@terra_money is a layer 1 blockchain built on the Cosmos SDK that facilitates low-cost transactions in close to 7 seconds.

Its primary product is a suite of industry-leading decentralised stablecoins that are pegged to a range of fiat currencies.

Its primary product is a suite of industry-leading decentralised stablecoins that are pegged to a range of fiat currencies.

It’s most used stablecoin, as of now, is TerraUSD or $UST, which as you may have guessed is pegged 1:1 with the US Dollar.

I’ll later talk about how this pegging mechanism works, but first we must understand why we need a decentralised stablecoin.

I’ll later talk about how this pegging mechanism works, but first we must understand why we need a decentralised stablecoin.

The need for decentralised finance is forever growing more prominent as TradFi proves to become more restricted and censorable. The financial institutions you bank with, are constantly limiting what you can do with your own money.

• Daily limits

• Low interest

• High fees

• Daily limits

• Low interest

• High fees

More worrying, is the rise of financial censorship, where governments can limit, or completely cut you out of the financial system.

With no access to money, you’re effectively restricted from your constitutional rights. Check this out. 👇

With no access to money, you’re effectively restricted from your constitutional rights. Check this out. 👇

Through using DeFi (Decentralised Finance), we remove the centralised organisations and instead replace them with trust-less algorithms which are governed by the users themselves.

This removes the need for trust, and more importantly removes the risk of being wrongly censored.

This removes the need for trust, and more importantly removes the risk of being wrongly censored.

In its current state, $USDT and $USDC underpin majority of DeFi activities outside of the Terra ecosystem. This undermines all of the systems which revolve around it.

This thread is well worth a read if you're interested in the future of $UST reserves 👇

This thread is well worth a read if you're interested in the future of $UST reserves 👇

As demand for $UST outpaces supply, there will be a tendency for $UST to trade above peg, this leads us onto its pegging mechanism.

1 $UST is interchangeable for $1 worth of $LUNA, no matter the price of $UST.

Whenever $UST trades above peg, there is an arbitrage opportunity.

1 $UST is interchangeable for $1 worth of $LUNA, no matter the price of $UST.

Whenever $UST trades above peg, there is an arbitrage opportunity.

Arbitrageurs will buy $LUNA and burn it for $UST to make an arbitrage profit.

Here’s a quick example where $UST = $1.05 (above peg):

The arbitrageur will:

1. Buy $1 worth of $LUNA

2. Burn that $1 worth of $LUNA to mint 1 $UST

3. Sell that 1 $UST for $1.05 on an exchange

Here’s a quick example where $UST = $1.05 (above peg):

The arbitrageur will:

1. Buy $1 worth of $LUNA

2. Burn that $1 worth of $LUNA to mint 1 $UST

3. Sell that 1 $UST for $1.05 on an exchange

By the end of this process, three things will have occurred:

• There is an increase in buying pressure on $LUNA.

• There is an increase in the supply of $UST which drives supply closer to demand, helping $UST regain peg.

• The arbitrageur is left with $0.05 profit.

• There is an increase in buying pressure on $LUNA.

• There is an increase in the supply of $UST which drives supply closer to demand, helping $UST regain peg.

• The arbitrageur is left with $0.05 profit.

The simple way of looking at $LUNA's value capture in relation to $UST is this:

For every dollar increase in $UST demand, there is a dollar of buying pressure on $LUNA which is then taken out of supply.

For every dollar increase in $UST demand, there is a dollar of buying pressure on $LUNA which is then taken out of supply.

Though this is the case, I believe a common misconception is that $LUNA's price has to go up as demand for $UST rises. It does not.

During times of extreme market volatility and sell-offs, the sell pressure sourced from the markets will exceed the buy pressure from the $UST demand, resulting in a price decrease.

Sadly, no, $LUNA is not immune to paper hands.

Sadly, no, $LUNA is not immune to paper hands.

This is not to say that $UST demand and the price of $LUNA have zero correlation; they definitely do, up to a certain degree.

As stated earlier, an increase in $UST demand will increase buy pressure on $LUNA, they are inherently linked.

As stated earlier, an increase in $UST demand will increase buy pressure on $LUNA, they are inherently linked.

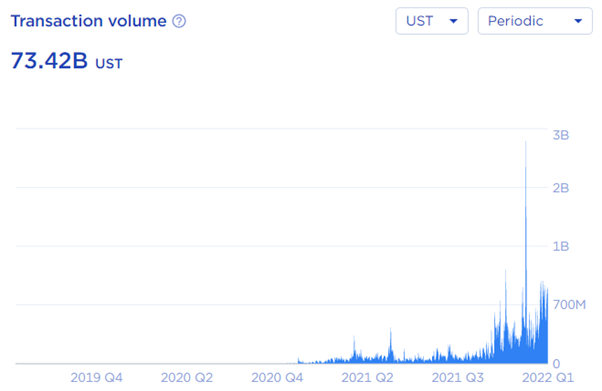

Due to the unprecedented growth of $UST, $LUNA has been burning at truly extreme rate.

Over the past month, we have burned:

• 45 million $LUNA

Equivalent to:

• 5.5% of the total supply

• 11.1% of the circulating supply

Over the past month, we have burned:

• 45 million $LUNA

Equivalent to:

• 5.5% of the total supply

• 11.1% of the circulating supply

You may now be wondering; What are the most promising protocols built on Terra?

The first is @anchor_protocol - $ANC.

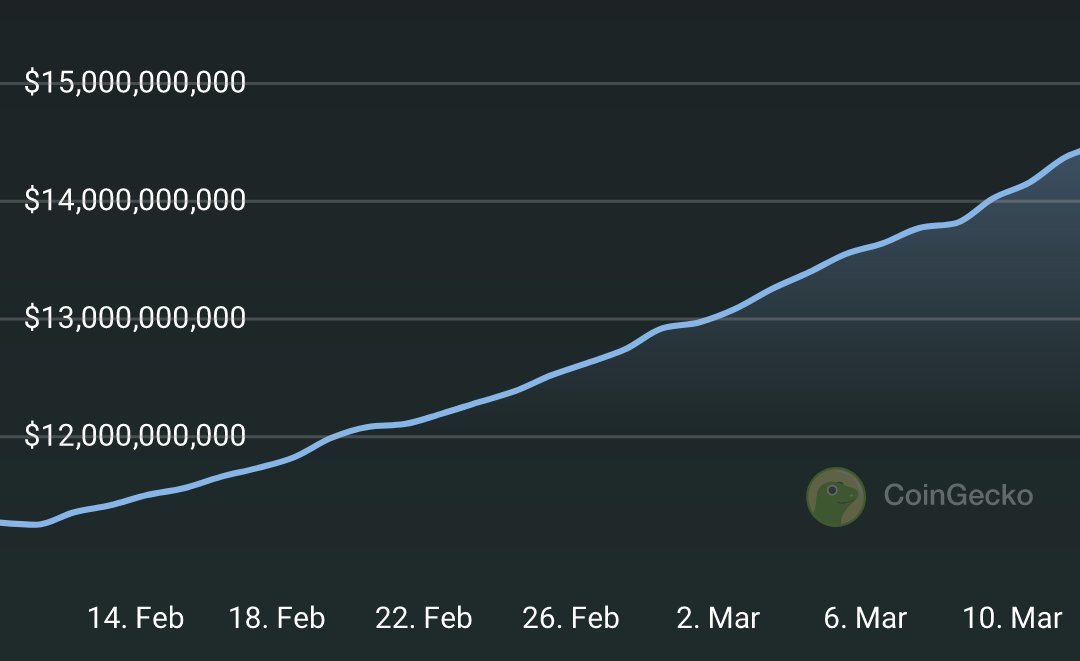

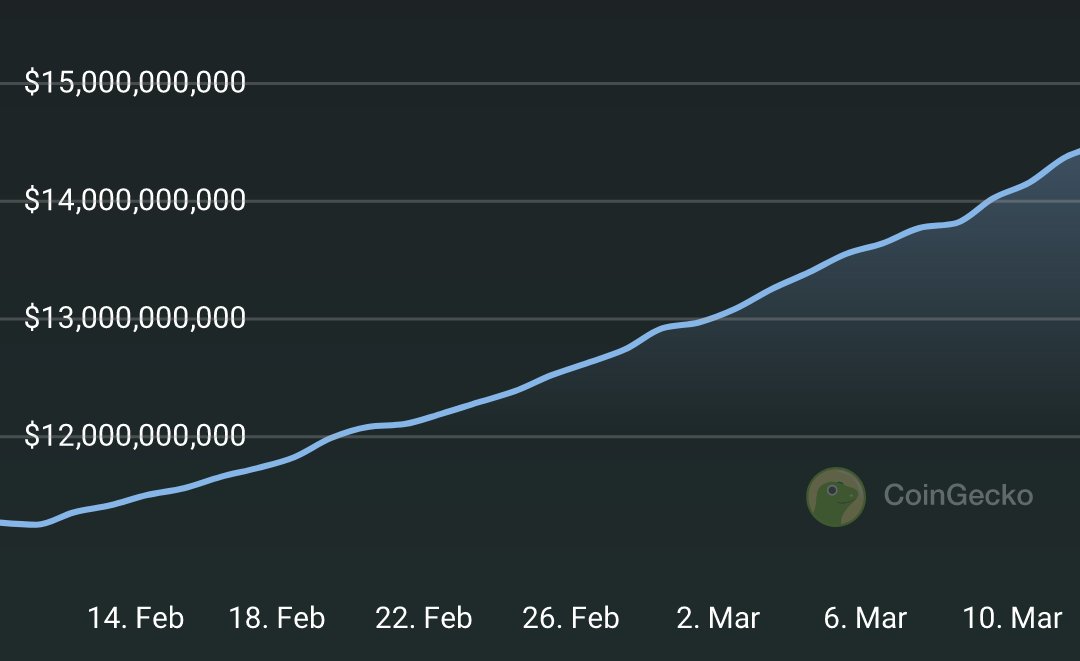

$ANC sits at a MC of $950m with TVL upwards of $13b, making it the largest lending platform in DeFI and accounting for 6.5% of all TVL in DeFi.

The first is @anchor_protocol - $ANC.

$ANC sits at a MC of $950m with TVL upwards of $13b, making it the largest lending platform in DeFI and accounting for 6.5% of all TVL in DeFi.

Anchor is unique as it:

• Targets a stable depositor yield on $UST (currently 20%)

• Uses staking derivatives such as $bLUNA and $bETH for collateral

The team also has significant changes to its tokenomics in the works to increase $ANC value capture.

• Targets a stable depositor yield on $UST (currently 20%)

• Uses staking derivatives such as $bLUNA and $bETH for collateral

The team also has significant changes to its tokenomics in the works to increase $ANC value capture.

The second protocol worth mentioning is @astroport_fi - $ASTRO.

Astroport Is a DEX built on Terra that covers all bases by providing:

• Constant product pools

• Stableswap invariant pools

• Liquidity bootstrapping pools (LBPs)

Astroport Is a DEX built on Terra that covers all bases by providing:

• Constant product pools

• Stableswap invariant pools

• Liquidity bootstrapping pools (LBPs)

After launching 3 months ago, it’s achieved some pretty impressive figures:

• $1.45B in liquidity ranking It the 7th largest DEX by TVL

• Volume upwards of $600m on some days which puts it up as the 2nd largest DEX by trading volume on that day

• $1.45B in liquidity ranking It the 7th largest DEX by TVL

• Volume upwards of $600m on some days which puts it up as the 2nd largest DEX by trading volume on that day

Staking is yet to go live, but is expected this month with:

• $xASTRO:

- Accrues trading fees

- Voting rights

- Liquid and transferable

• $vxASTRO

- Locked $xASTRO

- Accrues more fees

- Increases voting power

- Provides LP boosties

Read more below👇

• $xASTRO:

- Accrues trading fees

- Voting rights

- Liquid and transferable

• $vxASTRO

- Locked $xASTRO

- Accrues more fees

- Increases voting power

- Provides LP boosties

Read more below👇

The third is @TeamKujira - $KUJI

Kujira's ORCA app, which is focused on the democratization of liquidations through removing the need for technical knowledge and speed.

They utilise a liquidation queue in which users can make bids to buy liquidated collateral at a discount.

Kujira's ORCA app, which is focused on the democratization of liquidations through removing the need for technical knowledge and speed.

They utilise a liquidation queue in which users can make bids to buy liquidated collateral at a discount.

Currently, ORCAs liquidation queue is only implemented into Anchor, but the team is in talks with other cross-chain lending protocols.

It's governance token has a MC of $38m, which accrues fees in the form of the liquidated assets.

It's governance token has a MC of $38m, which accrues fees in the form of the liquidated assets.

If you enjoyed the thread, a like and retweet on the opening tweet of the thread would be greatly appreciated!

Also feel free to follow me @CryptoHarry_ for more informative information, primarily focused on Terra, but also looking elsewhere in DeFi.

Also feel free to follow me @CryptoHarry_ for more informative information, primarily focused on Terra, but also looking elsewhere in DeFi.

جاري تحميل الاقتراحات...