Top 5 Trend #Indicators that identify the Direction of Trend

A thread(🧵)... (1/22)

A thread(🧵)... (1/22)

1. Moving Average: The Simplest of all indicators that every #trader trusts have to be #MovingAverage.

Based on the type of trade: Swing, Positionalor #Intraday, traders may look at various moving Averages (2/22)

Based on the type of trade: Swing, Positionalor #Intraday, traders may look at various moving Averages (2/22)

If the Moving Average is horizontal, the #stock price is ranging. If it is angled up, there is an upward Trend (3/22)

Based on the direction of the trend, the #Supertrend changes colour.

On closing below the closing price, the line turns green, indicating a buy signal.

Conversely, on closing above the closing price, the line turns red, indicating a sell signal (5/22)

On closing below the closing price, the line turns green, indicating a buy signal.

Conversely, on closing above the closing price, the line turns red, indicating a sell signal (5/22)

When the dots reverse, it indicates a potential change in the price direction, as shown in the figure👇 (8/22)

OBV Calculates the cumulative buying and selling pressure by adding the volume on Bullish days and subtracting it on Bearish days👇 (10/22)

However, the #volume must confirm trends. A rise in the price should be accompanied by a rising OBV, vice-versa👇 (11/22)

A buy signal occurs when the MACD line crosses above the signal, and a sell signal occurs when the MACD line crosses below the signal line👇

Read The Blog Here: sedg.in (13/22)

Read The Blog Here: sedg.in (13/22)

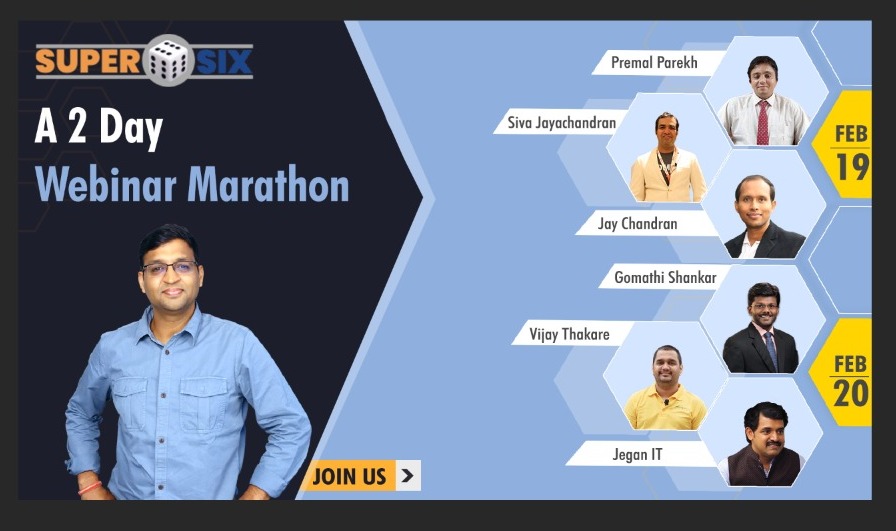

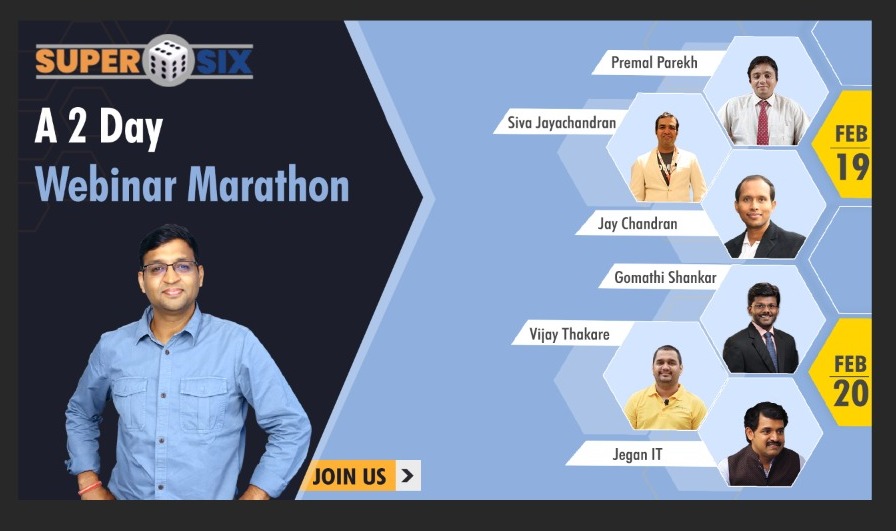

Don't miss out on our biggest event of the year, with 6 eminent mentors!

Enroll for Super Six here (14/22)

Enroll for Super Six here (14/22)

2. Sivakumar Jayachandran(@Justsiva123):sedg.in Open & High Strategy in Index #Options & #Futures (17/22)

3. Vijay Thakare (@VijaySThakare): sedg.in Introduction to Algo Candles and Patterns (22/22)

Book your seat for 2 days and get a Rs.2800 OFF!

sedg.in

sedg.in

Loading suggestions...