1/ Recently I've seen plenty of speculations about arb opportunities and high APR yields on your stables on #terra chain with @NexusProtocol and @pylon_protocol.

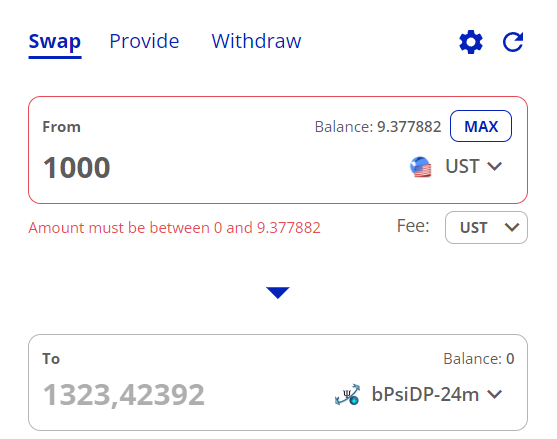

2/ What is it all about? You can liquid stake $bPsi-24m token on @pylonprotocol which can be redeemed for $UST at 1:1 ratio after 24 months of vesting. If you don't want to hold it so long, you can sell it on the market.

3/ You start receiving $Psi rewards when you are keeping $bPsi-24m in the wallet or you can send your stake to the auto compounder at @SpecProtocol for 16% APY.

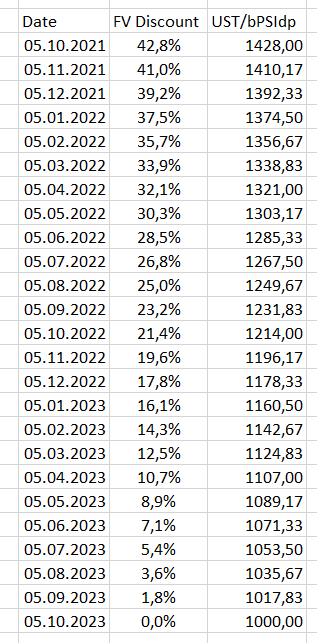

5/ The answer is very simple. You can redeem $bPsi-24m for UST at 1:1 ratio only after 24 months, that means that your $UST doesn't receive @anchor_protocol yields. For 24 months you would get 42.8% gain on your $UST if deposited to anchor.

7/ @ArbieApp would you consider to change some numbers for UST → bPsiDP arb opportunity?

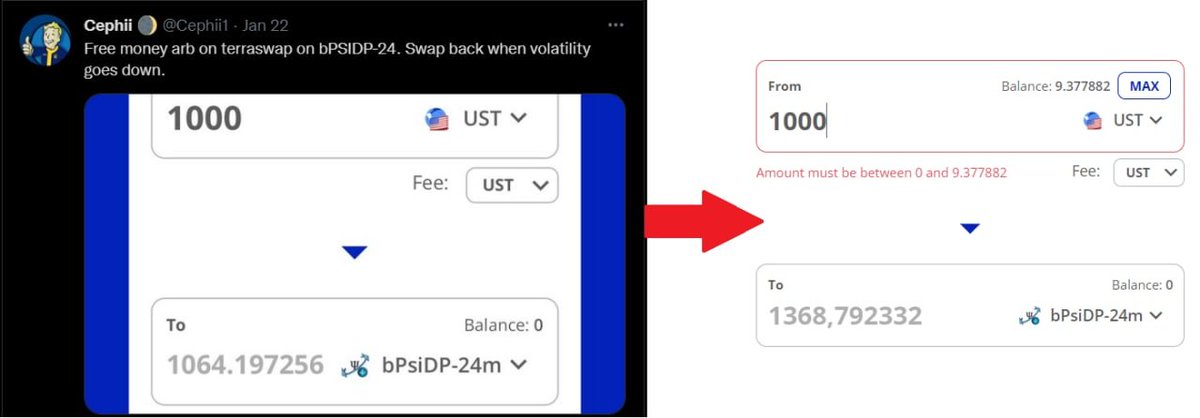

8/ So real arbitrage opportunity comes from arbing difference between fair price and market price of $bPsi-24m. But why would you swap your $UST for $bPsi-24m at all?

9/ As of now you are earning 16% APY on $bPsi-24m on @SpecProtocol and if the rate stays the same until the end and you bought $bPsi-24m at a fair value then you will get a really high APR on your stables.

10/ Assume you bought 1356 $bPsi-24m for 1000 $UST on 5th Feb and 16% APY remains constant until the end of 24m vesting. After 20 months you can redeem 1716 $bPsi-24m for 1716 $UST with an effective APY of 42.9% on your stables! More than double of the anchor yield!

11/ If staking APR of $bPsi-24m doesn't fall further and you will take arb opportunities between fair and market value of the 1350 $bPsi-24m then you can double or even triple your anchor yields.

12/ There are not many additional risks out there, except standart smart contract risks, etc. Worst case scenario is if the spot price will be much lower than fair price and you won't be able to exit the position before the end of the vesting without loss if needed.

14/ If you liked this thread, I would love it if you could share it by retweeting the first tweet:

Thank you!

Thank you!

جاري تحميل الاقتراحات...