What is on-chain analytics?

🧵👇🏼

🧵👇🏼

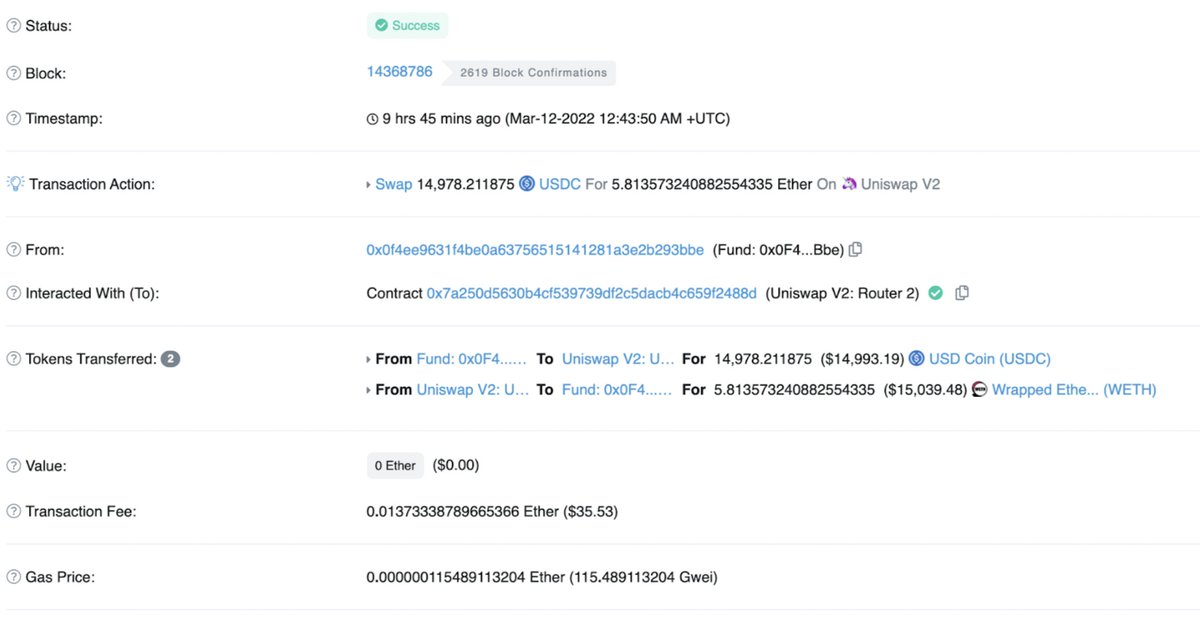

2/ In crypto, every on-chain transaction on the public network is recorded and stored on the blockchain. Remember that time when you did a swap USDC for ETH on uniswap? Or you yield farm by providing liquidity on sushiswap?

3/ Or when you minted your favorite NFT?

Those transactions are all stored on the blockchain for everyone to see. Since all these can be tracked on-chain there are many things we can look at, from token holdings in a wallet,

Those transactions are all stored on the blockchain for everyone to see. Since all these can be tracked on-chain there are many things we can look at, from token holdings in a wallet,

4/ buying/selling of tokens, depositing into a staking pool, minting NFT, providing liquidity etc.

5/ But these are all very raw on-chain information where there is no context of who the market participants are. Picture 1 is an example you would see on Etherscan of a swap transaction executed through uniswap.

8/ Every transaction that happens on-chain is recorded on the blockchain, it is available to everyone to see and track. Nansen takes this a step further, and gives you more context on who is executing the transaction.

9/ But how can this give you an edge? We will explore how to take advantage of this in the coming chapters.

10/ For the whole guide, head over to -

Loading suggestions...