the process:

1⃣ wait for the first hour bar to close (10am)

2⃣ wait for the second hour bar to become a 2 (break of high/low of the previous bar)

3⃣ wait for the price to come back in the middle point area of the previous hourly bar

4⃣ find a trigger pattern on 5min chart

1⃣ wait for the first hour bar to close (10am)

2⃣ wait for the second hour bar to become a 2 (break of high/low of the previous bar)

3⃣ wait for the price to come back in the middle point area of the previous hourly bar

4⃣ find a trigger pattern on 5min chart

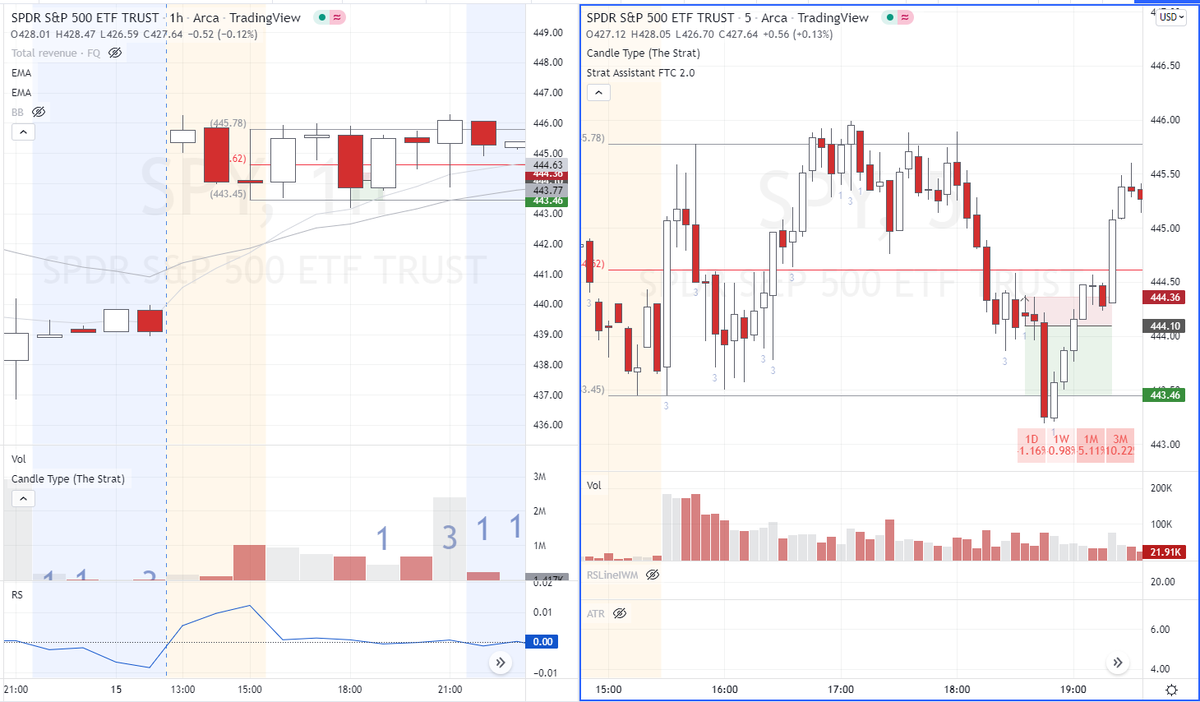

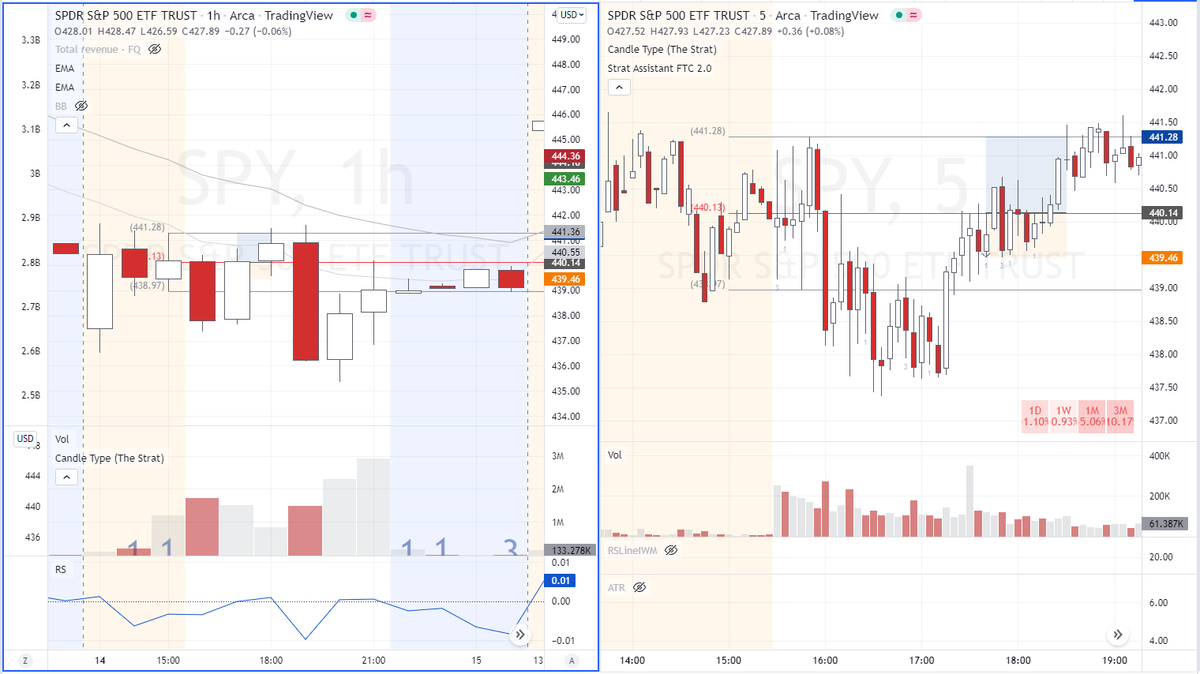

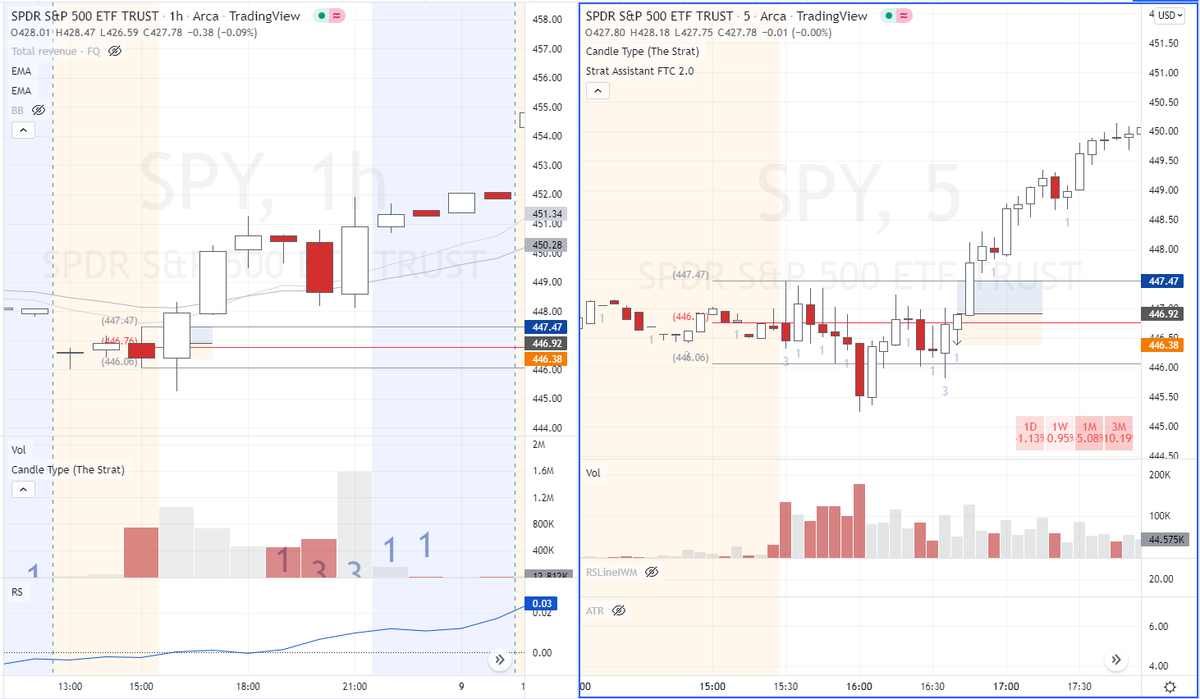

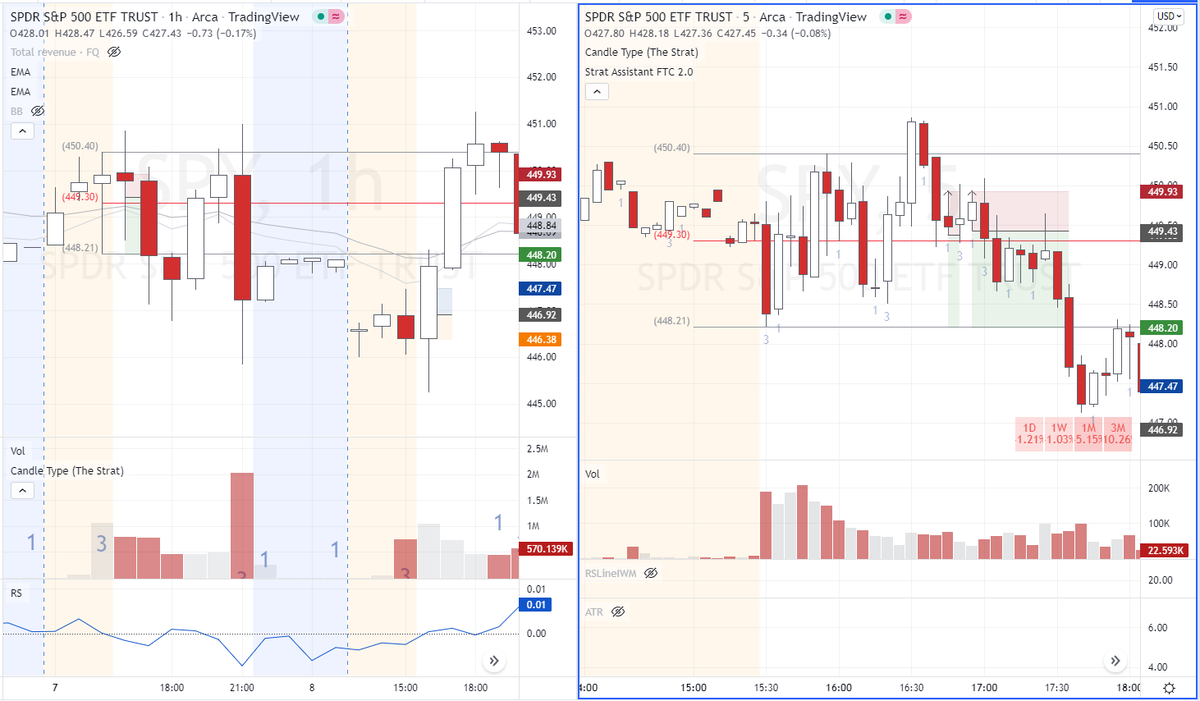

Here following some examples from the last 3 weeks in #spy:

✅6 sessions with a triggered entry

✅5 sessions without entry point 👇

✅6 sessions with a triggered entry

✅5 sessions without entry point 👇

In summary:

.sessions triggered: 6/11

.long trades: 2

.short trades: 4

.total trades: 7

.trades at target: 6

.loss: 1

.total R: 10... not bad!

.sessions triggered: 6/11

.long trades: 2

.short trades: 4

.total trades: 7

.trades at target: 6

.loss: 1

.total R: 10... not bad!

If you like this content, please share the very first tweet and make sure to follow @tradingandata for new data and insights.

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

By the way, for more content about strategies, backtesting and wisdom from the #trading Masters, check this growing library 👇

Loading suggestions...