Let's take #DIS as example, trying to walk through the January month bar looking for a #SSS50PercentRule

opportunity. 👇🧵

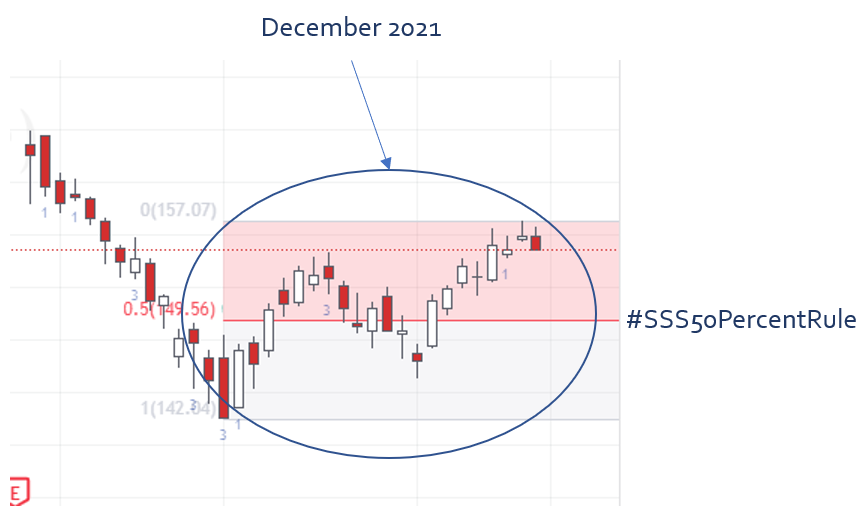

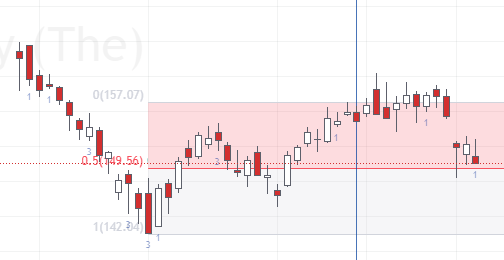

This is the context at the end of December 2022:

#trading #TheStrat

opportunity. 👇🧵

This is the context at the end of December 2022:

#trading #TheStrat

1.

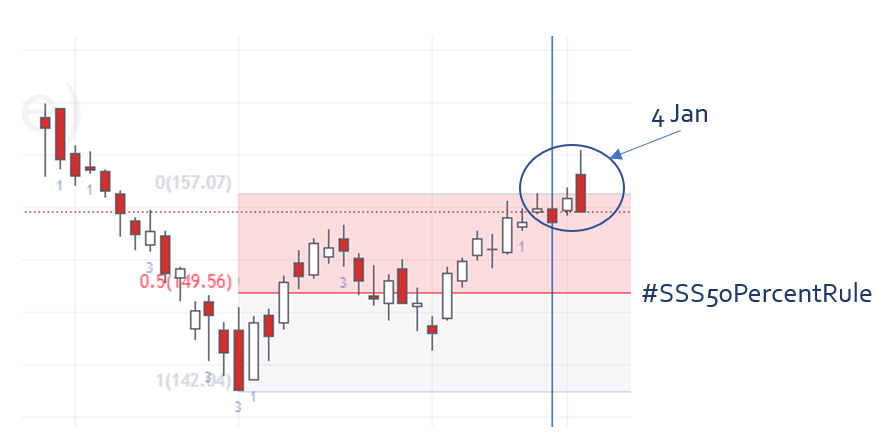

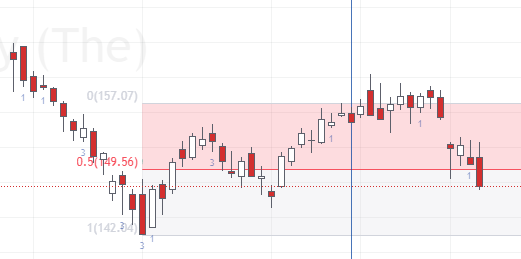

Jan 4: #DIS broke the previous month high 👇

At that moment, the new month bar was a 2up.

If you were particularly aggressive, there was already an entry opportunity with a potential 2u-2d, but we were still far from the middle of the December bar.

Jan 4: #DIS broke the previous month high 👇

At that moment, the new month bar was a 2up.

If you were particularly aggressive, there was already an entry opportunity with a potential 2u-2d, but we were still far from the middle of the December bar.

6.

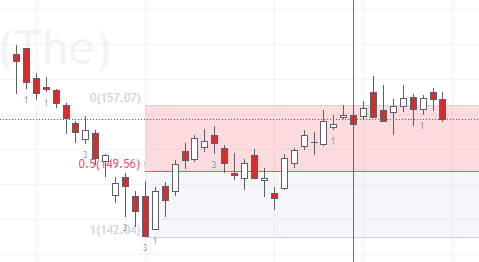

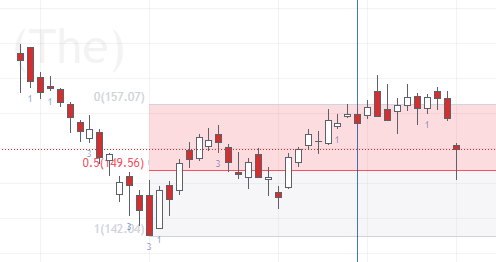

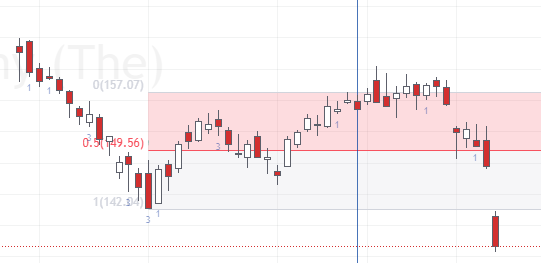

Jan 21: almost no waiting! just 1 session and #DIS triggered the target point with a huge gap down! 🙌

The January bar is now an outside bar and the #SSS50PercentRule helped to set up a perfect trade!

Jan 21: almost no waiting! just 1 session and #DIS triggered the target point with a huge gap down! 🙌

The January bar is now an outside bar and the #SSS50PercentRule helped to set up a perfect trade!

7.

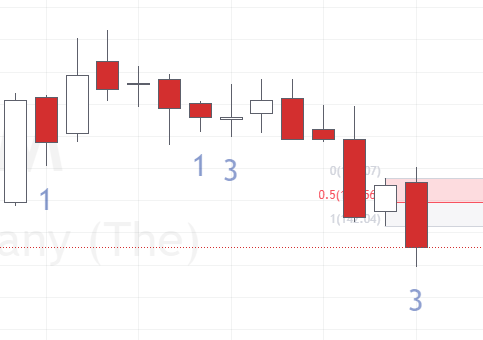

#DIS monthly bars 👇

#DIS monthly bars 👇

As of 1 February, we'll follow live, one session at a time, the best #SSS50PercentRule opportunities on #spy #stocks monthly bars.

If you like this content, please share and make sure to follow @tradingandata

#trading #thestrat

If you like this content, please share and make sure to follow @tradingandata

#trading #thestrat

Loading suggestions...