Let’s try to understand the business of #FazeThree

An In-depth Thread (1/25)

An In-depth Thread (1/25)

What does the company do?

Faze three was incorporated in 1985. It manufactures and sells home furnishing products like Bathmats,

doormats, blankets, rugs, cushions, throws curtains, bedspreads and matelasses, kids line, kitchen line &

kitchen products in India. (2/25)

Faze three was incorporated in 1985. It manufactures and sells home furnishing products like Bathmats,

doormats, blankets, rugs, cushions, throws curtains, bedspreads and matelasses, kids line, kitchen line &

kitchen products in India. (2/25)

It also offers automotive textiles to OEMs. The company is a Direct Exporter to

Large Retailers in USA, UK & EUR region. Over 90% Revenue is through Exports only. (3/25)

Large Retailers in USA, UK & EUR region. Over 90% Revenue is through Exports only. (3/25)

Faze Three is headquartered in Mumbai, India.

Currently floor covering segment is the dominant product category. The company has Vertically

integrated operations for all products. (4/25)

Currently floor covering segment is the dominant product category. The company has Vertically

integrated operations for all products. (4/25)

The profit CAGR of the Company for the past 5 years has been 75%. It is empowered by experienced

promoters, along with the managing director and chairman Ajay Anand, who has been working with the

Company for the last 35 years. (5/25)

promoters, along with the managing director and chairman Ajay Anand, who has been working with the

Company for the last 35 years. (5/25)

It is expected that Company will receive benefits from PLI (production-

linked incentive) Schemes of Government. (6/25)

linked incentive) Schemes of Government. (6/25)

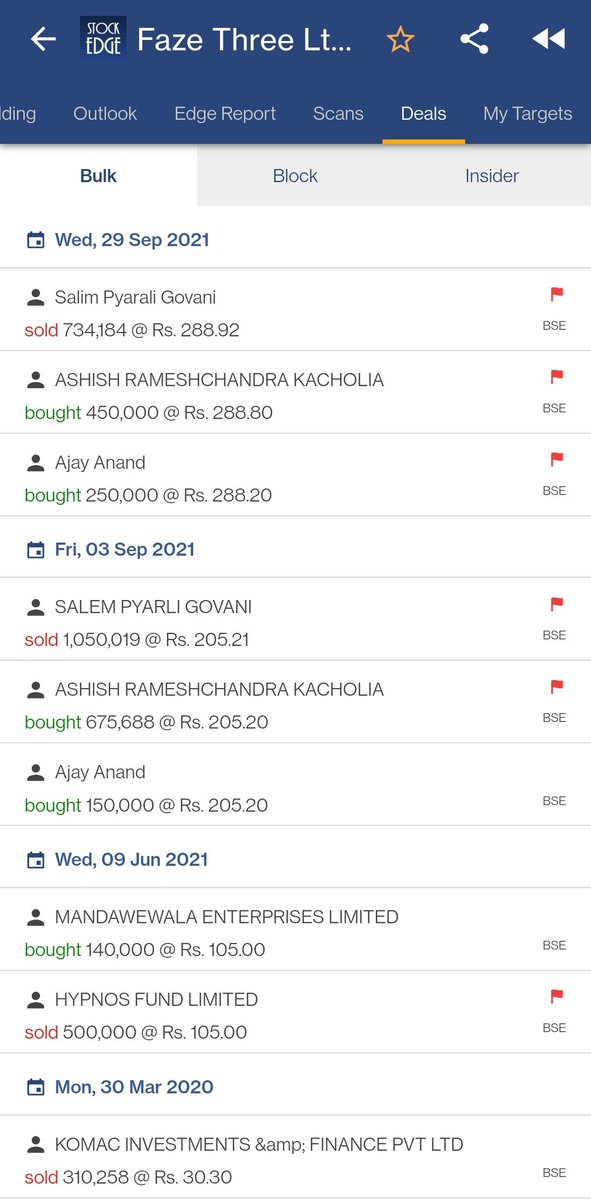

It has prominent names in its kitty as investor and promoter; one of them is Ashish Kacholia. Celebrity

investor Ashish Kacholia has increased stakes in Faze Three Ltd in the quarter ended December 31,

2021 (9/25)

investor Ashish Kacholia has increased stakes in Faze Three Ltd in the quarter ended December 31,

2021 (9/25)

In the December quarter, Kacholia has picked up additional 1.9 per cent stake in the textile

company. (10/25)

company. (10/25)

As per the BSE December corporate filings, the ace investor now has 4.63% holding of the

company or 11,25,688 equity shares. Kacholia held 6,75,688 equity shares or 2.78 per cent stake in the

company in the quarter ended September 31, 2021. (11/25)

company or 11,25,688 equity shares. Kacholia held 6,75,688 equity shares or 2.78 per cent stake in the

company in the quarter ended September 31, 2021. (11/25)

Company’s readiness to capitalize on the following Opportunity: (15/25)

👉 Invested over INR 40 Crs from internal accruals across units for new machinery, new

technologies & de-bottlenecking from 2017- 2020

👉 Planned Expansions: (16/25)

technologies & de-bottlenecking from 2017- 2020

👉 Planned Expansions: (16/25)

👉 Commenced Expansion at Silvassa in Dec 2020 to have 2.5x capacity by Mar 2022 on existing

spare land, under Floor coverings / Rugs segment. (17/25)

spare land, under Floor coverings / Rugs segment. (17/25)

👉 Overall Investment of INR 30 Crs (Of which INR 20 Crs already incurred).

Plan to commence expansion in Top of Bed & Blankets segment (Nov21 to Jun22) to

increase capacity to 3x of existing capacity, backed by commitments from various customers. Overall investment INR 15 Crs.

Plan to commence expansion in Top of Bed & Blankets segment (Nov21 to Jun22) to

increase capacity to 3x of existing capacity, backed by commitments from various customers. Overall investment INR 15 Crs.

👉 Commenced Expansion at Panipat, Handloom Home Textiles division to have 3x capacity by Dec

2022. Overall Investment INR 30 Crs. (19/25)

2022. Overall Investment INR 30 Crs. (19/25)

👉 All of the above expansions shall be funded from Internal Cash Accruals 9 Company is also under

process of evaluating / exploring relevant / ready to use for manufacturing (brownfield

opportunities) from time to time. (20/25)

process of evaluating / exploring relevant / ready to use for manufacturing (brownfield

opportunities) from time to time. (20/25)

👉 Invested in Talent acquisition across units, new product development, green initiatives, etc. - Comfortable Capital Structure. Rated “A-” Long term & A2+ Short term (Aug 2021). (21/25)

👉 Significant ability withstand supply chain pressures on working capital. Entire internal accruals

directed towards accelerated expansion & growth in operations (22/25)

directed towards accelerated expansion & growth in operations (22/25)

👉 Zero Long term debt since 2018. Factories / Infrastructure current replacement value estimated

~ INR 350 Crs, poses significant entry barrier for new entrants (23/25)

~ INR 350 Crs, poses significant entry barrier for new entrants (23/25)

👉Focus on reducing costs and being most competitive manufacturer for the customer while

maintaining budgeted net profit margins (24/25)

maintaining budgeted net profit margins (24/25)

👉 Join the #StockEdge family today and get more such insights from our StockEdge premium plan: sedg.in

Subscribe today at a 20% discount using code "PREMIUM20" (25/25)

Subscribe today at a 20% discount using code "PREMIUM20" (25/25)

Loading suggestions...