Buy & Hold Strategy: How To Discover Opportunities?

🧵👇🏼

🧵👇🏼

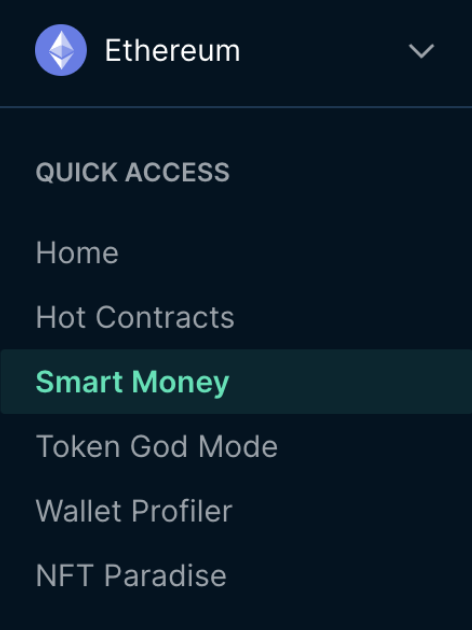

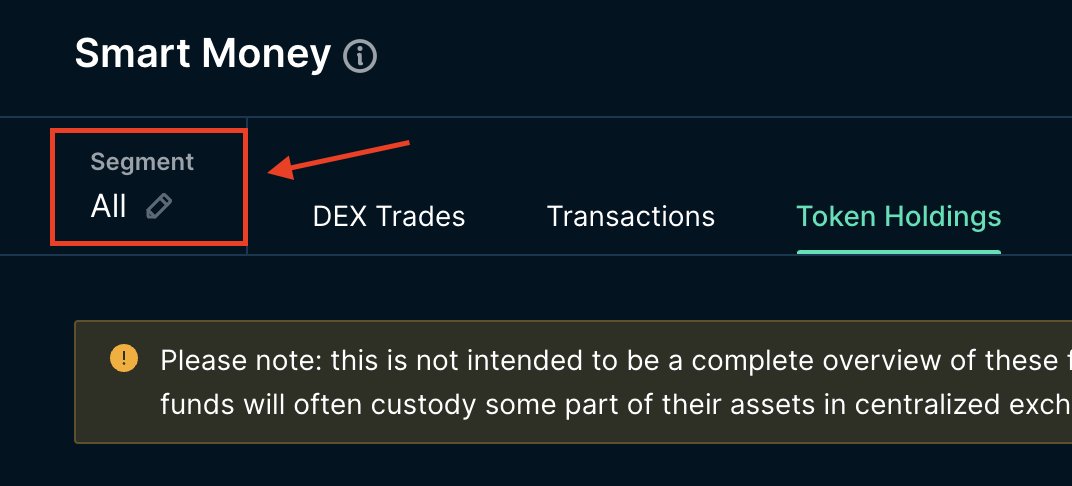

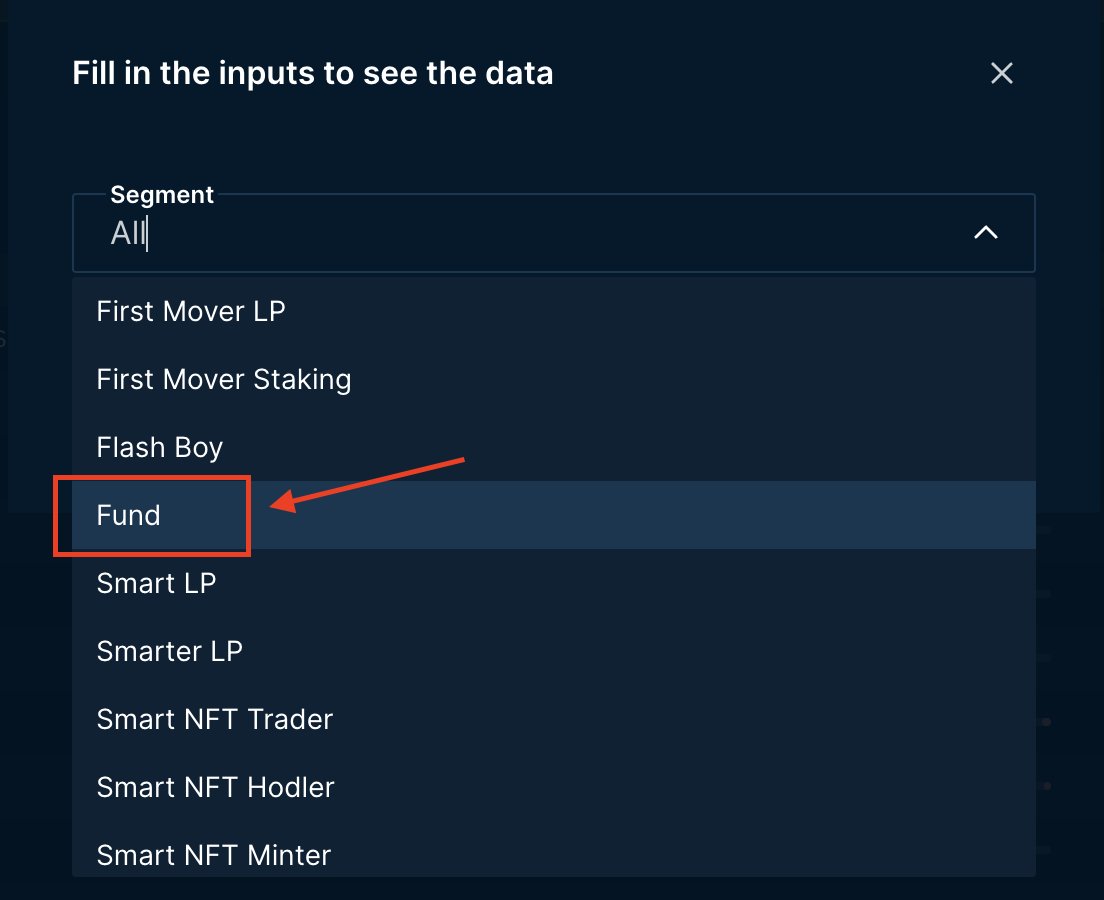

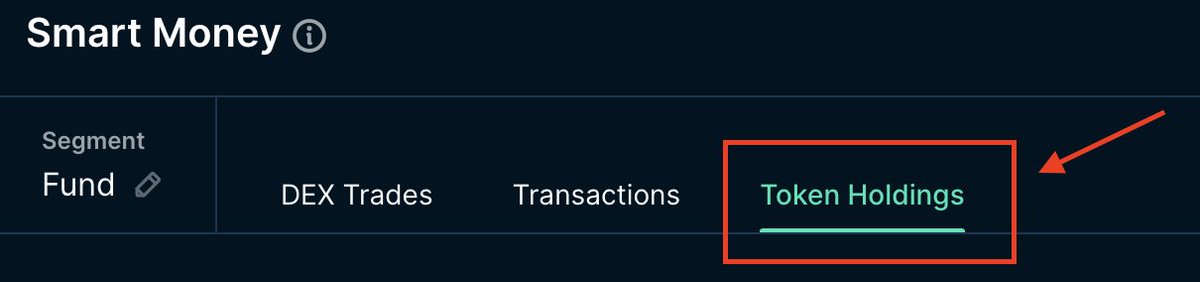

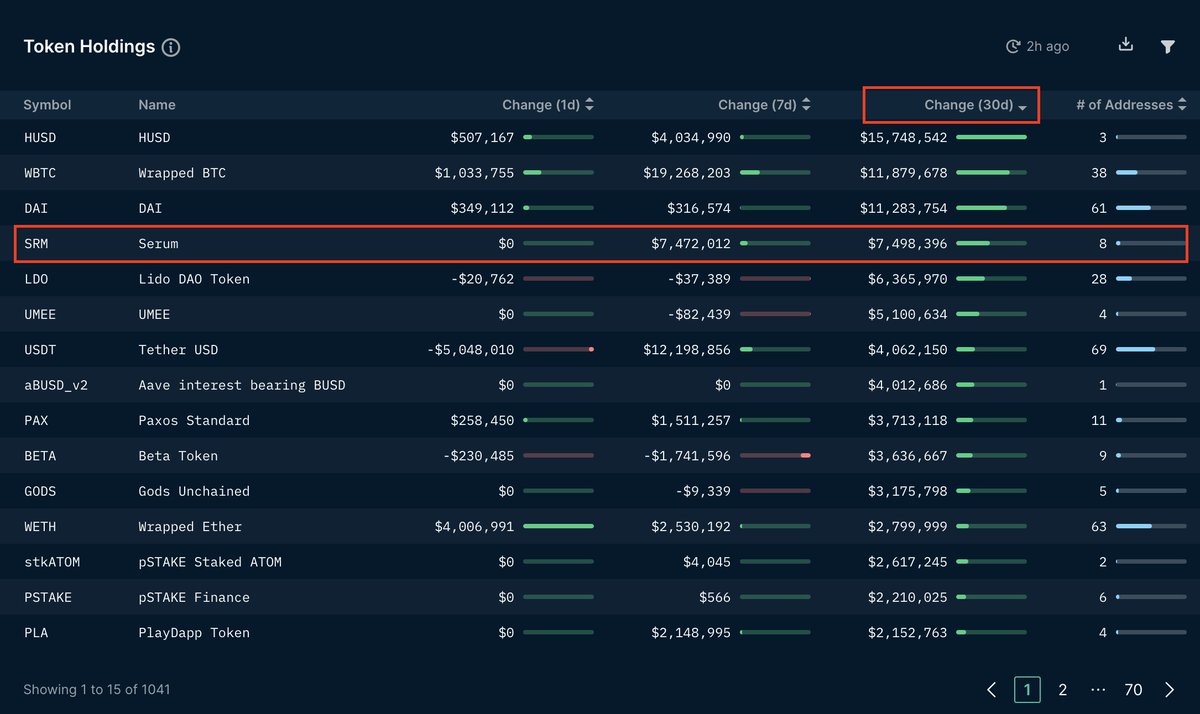

2/ This is the part you guys have been waiting for. If you have read up to this point, you definitely will have what it takes to do the work needed to uncover opportunities using on-chain analytics.

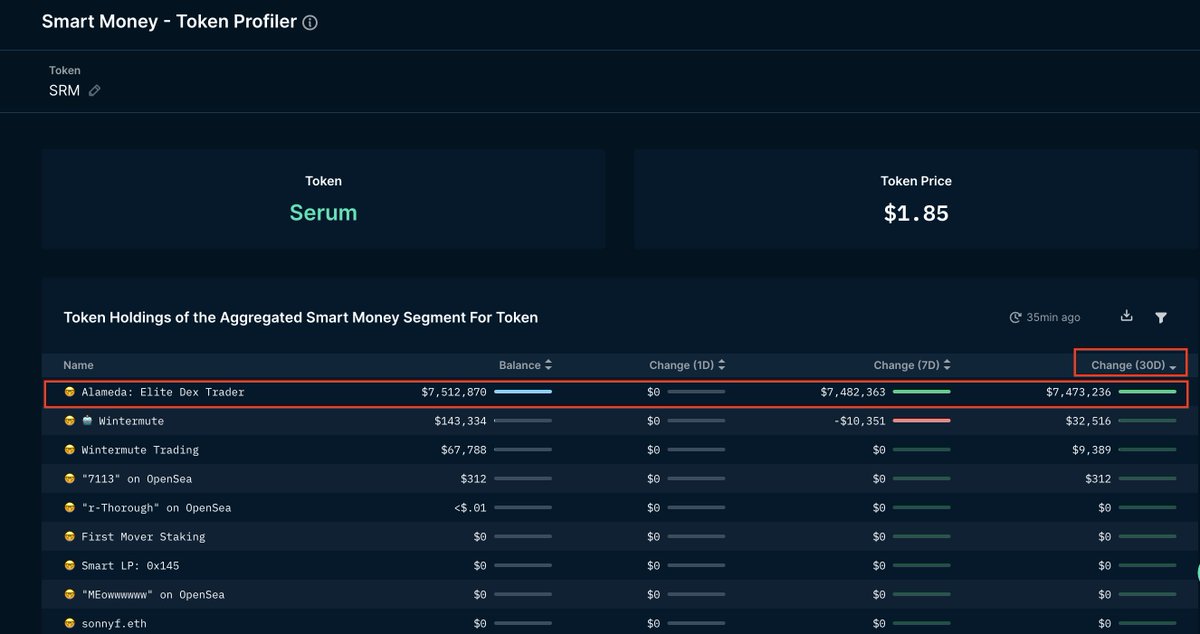

8/ As I mentioned earlier, do not ape into a token upon seeing this. Dig deeper into understanding what causes the balance change.

9/ There can be a couple of reasons for this:

- Fund receiving their vesting allocation from early round investment

- Fund receiving token from centralised exchange (eg ftx, coinbase etc)

- Fund doing swap on decentralised exchange (eg uniswap, sushiswap)

- Fund receiving their vesting allocation from early round investment

- Fund receiving token from centralised exchange (eg ftx, coinbase etc)

- Fund doing swap on decentralised exchange (eg uniswap, sushiswap)

10/

- Fund withdrawing liquidity from liquidity pool or staking pool

- Fund receiving token from bridge contract

Hence, it is always best to understand better where the token comes from to build your thesis.

- Fund withdrawing liquidity from liquidity pool or staking pool

- Fund receiving token from bridge contract

Hence, it is always best to understand better where the token comes from to build your thesis.

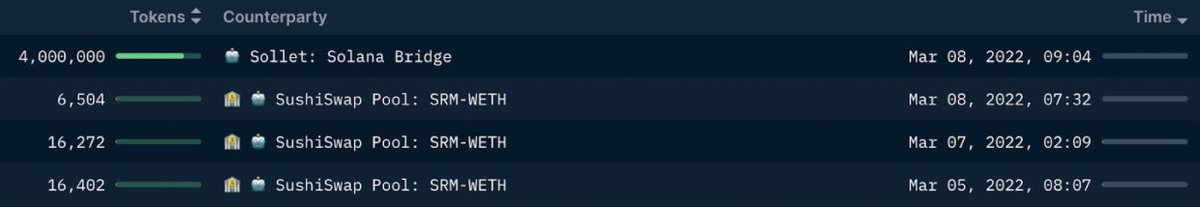

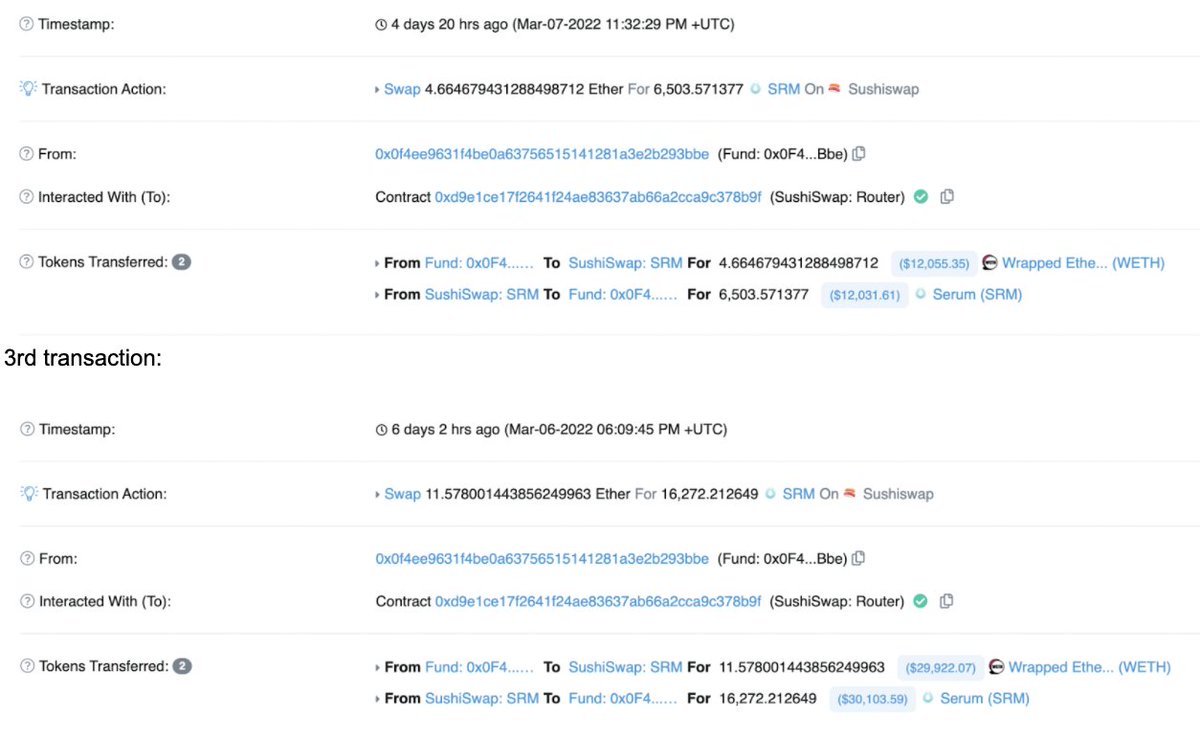

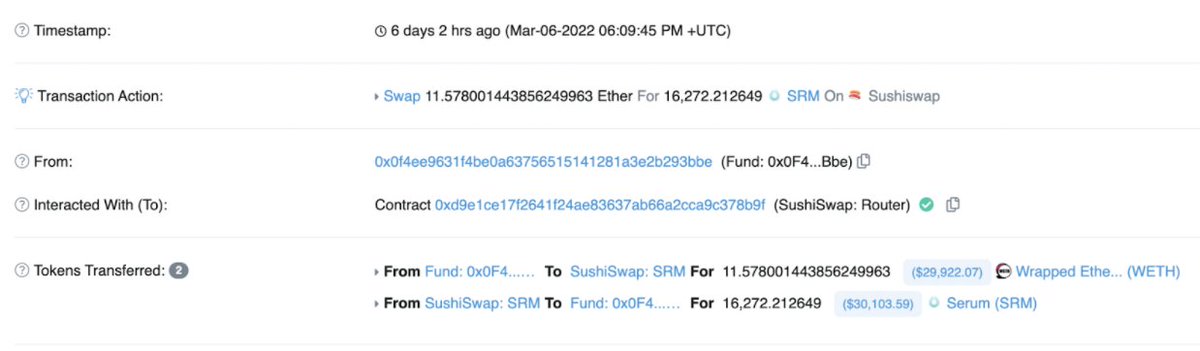

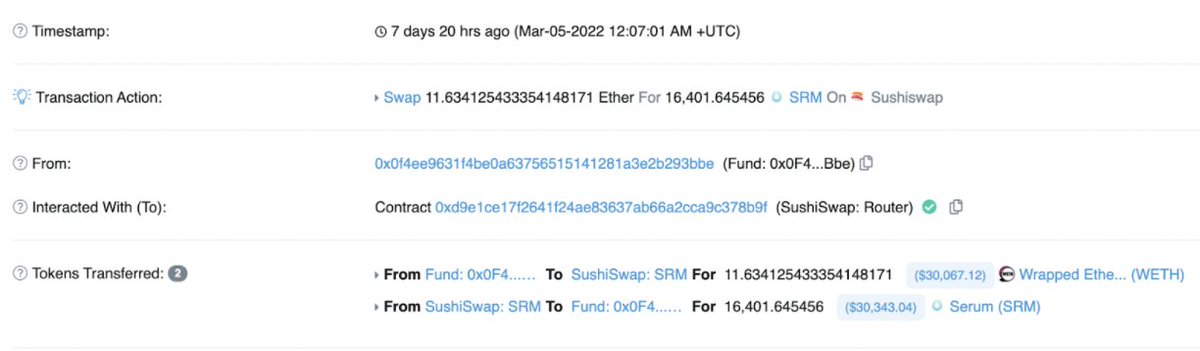

16/ The second, third and fourth transaction is what we are looking for. It came from “Sushiswap Pool: SRM-WETH”, which means that either they bought SRM through SushiSwap or they withdrew liquidity from the pool.

17/ Step 11: Looking at the individual Etherscan transaction, we can clearly see that it was a swap transaction, which means that they bought SRM.

21/ Now that I have verified that Alameda bought SRM from SushiSwap, I will start doing my due diligence to see who are the other market participants that have exposure to SRM and what they are doing with it.

22/ In the next chapter, we will go through the steps you can take to start doing your due diligence. The examples used here is not an indication for you to buy/sell. This is meant for educational purpose to show the steps you can take.

23/ Take away the concept instead of looking at the token specifically. I will use different examples in this guide and use the ones that has the clearest example for you to understand.

24/ This is Chapter 5 of the guide. For other chapters, check out -

Loading suggestions...