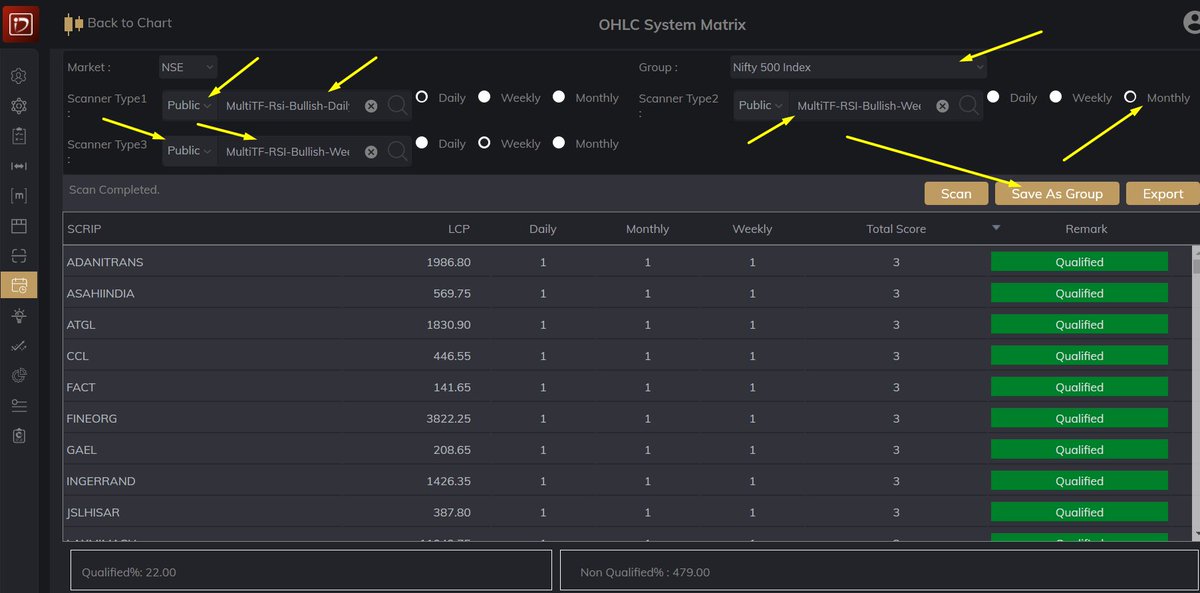

A small multi time frame system to identify stronger stocks based on RSI/SuperTrend/EMA

@Definedge

Conditions:

a) RSI > 55 < 70 in daily

b) RSI > 60 in weekly/monthly

c) Candle close above SuperTrend(10,3)

d) Candle close above 200EMA in daily and 34EMA in weekly/monthly

+

@Definedge

Conditions:

a) RSI > 55 < 70 in daily

b) RSI > 60 in weekly/monthly

c) Candle close above SuperTrend(10,3)

d) Candle close above 200EMA in daily and 34EMA in weekly/monthly

+

I have published these scanners in TradePoint Web of @Definedge. These scanners can also be developed in TradePoint Desktop.

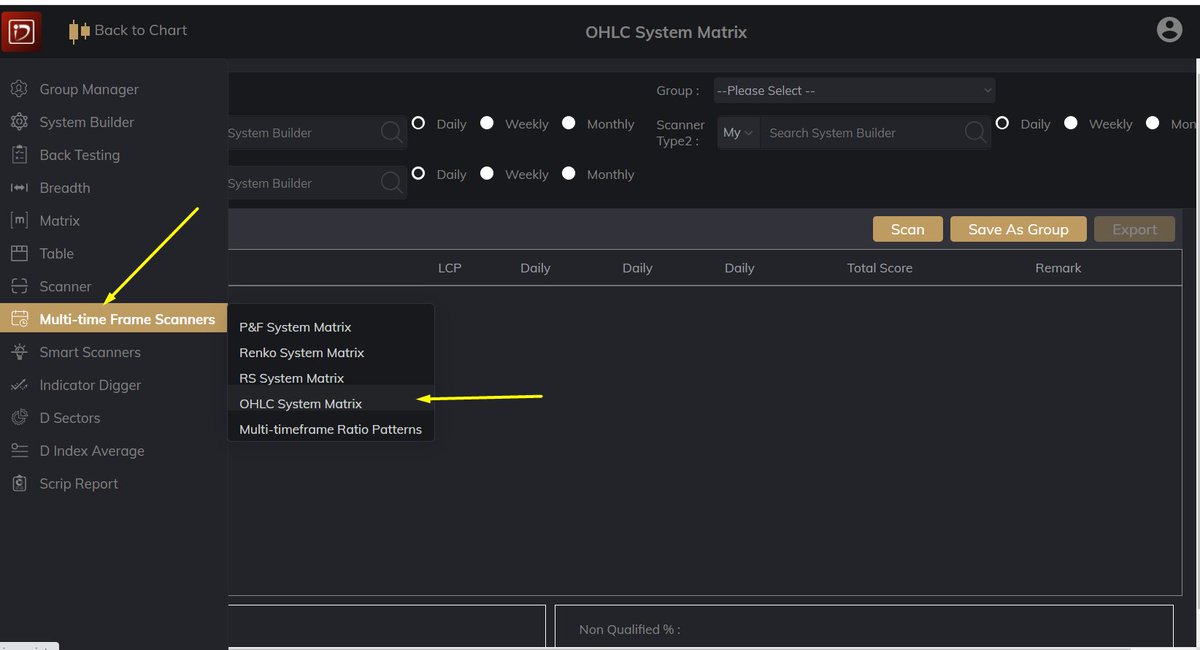

1) Run these scanners on Multi Time Frame Scanners

+

1) Run these scanners on Multi Time Frame Scanners

+

One example #TATAELXSI on daily charts

RS chart bullish ABC pattern and in Price chart probable bear trap and bullish ABC

(bullish divergence between price and RS charts also)

+5

RS chart bullish ABC pattern and in Price chart probable bear trap and bullish ABC

(bullish divergence between price and RS charts also)

+5

Another way of doing further study is to run Heikin-Ashi bullish reversal scanner on the short-listed candidates. This scanner is also published in TradePoint.

I ran this scanner and the result as follows:

Example of #ONGC

I ran this scanner and the result as follows:

Example of #ONGC

جاري تحميل الاقتراحات...