An interesting read!

A thread on RHI Magnesita India Ltd and Refractory Industry in detail.

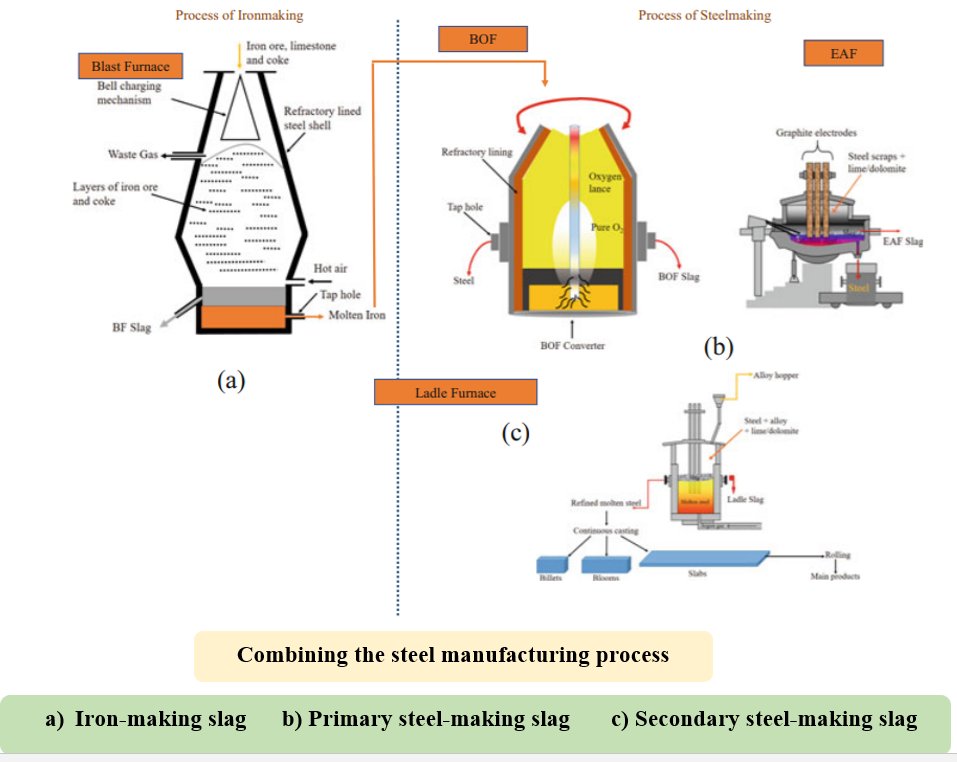

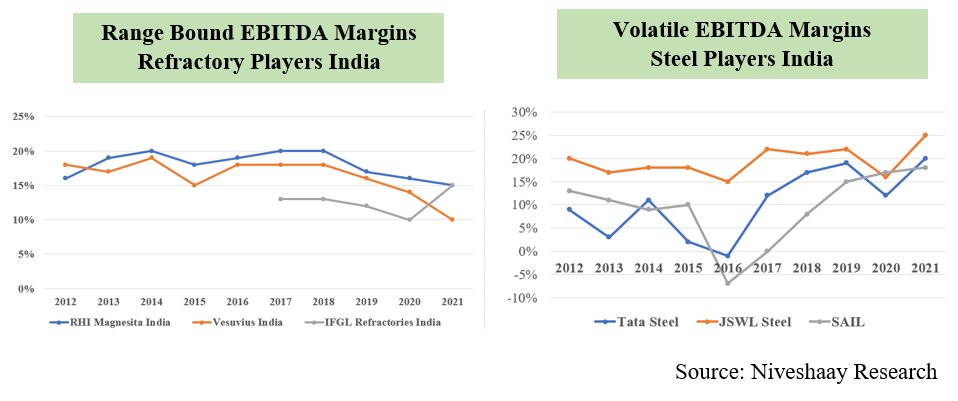

Why this sector? Refractory business is an indirect play on steel industry and capex cycle with less volatility

#refractories #RHIM #learningsatniveshaay

A thread on RHI Magnesita India Ltd and Refractory Industry in detail.

Why this sector? Refractory business is an indirect play on steel industry and capex cycle with less volatility

#refractories #RHIM #learningsatniveshaay

What led us to research this industry?

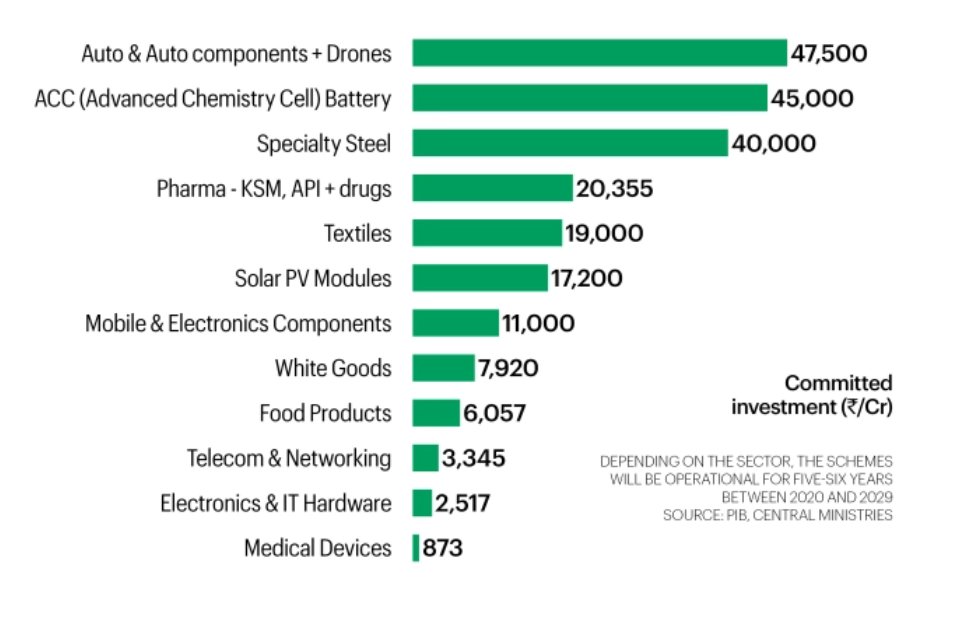

Revival in Indian Capex Cycle expected (Govt+Pvt) with favorable Govt. policies & reforms like PLI, NIP, Import Substitution, AMP, reduced corporate tax rate

Highlight of the #Budget2022 was also on reviving CAPEX cycle in India

Revival in Indian Capex Cycle expected (Govt+Pvt) with favorable Govt. policies & reforms like PLI, NIP, Import Substitution, AMP, reduced corporate tax rate

Highlight of the #Budget2022 was also on reviving CAPEX cycle in India

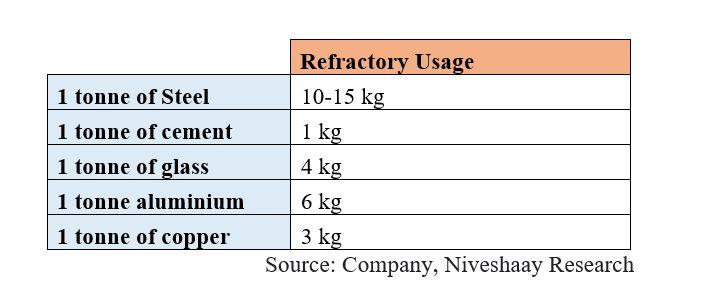

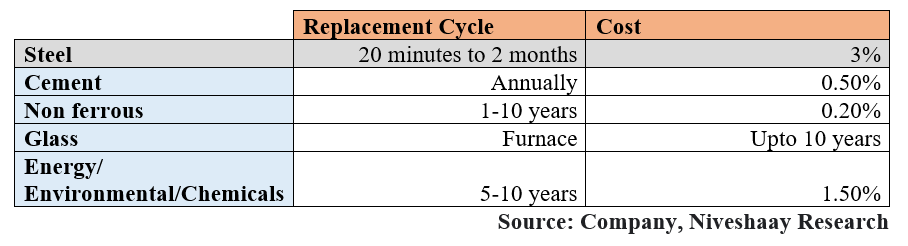

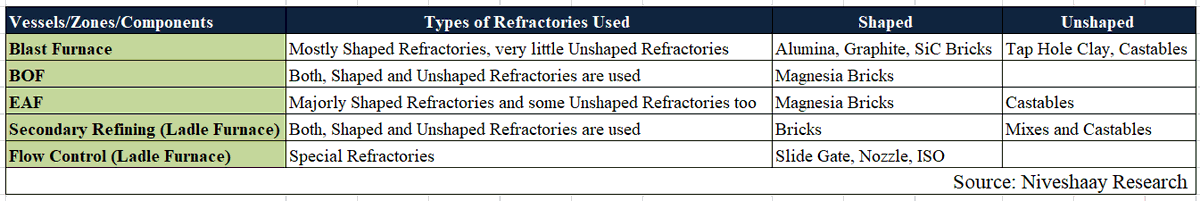

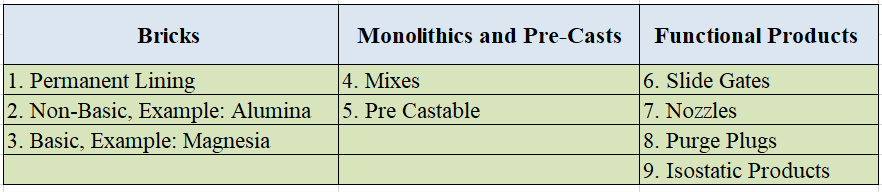

Refractories are characterized as Consumable(75%) or Investment Goods(25%) depending on the end user industry.

Application: 75% of refractory demand comes from Iron & Steel industry and remaining is from cement, glass, non ferrous & energy/environment/Chemicals.

#refractories

Application: 75% of refractory demand comes from Iron & Steel industry and remaining is from cement, glass, non ferrous & energy/environment/Chemicals.

#refractories

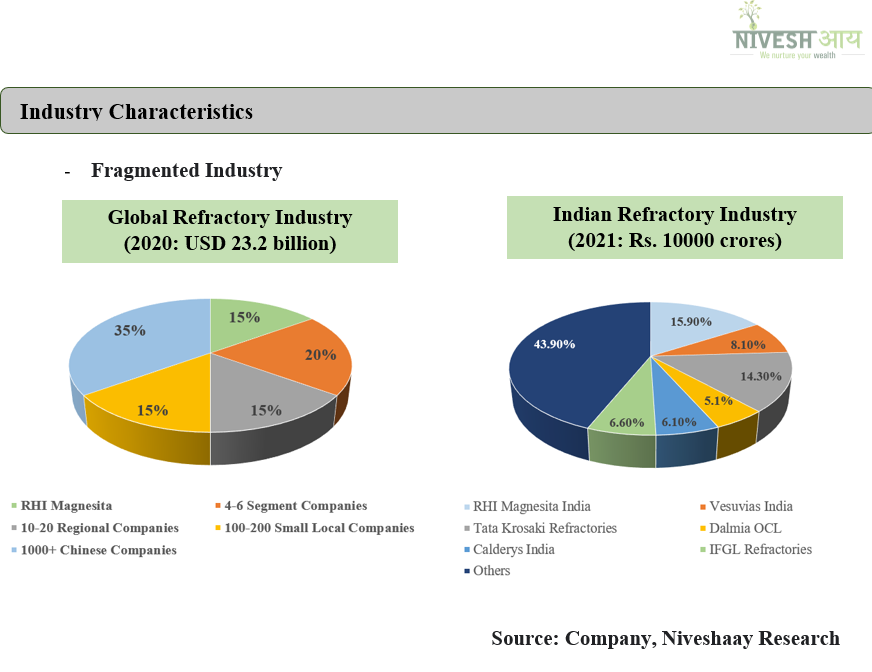

Why RHI Magnesita India?

-Market Leader ~15.9% market share

-Direct beneficiary of expected consolidation

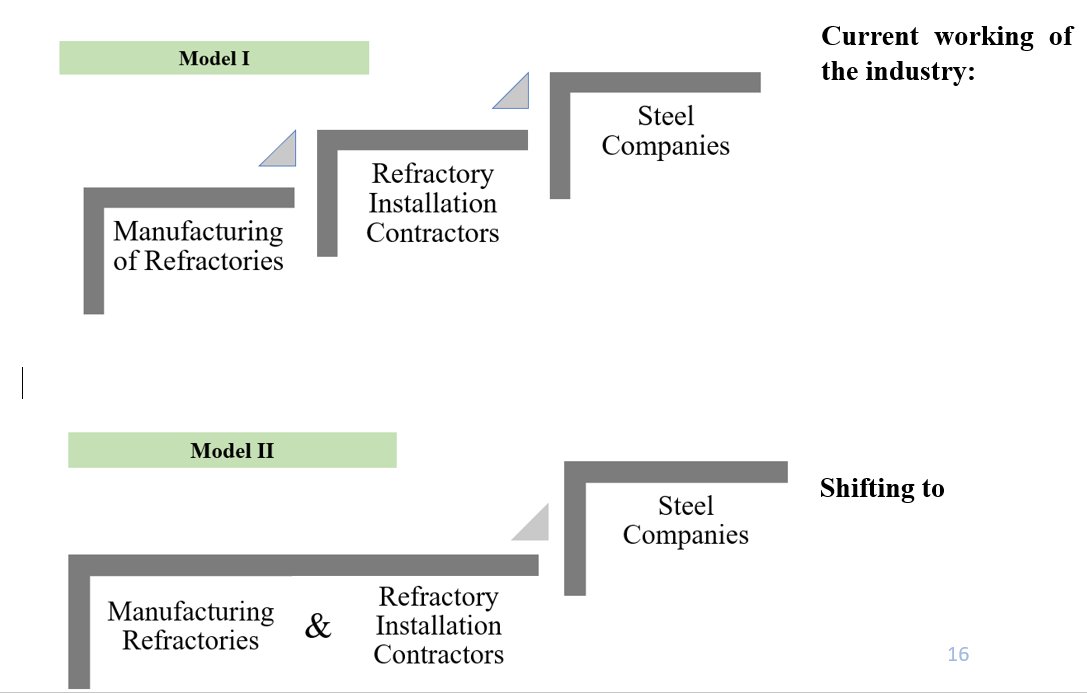

-TRM

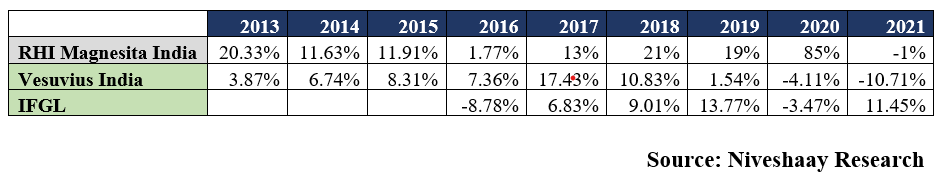

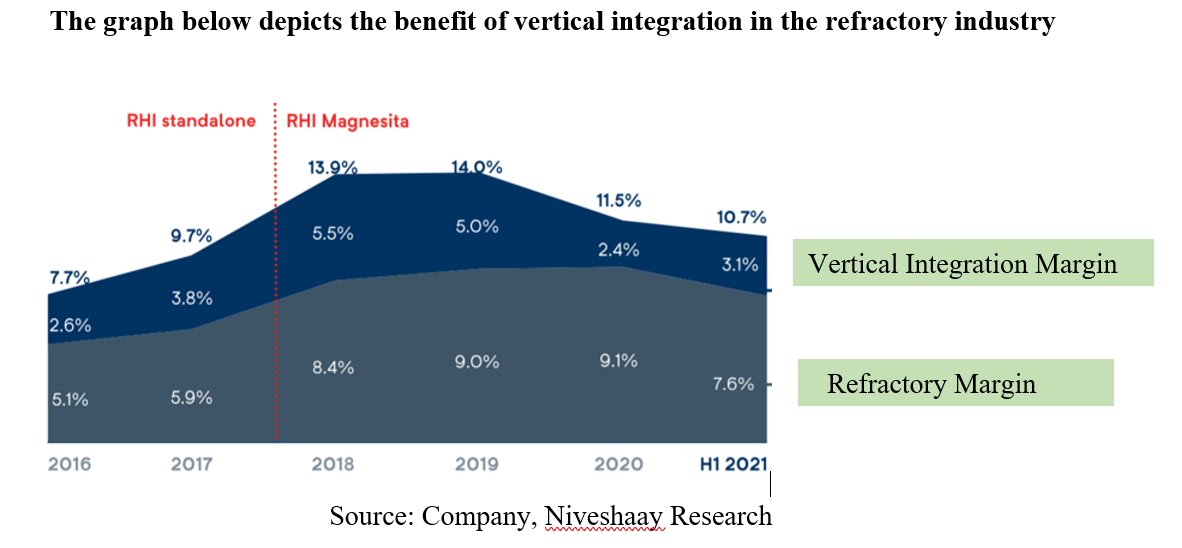

-Superior Margins than peers & comparatively lower on cost curve

-Better capacity utilisation than competitors

-Better Product Mix

-CAPEX Plan (400 Cr. for next 3 yrs)

-Market Leader ~15.9% market share

-Direct beneficiary of expected consolidation

-TRM

-Superior Margins than peers & comparatively lower on cost curve

-Better capacity utilisation than competitors

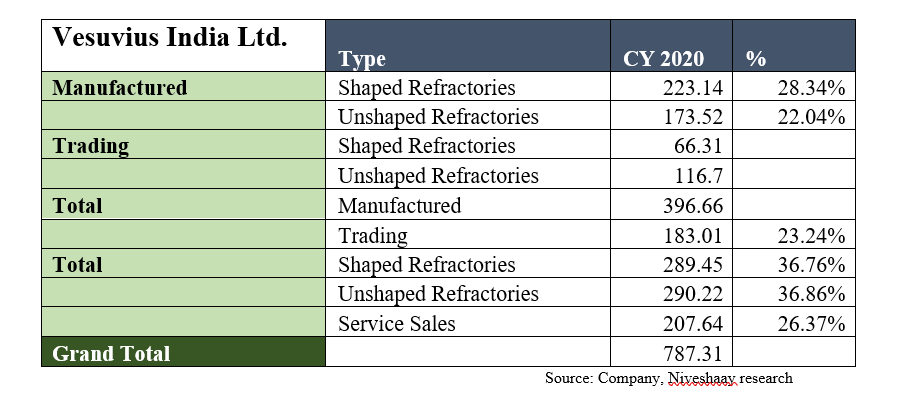

-Better Product Mix

-CAPEX Plan (400 Cr. for next 3 yrs)

About company

- Incorporated in 2021 with merger of 3 RHI entities

Orient Refractories Ltd., RHI Clasil & RHI India Pvt Ltd.

Total installed capacity : 128000 tons PA

- Geography Wise Revenue: India 75% Exports 25%

- Key Risks:

1.Volatility in RM Prices

2.Downturn in Steel Ind

- Incorporated in 2021 with merger of 3 RHI entities

Orient Refractories Ltd., RHI Clasil & RHI India Pvt Ltd.

Total installed capacity : 128000 tons PA

- Geography Wise Revenue: India 75% Exports 25%

- Key Risks:

1.Volatility in RM Prices

2.Downturn in Steel Ind

Loading suggestions...