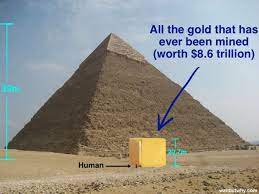

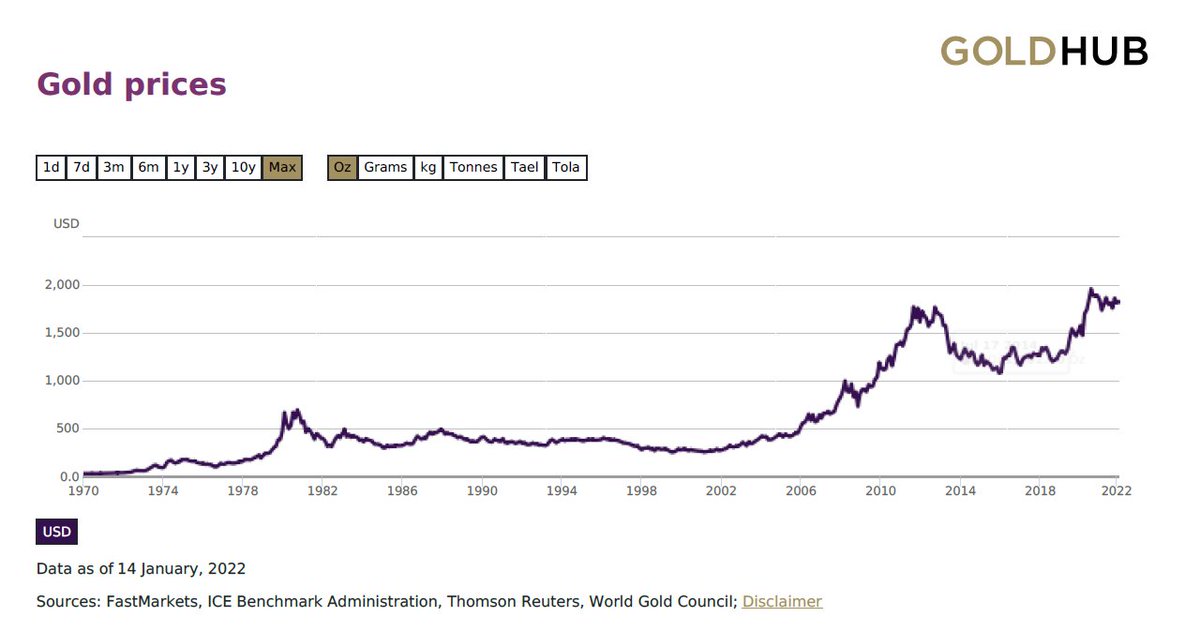

Gold is known as an inflation hedge or store of value for as long as human civilization goes.

But lately Many are calling #Bitcoin a Digital Gold. An 11-year-old Blockchain-based currency currently trades at $814 billion.

Simple Thread of Gold, Bitcoin, Price/Supply Dynamics

But lately Many are calling #Bitcoin a Digital Gold. An 11-year-old Blockchain-based currency currently trades at $814 billion.

Simple Thread of Gold, Bitcoin, Price/Supply Dynamics

Gold has superior chemical properties

It cannot be destroyed by water, as it doesn't rust;

Coins remain recognizable after a thousand years

It takes 1945.4° F to melt

It is also uniquely malleable, as it spreads without cracking

It’s ductile, as it stretches without breaking

It cannot be destroyed by water, as it doesn't rust;

Coins remain recognizable after a thousand years

It takes 1945.4° F to melt

It is also uniquely malleable, as it spreads without cracking

It’s ductile, as it stretches without breaking

Random Fact

No one knows how much Gold is above the earth and how much is beneath the earth.

Everyone Institution has its own guess.

No one knows how much Gold is above the earth and how much is beneath the earth.

Everyone Institution has its own guess.

Moving to Bitcoin

The limit of Bitcoin’s supply is set at 21 million coins. Out of this, 18.77 million have already been ‘mined’. That means, 83% of all the Bitcoin that will ever come into existence have already been brought into circulation within 12 years of its creation

The limit of Bitcoin’s supply is set at 21 million coins. Out of this, 18.77 million have already been ‘mined’. That means, 83% of all the Bitcoin that will ever come into existence have already been brought into circulation within 12 years of its creation

As per the World Wealth Report by Capgemini, there are 2800 Billionaires in the world with a total wealth of $13 trillion+.

There are 56.1 million millionaires worldwide at the moment.

Between 2020 and 2025, global wealth is projected to rise by 39%

There are 56.1 million millionaires worldwide at the moment.

Between 2020 and 2025, global wealth is projected to rise by 39%

The percentage of millionaires in the world will also likely grow over the next five years, reaching 84 million people.

5.2 million new millionaires appeared worldwide in 2020

5.2 million new millionaires appeared worldwide in 2020

84 Million Ultra-rich people vs 21 Million BTC

The Law of Economics.

Price -Demand Principle for Veblen goods. Provides clarity.

The Law of Economics.

Price -Demand Principle for Veblen goods. Provides clarity.

To add

Institutional investors are also increasingly buying up Bitcoin too.

Several major firms, among them Tesla, Square and Coinbase, have collectively purchased hundreds of millions of dollars worth of cryptocurrency.

Institutional investors are also increasingly buying up Bitcoin too.

Several major firms, among them Tesla, Square and Coinbase, have collectively purchased hundreds of millions of dollars worth of cryptocurrency.

Interesting fact

Morgan Stanley has bought 11 % stake in Company MicroStartegy which owns 1.25 lacs BTC worth $2billion.

Morgan Stanley has bought 11 % stake in Company MicroStartegy which owns 1.25 lacs BTC worth $2billion.

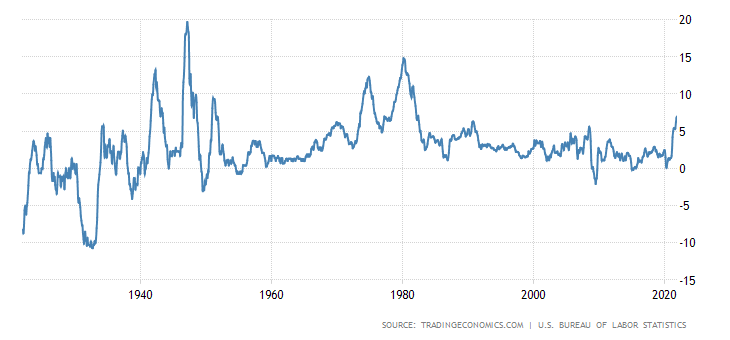

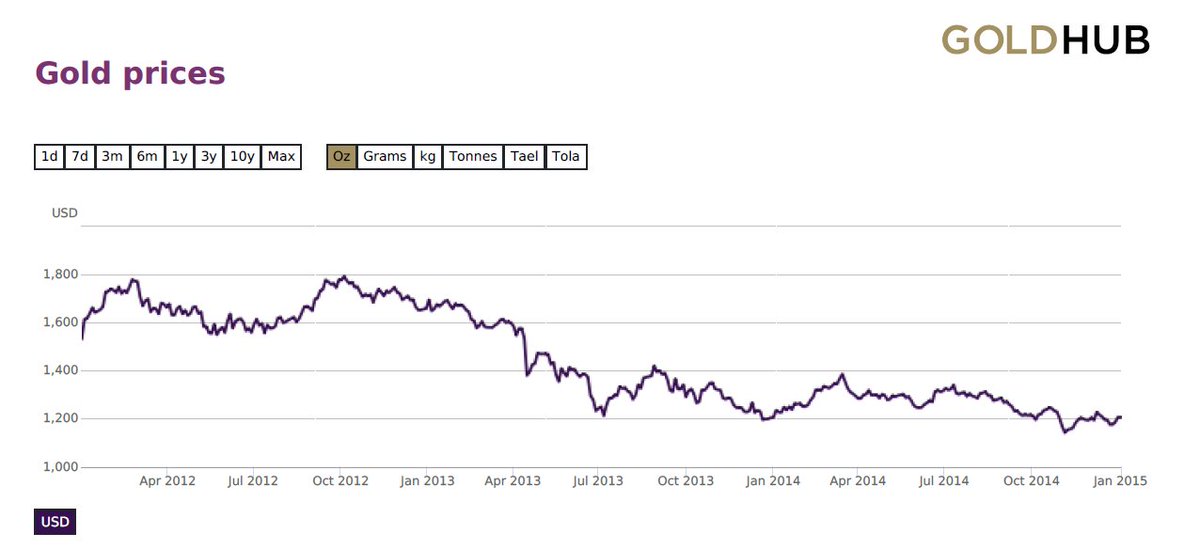

Bitcoin price will remain highly volatile.

Currently trading at $43K ie down by 36 % from its peak of $67K.

In the past corrected by up to 80%.

as @akshat_world says

Currently trading at $43K ie down by 36 % from its peak of $67K.

In the past corrected by up to 80%.

as @akshat_world says

Why so volatile?

Average Trading Volume

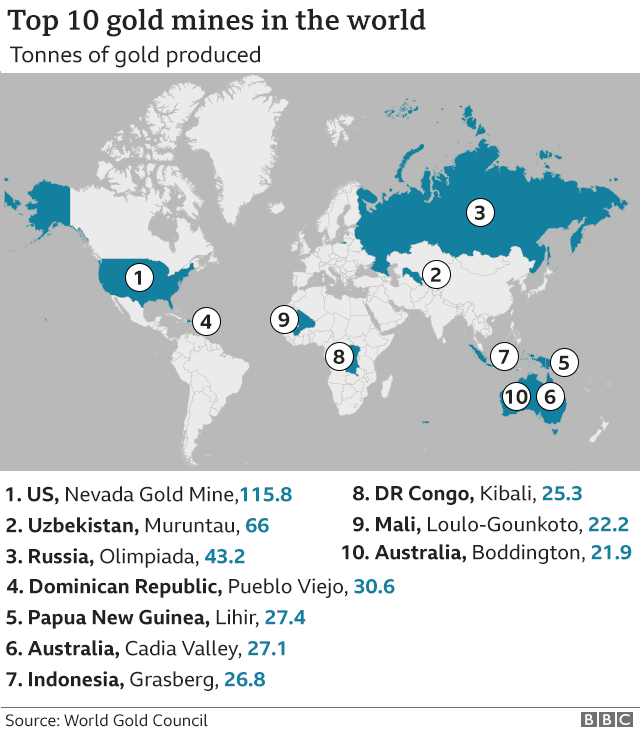

Gold had the third highest average daily trading volume at 145.5 billion U.S. dollars.

Bitcoin's Average Trading volume is $5-6 Billion only.

Better trading volume =better price discovery = less short term volatility

Average Trading Volume

Gold had the third highest average daily trading volume at 145.5 billion U.S. dollars.

Bitcoin's Average Trading volume is $5-6 Billion only.

Better trading volume =better price discovery = less short term volatility

Similarities

Gold is a rare metal with established trust.

Bitcoin is a rare blockchain-based digital currency trusted by few thus will remain more volatile and will be challenged by media/regulators and its own hype.

Gold is a rare metal with established trust.

Bitcoin is a rare blockchain-based digital currency trusted by few thus will remain more volatile and will be challenged by media/regulators and its own hype.

As more you mine both Gold & Bitcoin, mining cost goes up.

The mining process of both is not environmentally friendly.

But Mining process of Bitcoin can improve by using more renewable sources of energy.

The mining process of both is not environmentally friendly.

But Mining process of Bitcoin can improve by using more renewable sources of energy.

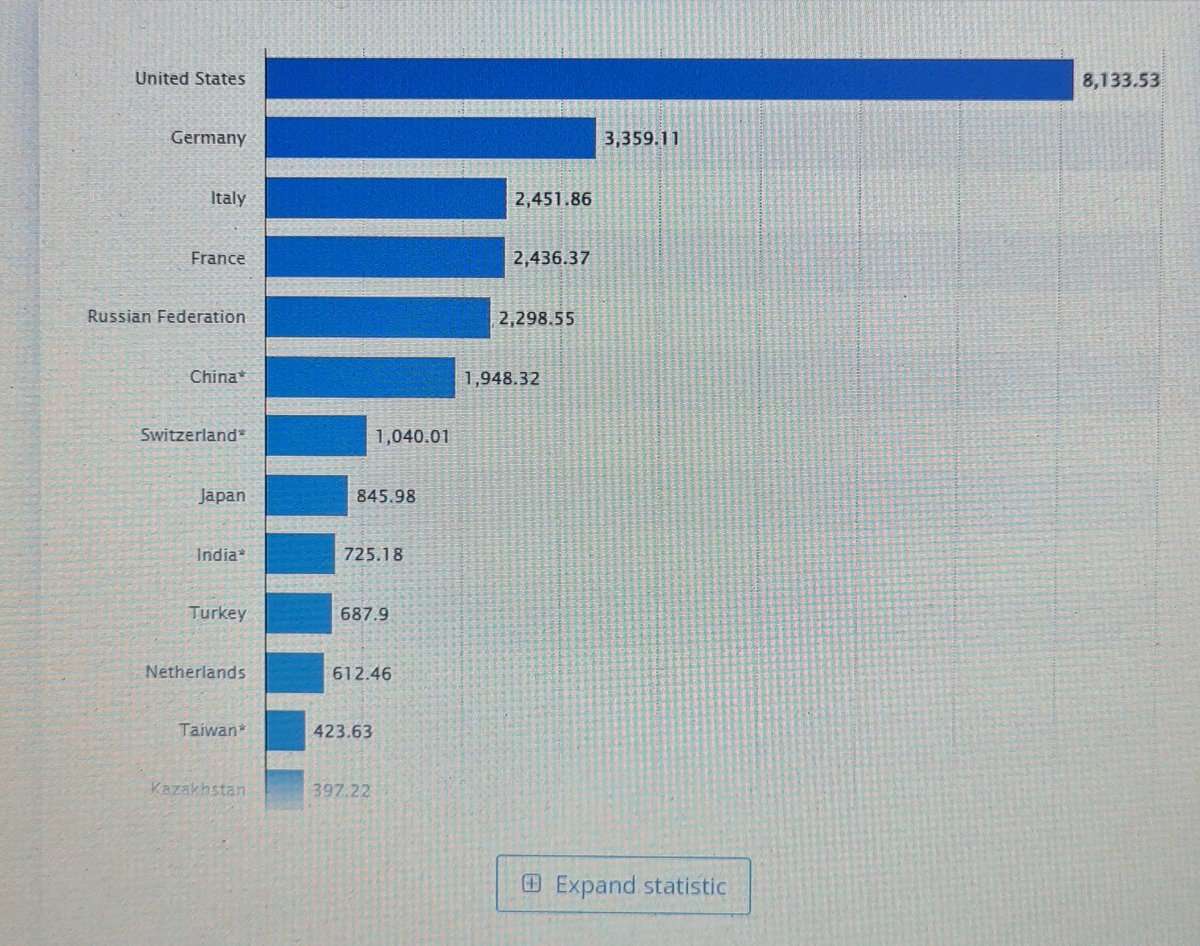

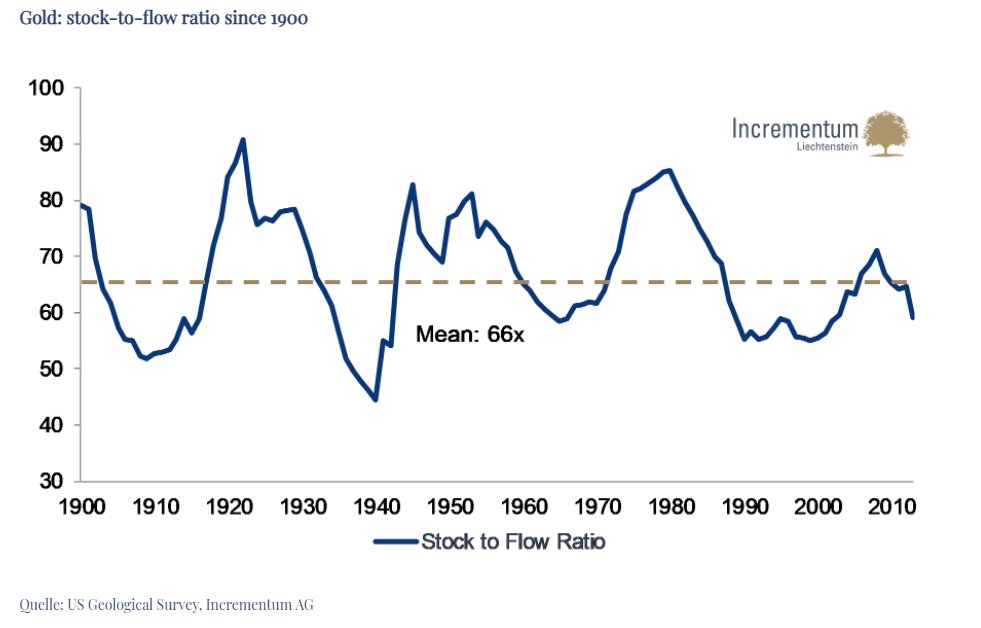

Pricing model Stock to flow

SF = stock / flow

Stock is the size of the existing stockpiles or reserves. Flow is the yearly production. Instead of SF, people also use a supply growth rate (flow/stock). Note that SF = 1 / supply growth rate.

SF = stock / flow

Stock is the size of the existing stockpiles or reserves. Flow is the yearly production. Instead of SF, people also use a supply growth rate (flow/stock). Note that SF = 1 / supply growth rate.

In 2021, the circulating supply of BTC was 18.8 million. There is a flow of 0.33 million bitcoins (328,725 ÷ 1,000,000).

This gives Bitcoin a current stock-to-flow ratio of 18.8 million ÷ 0.33 million = 57.

This gives Bitcoin a current stock-to-flow ratio of 18.8 million ÷ 0.33 million = 57.

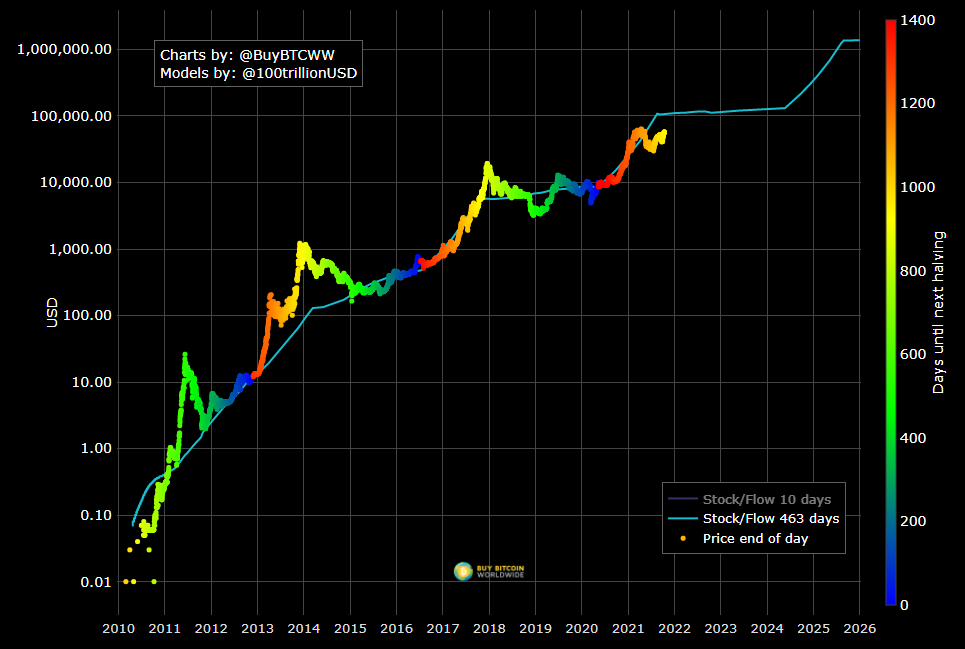

With limited supply, SF for BTC will only move up. Price prediction of BTC basis SF

Model And chart by @100trillionUSD

Model And chart by @100trillionUSD

The current stock-to-flow ratios of Bitcoin suggest that it’s an increasingly rare resource. The stock-to-flow model shows a market relative of Bitcoin’s current price is almost half of the model price, suggesting Bitcoin is actually relatively cheap.

I believe Bitcoin has an advantage over Gold over a longer period of time. But clearly riskier.

Bitcoin can go down by 80% or can go up to 10X. Even Both.

Bitcoin can go down by 80% or can go up to 10X. Even Both.

This is not investment advice. The above thread is for my own understanding.

I use Twitter for making notes for myself for better clarity. And keep coming back to them.

If you like it please retweet.

I use Twitter for making notes for myself for better clarity. And keep coming back to them.

If you like it please retweet.

Some of the thoughts are sourced from @Akshat_World tweets and videos. Marking him for better reach.

Loading suggestions...