Technology

Business

Finance

Financials

Automotive

Company Overview

Industry Overview

Key offering

Cartrade Carwale amp Bikewale

Shriram automall

Adroit Auto

CarTrade Exchange

Auto biz

Carwale abSure

Key competitors

Risks

Value Educators Scuttlebutt

🚗 #Cartrade Business Model Long Thread 🧵

Like & Retweet for better Reach !

@NeilBahal

Topics covered

1. Company overview

2.Industry overview

3.Key offering

4.Cartrade, Carwale & Bikewale

5. Shriram automall

6. Adroit Auto

7.CarTrade Exchange

8. Auto biz

9.Financials

Like & Retweet for better Reach !

@NeilBahal

Topics covered

1. Company overview

2.Industry overview

3.Key offering

4.Cartrade, Carwale & Bikewale

5. Shriram automall

6. Adroit Auto

7.CarTrade Exchange

8. Auto biz

9.Financials

10. Carwale abSure.

11. Key competitors.

12. Investment in Acquisition & Infrastructure.

13. Risks

14. Value Educator's Scuttlebutt

15. Our View on Car Trading Platforms

Company Overview:

1.CarTrade Tech is an online auto classifieds platform serving as a marketplace for users

11. Key competitors.

12. Investment in Acquisition & Infrastructure.

13. Risks

14. Value Educator's Scuttlebutt

15. Our View on Car Trading Platforms

Company Overview:

1.CarTrade Tech is an online auto classifieds platform serving as a marketplace for users

interested in buying and selling new and used vehicles.

2.CarTrade Tech operates several brands: CarWale, CarTrade, Shriram Automall, BikeWale,CarTradeExchange, Adroit Auto and AutoBiz.

3. Through these platforms, new and used automobile customers, vehicle dealerships,

2.CarTrade Tech operates several brands: CarWale, CarTrade, Shriram Automall, BikeWale,CarTradeExchange, Adroit Auto and AutoBiz.

3. Through these platforms, new and used automobile customers, vehicle dealerships,

vehicle OEMs and other businesses can buy/sell, advertise their vehicles in a simple and efficient manner.

4.Their vision is to create an automotive digital ecosystem which connects automobile customers, OEMs, dealers, banks, insurance companies and other stakeholders.

4.Their vision is to create an automotive digital ecosystem which connects automobile customers, OEMs, dealers, banks, insurance companies and other stakeholders.

5. CarTrade Tech came up with the IPO in August 2021. The offer included no fresh equity issue and offer for sale(OFS) with the issue size of ₹3000cr.

Industry Overview :

1.The used car market in India is relatively smaller than those of other developed countries. In India, the parc turn rate [total number of used cars sold divided by the total volume of cars]is approximately 16%, indicating significant headroom for used car

1.The used car market in India is relatively smaller than those of other developed countries. In India, the parc turn rate [total number of used cars sold divided by the total volume of cars]is approximately 16%, indicating significant headroom for used car

sales.

2.The used car market in India is expected to grow at a CAGR of at least 11% in the next five years, from its current size of approximately 4.4 million cars in financial year 2020 to approximately 8.3 million cars in financial year 2026.

2.The used car market in India is expected to grow at a CAGR of at least 11% in the next five years, from its current size of approximately 4.4 million cars in financial year 2020 to approximately 8.3 million cars in financial year 2026.

2.India is expected to become the world’s third largest automotive market by 2025 in terms of volume.

3.The used car market is highly fragmented in India and comprises a mix of individual dealers or brokers who have no physical place of business, and institutional dealers,

3.The used car market is highly fragmented in India and comprises a mix of individual dealers or brokers who have no physical place of business, and institutional dealers,

or those that operate out of a physical place of business, comprising unorganised dealers and branded showrooms. Approximately 90% of dealers are unorganised.

4.Despite several opportunities in used car sales, approximately 50% of dealers face challenges in conversion of leads,

4.Despite several opportunities in used car sales, approximately 50% of dealers face challenges in conversion of leads,

unavailability of vehicle range and low volume of leads.

Key offering :

1. Car shoppers can visit CarWale and CarTrade platforms to research and connect with dealers, OEMs and other partners to sell and buy cars from the large variety of new and used cars offered by them.

Key offering :

1. Car shoppers can visit CarWale and CarTrade platforms to research and connect with dealers, OEMs and other partners to sell and buy cars from the large variety of new and used cars offered by them.

2.Customers looking for new and used two-wheelers can research and connect with dealers, OEMs and other partners on BikeWale to sell and buy two-wheelers from the variety of new and used two-wheelers offered by them.

3.Their subsidiary, Shriram Automall, facilitates sales of pre-owned cars, two-wheelers, commercial vehicles, three wheelers, and farm and construction equipment.

to these customers and can reach out to them.

4.They are generally a marketplace for connecting buyers and sellers.They work in an asset light model where they do not own the inventory.

5.Cartrade is the only profitable platform among its peers.

4.They are generally a marketplace for connecting buyers and sellers.They work in an asset light model where they do not own the inventory.

5.Cartrade is the only profitable platform among its peers.

Their platform CarWale, CarTrade and BikeWale get more than 34 Million monthly unique visitors on their websites and more than 87% of them come organically.

6.Revenue is generated mainly from their subsidiary Shriram AutoMall, they also earn from advertisements and other value

6.Revenue is generated mainly from their subsidiary Shriram AutoMall, they also earn from advertisements and other value

added services.

7.OEMs and dealers can showcase their vehicles and advertise their brands and products on the platform.

Their wide consumer reach helps them to capture a significant share of the digital spending of dealers and OEMs.

7.OEMs and dealers can showcase their vehicles and advertise their brands and products on the platform.

Their wide consumer reach helps them to capture a significant share of the digital spending of dealers and OEMs.

8.They also provide OEMs with consumer insights, lead generation and data-driven solutions.

They provide auto-financing services to their customers in order to complete their car and bike buying journey.

They provide auto-financing services to their customers in order to complete their car and bike buying journey.

2. In January 2018 ,CarTrade acquired 51% in Shriram Automall India Limited (SAMIL) which is a marketplace connecting pre-owned vehicles & equipment buyers and sellers.

3. SAMIL began its journey by setting up India's first professionally managed and

3. SAMIL began its journey by setting up India's first professionally managed and

organized Auction Platform for buying and selling pre-owned cars, commercial vehicles, construction equipment, farm equipment, three-wheelers, two-wheelers, gold, and properties.

4.These auctions are conducted online as well as offline at their 114 automalls across India.

4.These auctions are conducted online as well as offline at their 114 automalls across India.

5.They do more than 8,00,000+ listings annually and have done more than 25,000+ Cr in transactions.

6. Shriram Automall earns revenue majorly from Transaction/ Commision from their auctions.

6. Shriram Automall earns revenue majorly from Transaction/ Commision from their auctions.

7. They also provide Parking service, if customers want to sell an existing vehicle or equipment or bought one from SAMIL but no space to park it, then they can opt for Parking Services at Shriram Automall.

8.Other services like auto finance, logistics, RTO transfer services.

Apart from auto they also do property auctions, gold and jewellery auctions.

9.57% of the CarTrade revenue comes from C2B, B2B auction business i.e from SAMIL.

Apart from auto they also do property auctions, gold and jewellery auctions.

9.57% of the CarTrade revenue comes from C2B, B2B auction business i.e from SAMIL.

10. In FY20-21 Shriram Automall revenues were 139.51cr compared to 159.96cr in FY19-20. Profit after tax for the period 20-21 was 26.36cr as compared to 22.48cr in 19-20. EBITDA margins were 30%.

2.Similarly, lenders require independent valuation of used automobiles in case a loan is to be issued with these automobiles as collateral.

3.Adroit’s valuation and inspection services are also used by clients of Shriram Automall as clients typically request

3.Adroit’s valuation and inspection services are also used by clients of Shriram Automall as clients typically request

independent valuation reports before a vehicle is sent for auction. Adroit carried out 728,198 inspections and valuations in the financial year 2021

Cartrade Exchange :

1. CarTrade Exchange is an online auction platform and a used vehicle ERP system.

2. Shriram Automall uses CarTrade Exchange to sell vehicles through online auctions to CarTrade Exchange’s users. It is extensively used by consumers, business sellers,

1. CarTrade Exchange is an online auction platform and a used vehicle ERP system.

2. Shriram Automall uses CarTrade Exchange to sell vehicles through online auctions to CarTrade Exchange’s users. It is extensively used by consumers, business sellers,

dealers and fleet owners to sell vehicles to end users, automotive dealers and fleet owners.

3.Automotive dealers also use this system to manage their business. The system helps dealers to manage their processes for procurement, inventory management and CRM

3.Automotive dealers also use this system to manage their business. The system helps dealers to manage their processes for procurement, inventory management and CRM

AutoBiz :

New vehicle dealers use their cloud-based CRM tool AutoBiz to manage their sales leads and ensure that the dealership executives manage and follow up effectively as well as give dealership management insight into their sales team’s performance.

New vehicle dealers use their cloud-based CRM tool AutoBiz to manage their sales leads and ensure that the dealership executives manage and follow up effectively as well as give dealership management insight into their sales team’s performance.

Financials :

1.The half year revenues for FY22 was at ₹150 crores as against ₹103 crores of last year.

2.Adjusted EBITDA was at ₹33 crores as against ₹16 crores with an adjusted EBITDA margin of 28% for Q2.

1.The half year revenues for FY22 was at ₹150 crores as against ₹103 crores of last year.

2.Adjusted EBITDA was at ₹33 crores as against ₹16 crores with an adjusted EBITDA margin of 28% for Q2.

3.57% of the revenue comes from C2B B2B auction platform Shriram Automall.

4.The other 43% comes from advertising and other value added services provided to OEMs and dealers.

4.The other 43% comes from advertising and other value added services provided to OEMs and dealers.

large dealers in the country such as Shaman, Classic Automotive and Kolkata Car Bazaar.

3.22 outlets are already in operation across 18 cities that comprise Mumbai, Bangalore, Surat, Kanpur, Noida, Chennai, Bhopal, Kolkata and Ahmedabad.

3.22 outlets are already in operation across 18 cities that comprise Mumbai, Bangalore, Surat, Kanpur, Noida, Chennai, Bhopal, Kolkata and Ahmedabad.

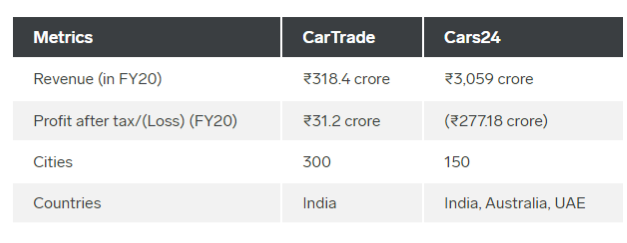

2. CarTrade, despite being profitable, has not been able to cross the billion dollar valuation mark.

3. Cars24 and Cardekho are two market leaders in terms of revenue and market cap.

3. Cars24 entered Thailand in November and is also present in UAE and Australia.

3. Cars24 and Cardekho are two market leaders in terms of revenue and market cap.

3. Cars24 entered Thailand in November and is also present in UAE and Australia.

5.They also offer other perks like a 7-day return if a customer is not satisfied with the car with no questions asked, other financial services like loans, EMI etc.

Investment in Acquisition & Infrastructure :

The Company announced in December it’s plans to invest surplus funds of upto ₹750cr for strategic acquisitions and investments in the automotive ecosystem.

Risks

1. No Promoter holdings.

2.Highly competitive market with low barrier

The Company announced in December it’s plans to invest surplus funds of upto ₹750cr for strategic acquisitions and investments in the automotive ecosystem.

Risks

1. No Promoter holdings.

2.Highly competitive market with low barrier

Value Educator's Scuttlebutt :

Scuttlebutt was done with a local used car dealer who owns the franchise of Carwale for almost 5-6 years.

1. How does carwale/cartrade help you?

Company provides car certification, verification, and with lead generated through their website,

Scuttlebutt was done with a local used car dealer who owns the franchise of Carwale for almost 5-6 years.

1. How does carwale/cartrade help you?

Company provides car certification, verification, and with lead generated through their website,

premium i.e featured listing on their website.

2. Is the inventory owned by you or carwale?

The inventory is owned by me i.e the dealer.

3. How does carwale/cartrade charge you?

They charge franchise fees, which can be paid annually, quarterly or monthly.

2. Is the inventory owned by you or carwale?

The inventory is owned by me i.e the dealer.

3. How does carwale/cartrade charge you?

They charge franchise fees, which can be paid annually, quarterly or monthly.

There is no extra charge apart from this fee.

4. Are you Carwale exclusive?

We as a dealer will list our inventory on carwale, olxautos,cars24 and many more. As a dealer it doesn't matter where the lead comes from.

4. Are you Carwale exclusive?

We as a dealer will list our inventory on carwale, olxautos,cars24 and many more. As a dealer it doesn't matter where the lead comes from.

Leads for a car can be generated through carwale, olxautos or anywhere else. I buy the car from Cars24 and list on Carwale, Olxautos.

5. So if brand loyalty doesn't matter for a dealer then why did you choose to go with the Carwale franchise and not Olx autos?

5. So if brand loyalty doesn't matter for a dealer then why did you choose to go with the Carwale franchise and not Olx autos?

For customers, brand matters a lot in order to gain trust and many customers seeing the carwale board at our store and carwale verification certificate are able to trust us and the service. The leads given by carwale are good.

But in the future if I am not satisfied by their service I can just switch to other companies.

6.What do you think about their Carwale abSure plans?

I personally don't think this model will work out for them because procurement of good used car vehicles is hard and it will be a

6.What do you think about their Carwale abSure plans?

I personally don't think this model will work out for them because procurement of good used car vehicles is hard and it will be a

challenge for them.

Our View on Car Trading Platforms :

1. In an industry where there are multiple players in the market, in order to become big in the market one of the key moats a company should have is their BRAND affinity.

Our View on Car Trading Platforms :

1. In an industry where there are multiple players in the market, in order to become big in the market one of the key moats a company should have is their BRAND affinity.

Even though CarTrade, CarWale are known to consumers, they don't really have brand affinity.

3.Generally, in an organised used car market brand affinity is not considered as a moat for a company.

For an average consumer who buys a car mostly twice or thrice in his lifetime brand loyalty does not play an important role.

For an average consumer who buys a car mostly twice or thrice in his lifetime brand loyalty does not play an important role.

4.A consumer will buy a car wherever he gets a good price for a good car. So for a consumer it doesn't really matter if the car is being sold by CarTrade or Cars24 or OlxAuto.

5.Even for a consumer to sell his/her car, it doesn't really matter if he is selling to Cars24, Olx Autos or listing his car on CarTrade Carwale. If he is getting the car valuation which he is desiring, he will sell it to that brand.

6.Unless and until the market is a monopoly or duopoly (which is likely to happen in a used car market) brand affinity does not play an important role.

7.For a dealer also brand loyalty is not an important factor. Because even today if a dealer owns a franchise of a particular company (eg. carwale franchise), he lists his inventory on all the platforms which provide the same services, it does not matter for a dealer

where the leads come from.

So the stickiness of dealers towards a particular brand is not there.

8. The industry is highly competitive in nature. There are many players in the Indian used car market Cars24, Olxautos, CarDekho, Droom and recently turned unicorn Spinny.

So the stickiness of dealers towards a particular brand is not there.

8. The industry is highly competitive in nature. There are many players in the Indian used car market Cars24, Olxautos, CarDekho, Droom and recently turned unicorn Spinny.

There are no major entry barriers in this industry.

9. In the US there are almost 800 cars per 1000 people. The used car market in the US is very big and mostly organised. Even with the market of that size, there aren’t many profitable players with a business model

9. In the US there are almost 800 cars per 1000 people. The used car market in the US is very big and mostly organised. Even with the market of that size, there aren’t many profitable players with a business model

similar to CarTrade.

10. CarWale is mostly used by consumers for research purposes, car reviews etc and carwale earns through advertisements but with resources like Youtube, most people including myself will prefer to watch a detailed review of a car in the form of a video rather

10. CarWale is mostly used by consumers for research purposes, car reviews etc and carwale earns through advertisements but with resources like Youtube, most people including myself will prefer to watch a detailed review of a car in the form of a video rather

than see a picture.

11. The used car market in India is relatively smaller than those of other developed countries. The opportunity size for the used car market is huge in the future. In India there are only 20-30 cars per 1000 thousand people as compared to the US which has

11. The used car market in India is relatively smaller than those of other developed countries. The opportunity size for the used car market is huge in the future. In India there are only 20-30 cars per 1000 thousand people as compared to the US which has

800 per 1000 cars.

12. The used car market in India is expected to grow at a CAGR of at least 11% in the next five years, from its current size of approximately 4.4 million cars in financial year 2020 to approximately 8.3 million cars in financial year 2026.

12. The used car market in India is expected to grow at a CAGR of at least 11% in the next five years, from its current size of approximately 4.4 million cars in financial year 2020 to approximately 8.3 million cars in financial year 2026.

13. India is expected to become the world’s third largest automotive market by 2025 in terms of volume.

14.Even with the opportunity of this size the visibility for companies in the used car industry is not clear.

15.With the rising demand for EV cars and EV making a disruption in the automobile industry, what can & will happen to the Indian automobile industry is still not clear

15.With the rising demand for EV cars and EV making a disruption in the automobile industry, what can & will happen to the Indian automobile industry is still not clear

Loading suggestions...