The checklist ✅

1⃣Current Quarterly Earnings Growth

2⃣Annual Earnings Growth

3⃣New Products/Services/Management/Price Highs

4⃣Supply and Demand

5⃣Leader/Laggard

6⃣Institutional Sponsorship

7⃣Market Direction

1⃣Current Quarterly Earnings Growth

2⃣Annual Earnings Growth

3⃣New Products/Services/Management/Price Highs

4⃣Supply and Demand

5⃣Leader/Laggard

6⃣Institutional Sponsorship

7⃣Market Direction

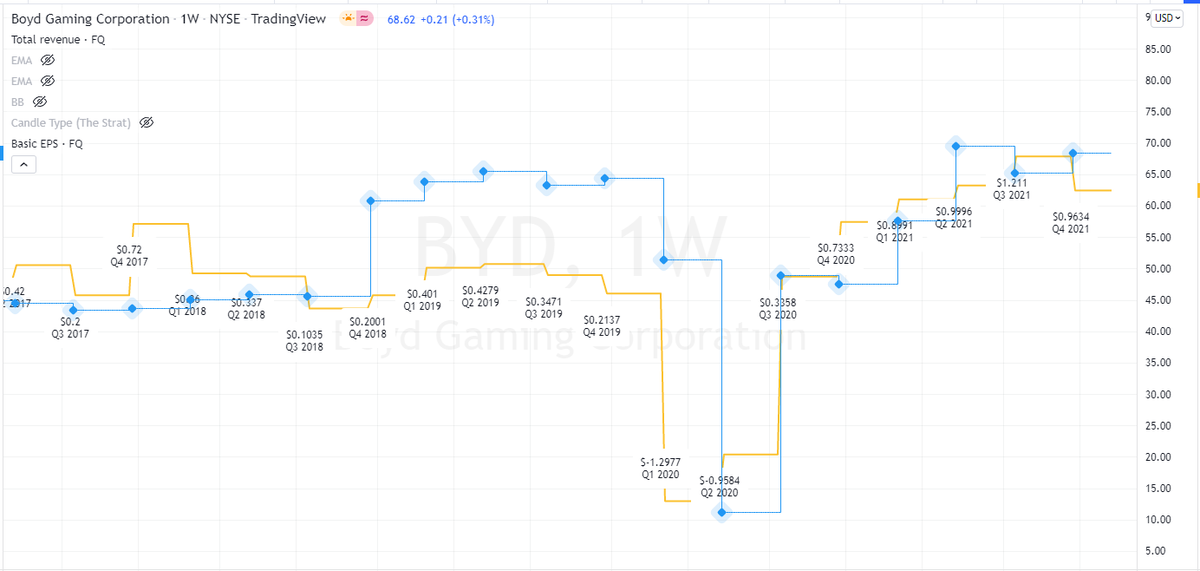

2⃣ C -A- NSLIM

For Annual Earnings Growth, we are looking for growth over the past few years and/or exceptional Annual EPS estimates for the current year and the next. 👇

EPS past 5y: 18%

EPS this y: 11%

EPS next 5y: 44%

For Annual Earnings Growth, we are looking for growth over the past few years and/or exceptional Annual EPS estimates for the current year and the next. 👇

EPS past 5y: 18%

EPS this y: 11%

EPS next 5y: 44%

3⃣ CA -N- SLIM

New products, management, or positive new events that could push the company's stock price. 👇

The "New" in this case is about new all-time price highs that is very close, and is a clear sign of a stock in demand.

New products, management, or positive new events that could push the company's stock price. 👇

The "New" in this case is about new all-time price highs that is very close, and is a clear sign of a stock in demand.

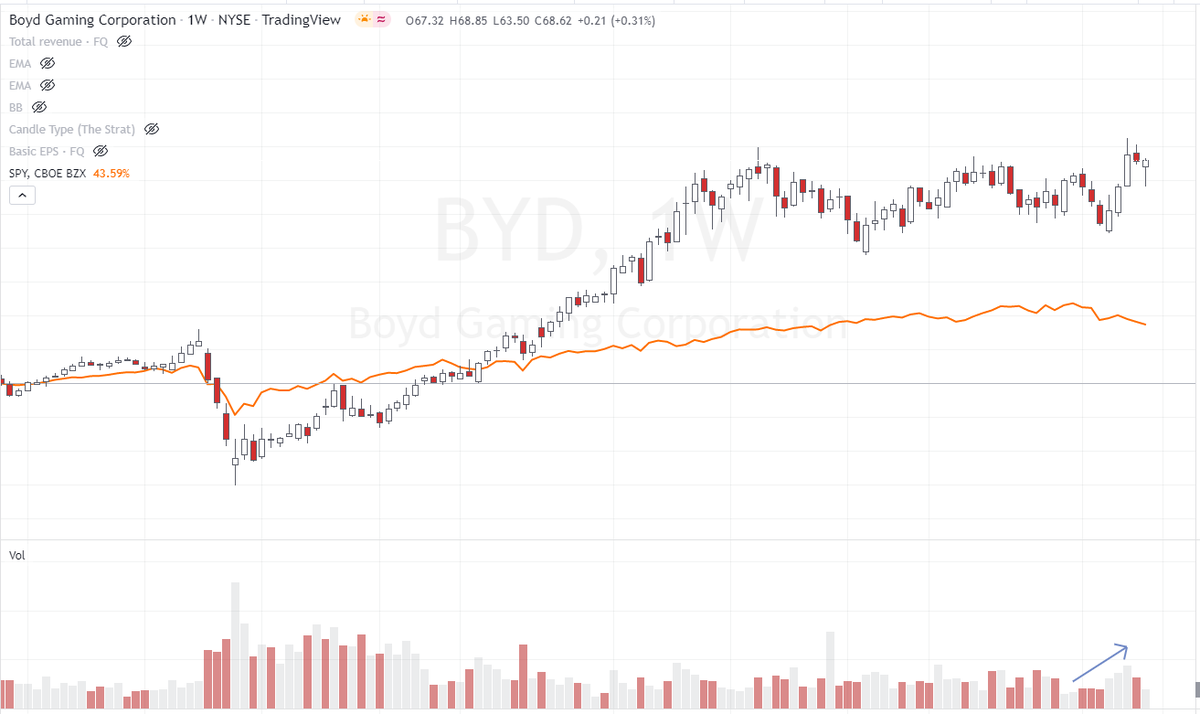

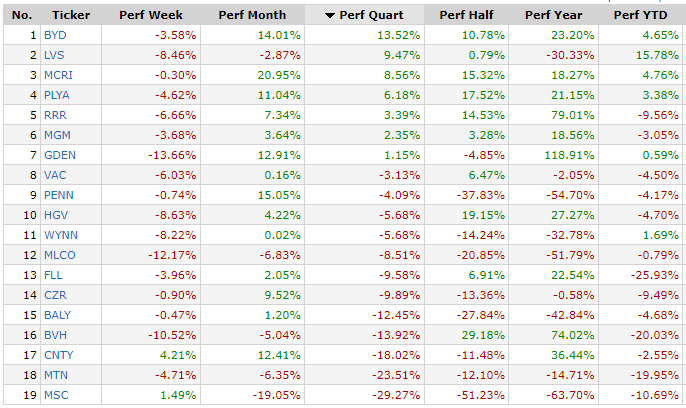

5⃣ CANS -L- IM

The stock is a leader or a laggard relative to the overall market? 👇

- great relative strength vs #spy

The stock is a leader or a laggard relative to the overall market? 👇

- great relative strength vs #spy

6⃣ CANSL -I- M

Pick stocks that have institutional sponsorship, but be cautious of stocks that are over-owned by institutions as you want to get in before the big money is fully invested. 👇

Current institutional ownership: 69%

Pick stocks that have institutional sponsorship, but be cautious of stocks that are over-owned by institutions as you want to get in before the big money is fully invested. 👇

Current institutional ownership: 69%

In summary:

✅ $BYD shows good fundamentals with a powerful chart and relative strength.

✅ so, it's a "YES", but we need to time the entry considering the particular market condition we are in.

✅ $BYD shows good fundamentals with a powerful chart and relative strength.

✅ so, it's a "YES", but we need to time the entry considering the particular market condition we are in.

If you like this content, please share the very first tweet and make sure to follow @tradingandata for new data and insights.

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

Loading suggestions...