An educational #Thread on which stocks to buy on breakout retest which hv higher probabilities of success with a grt risk reward. Playing the breakout is easy in a bull market but in a volatile, consolidating market the retest becomes a preferred play.

"WHAT, WHEN" to buy ?

1/n

"WHAT, WHEN" to buy ?

1/n

So 1st lets understand WHAT to buy i.e which stocks to buy in breakout retest whose probability of success is high. Let's make a checklist & understand with practical e.g's.

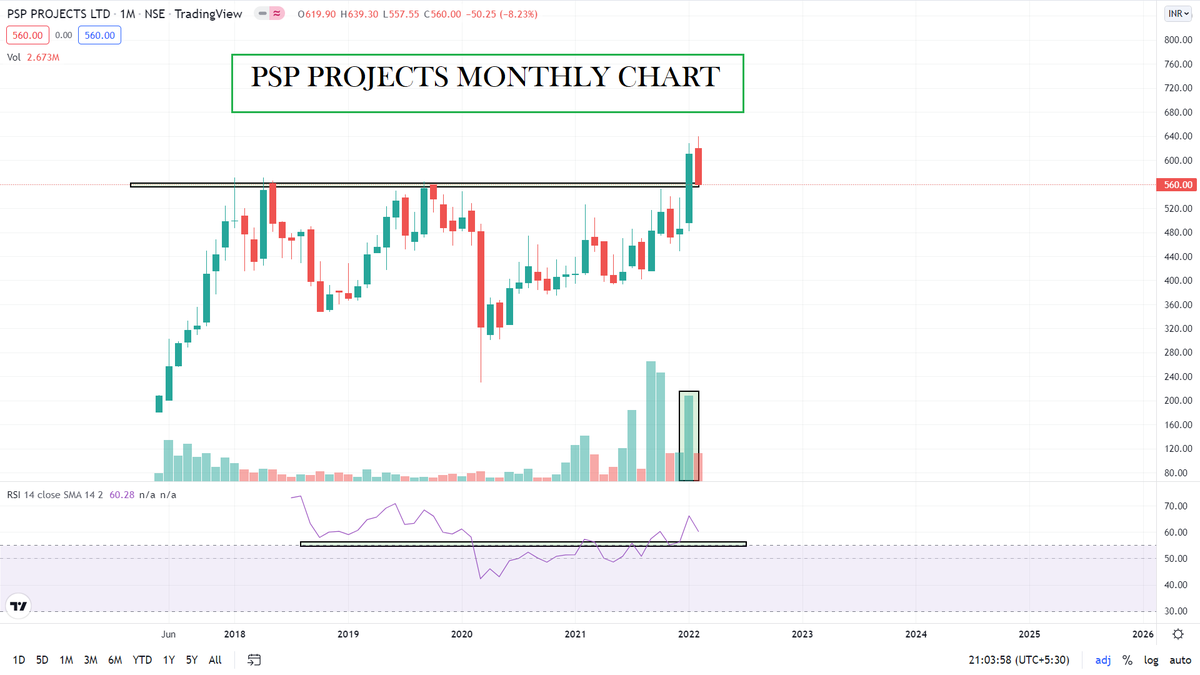

1. Buy only those stocks on retest which is retesting breakout on all imp. time frames i.e D,W & M.

2/n

1. Buy only those stocks on retest which is retesting breakout on all imp. time frames i.e D,W & M.

2/n

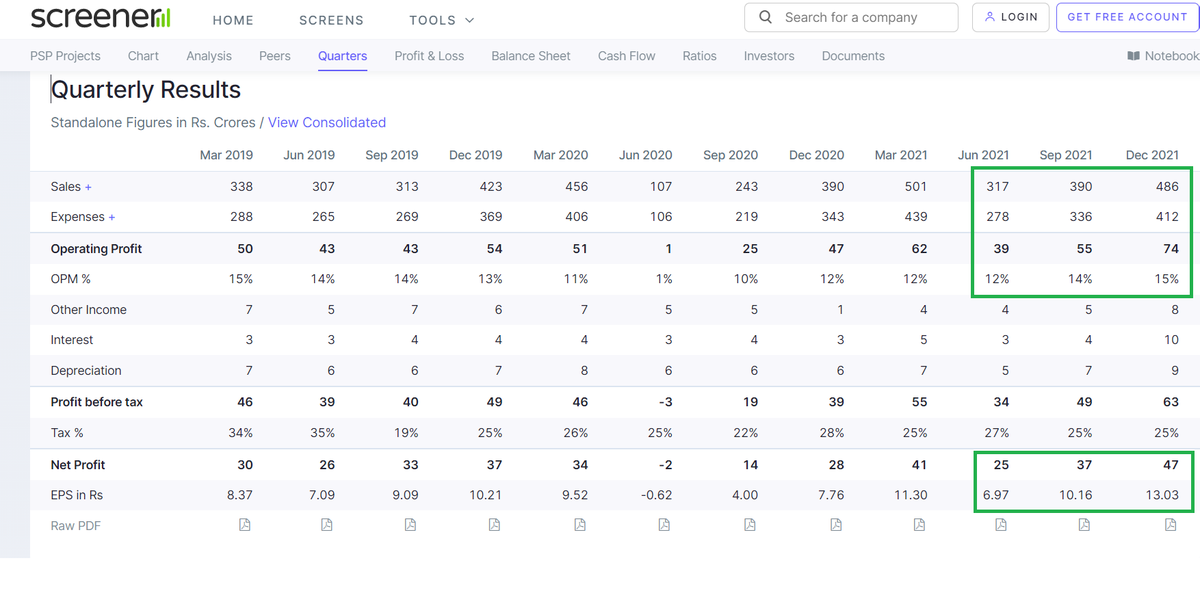

Buying strong Techno-Funda stocks at a reasonable #Price with favorable r:r is the perfect recipe for a high probability positional trade. As a exercise I would request every1 to post more e.g's of abv.

Do share this with like minded people. Suggestions, feedbacks are welcomed.

Do share this with like minded people. Suggestions, feedbacks are welcomed.

Loading suggestions...