A megathread on @NexusProtocol's upcoming suite of yield-generating products.

You don't want to miss this 🧵👇

$PSI $LUNA $UST

You don't want to miss this 🧵👇

$PSI $LUNA $UST

1/ @NexusProtocol are working on new products that fall under 3 main categories:

1. Vaults (stable yield)

2. Labs (higher upside yield, volatility, and risk)

3. Money Market

Let's start with my favorite 👇

1. Vaults (stable yield)

2. Labs (higher upside yield, volatility, and risk)

3. Money Market

Let's start with my favorite 👇

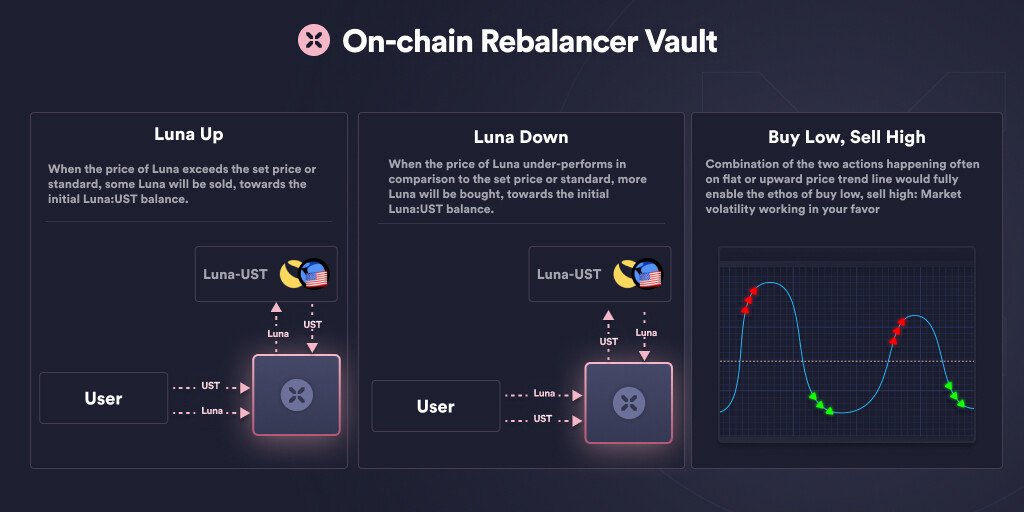

2/ On-Chain Rebalancer Vault

Type: Vault

Priority: Secondary

Status: Profitability Modeling

Type: Vault

Priority: Secondary

Status: Profitability Modeling

Proposed by @Cephii1, this vault is essentially an on-chain grid bot.

For example, users could deposit a combination of 80:20 or 50:50 $LUNA / $UST.

The vault will have a predetermined deviation which determines when trades are executed (e.g. ±1.5%).

For example, when price fluctuation exceeds the SD of ±1.5%, the vault will execute a buy or sell trade.

Advantages over a grid bot:

- Idle $UST can be converted to $aUST to earn 19.5% APR for maximum efficiency

- Idle $UST can be converted to $aUST to earn 19.5% APR for maximum efficiency

- Trades executed in the vault do not constitute as taxable events.

media2.giphy.com

media2.giphy.com

Limitations:

Since trades are conducted on an AMM, slippage is inevitable and thus this strategy is limited to high volume, high liquidity pairs such as $LUNA / $UST.

Since trades are conducted on an AMM, slippage is inevitable and thus this strategy is limited to high volume, high liquidity pairs such as $LUNA / $UST.

Risk:

This strat relies on the performance of the underlying asset, e.g. $LUNA, a constant drop in price may result in principal asset loss.

This strat relies on the performance of the underlying asset, e.g. $LUNA, a constant drop in price may result in principal asset loss.

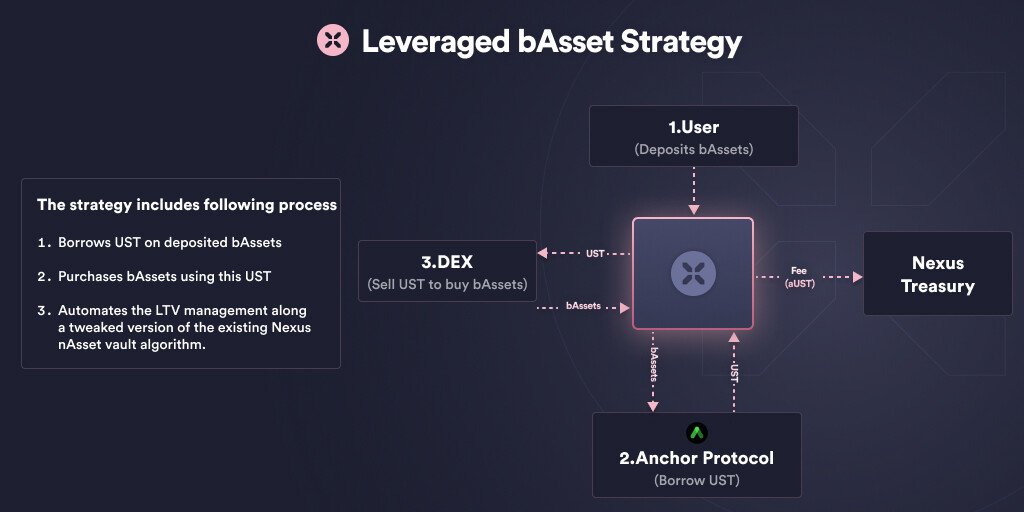

3/ Leveraged bAsset Strategy

Type: Labs

Priority: Secondary

Status: Feasibility Study & Modeling

Type: Labs

Priority: Secondary

Status: Feasibility Study & Modeling

This vault automates the now famous 'LUNAomics Strategy' by @Shigeo808.

What it does:

1. Deposit $bLUNA into @anchor_protocol

2. Borrow $UST up to 25% LTV and swap for $bLUNA

1. Deposit $bLUNA into @anchor_protocol

2. Borrow $UST up to 25% LTV and swap for $bLUNA

3. Borrow $UST to bring LTV from 25% to a reference LTV (e.g. 48%); Deposit $UST into Anchor Earn

4. Continuously manage position to maintain target LTV without getting liquidated.

4. Continuously manage position to maintain target LTV without getting liquidated.

Check out the pinned thread on @Shigeo808's profile to learn more about the strategy.

Risks:

As with any leveraged strategy, users run the risk of losses and potential liquidations.

This could be mitigated with user-defined stop-losses, and is still being discussed.

As with any leveraged strategy, users run the risk of losses and potential liquidations.

This could be mitigated with user-defined stop-losses, and is still being discussed.

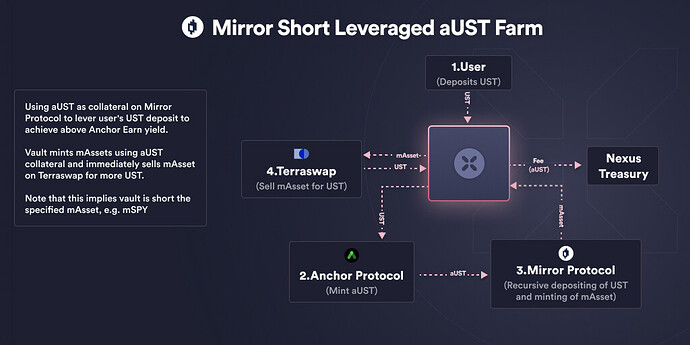

4/ Mirror Short Leveraged $aUST Farm

Type: Labs

Priority: Primary

Status: Under Development

Type: Labs

Priority: Primary

Status: Under Development

This strategy was pioneered by @DrCle4n and leverages on both @anchor_protocol and @mirror_protocol to supercharge their Anchor Earn yields.

How does it work?

1. Deposit $UST in @anchor_protocol and receive $aUST

2. Use $aUST to mint mAssets (e.g. $mSPY) in @mirror_protocol

3. Sell mAsset for $UST

4. Repeat Step 1 until pre-defined leveraged level and est. APR is reached.

1. Deposit $UST in @anchor_protocol and receive $aUST

2. Use $aUST to mint mAssets (e.g. $mSPY) in @mirror_protocol

3. Sell mAsset for $UST

4. Repeat Step 1 until pre-defined leveraged level and est. APR is reached.

Risks:

- Price risk due to shorting of the mAsset. A stop-loss feature will be introduced to mitigate this.

- Price risk due to shorting of the mAsset. A stop-loss feature will be introduced to mitigate this.

- Liquidation risk due to leverage. @NexusProtocol plans to manage liquidations by purchasing mAssets to close user positions to reduce losses.

This is as opposed to being liquidated by @mirror_protocol's fixed discount mechanism.

This is as opposed to being liquidated by @mirror_protocol's fixed discount mechanism.

5/ LP Money Market

Type: Money Market

Priority: Primary

Status: Under Development

Type: Money Market

Priority: Primary

Status: Under Development

This is a game-changer and opens up a whole new world of possibilities which deserve a thread on its own.

6/ Wrapped mAsset Strategy

Type: Labs

Priority: Secondary

Status: Market Demand Study

This strategy seeks to provide mAsset investors with yield that mimic's real-world dividend distributions.

Type: Labs

Priority: Secondary

Status: Market Demand Study

This strategy seeks to provide mAsset investors with yield that mimic's real-world dividend distributions.

Example:

1. Deposit 1 mPYPL as collateral to short-farm 0.32 mPYPL; this gives you MIR rewards which constitute the "dividend".

1. Deposit 1 mPYPL as collateral to short-farm 0.32 mPYPL; this gives you MIR rewards which constitute the "dividend".

2. Borrow $UST from Nexus LP Money Market for 2 weeks ($UST from shorting are locked for 2 weeks in @mirror_protocol).

3. Use borrowed $UST to purchase 0.32 mPYPL

You now have:

- Initial 1 mPYPL

- Debt of 0.32 mPYPL

- MIR rewards

- Additional 0.32 mPYPL

Total = 1 mPYPL + MIR rewards (dividend)

- Initial 1 mPYPL

- Debt of 0.32 mPYPL

- MIR rewards

- Additional 0.32 mPYPL

Total = 1 mPYPL + MIR rewards (dividend)

For more info on short-farming on @mirror_protocol, give this article by @Josephliow a read 👇

medium.com

medium.com

7/ DISCLAIMER: I am only human, don't take my word for it. Read the official docs and DYOR.

Participate in the forum discussions if you have ideas on how to make these vaults better.

Read the official post here 👇

forum.nexusprotocol.app

forum.nexusprotocol.app

On-Chain Rebalancer Vault👇

forum.nexusprotocol.app

forum.nexusprotocol.app

Leveraged bAsset Strategy👇

forum.nexusprotocol.app

forum.nexusprotocol.app

Mirror Short Leveraged aUST Farm👇

forum.nexusprotocol.app

forum.nexusprotocol.app

LP Money Market👇

forum.nexusprotocol.app

forum.nexusprotocol.app

Wrapped mAsset Strategy👇

forum.nexusprotocol.app

forum.nexusprotocol.app

Hate reading? Here's the recorded Spaces session that @Shigeo808 hosted with @NexusProtocl & @NexusShimmy👇

Loading suggestions...