Most people have their ETH sitting around doing nothing.

Here are some low-risk ways to earn passive income with your ETH:

Here are some low-risk ways to earn passive income with your ETH:

My ETH Philosophy

I'm going to focus on LOW-RISK ways to earn yield.

ETH's job is to preserve wealth and add stability to my portfolio.

It's a long term investment that I'm trying to squeeze some juice out of

I leave the high-risk, degen plays to other parts of my portfolio.

I'm going to focus on LOW-RISK ways to earn yield.

ETH's job is to preserve wealth and add stability to my portfolio.

It's a long term investment that I'm trying to squeeze some juice out of

I leave the high-risk, degen plays to other parts of my portfolio.

Method 1: Store in a Cold Wallet

You don’t have to earn a yield on everything.

Think of it like hiding storing gold bars away (but the price actually goes up)

DeFi's risky.

You're hedging yourself against possible exploits, hacks, & rug pulls.

Risk: 1/10

You don’t have to earn a yield on everything.

Think of it like hiding storing gold bars away (but the price actually goes up)

DeFi's risky.

You're hedging yourself against possible exploits, hacks, & rug pulls.

Risk: 1/10

Method 2: Lend Your ETH to CeFi

You can lend your ETH to companies.

They then lend it to hedge funds, exchanges, and institutional traders.

That's where the yield comes from.

Places include:

@CelsiusNetwork

@BlockFi

@hodlnautdotcom

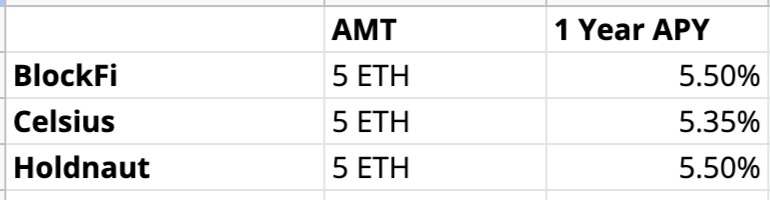

I've calculated some rates for 5 ETH.

You can lend your ETH to companies.

They then lend it to hedge funds, exchanges, and institutional traders.

That's where the yield comes from.

Places include:

@CelsiusNetwork

@BlockFi

@hodlnautdotcom

I've calculated some rates for 5 ETH.

Pros: It’s easy.

Cons: KYC. Fuck the suits. Not your keys.

How “safe” is it?

• These places are NOT FDIC insured like banks. They do take safety seriously. @BlockFi's coins are managed by @Gemini

• @celsiusnetwork was part of the @badgerdao exploit

Risk: 3/10.

Cons: KYC. Fuck the suits. Not your keys.

How “safe” is it?

• These places are NOT FDIC insured like banks. They do take safety seriously. @BlockFi's coins are managed by @Gemini

• @celsiusnetwork was part of the @badgerdao exploit

Risk: 3/10.

Method 3: Staking

Staking is the process of locking your tokens up to help secure a Proof of Stake network.

By staking your ETH, you earn additional ETH.

ETH is the hardest chain to stake directly so I don't recommend it, and it has a high minimum.

Staking is the process of locking your tokens up to help secure a Proof of Stake network.

By staking your ETH, you earn additional ETH.

ETH is the hardest chain to stake directly so I don't recommend it, and it has a high minimum.

Staking Ethereum Directly

Pros: ETH Maxis will jerk you off (for free).

Cons: 32 ETH min (roughly $100k), hard to set up, your ETH is LOCKED until the merge

There are some alternative options:

Pros: ETH Maxis will jerk you off (for free).

Cons: 32 ETH min (roughly $100k), hard to set up, your ETH is LOCKED until the merge

There are some alternative options:

a. Staking with a Centralized Exchange

Some exchanges like @coinbase will allow you to stake directly.

Rates: 4.5% APR

Pros: Stupid simple.

Cons: Lower Rates, KYC, Not in your Custody, fuck the suits.

Risk: 2/10

Some exchanges like @coinbase will allow you to stake directly.

Rates: 4.5% APR

Pros: Stupid simple.

Cons: Lower Rates, KYC, Not in your Custody, fuck the suits.

Risk: 2/10

b. Liquid Staking

Liquid Staking solves the problems with staking ETH directly.

• There's no minimum to stake.

• There's no lockup.

Your deposit your ETH. You get a token that REPRESENTS your staked eth like (stETH).

Liquid Staking solves the problems with staking ETH directly.

• There's no minimum to stake.

• There's no lockup.

Your deposit your ETH. You get a token that REPRESENTS your staked eth like (stETH).

The benefits of stETH (stETH is Lido's version)

• It's pegged 1:1. 1 ETH is always worth 1 stETH

• stETH earns staking reward through rebasing each day.

• You can do DeFi with stETH such as LP pair and lending / borrowing.

• It's pegged 1:1. 1 ETH is always worth 1 stETH

• stETH earns staking reward through rebasing each day.

• You can do DeFi with stETH such as LP pair and lending / borrowing.

Liquid Staking Solutions:

• @LidoFinance - The Most Popular and highest TVL

• @stakewise_io - 2 Token design that separates staked eth and the rewards.

• @Rocket_pool - The Most Decentralized. You can run your own node for additional yield!

Risk: 2/10

• @LidoFinance - The Most Popular and highest TVL

• @stakewise_io - 2 Token design that separates staked eth and the rewards.

• @Rocket_pool - The Most Decentralized. You can run your own node for additional yield!

Risk: 2/10

Advanced:

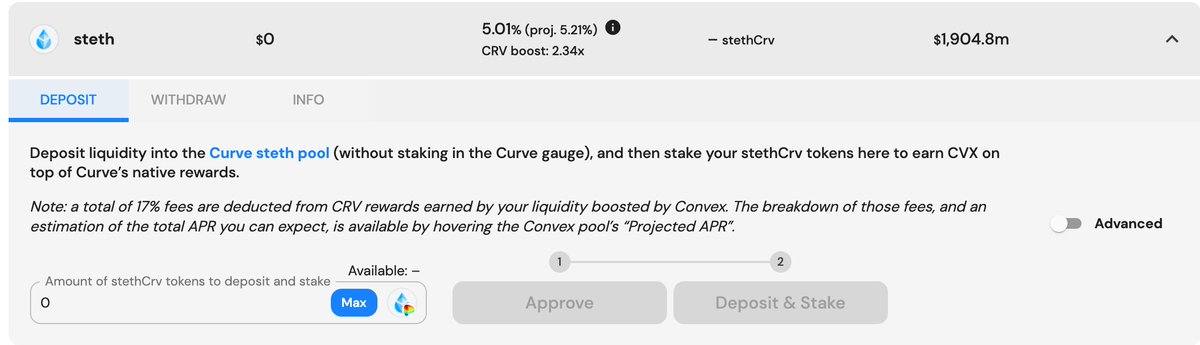

You can earn additional yield by using stETH in LP pools on ETH mainnet.

• @CurveFinance

• @ConvexFinance

• @iearnfinance

I'm not going to go into detail as ETH gas fees will price out most people reading this.

Risk: 4/10

You can earn additional yield by using stETH in LP pools on ETH mainnet.

• @CurveFinance

• @ConvexFinance

• @iearnfinance

I'm not going to go into detail as ETH gas fees will price out most people reading this.

Risk: 4/10

Method 4: Using ETH /w @AnchorProtocol

This is my PERSONAL strategy.

When I started this, the interest rates were much, much higher. 😞

They were paying you to borrow money, and I liked having exposure to @terra_money.

(Like this if you're a LUNAtic)

This is my PERSONAL strategy.

When I started this, the interest rates were much, much higher. 😞

They were paying you to borrow money, and I liked having exposure to @terra_money.

(Like this if you're a LUNAtic)

Steps:

1. Convert your ETH into stETH at @Lidofinance

2. Convert your stETH into bETH at anchor.lido.fi

3. Deposit your bETH as collateral on @anchorprotocol

4. You'll be able to borrow UST up to 75%. I recommend around 25% LTV.

Don't be greedy fren.

1. Convert your ETH into stETH at @Lidofinance

2. Convert your stETH into bETH at anchor.lido.fi

3. Deposit your bETH as collateral on @anchorprotocol

4. You'll be able to borrow UST up to 75%. I recommend around 25% LTV.

Don't be greedy fren.

Pros: Exposure to Terra Ecosystem. Additional possible yield with aUST

Cons:

• Converting might be taxable

• You’re using leverage

• the 19.5% APY might not last forever

• smart contract risks

• lots of moving parts for a noob.

Risk: 4/10

Cons:

• Converting might be taxable

• You’re using leverage

• the 19.5% APY might not last forever

• smart contract risks

• lots of moving parts for a noob.

Risk: 4/10

Advanced:

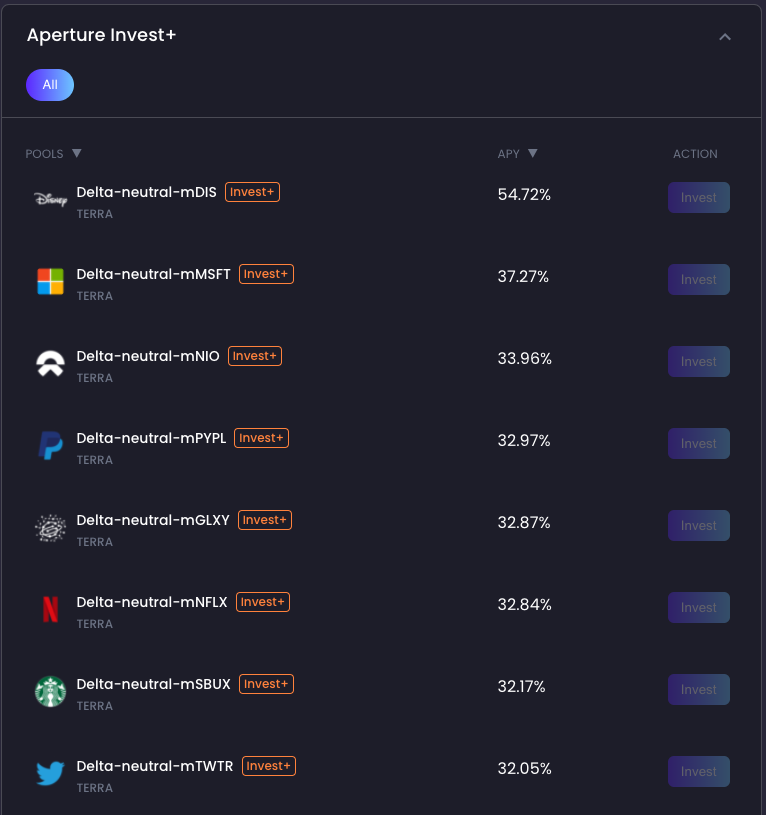

When you deposit UST, you get a token called aUST in return.

You can gain additional yield without too much risk with your aUST.

It's called Delta Neutral strategies on @Mirror_protocol

There's a new protocol called @aperturefinance that automates this.

Risk: 5/10

When you deposit UST, you get a token called aUST in return.

You can gain additional yield without too much risk with your aUST.

It's called Delta Neutral strategies on @Mirror_protocol

There's a new protocol called @aperturefinance that automates this.

Risk: 5/10

Method 5: Use ETH in an LP Pool

You can use ETH in a Liquidity Pair.

For example, you can pair ETH - USDC on a protocol and earn yield.

The problem is that using ETH Layer 1 is expensive due to Gas fees.

You can use ETH in a Liquidity Pair.

For example, you can pair ETH - USDC on a protocol and earn yield.

The problem is that using ETH Layer 1 is expensive due to Gas fees.

Solution?

You can bridge your ETH over to a different chain.

By bridging it over, to a cheaper chain, you keep the value of your ETH but you pay fewer gas fees.

Options:

ETH Scaling: MATIC, Arbitrum

Alt L1's: AVAX, FTM

FTM has the most opportunities right now.

You can bridge your ETH over to a different chain.

By bridging it over, to a cheaper chain, you keep the value of your ETH but you pay fewer gas fees.

Options:

ETH Scaling: MATIC, Arbitrum

Alt L1's: AVAX, FTM

FTM has the most opportunities right now.

جاري تحميل الاقتراحات...