Most people suck at yield farming.

What if you could outsource your yield farming to a team of professionals?

That's what "Farming as a Service" aims to do.

Here's a breakdown of what FAAS is and how it works:

What if you could outsource your yield farming to a team of professionals?

That's what "Farming as a Service" aims to do.

Here's a breakdown of what FAAS is and how it works:

In this thread I'll cover:

• FAAS 101

• FAAS Tokenomics

• The Major Protocols

• How to choose a FAAS protocol (with some data)

• The pros and cons of investing in FAAS.

I'll trade you 50+ hrs of research for 5 mins of your time.

Let's dive in!

• FAAS 101

• FAAS Tokenomics

• The Major Protocols

• How to choose a FAAS protocol (with some data)

• The pros and cons of investing in FAAS.

I'll trade you 50+ hrs of research for 5 mins of your time.

Let's dive in!

The DeFi space's biggest opportunity is in Yield Farming.

I'm sure you've seen the jaw-dropping ROIs that DeFi projects are offering.

The problem?

There's a high barrier of entry for the average person:

I'm sure you've seen the jaw-dropping ROIs that DeFi projects are offering.

The problem?

There's a high barrier of entry for the average person:

• The learning curve

• Keeping up with research. How are you supposed to keep up /w alpha if you have a job + kids?

• Knowing what's garbage and what's real

• Getting in EARLY enough before APY's drop

What if you want passive income without the headaches and complexity?

• Keeping up with research. How are you supposed to keep up /w alpha if you have a job + kids?

• Knowing what's garbage and what's real

• Getting in EARLY enough before APY's drop

What if you want passive income without the headaches and complexity?

FAAS protocols are offering this service for DeFi.

A team of DeFi experts will take your money, and invest it on your behalf.

They have the time and access to keep up with the latest narratives and "alpha" in the DeFi space.

Sound good?

Let's see how this works!

A team of DeFi experts will take your money, and invest it on your behalf.

They have the time and access to keep up with the latest narratives and "alpha" in the DeFi space.

Sound good?

Let's see how this works!

Here's the formula that most FAAS are following:

1. You buy the Protocol's token and get taxed immediately.

2. The FAAS grows the treasury via yield farming

3. The protocol pays you a share of the treasury profits through distributions.

Let's go through them step by step:

1. You buy the Protocol's token and get taxed immediately.

2. The FAAS grows the treasury via yield farming

3. The protocol pays you a share of the treasury profits through distributions.

Let's go through them step by step:

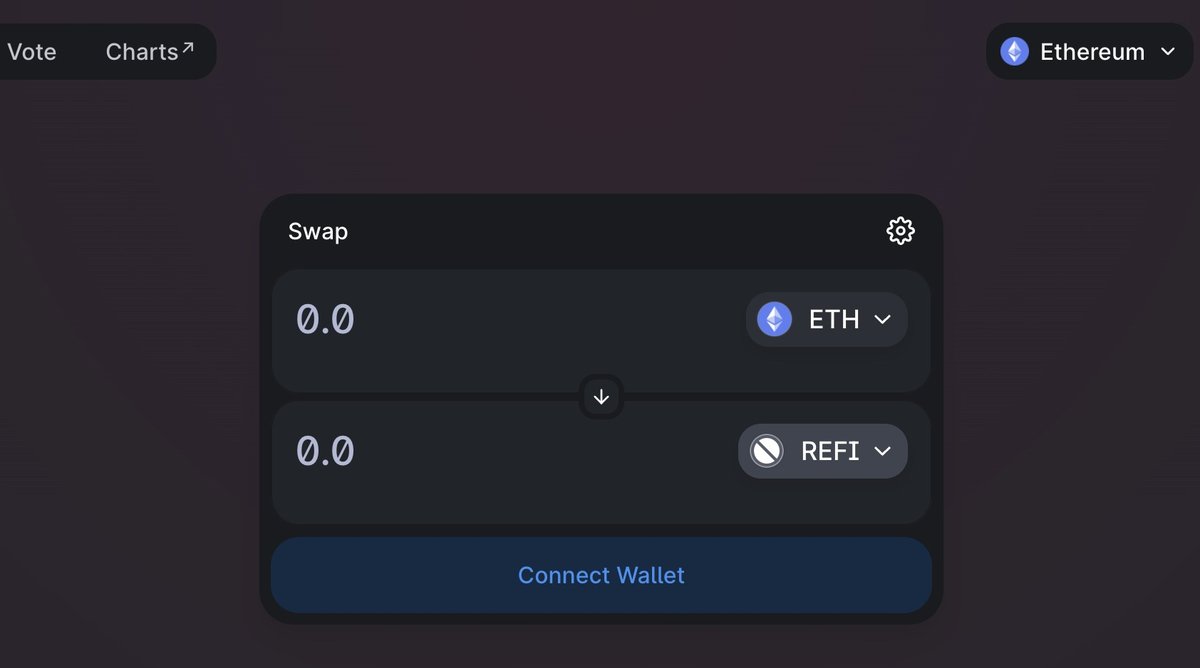

1. You buy the protocol's token.

Most FAAS tokens are Ethereum based, but they are expanding to cheaper chains such as FTM & BSC.

You can buy them on DEX's such as @Uniswap

Watch out for gas fees and slippage.

Next, let's look at "tax" when you buy and sell.

Most FAAS tokens are Ethereum based, but they are expanding to cheaper chains such as FTM & BSC.

You can buy them on DEX's such as @Uniswap

Watch out for gas fees and slippage.

Next, let's look at "tax" when you buy and sell.

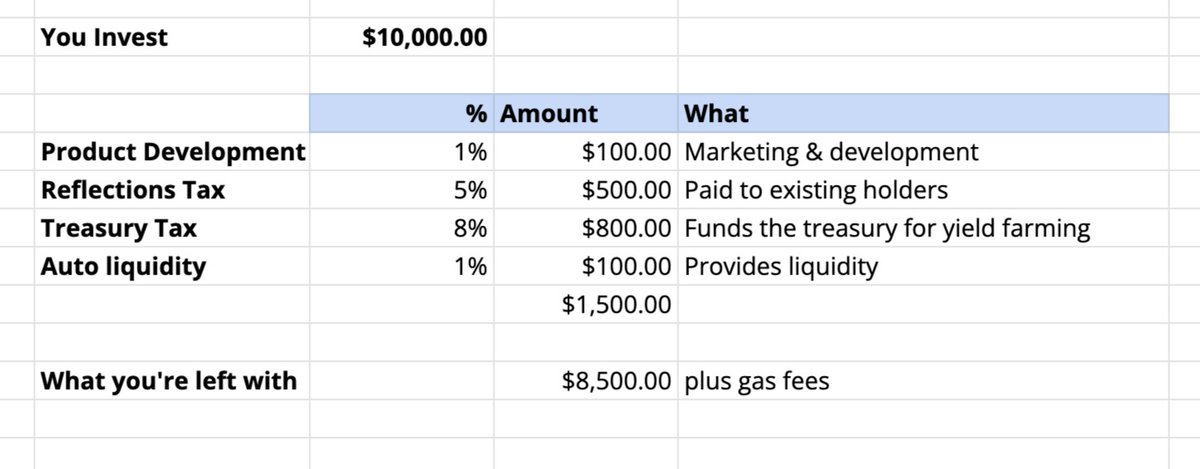

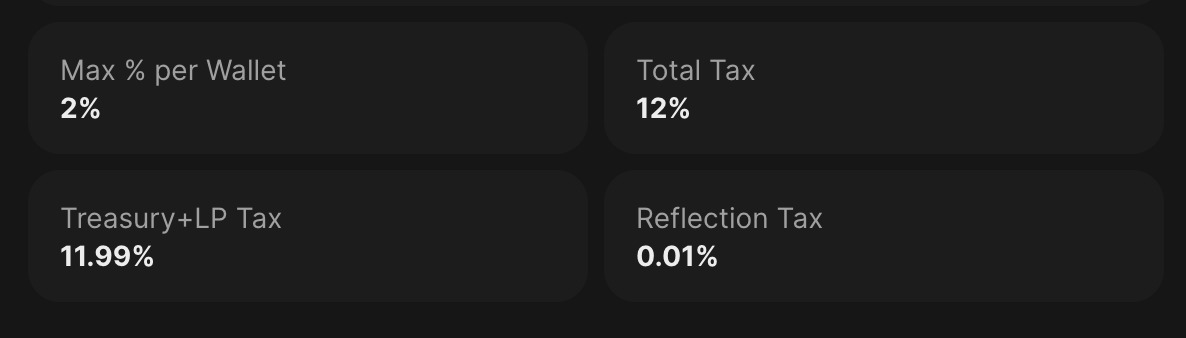

2. When you BUY the token, there's a TAX. This is how they build the treasury.

Here's an example from @expo_capital, and I ran it through a spreadsheet.

Remember that you're taxed TWICE - when buying AND selling.

Here's an example from @expo_capital, and I ran it through a spreadsheet.

Remember that you're taxed TWICE - when buying AND selling.

3. Utilizing the Treasury

There's now a war chest that'll be put to work through

• Farming

• Trading

• Investing in early-stage projects/seed rounds.

Remember that not all farmers are equal. They all have different strategies to generate yield.

There's now a war chest that'll be put to work through

• Farming

• Trading

• Investing in early-stage projects/seed rounds.

Remember that not all farmers are equal. They all have different strategies to generate yield.

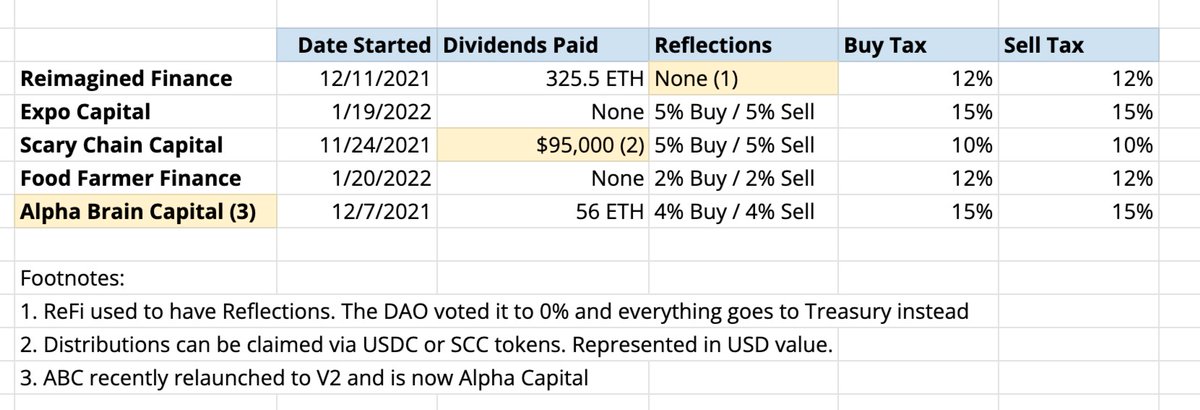

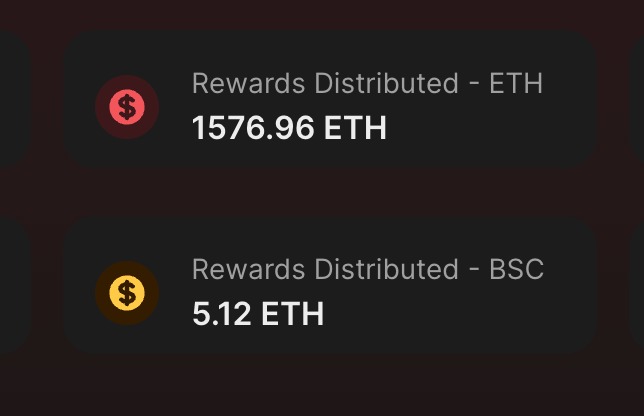

4. Getting paid via Dividends

Once there's a profit, the protocol may choose to issue you a dividend.

Kinda like how some stocks do.

Most are paying out in ETH rather than their native tokens.

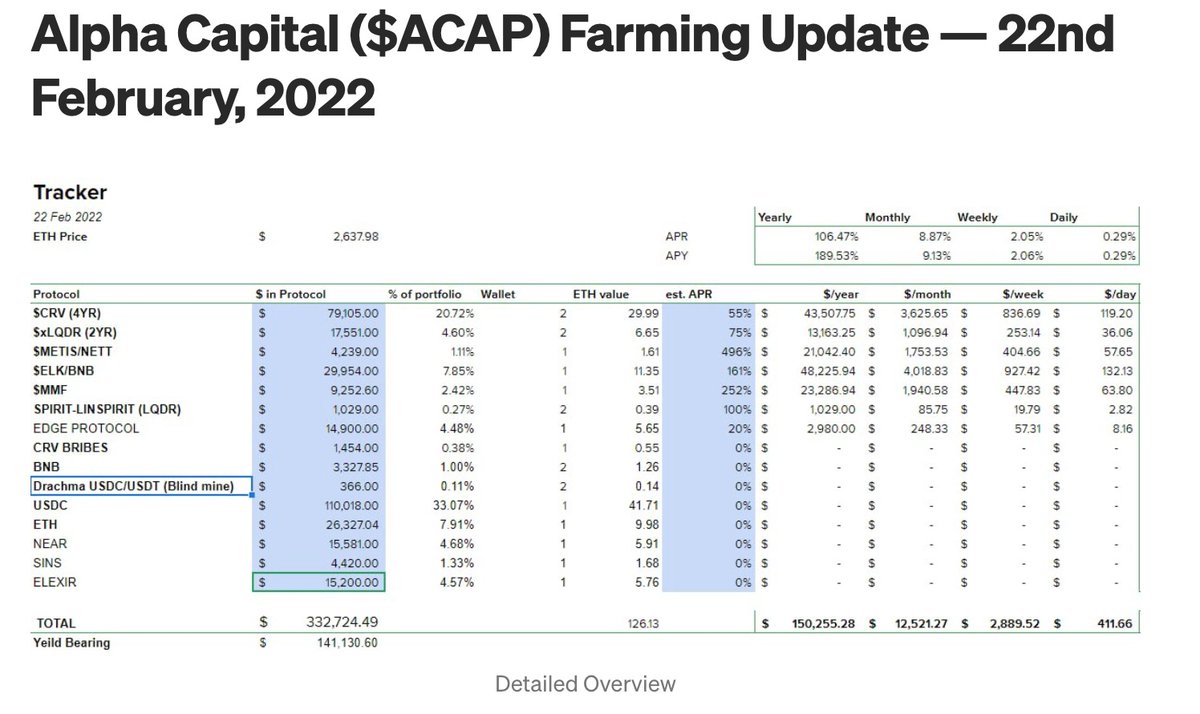

@poordefipenguin put some data together for us on who has issued dividends so far.

Once there's a profit, the protocol may choose to issue you a dividend.

Kinda like how some stocks do.

Most are paying out in ETH rather than their native tokens.

@poordefipenguin put some data together for us on who has issued dividends so far.

Paying you in ETH is badass.

This means they're not printing inflationary tokens, and there's no downward selling pressure on the native token.

Most protocols have a fixed supply, and some are even making it deflationary.

This means they're not printing inflationary tokens, and there's no downward selling pressure on the native token.

Most protocols have a fixed supply, and some are even making it deflationary.

Other Tokenomics:

• These Protocols do buybacks & burns which reduces the token supply.

• Some offer bonds/minting like OHM.

• Majority of the teams are yield farming. They're starting to branch into private seed rounds and launchpads 🚀

• These Protocols do buybacks & burns which reduces the token supply.

• Some offer bonds/minting like OHM.

• Majority of the teams are yield farming. They're starting to branch into private seed rounds and launchpads 🚀

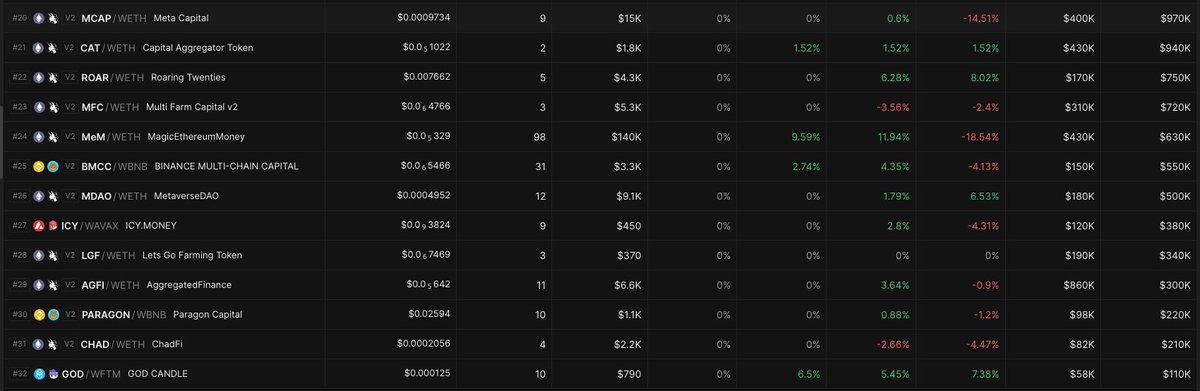

Who are the Players in this space?

You have a ton of FAAS protocols to choose from, and more are being created each week.

It kinda reminds me of OHM / Tomb fork season.

I'm going to highlight a few of them:

You have a ton of FAAS protocols to choose from, and more are being created each week.

It kinda reminds me of OHM / Tomb fork season.

I'm going to highlight a few of them:

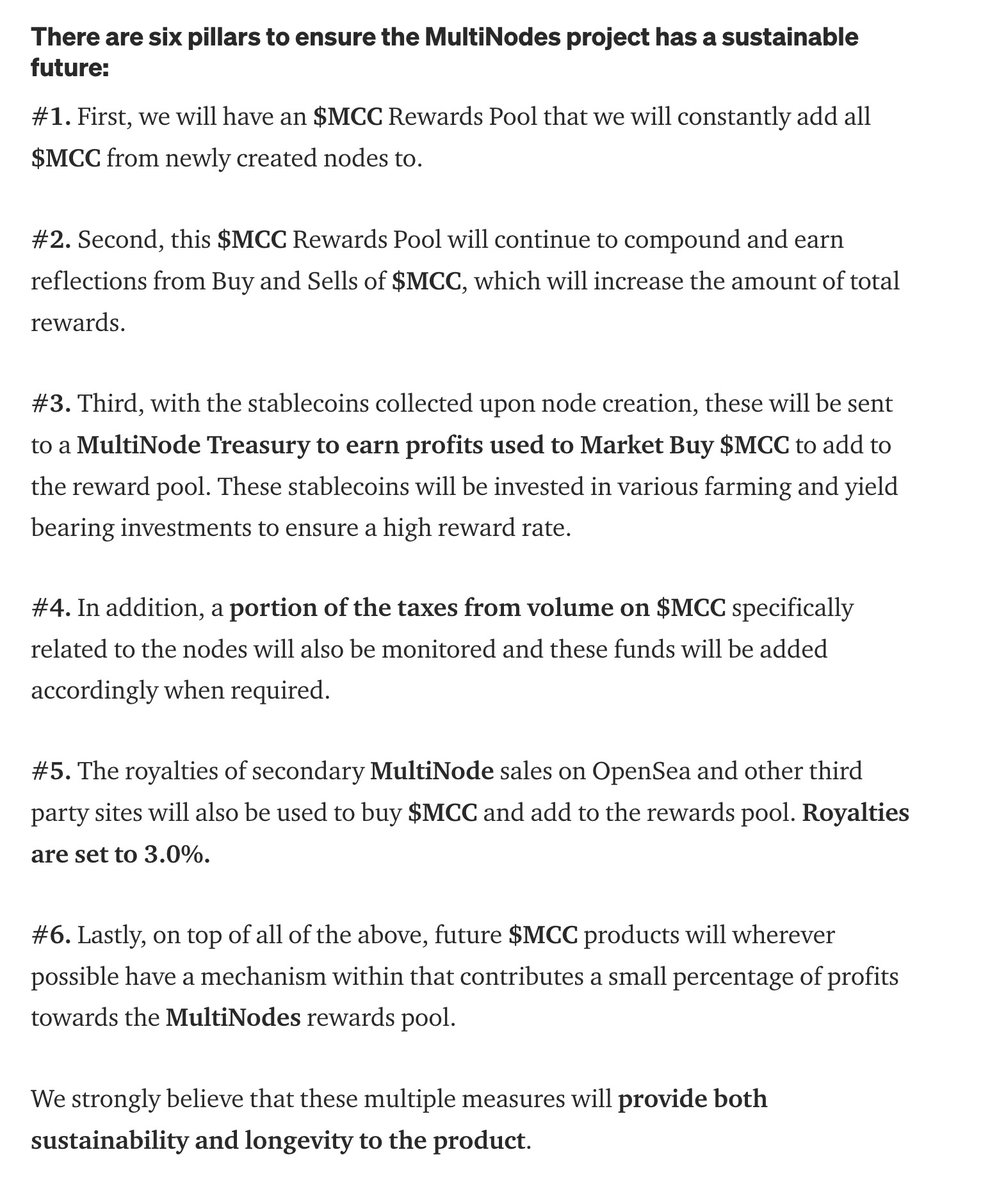

The Biggest: @mulchaincapital BMCC

They were the 1st one, and have the biggest treasury.

Their biggest differentiation is they introduced MultiNODES last month.

Nodes are controversial - can MCC make nodes sustainable?

They were the 1st one, and have the biggest treasury.

Their biggest differentiation is they introduced MultiNODES last month.

Nodes are controversial - can MCC make nodes sustainable?

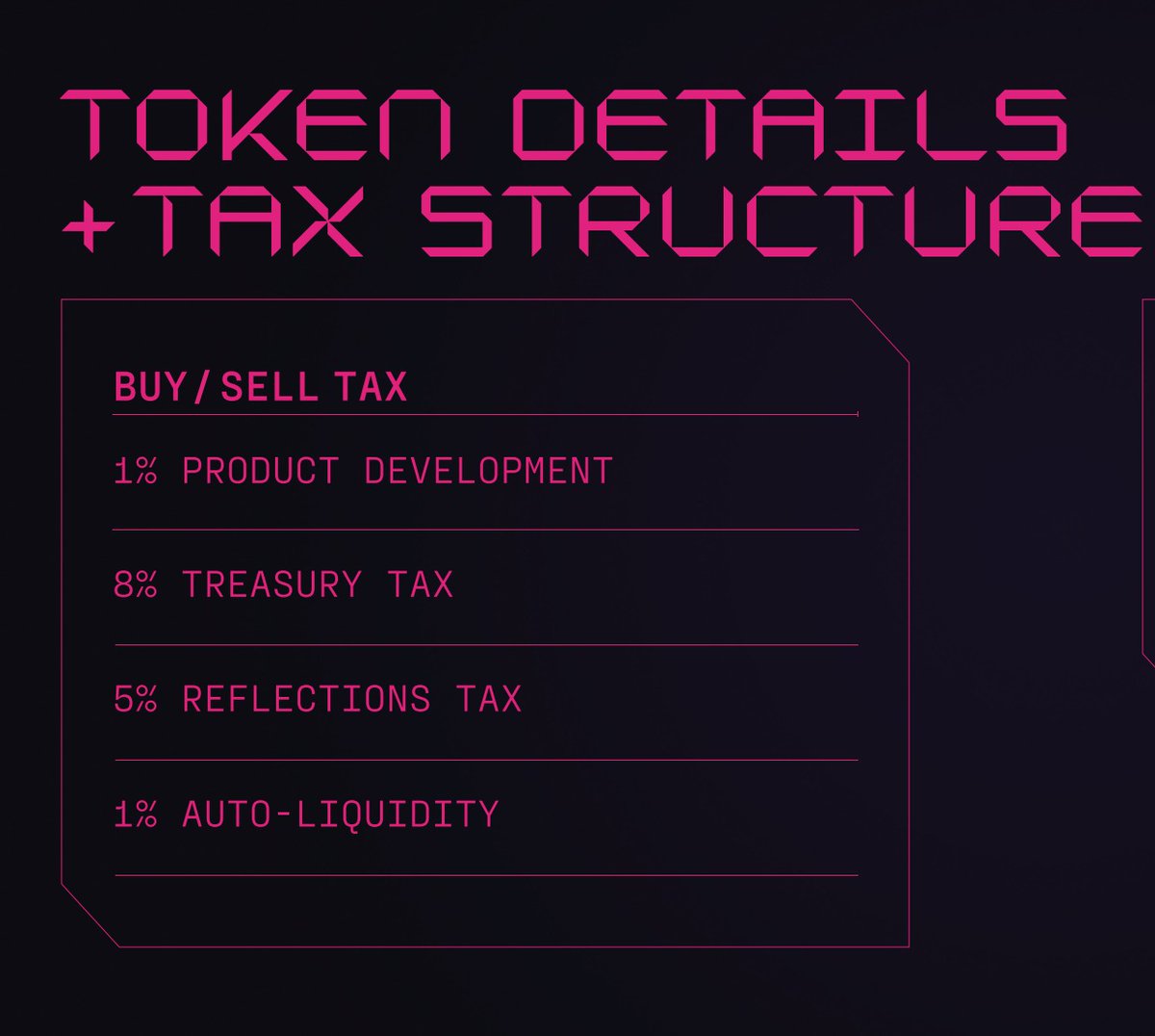

The Transparent: @ReimaginedFi #ReFi

• 2nd largest treasury & known for their transparency.

• The DAO voted to get RID of the reflections recently. The 12% tax goes straight to the treasury.

• They have paid out 1500+ ETH in dividends.

• 2nd largest treasury & known for their transparency.

• The DAO voted to get RID of the reflections recently. The 12% tax goes straight to the treasury.

• They have paid out 1500+ ETH in dividends.

There are other players in the space, and they all have slight twists to the formula.

Here's a list that I obtained from @CrossChainAlex.

It's a custom watchlist that he created from @dexscreener

Here's a list that I obtained from @CrossChainAlex.

It's a custom watchlist that he created from @dexscreener

The newer players are adding some innovations to stand out.

• @schaincapital - allows minting/bonding

• @jpegmorganxyz - Generates part of its yield from NFT's. (DOPE name)

It'll be interesting to see what other innovations future protocols will bring to the formula.

• @schaincapital - allows minting/bonding

• @jpegmorganxyz - Generates part of its yield from NFT's. (DOPE name)

It'll be interesting to see what other innovations future protocols will bring to the formula.

Which FAAS should you invest in?

So you're probably wondering which FAAS protocol I'd recommend.

I'm trying to stay as objective as possible.

Instead, I'd prefer to educate you so you can pick for yourself.

Here's what I'd look at:

So you're probably wondering which FAAS protocol I'd recommend.

I'm trying to stay as objective as possible.

Instead, I'd prefer to educate you so you can pick for yourself.

Here's what I'd look at:

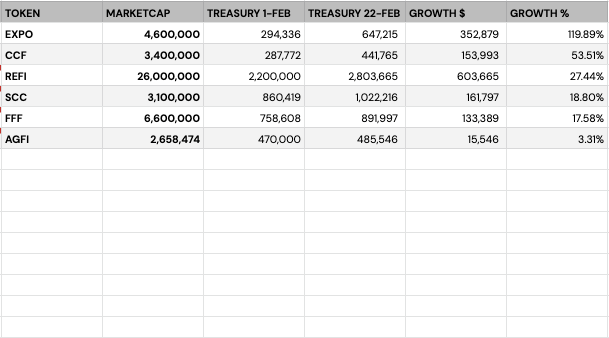

1. Marketcap to Treasury Ratio

How large is their treasury compared to the market cap?

It's kinda like TVL / mCAP to measure L1's/

This is 1 way to measure value and if you're getting a "good deal."

I found a recent tracker from @poordefipenguin

How large is their treasury compared to the market cap?

It's kinda like TVL / mCAP to measure L1's/

This is 1 way to measure value and if you're getting a "good deal."

I found a recent tracker from @poordefipenguin

These numbers are hard to compare:

1. Some protocols have already paid off distributions and dividends. The treasury might not reflect their true value.

2. Some of the data is hard to find.

Here's another tracker from @crosschainalex

1. Some protocols have already paid off distributions and dividends. The treasury might not reflect their true value.

2. Some of the data is hard to find.

Here's another tracker from @crosschainalex

2. The Team

There are no "moats" that separate FAAS from each other.

You're betting 100% on the team and their ability to farm the treasury.

• Look at the team's experience.

• Look at their communication.

• Look at the performance.

There are no "moats" that separate FAAS from each other.

You're betting 100% on the team and their ability to farm the treasury.

• Look at the team's experience.

• Look at their communication.

• Look at the performance.

The farmers affect the performance.

Imagine if @Bitboy_crypto was in charge of your farming. NGMI.

Here are a few of the leads farmers I found.

• ReFi: @hufhaus

• FFF: @rektfoodfarmer

• SCC: @eldtrades @mapletarzan

• Expo: @blocmatesdotcom

• ACAP: Anon + @j0rby

Imagine if @Bitboy_crypto was in charge of your farming. NGMI.

Here are a few of the leads farmers I found.

• ReFi: @hufhaus

• FFF: @rektfoodfarmer

• SCC: @eldtrades @mapletarzan

• Expo: @blocmatesdotcom

• ACAP: Anon + @j0rby

3. How's the Team compensated?

Many FAAS are transparent when it comes to holdings.

But it isn't AS clear on how the teams are compensated, or how many tokens they hold each. 🤔

This is an area that can be improved considering how transparent everything else is.

Many FAAS are transparent when it comes to holdings.

But it isn't AS clear on how the teams are compensated, or how many tokens they hold each. 🤔

This is an area that can be improved considering how transparent everything else is.

4. Bear Market Strategies & Risk Management

We're at an unusual time right now for the space.

The Fed wants to raise interest rates, and there's the Ukraine situation.

How are the projects navigating these times? They could get rekt'ed if they're not careful.

We're at an unusual time right now for the space.

The Fed wants to raise interest rates, and there's the Ukraine situation.

How are the projects navigating these times? They could get rekt'ed if they're not careful.

5. STUDY the numbers.

How much of their performance is due to the reflections tax?

You want to judge the numbers by the performance of the treasury due to FARMING.

How much of their performance is due to the reflections tax?

You want to judge the numbers by the performance of the treasury due to FARMING.

Let's wrap this up.

I don't have a horse in this race, so here's how I'm seeing the sector right now.

Below is a list of all the pros and cons that I see:

I don't have a horse in this race, so here's how I'm seeing the sector right now.

Below is a list of all the pros and cons that I see:

The Bull:

• It does what it says it does - hands-off degen farming in the hands of professionals.

• A lot of these farmers DO know their DeFi from the moves I'm seeing.

They can outperform 95% of DeFi farmers.

• It does what it says it does - hands-off degen farming in the hands of professionals.

• A lot of these farmers DO know their DeFi from the moves I'm seeing.

They can outperform 95% of DeFi farmers.

• It's a higher-risk investment in a Risk Off environment.

• Watch out for liquidity/slippage

• Their investments are public. You can copy some of the trades yourself if you want.

• Watch out for liquidity/slippage

• Their investments are public. You can copy some of the trades yourself if you want.

And finally, DeFi's barely over 1.5 years old and FAAS around 4 months.

Most Hedgefund managers have track records of at least a decade.

We don't know how the farmers perform over the long term.

I view this sector as a 7/10 risk.

The risk will lower as the space matures.

Most Hedgefund managers have track records of at least a decade.

We don't know how the farmers perform over the long term.

I view this sector as a 7/10 risk.

The risk will lower as the space matures.

Final Thoughts

This sector 100% has potential.

It's YOUNG. Expect more players to enter and more innovations to come.

Be careful - this bear market will wipe out a ton of players.

You can always wait on the sidelines for the space to mature before investing.

This sector 100% has potential.

It's YOUNG. Expect more players to enter and more innovations to come.

Be careful - this bear market will wipe out a ton of players.

You can always wait on the sidelines for the space to mature before investing.

Takeaways

• FAAS operates like a hedge fund for DeFi

• Understand tokenomics before investing especially how the tax system works.

• Learn how the protocols differentiate from each other.

• You're 100% betting on the farmers and team experience.

• FAAS operates like a hedge fund for DeFi

• Understand tokenomics before investing especially how the tax system works.

• Learn how the protocols differentiate from each other.

• You're 100% betting on the farmers and team experience.

Transparency

I am not invested in any FAAS projects.

No one paid me anything to mention them.

I interviewed @hufhaus9 of @reimaginedfi and @crosschainalex of @4dothq for an insider's perspective of the space.

@poordefipenguin helped put together some data.

I am not invested in any FAAS projects.

No one paid me anything to mention them.

I interviewed @hufhaus9 of @reimaginedfi and @crosschainalex of @4dothq for an insider's perspective of the space.

@poordefipenguin helped put together some data.

Did you enjoy this?

1. Follow me for more threads on DeFi trends, frameworks. and mental models -> @TheDeFiEdge

2. I also write a free weekly newsletter. Subscribe at TheDeFiEdge.com

1. Follow me for more threads on DeFi trends, frameworks. and mental models -> @TheDeFiEdge

2. I also write a free weekly newsletter. Subscribe at TheDeFiEdge.com

Also, I'd appreciate if you could like & retweet the 1st thread below.

This thread took 50+ hours of work to research and write.

I'd love to put in this much effort into future ones, but I want to make sure the #'s are worth it.

This thread took 50+ hours of work to research and write.

I'd love to put in this much effort into future ones, but I want to make sure the #'s are worth it.

جاري تحميل الاقتراحات...