#LaurusLabs Q3FY22 Earnings Analysis

In depth attempt to understand beyond the numbers 🧵⤵️

In depth attempt to understand beyond the numbers 🧵⤵️

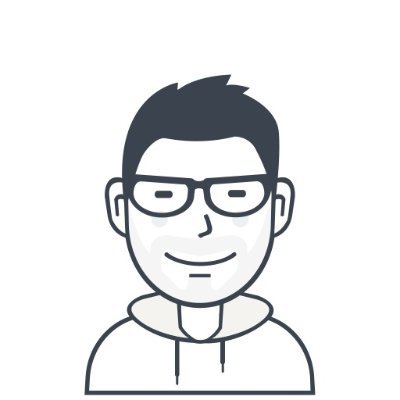

Lets zoom out first and look at QoQ topline chart for #LaurusLabs

Let's first analyze what were the reasons behind 7 quarters of consecutive growth rates.

Laurus was exceptionally placed to take advantage of Covid related tailwinds

1⃣ The company had just increased its FDF capacity

2⃣ End customers were stocking up ARV supplies, helping Laurus run those capacities at optimum utilization there by churning out more revenues

1⃣ The company had just increased its FDF capacity

2⃣ End customers were stocking up ARV supplies, helping Laurus run those capacities at optimum utilization there by churning out more revenues

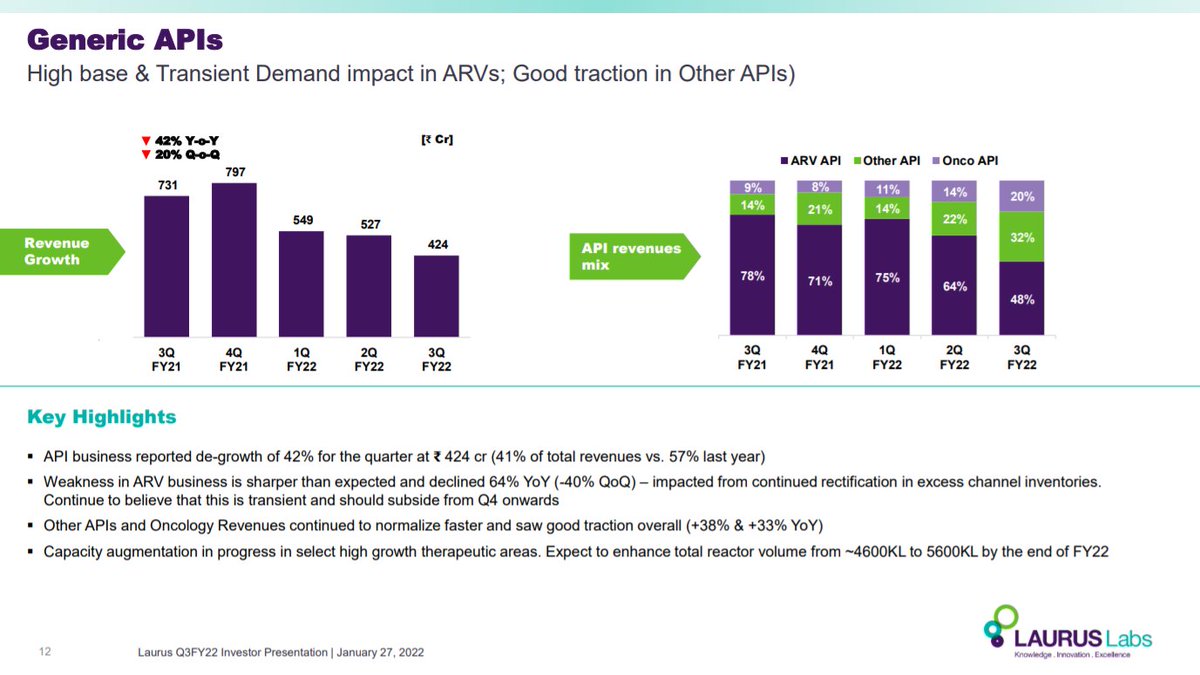

Now lets look at why the revenue has degrown QoQ for 3 quarters in a row

All these three factors combined help explain the decrease in topline for 3 quarters.

However, Laurus is the lowest cost producer of ARV APIs globally

This will help them remain the last standing producer of these APIs until they become non-existent (which is still many years away) and remaining producers opt out

This is still a declining industry though

This will help them remain the last standing producer of these APIs until they become non-existent (which is still many years away) and remaining producers opt out

This is still a declining industry though

If you're investing in hopes that this will give you anything more than 20% CAGR over 10 years, then I am sorry to tell you that you're investing in the wrong stock.

Even that 20% CAGR has several risk factors associated with it.

Even that 20% CAGR has several risk factors associated with it.

Having said that lets talk about where the growth will come from and why I am invested in the company.

The company has a target of doing $1 Billion in Revenue by FY24 (~ 2 years from today) and I suspect Synthesis will be a big lever to achieve that target.

Lot of investors get excited about #LaurusBio but that at best is an optionality today and I do not see it aiding in any meaningful revenue generation by FY24

Risks to that target topline of $1 Billion

1⃣ Any USFDA Observations (they have a clean track record though)

2⃣ Higher than expected deacceleration in ARV revenues

3⃣ Keyman Risk

1⃣ Any USFDA Observations (they have a clean track record though)

2⃣ Higher than expected deacceleration in ARV revenues

3⃣ Keyman Risk

So that was the complete analysis, I hope it helped you get some clarity.

Please do not get trapped by Momentum advisors and Excel Drag and Drop analysts advising on each quarterly increase in revenue.

Please do not get trapped by Momentum advisors and Excel Drag and Drop analysts advising on each quarterly increase in revenue.

Thank you and have a great day ahead!

Loading suggestions...