A few days ago @GiganticRebirth's ‘Big short’ article popped up. Great read.

A while back I did research on token unlocks myself. I’ve attached a sheet with unlock info of some tokens

In the thread below, I will share some thoughts on FDV & Unlocks

🧵👇

docs.google.com

A while back I did research on token unlocks myself. I’ve attached a sheet with unlock info of some tokens

In the thread below, I will share some thoughts on FDV & Unlocks

🧵👇

docs.google.com

The reason I decided to look into token unlocks was actually a tweet from GCR himself:

This together with some great tweets like this made me realise 2022 is the year of unlocks.

This together with some great tweets like this made me realise 2022 is the year of unlocks.

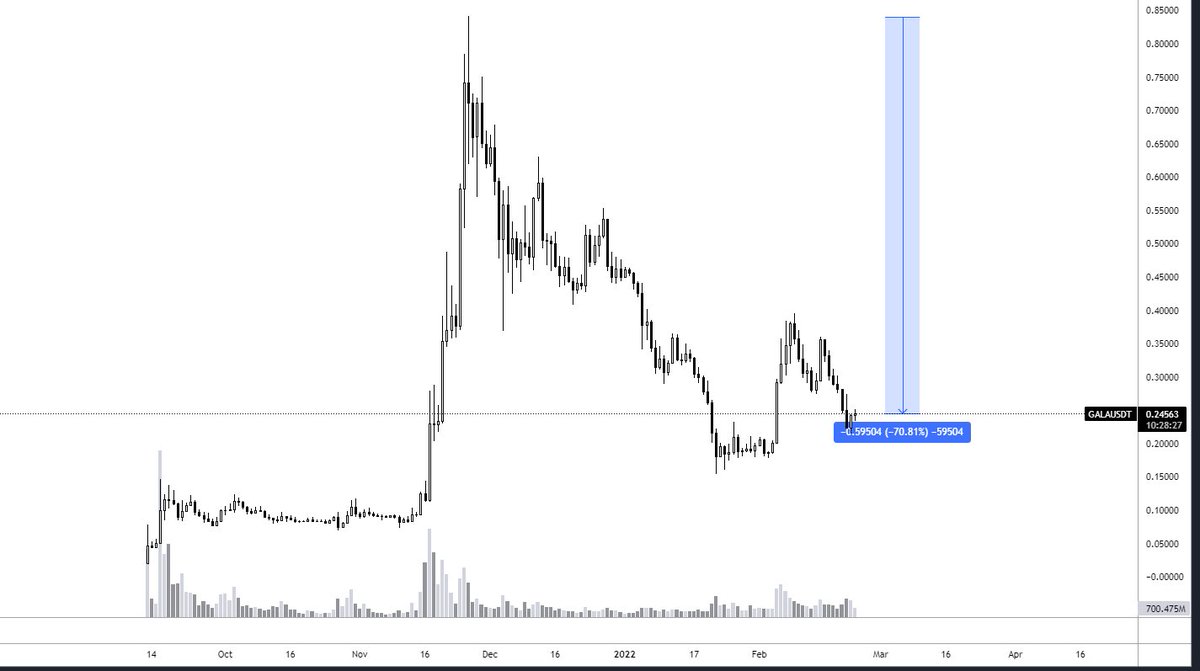

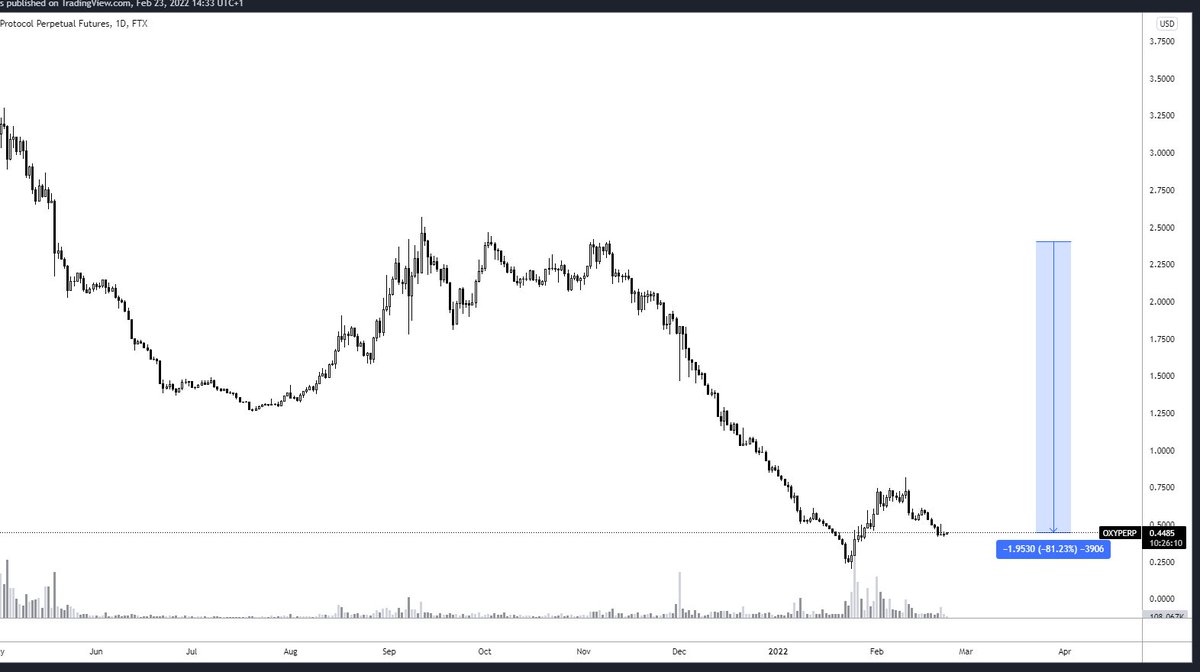

We can keep going, but I think a point is made. Keeping tabs on unlocks can be very important.

And yes, I understand almost every token has been going down for the last weeks, but why not use these low-float tokens as a hedge?

Let's talk more about token unlocks 👇

And yes, I understand almost every token has been going down for the last weeks, but why not use these low-float tokens as a hedge?

Let's talk more about token unlocks 👇

Token unlocks increase supply and create sell pressure. However, as we have seen with previous unlocks, they are not always bearish. We’ve all heard of the ‘bullish unlock’ meme. What are some things we should look out for?

The fact was and still is that a lot of projects have done many multiples this cycle, meaning private and seed investors are up a ton. Even when their projects dump 50% they’ll be up many multiples and happy to sell at this late stage of the cycle.

Locked tokens however have a market of their own. Many times, VC’s have already sold their locked tokens OTC to other VC’s or professional investors.

E.g. Alameda has a big bag of SOL, but prefers liquidity. They can sell their locked tokens OTC, and sign...

E.g. Alameda has a big bag of SOL, but prefers liquidity. They can sell their locked tokens OTC, and sign...

... legal contracts, to e.g. 3AC for a discount to the market price. When these tokens are unlocked, instead of Alameda having a 1000x and dumping their tokens, 3AC will have a 3x and won’t dump their tokens.

On top, many times OTC deals have an extended lock period. These unlocked tokens have a cost basis not too far from the current market price. Since many investors expected the unlock to be bearish, which it actually wasn’t, this could result in a bullish event.

The most accurate way to see if there is OTC demand is to participate in the OTC market itself and evaluate if the project is good (product-market fit, adoption, w/e). Another way to look at it is see who bought into the seed or private rounds that will be unlocked.

Imo VCs will dump their tokens at a late stage of the cycle if a project isn’t A tier, but the chance that retail investors will do so is far greater. We can see if a project has had institutional interest (lot of VC funding, extra funding rounds later on) or more retail funding

For the projects in the sheet, I would argue most are bearish.

I highly recommend reading this article by Cobie btw (all his articles for that matter): cobie.substack.com

“I would imagine that 90-95% of unlocks happening through 2022 are bearish.” – Cobie

I highly recommend reading this article by Cobie btw (all his articles for that matter): cobie.substack.com

“I would imagine that 90-95% of unlocks happening through 2022 are bearish.” – Cobie

So what do we do with this information?

- Short

- Hedge

- be aware of the distribution scheme of the tokens in your portfolio

- Short

- Hedge

- be aware of the distribution scheme of the tokens in your portfolio

fin.

Have fun playing the S&P500 simulator.

Liked the thread? RTs/favorites/shares are appreciated! ♥️

For more threads like this, give me a follow. 🤝

Have fun playing the S&P500 simulator.

Liked the thread? RTs/favorites/shares are appreciated! ♥️

For more threads like this, give me a follow. 🤝

Loading suggestions...