SBM bank – #Amazon of banking

Take a name in #fintech space & the odds are it had partnered with State bank of #Mauritius.

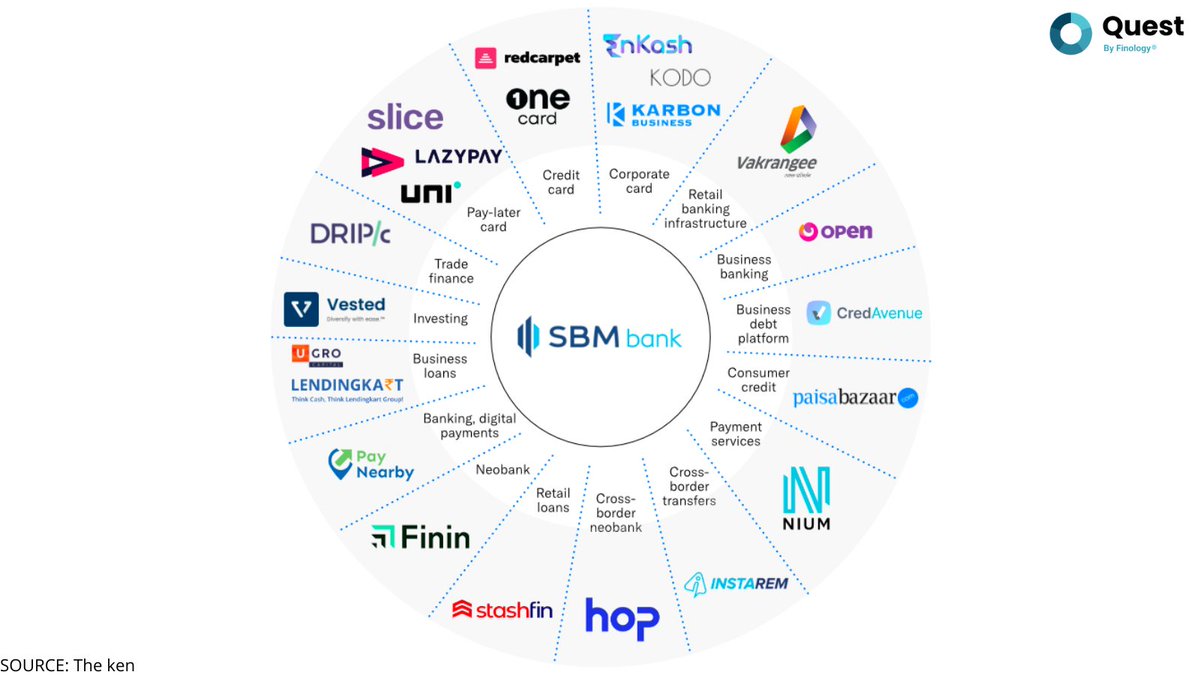

SBM has partnered with almost 30 fintech firms as a part of its strategy to acquire customers using the ‘banking as a service’ model.

- A thread 🧵 (1/11)

Take a name in #fintech space & the odds are it had partnered with State bank of #Mauritius.

SBM has partnered with almost 30 fintech firms as a part of its strategy to acquire customers using the ‘banking as a service’ model.

- A thread 🧵 (1/11)

In December 2018, SMB got the licence to operate full-banking services from #RBI. It is 1 of only 2 foreign lenders to open local units in India & has drawn up an asset-light fintech partnership-based strategy.

(2/11)

(2/11)

SBM provides fintech companies with an interface for their customers, & it would help in providing a network that would connect customers not only with banking facilities but also utilising other facilities of #fintech companies.

(3/11)

(3/11)

SBM has branches in Mumbai, New Delhi, Bengaluru, Chennai, Hyderabad, Ahmedabad, Ramachandrapuram & Palghar; it claims to reach customers in 500+ cities via its digital channels, growing its AMU more than 3.5X with just 8 branches & < 250 employees across the country.

(4/11)

(4/11)

According to the MD & CEO, Rath said, Building a branch network is expensive & it costs Rs 1.5 to 2 crore.

They focused on building a liability (deposit) franchise 1st & asset book will follow liabilities.

(5/11)

They focused on building a liability (deposit) franchise 1st & asset book will follow liabilities.

(5/11)

SBM currently works with 30 different fintech firms, including lending platform Lendingkart, supply chain finance provider Drip Capital, & pay-later card providers such as #slice, Uni, & LazyPay.

(6/11)

(6/11)

For Eg: It has partnered with Paisabazaar, through which it issues innovative products like a secured credit card to people who are otherwise ineligible for it.

(7/11)

(7/11)

Now they can instantly open an FD online & get a secured credit card & as they build a track record of paying bills in time, they are eligible for a regular card.

(8/11)

(8/11)

As SBM doesn’t have endless capital to spend on customer acquisition, fintech serves as distributors for their banking services. It is easy way for to grow deposits passively.

SBM’s retail deposits have grown 24% in the year ended March 2021; its gross NPA stood at 2.97%.

(9/11)

SBM’s retail deposits have grown 24% in the year ended March 2021; its gross NPA stood at 2.97%.

(9/11)

Slice, one of its partner, has also become Unicorn; while other banks were hesitant because of Slice’s Business model, SBM was willing to take the plunge. This contributed to SBM acquiring Slice as a partner in 2019.

(10/11)

(10/11)

Learn more about the banking industry in our Academy of value investing course.

Link: #value-investing" target="_blank" rel="noopener" onclick="event.stopPropagation()">quest.finology.in

(11/11)

Link: #value-investing" target="_blank" rel="noopener" onclick="event.stopPropagation()">quest.finology.in

(11/11)

جاري تحميل الاقتراحات...