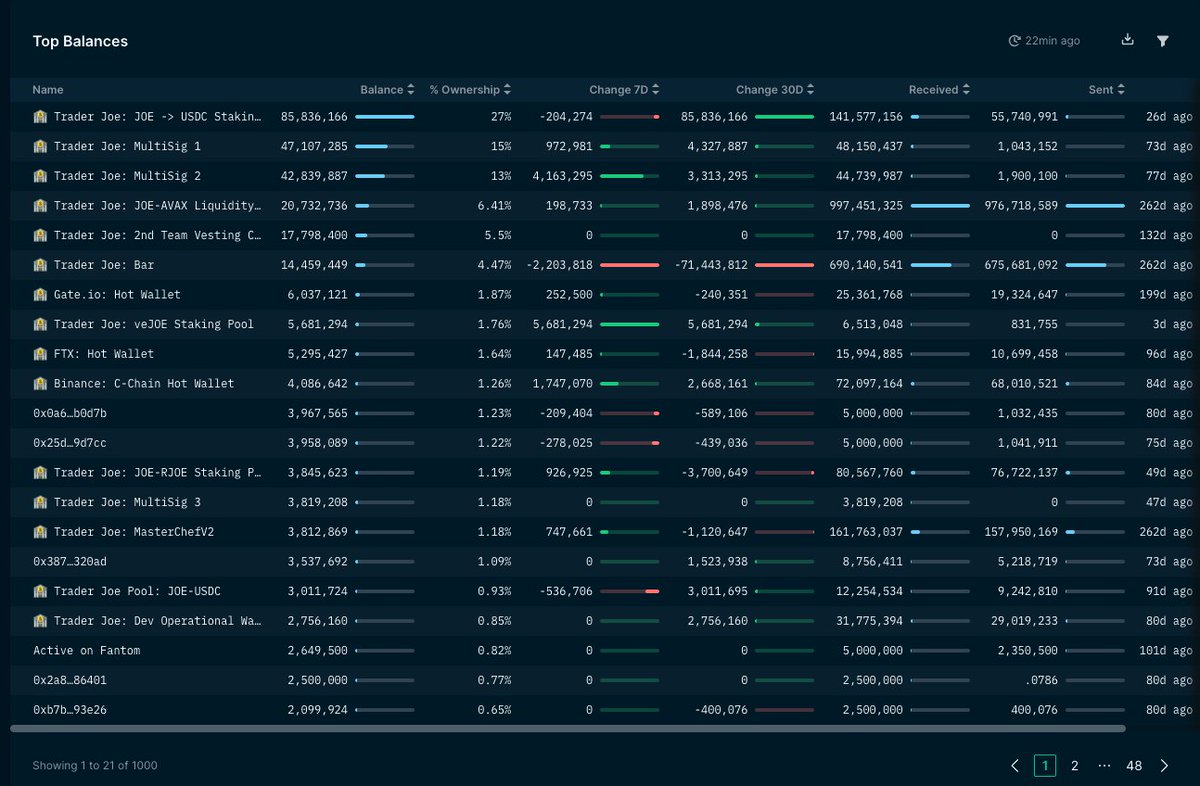

5/ Step 2: Input the contract address and token being deposited. In this example, I have selected $JOE staking pool on @traderjoe_xyz

12/ In the advance guide at a later stage, we will go through how to use more advanced filtering techniques to reduce noise.

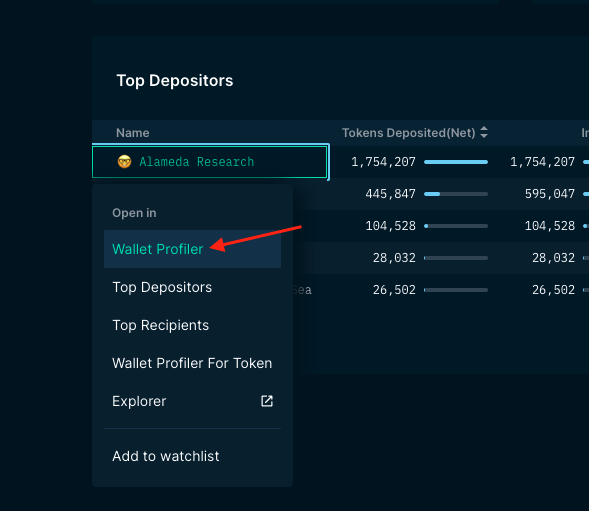

14/ Now, if a huge amount is being withdrawn by these major market participants, you will get notified on it.

18/ Take away the concept instead of looking at the project specifically. I will use different examples in this guide and use the ones that has the clearest example for you to understand.

19/ This is Chapter 9 of the guide. For other chapters, check out -

20/ This is for educational purpose only and should not be viewed as financial advice. This process highlights how you can use on-chain analytics to find opportunities, more research still have to be done on contracts and project.

Loading suggestions...