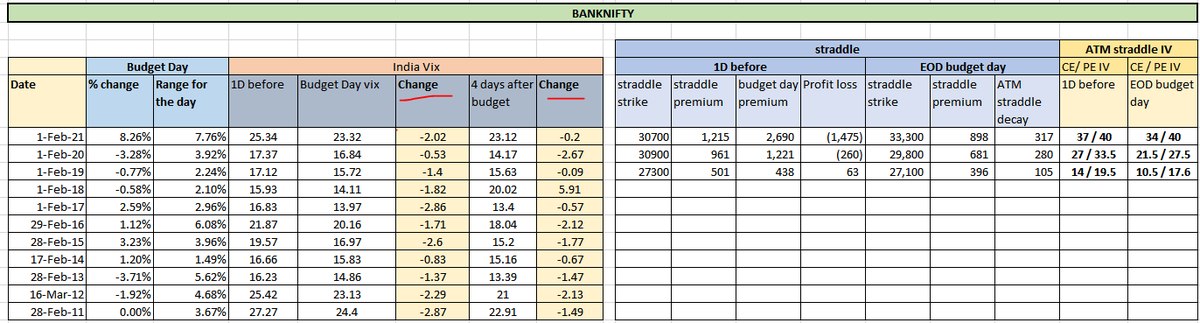

for simple calculation have compared straddles 1day before budget and at EOD of budget day

1⃣On an average vix falls by 2% on budget day and buy another 2% in next 4 days

2⃣in last 2 years realised decay on straddle was zero[without adjustment]

[2/n]

1⃣On an average vix falls by 2% on budget day and buy another 2% in next 4 days

2⃣in last 2 years realised decay on straddle was zero[without adjustment]

[2/n]

Loading suggestions...