1) Some thoughts on crypto, Ukraine, and stocks

2) NOT FINANCIAL ADVICE

And more importantly, there might be war. That's really bad for the world. Fuck all this price stuff. Go outside and do something nice for someone.

-----

Seriously, do something nice. The world could use it.

I'll wait.

-----

And more importantly, there might be war. That's really bad for the world. Fuck all this price stuff. Go outside and do something nice for someone.

-----

Seriously, do something nice. The world could use it.

I'll wait.

-----

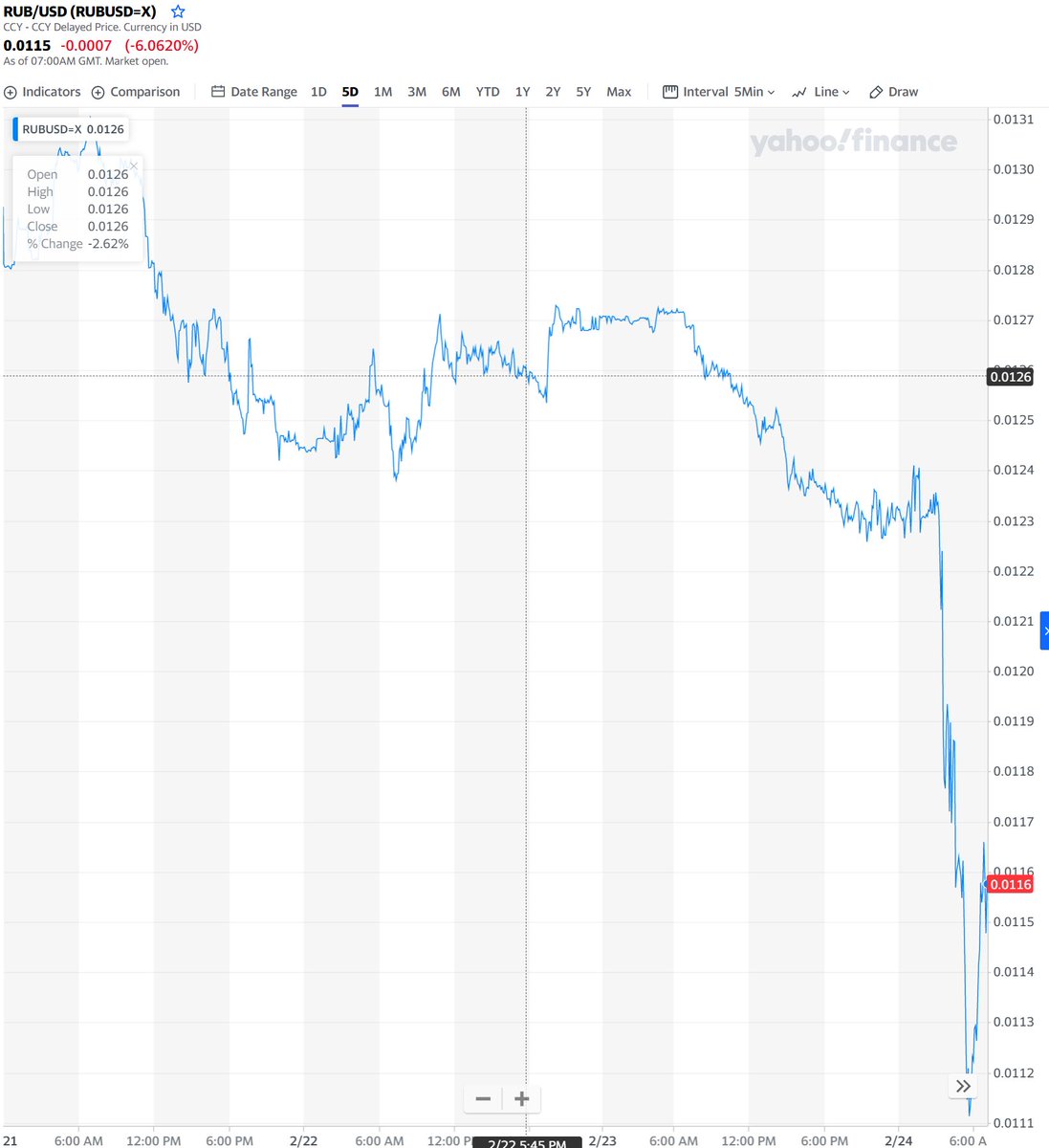

3) In the last day, the S&P500 is down about 4%, and BTC is down about 8%.

Why? Well, I mean, because of the obvious.

Why? Well, I mean, because of the obvious.

4) It makes sense that stocks are down. War is, generally, bad.

What should BTC be doing here?

Well, on the one hand, if the world gets shittier, people have less free cash.

Basically, selling BTC--along with stocks, etc.--to pay for war.

What should BTC be doing here?

Well, on the one hand, if the world gets shittier, people have less free cash.

Basically, selling BTC--along with stocks, etc.--to pay for war.

6) So there are arguments both ways for what should be happening to BTC right now. I'm not really sure I would have guessed it would go down based on the fundamentals.

But it is down, a lot! Why?

But it is down, a lot! Why?

7) Well, let's say there are 2 types of people in the world: fundamental investors and algorithm followers.

Fundamental investors look at the situation and are uncertain which direction BTC/USD should move.

Algorithm followers consult the data. Historically, what's the trend?

Fundamental investors look at the situation and are uncertain which direction BTC/USD should move.

Algorithm followers consult the data. Historically, what's the trend?

8) Well, over the last year, there's been a really high correlation between crypto and equities.

The main reason is monetary policy: moves in expectations of inflation and interest rates change USD and other fiat currencies.

More inflation --> crypto + equities up vs USD.

The main reason is monetary policy: moves in expectations of inflation and interest rates change USD and other fiat currencies.

More inflation --> crypto + equities up vs USD.

9) And so the algorithms look at the data, and decide based on that BTC should be 80% correlated to the S&P500, with a beta of 4 (i.e. if S&P500 moves 1%, BTC moves 4%).

Then war happens.

Then war happens.

10) Fundamental investors are neutral, but algorithmic investors see the S&P500 go down 4%, and so expect BTC to go down 4*4%=16% based on historical studies.

11) There's a push and a pull, with fundamental investors buying and algorithmic investors selling; on net, BTC ends up halfway in between, down 8% on the day.

So, who's "right"?

So, who's "right"?

12) Well, I don't know.

Maybe the algorithmic investor is: maybe we *think* this is about financial systems but actually the dominant effect is just everything selling off to fund wars.

But maybe they're not: maybe they're basing their judgements on monetary policy moves.

Maybe the algorithmic investor is: maybe we *think* this is about financial systems but actually the dominant effect is just everything selling off to fund wars.

But maybe they're not: maybe they're basing their judgements on monetary policy moves.

13) But this isn't a monetary policy move.

So BTC goes down 8%, half of the 16% that the algorithmic investors predict.

At which point their model updates a bit--BTC went down less than the 4x they predicted--and a cycle begins.

Maybe.

So BTC goes down 8%, half of the 16% that the algorithmic investors predict.

At which point their model updates a bit--BTC went down less than the 4x they predicted--and a cycle begins.

Maybe.

14) Or maybe the real effect here has nothing to do with any of those things.

Maybe it's liquidity.

If you're risk averse, maybe you're selling whatever you have right now, because who knows what'll happen.

And markets are illiquid right now--who's buying volatile assets?

Maybe it's liquidity.

If you're risk averse, maybe you're selling whatever you have right now, because who knows what'll happen.

And markets are illiquid right now--who's buying volatile assets?

15) Anyway, who knows what will happen--anything could and I don't mean to imply that I know what will happen.

But I also think we're probably in a new regime than we've been in the last year and a half. We'll have to see how things work here.

But I also think we're probably in a new regime than we've been in the last year and a half. We'll have to see how things work here.

16) And again, go do something nice for someone.

The world could use it right about now.

The world could use it right about now.

Loading suggestions...