Wars and #stockmarkets

let's find some evidence in past data points 👇

thread 🧵

#trading

#RussiaUkraineConflict

let's find some evidence in past data points 👇

thread 🧵

#trading

#RussiaUkraineConflict

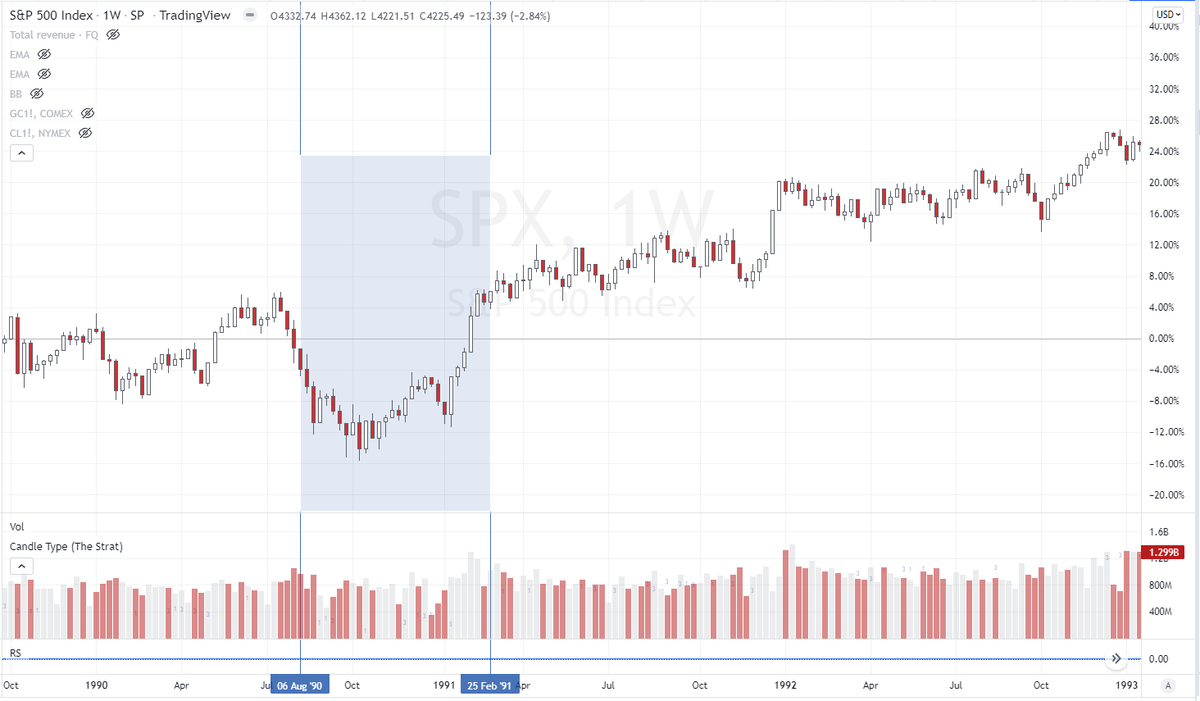

1. #spy and Gulf War

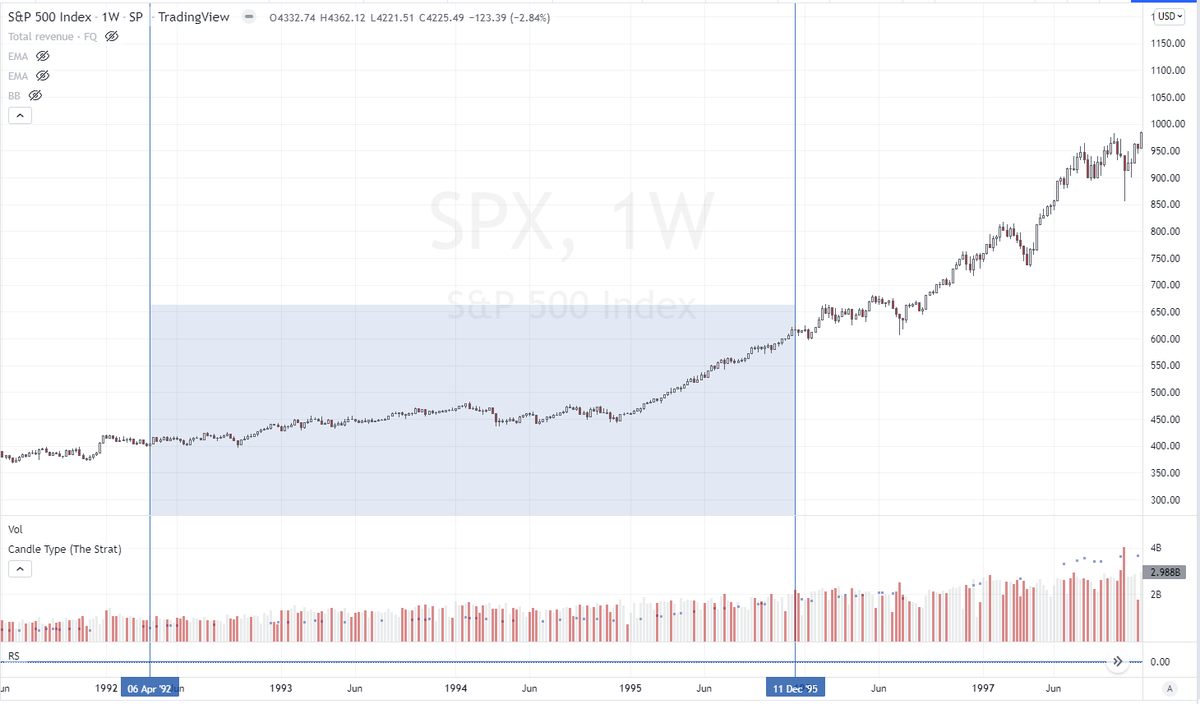

2. #spy and Bosnian War

3. #spy and Kosovo War

4. #spy and Afghanistan invasion

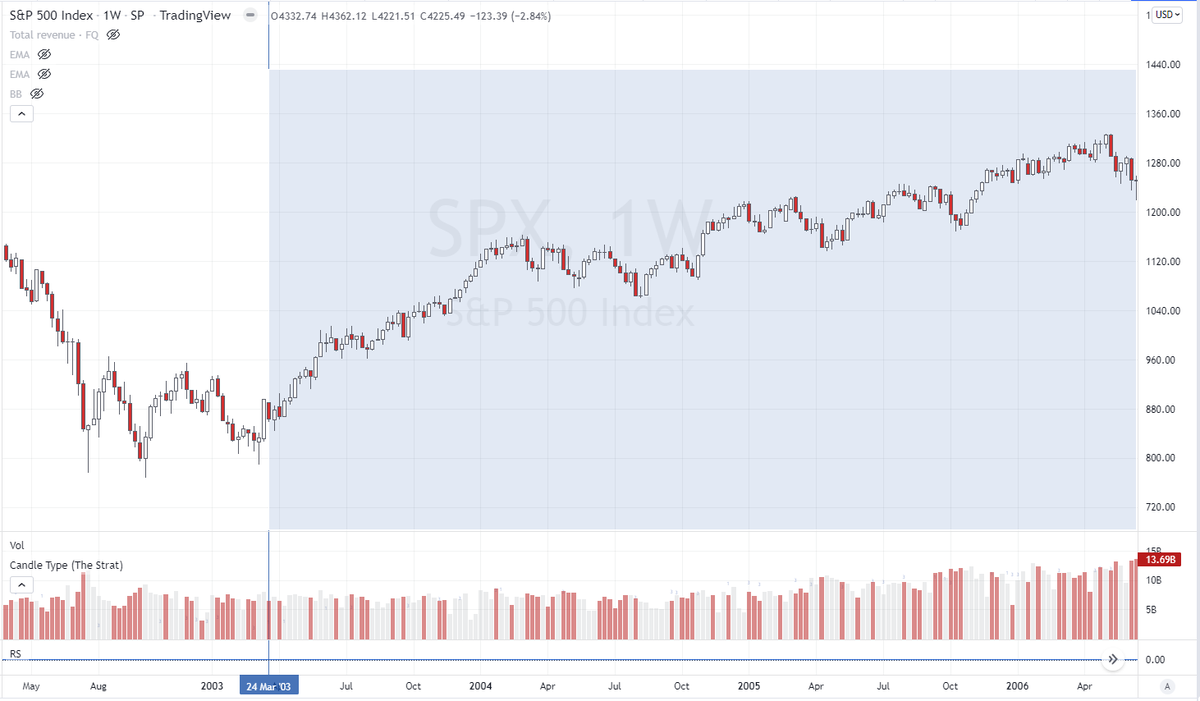

5. #spy and Iraq invasion

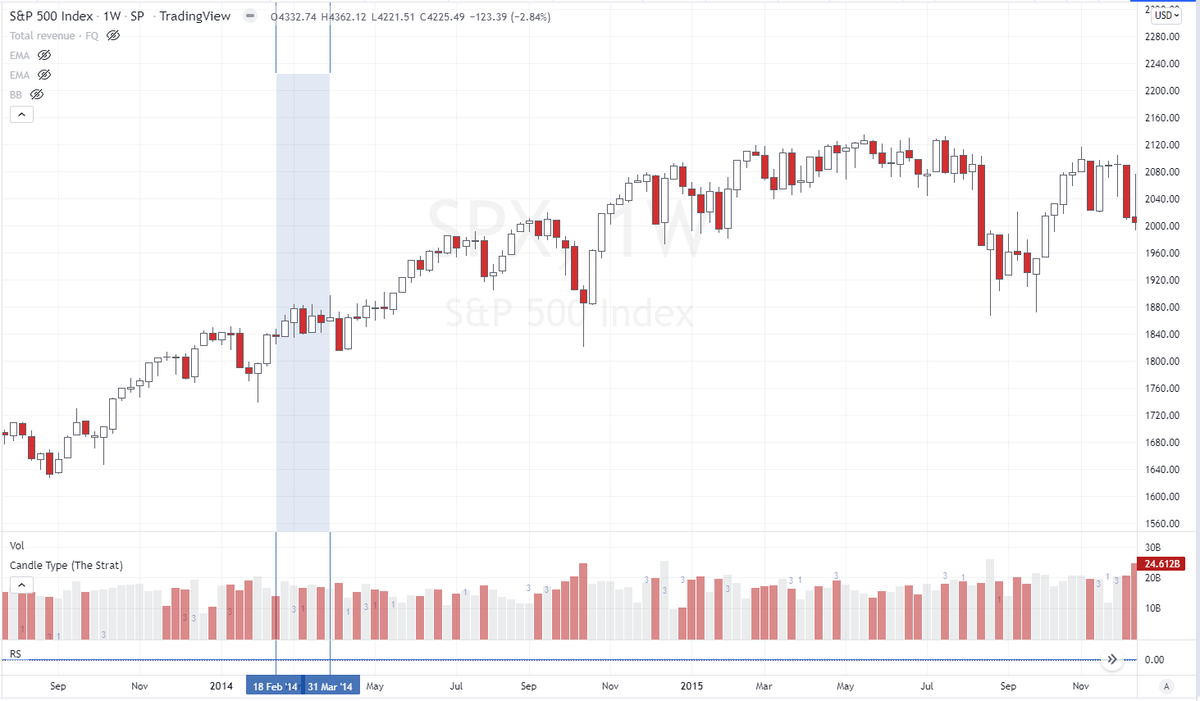

6. #spy and Crimea invasion

7.

The war puzzle

In cases when there is a pre-war phase, an increase in the war likelihood tends to decrease stock prices, but the ultimate outbreak of a war increases them.

However, in cases when a war starts as a surprise, the outbreak of a war decreases stock prices.

The war puzzle

In cases when there is a pre-war phase, an increase in the war likelihood tends to decrease stock prices, but the ultimate outbreak of a war increases them.

However, in cases when a war starts as a surprise, the outbreak of a war decreases stock prices.

8.

Optimism...

The Vietnam war and both of the Gulf wars are examples of short-lived drops followed by long upward trajectories.

Afghanistan in 1979 was followed by a 12-day index drop of about 3.8% in total.

When Russia later took Crimea in 2014, there was just a 2% drop.

Optimism...

The Vietnam war and both of the Gulf wars are examples of short-lived drops followed by long upward trajectories.

Afghanistan in 1979 was followed by a 12-day index drop of about 3.8% in total.

When Russia later took Crimea in 2014, there was just a 2% drop.

9.

Buy the invasion?

Buy the invasion?

10.

Wars and volatility

Stock market volatility was actually lower during periods of war.

Intuitively, one would expect uncertainty to go higher, however, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average.

Wars and volatility

Stock market volatility was actually lower during periods of war.

Intuitively, one would expect uncertainty to go higher, however, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average.

11.

Be aware of inflation

The current geopolitical tensions could be peculiar, because the armed conflict coincides with one of the highest threats of inflation since World War 2.

Be aware of inflation

The current geopolitical tensions could be peculiar, because the armed conflict coincides with one of the highest threats of inflation since World War 2.

12.

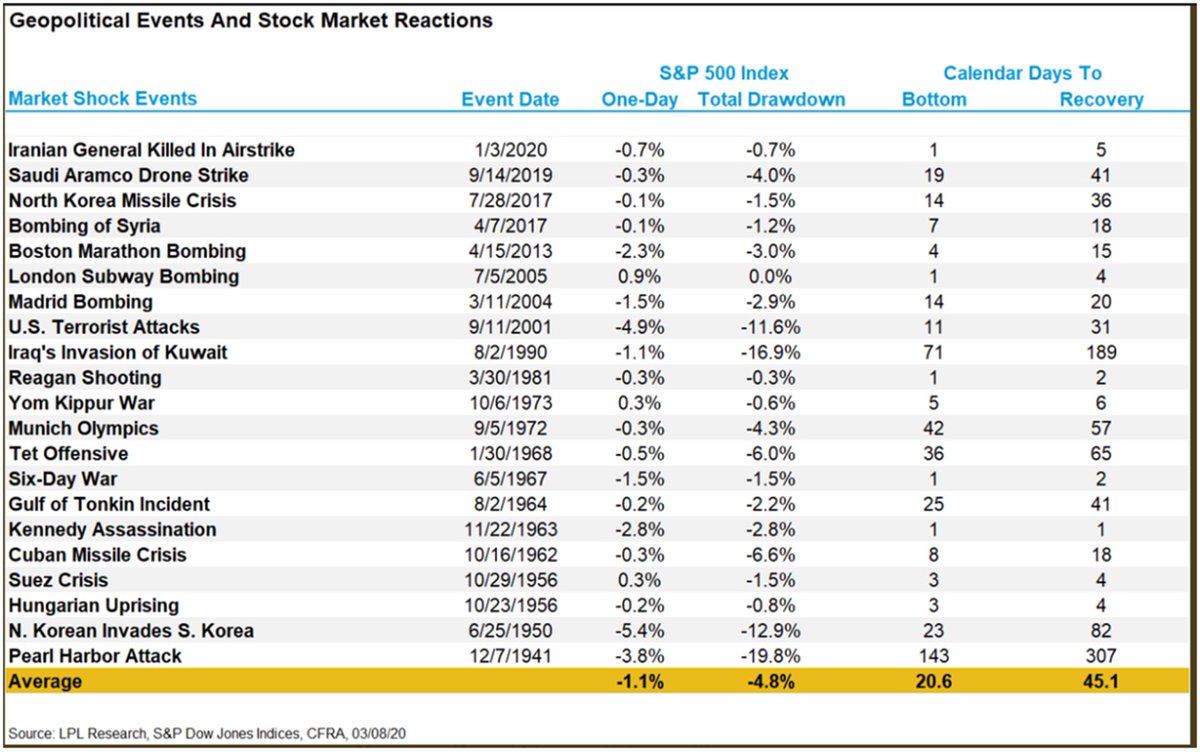

Geopolitical events and #stockmarkets reaction:

Geopolitical events and #stockmarkets reaction:

In summary:

✅War and conflict bring sudden crashes, varying in their degrees and depths, but usually the recovery is relatively forecastable.

✅The implication from these historical sources is that an armed conflict should be viewed as a buying opportunity for quality stocks.

✅War and conflict bring sudden crashes, varying in their degrees and depths, but usually the recovery is relatively forecastable.

✅The implication from these historical sources is that an armed conflict should be viewed as a buying opportunity for quality stocks.

If you like this content, please share the very first tweet and make sure to follow @tradingandata for new data and insights.

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

Loading suggestions...