Have you ever wondered why some Tokens crash in price and others don't?

Knowing this will help you decide if you should HODL or cut your losses.

Here's a checklist of 17 reasons why tokens tank:

Knowing this will help you decide if you should HODL or cut your losses.

Here's a checklist of 17 reasons why tokens tank:

I used to be a panic seller - any FUD or price dips would cause me to freak out.

Over the years, I've learned to separate the signals from the noise.

I'm able to now assess price dips more accurately, and it has made me a much more profitable investor.

Here they are:

Over the years, I've learned to separate the signals from the noise.

I'm able to now assess price dips more accurately, and it has made me a much more profitable investor.

Here they are:

/1 Macro Forces

This is what we're going through...

• A pandemic

• Russia invades Ukraine

• The Fed increases the interest rate

People will panic sell if there's uncertainty in the market.

Crypto's performance is tied to the stock market's (for now).

This is what we're going through...

• A pandemic

• Russia invades Ukraine

• The Fed increases the interest rate

People will panic sell if there's uncertainty in the market.

Crypto's performance is tied to the stock market's (for now).

Why do people sell?

• They don't know when the market will recover

• They believe prices will drop further

• They're overexposed and need cash

• Cus they're NGMI

The low market cap coins get hit the hardest in these situations.

• They don't know when the market will recover

• They believe prices will drop further

• They're overexposed and need cash

• Cus they're NGMI

The low market cap coins get hit the hardest in these situations.

/3 Whales Sell

Besides VCs, you could see Whales dumping.

They're taking profits, losing faith in the project, or chasing the next shiny object.

The lower the market cap, the more vulnerable the project is to whales.

Hint: See the % allocation of top wallets

Besides VCs, you could see Whales dumping.

They're taking profits, losing faith in the project, or chasing the next shiny object.

The lower the market cap, the more vulnerable the project is to whales.

Hint: See the % allocation of top wallets

/5 The Meta

DeFi 1.0 OG's like Aave, Sushi, and Maker have fallen in price since last year.

Why? People started chasing after the DeFi 2.0 protocols.

They seemed more innovative and people wanted the chance to get in EARLY

This is why understanding the "meta" is important

DeFi 1.0 OG's like Aave, Sushi, and Maker have fallen in price since last year.

Why? People started chasing after the DeFi 2.0 protocols.

They seemed more innovative and people wanted the chance to get in EARLY

This is why understanding the "meta" is important

/6 The Marketing Sucks

Some protocols focus 100% on the product and nothing on marketing.

No marketing = no attention = no $ inflow

Remember that Crypto's not just a battle of product, but also a battle of perception and attention.

What tokens come to mind?

Some protocols focus 100% on the product and nothing on marketing.

No marketing = no attention = no $ inflow

Remember that Crypto's not just a battle of product, but also a battle of perception and attention.

What tokens come to mind?

/7 They're Missing Milestones

The team has a public roadmap and they're not hitting their milestones.

Delays.

Excuses.

Silence.

After a while, the investors start losing confidence in their ability to execute.

The team has a public roadmap and they're not hitting their milestones.

Delays.

Excuses.

Silence.

After a while, the investors start losing confidence in their ability to execute.

/8 Stray bullets

The protocol didn't do anything wrong, but their price crashed due to associations.

Popsicle Finance and Spell are great protocols.

Their prices suffered due to the association with 🐸 nation after the fallout of SifuGate.

The protocol didn't do anything wrong, but their price crashed due to associations.

Popsicle Finance and Spell are great protocols.

Their prices suffered due to the association with 🐸 nation after the fallout of SifuGate.

/9 The Competition

Netflix killed blockbuster and Apple killed Blackberry. The market rewards better products.

This is more prevalent in DeFi.

Protocols can easily be forked and adjusted with better tokenomics and features.

Netflix killed blockbuster and Apple killed Blackberry. The market rewards better products.

This is more prevalent in DeFi.

Protocols can easily be forked and adjusted with better tokenomics and features.

One example of this is Pangolin.

They were the original DEX on Avalanche and had a 1st mover's advantage.

Then Trader Joe came out of nowhere and ate their lunch.

They were the original DEX on Avalanche and had a 1st mover's advantage.

Then Trader Joe came out of nowhere and ate their lunch.

/10 New Regulations

New regulations or the thread of them could cause a price to crash.

Right now Ethereum's in a grayish territory with regulations.

The price of Ethereum would crash if it was ever classified as a security.

Or what if a CEX Token lost its licensing?

New regulations or the thread of them could cause a price to crash.

Right now Ethereum's in a grayish territory with regulations.

The price of Ethereum would crash if it was ever classified as a security.

Or what if a CEX Token lost its licensing?

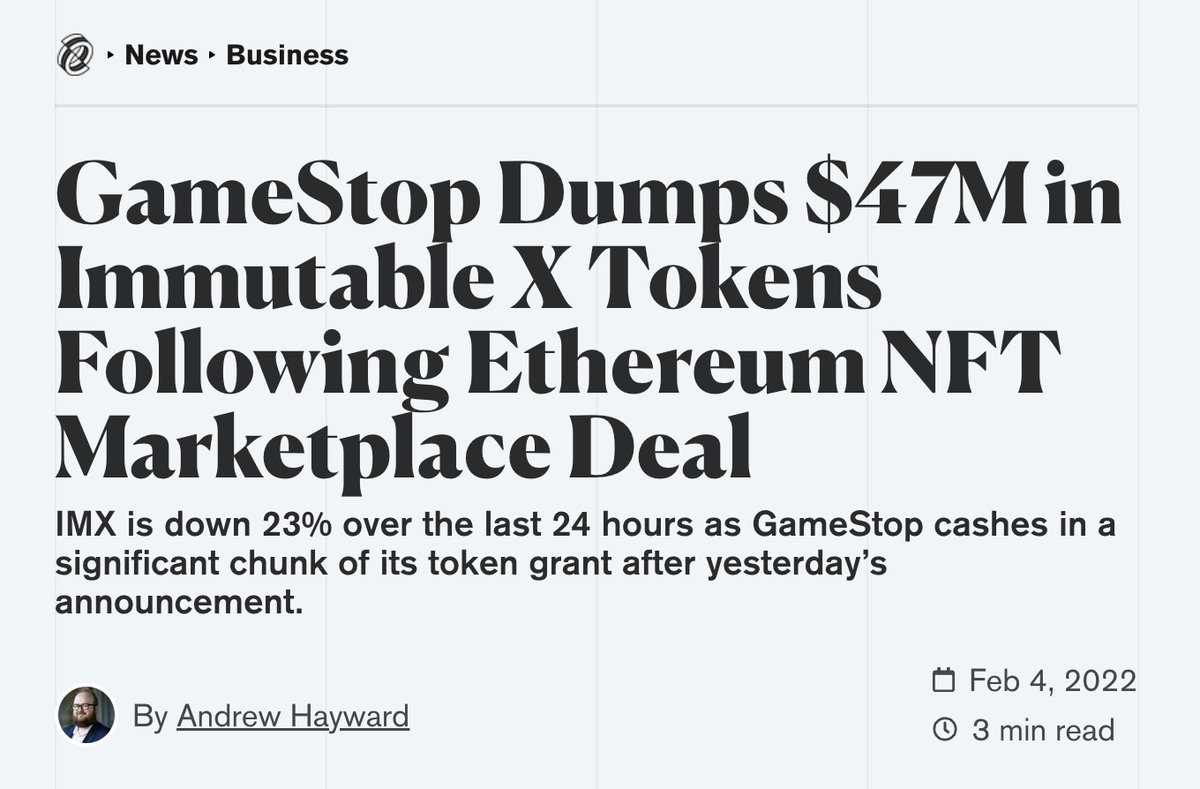

/11 A Lost Partnership

A price can pump because of an anticipated partnership. What happens if that falls through?

People thought GameStop would work with Loopring for its NFT marketplace.

They chose to work with ImmutableX instead.

A price can pump because of an anticipated partnership. What happens if that falls through?

People thought GameStop would work with Loopring for its NFT marketplace.

They chose to work with ImmutableX instead.

/12 Fake news

Sometimes the token has done nothing wrong - The price drops because of false rumors.

RektHQ shared some false information about @FantomFDN which caused the price to drop.

By the way, it was proven false.

Sometimes the token has done nothing wrong - The price drops because of false rumors.

RektHQ shared some false information about @FantomFDN which caused the price to drop.

By the way, it was proven false.

/13 Tokenomics + Lack of Utility

There's no such thing as a free lunch - the massive APY % has to come from somewhere.

This is the case for Pancakeswap.

It's an inflationary token and there isn't much utility for Cake. People earn Cake and then sell.

There's no such thing as a free lunch - the massive APY % has to come from somewhere.

This is the case for Pancakeswap.

It's an inflationary token and there isn't much utility for Cake. People earn Cake and then sell.

Compare this to other AMM's such as Beets and SpiritSwap.

They've revamped their tokenomics to add more utility to the native tokens.

Staking the tokens = a share in protocol revenue.

And then there's demand for the tokens due to their voting power.

(Beets & Spirit wars)

They've revamped their tokenomics to add more utility to the native tokens.

Staking the tokens = a share in protocol revenue.

And then there's demand for the tokens due to their voting power.

(Beets & Spirit wars)

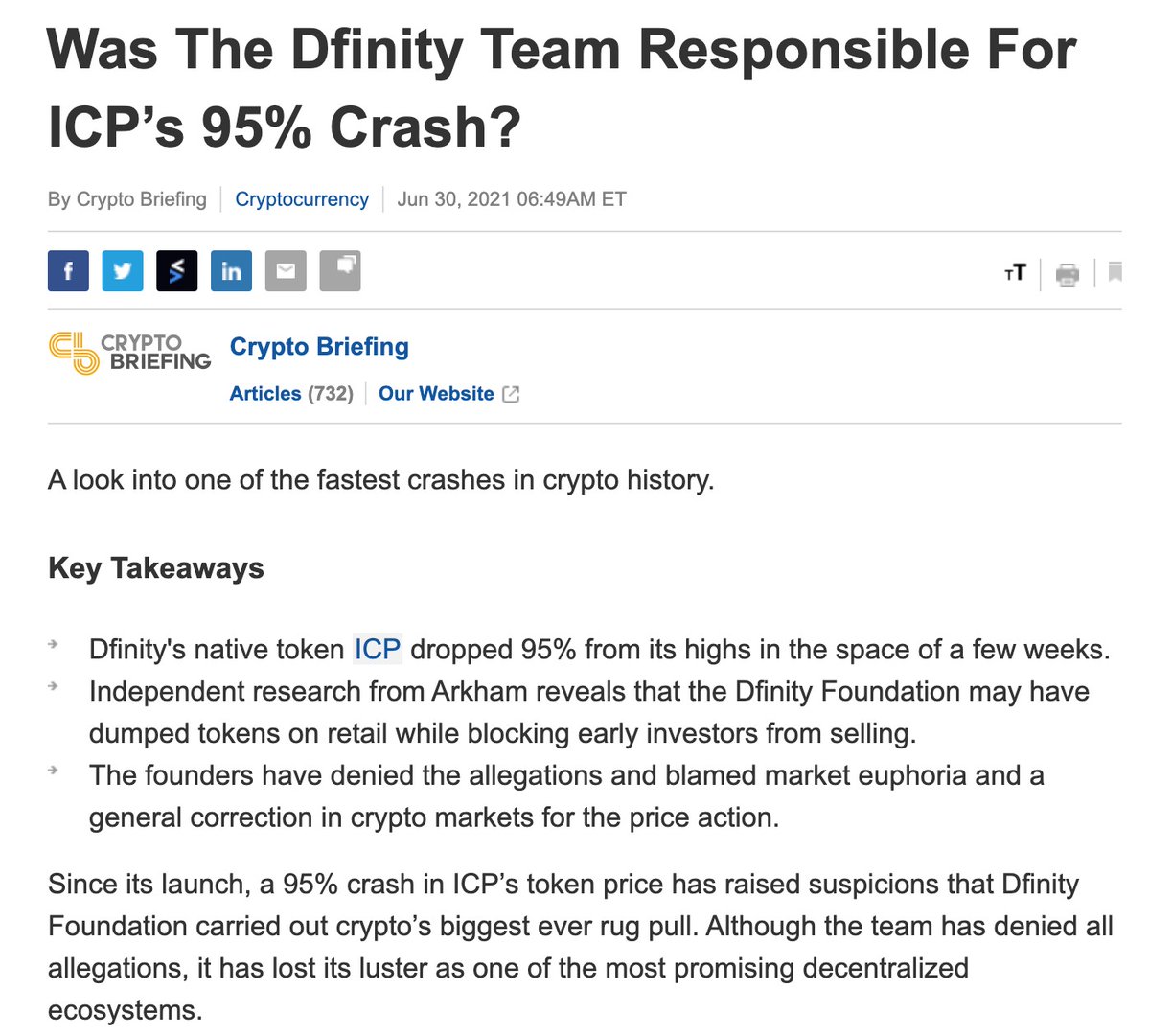

/15 The Project is Overhyped

Marketing and Hype can pump a coin's price.

People invest based on their potential.

But after a certain point, there needs to be enough usage and adoption to justify the token's price.

Yes, I am thinking about Cardano as I write this.

Marketing and Hype can pump a coin's price.

People invest based on their potential.

But after a certain point, there needs to be enough usage and adoption to justify the token's price.

Yes, I am thinking about Cardano as I write this.

/16 Liquidation Cascades

Let's say the market's hot.

Bitcoin's doing well so some degens want to use it as leverage. They use some Bitcoin as collateral to borrow money to re-invest.

They have a liquidation value of $40k.

Let's say the market's hot.

Bitcoin's doing well so some degens want to use it as leverage. They use some Bitcoin as collateral to borrow money to re-invest.

They have a liquidation value of $40k.

"But ser, the fundamentals & tech are so good."

Remember, people are here to make money.

A good investment has:

• tokenomics

• utility

• good team

• marketing / hype

Remember, people are here to make money.

A good investment has:

• tokenomics

• utility

• good team

• marketing / hype

Disclaimer

I shared some examples to help explain my points better.

None of the examples are 100% fact - they are my opinion.

Crypto's complicated and I don't have ALL the information.

I'm making the best read with the information I have.

I shared some examples to help explain my points better.

None of the examples are 100% fact - they are my opinion.

Crypto's complicated and I don't have ALL the information.

I'm making the best read with the information I have.

Takeaways:

• Tokens can drop in price for many reasons

• Investors underestimate the impact of marketing, perception, and narratives

• There needs to be UTILITY to the token for value to accrue.

• Think about these risks the next time you invest

• Tokens can drop in price for many reasons

• Investors underestimate the impact of marketing, perception, and narratives

• There needs to be UTILITY to the token for value to accrue.

• Think about these risks the next time you invest

That's it for today.

If you enjoyed this, I write several interesting threads a week on Crypto and DeFi.

Make sure you're following @thedefiedge so you don't miss out.

Here's a bonus thread you might like:

If you enjoyed this, I write several interesting threads a week on Crypto and DeFi.

Make sure you're following @thedefiedge so you don't miss out.

Here's a bonus thread you might like:

By the way, I share actionable insights like this in my weekly newsletter.

It's 100% free.

Go subscribe at -> TheDeFiEdge.com

It's 100% free.

Go subscribe at -> TheDeFiEdge.com

Loading suggestions...