How Devyani International is planning to take over Jubilant FoodWorks? 😯

- A thread 🧵 (1/17)

#Dominos #pizzahut #sharemarket

- A thread 🧵 (1/17)

#Dominos #pizzahut #sharemarket

By now you must have seen a lot of influencers relishing Pizza hut’s Momo #pizza and a lot of other new items on its menu, but it's not just the Pizza hut’s Menu that has changed, the pizza chain has a new strategy to take over the Indian market. (2/17)

1 reason Y most restaurants shut down is “high fixed costs”. They have to hire cooks, tablestaff, pay huge rents even if there r no or fewer dine-ins & it seems like Pizzahut has addressed this pain point as its new strategy is simple:Open small stores & Stick to delivery.(3/17)

This new strategy of Pizza hut takes a lot of inspiration from the most successful #pizza chain in India, Domino’s. Because what is better than copying the most successful player in the industry? (4/17)

Although Domino’s and Pizza hut are in the same QSR industry, there is a stark difference in how both of them operate, while Domino focuses on delivery and has compact stores, Pizza hut is perceived as Dine in brand. (5/17)

Pizza hut lags behind Dominos in India, mainly because of two reasons, the company is perceived to be expensive because of its big stores and they do not have a credible delivery model. (6/17)

However, Devyani International, the company that operates the stores of Pizza hut in India has taken note of it and currently is focusing more on opening small stores and having a better delivery network. (7/17)

“Pizza Hut is basically not dine-in now,” Devyani chairman Ravi Jaipuria said on an analyst call after the recent quarterly results. “It’s a delivery store, but if anyone wants to eat there, we just give them the box.” No cutlery, sorry. (8/17)

The company is focusing on opening compact outlets, previously the company had outlets that could seat around 120 people, but now it is happy with small outlets that could seat around 40 people. (9/17)

Also, Domino’s stores generally measure around 1,400-1,600 sq ft, but Devyani’s new Pizza Hut stores are even more compact, in the 800-1,100 sq ft range, compared to its previous stores which measured 2,000 sq ft-sized. (10/17)

This shift is beginning to reflect in Devyani’s numbers. Acc to Edelweiss, Due to its new delivery-focused stores, which require low upfront investment & operating expenses, company had an OPM of 14%, which is 2x higher than the margin that a dine-in store would make. (11/17)

Also, even though the company is on an expansion spree, its average daily sales (ADS) per store have been on the rise, up 18% year on year. (12/17)

So, has the time come for Pizza hut? Will it dethrone Domino’s to be Pizza king in India? Maybe not! There are quite a few things that could hold it back. (13/17)

Jubilant FoodWorks Ltd is the sole franchisee for Domino’s in India, Devyani has to share the rights for Pizza Hut—and KFC, also from the Yum! Brands with Sapphire foods. (14/17)

While Jubilant has a free hand in operating Domino’s, because it does not have its team in India, Yum! has its team and therefore to scale Pizza hut in India, Devyani, Sapphire foods and Yum! have to be aligned. (15/17)

Also, it's tough for Pizza hut to compete against Domino’s, when it comes to technology. As Domino’s gets more than half its business from its own app and website,Pizza Hut generates just 10-20% of its online orders on its own. (16/17)

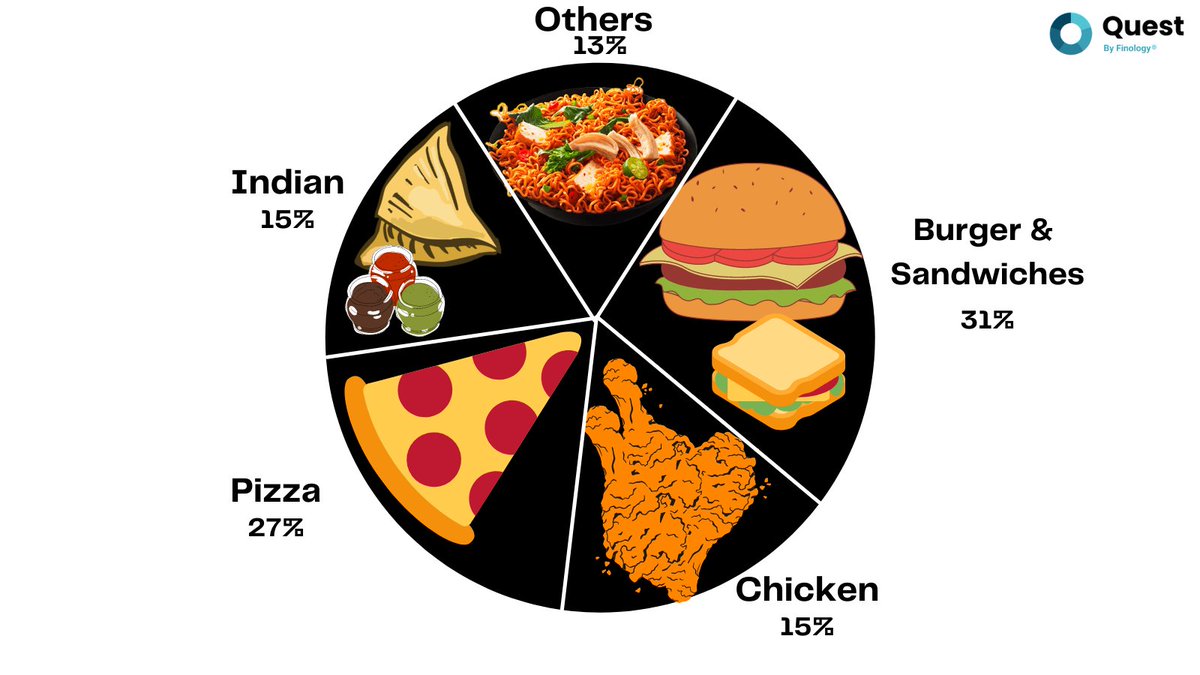

Fun Fact! Did you know that Burgers and Pizza’s account for half of India’s fast-food market?

On Quest we have a dedicated 15 min video course Jubilant’s Anaysis. (17/17)

Link: quest.finology.in

#pizza #Dominos #PizzaDay

On Quest we have a dedicated 15 min video course Jubilant’s Anaysis. (17/17)

Link: quest.finology.in

#pizza #Dominos #PizzaDay

Loading suggestions...