Just came across an interesting LP on @loop_finance.

$aUST / $UST LP.

Now, you must be thinking: "Wut? How is that interesting?"

/1

$aUST / $UST LP.

Now, you must be thinking: "Wut? How is that interesting?"

/1

Let's start from the top.

$aUST is simply $UST deposited into @anchor_protocol Earn - earning 19.5% APY vs holding $UST in your wallet.

In the pool, we have half of our position in $aUST, effectively earning 9.75% APY.

That's not all though...

/2

$aUST is simply $UST deposited into @anchor_protocol Earn - earning 19.5% APY vs holding $UST in your wallet.

In the pool, we have half of our position in $aUST, effectively earning 9.75% APY.

That's not all though...

/2

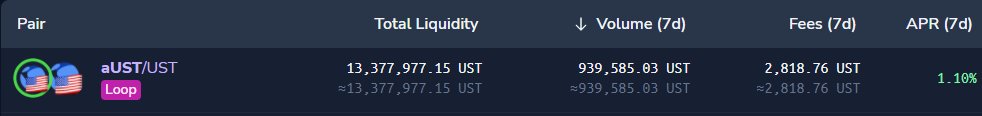

People actively trade against the $aUST / $UST pool, which means it accumulates trading fees.

As per @coinhall_org, the 7-day-average gives extra 1.10%:

We're at 10.85% yearly ynow.

Not much, but it's something.

We're at 10.85% yearly yield now.

/3

As per @coinhall_org, the 7-day-average gives extra 1.10%:

We're at 10.85% yearly ynow.

Not much, but it's something.

We're at 10.85% yearly yield now.

/3

Additionally, @loop_finance provides LP incentives on top of that - currently sitting at 21.76%.

For the total of 33.66%. On what is pretty much $UST.

It beats the somewhat famous $bPsiDP-24m strategy with $PSI pylon pool and @SpecProtocol auto-compounding (32.41% APY).

/4

For the total of 33.66%. On what is pretty much $UST.

It beats the somewhat famous $bPsiDP-24m strategy with $PSI pylon pool and @SpecProtocol auto-compounding (32.41% APY).

/4

So if you want a stablecoin farm with above-Anchor-Earn APY, that might be it.

There are some risks involved though, which I would like to mention:

/5

There are some risks involved though, which I would like to mention:

/5

$aUST / $UST is a liquidity pool, so technically there is a risk that you will suffer impermanent loss.

In practice, since @anchor_protocol allows for swapping back and forth at a constant (and increasing) rate, any bigger deviations will be consumed by arbitrageurs.

/6

In practice, since @anchor_protocol allows for swapping back and forth at a constant (and increasing) rate, any bigger deviations will be consumed by arbitrageurs.

/6

As well, trading fees are just a 7-day average extrapolated to a whole year.

While 1.10% has very limited downside potential, I can't really see too many reasons for people to trade against this pair. The rate will almost always be better on ⚓, so upside is limited too.

/7

While 1.10% has very limited downside potential, I can't really see too many reasons for people to trade against this pair. The rate will almost always be better on ⚓, so upside is limited too.

/7

@loop_finance LP has a constant incentives of 25k $LOOP per day. This means:

Pool TVL↗ -> APR↘

Pool TVL↘ -> APR↗

$LOOP price↗ -> APR↗

$LOOP price↘ -> APR↘

/8

Pool TVL↗ -> APR↘

Pool TVL↘ -> APR↗

$LOOP price↗ -> APR↗

$LOOP price↘ -> APR↘

/8

Last but not least - you need to stay in the LP for at least 2 weeks to get any $LOOP rewards. and enjoy ~33% APR.

The clock is reset as well every time you add to the LP.

Without those rewards, you are back to ~11% and better of just sticking to Anchor Earn.

/9-end

The clock is reset as well every time you add to the LP.

Without those rewards, you are back to ~11% and better of just sticking to Anchor Earn.

/9-end

جاري تحميل الاقتراحات...