A lot of people often compare @ApolloDAO to @SpecProtocol. While they do both offer auto-compounding vaults, I see them as quite different. Let’s take a look. This 🧵 covers:

- A quick comparison.

- $APOLLO's and its Warchest.

- $SPEC and its value capture.

- A quick comparison.

- $APOLLO's and its Warchest.

- $SPEC and its value capture.

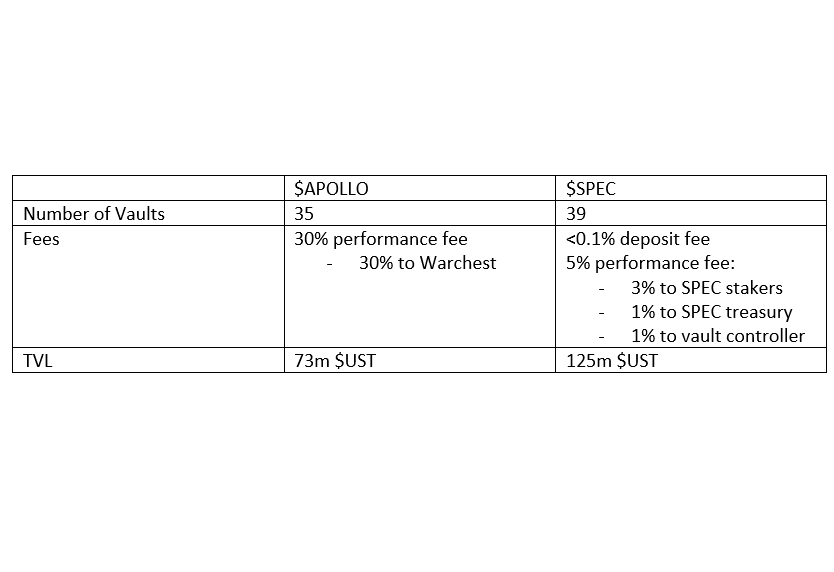

The first thing to note is the fact that @ApolloDAO is aiming to build up a Warchest and eventually become a decentralised hedge fund, whereas @SpecProtocol is aimed solely at becoming the best yield optimizer in the space. This factor alone is a significant differentiator.

You may now be asking yourself, why in the world are $APOLLO's fees so high? And why would anyone in their right mind use it instead of $SPEC?

The answer is pretty simple really. As stated earlier, $APOLLO's aim is to build it’s Warchest, to do this, they have increased fees (inflows to Warchest) while also increasing $APOLLO emissions to vault depositors, effectively subsidising the yield paid out to users.

Some could liken this to @OlympusDAO’s bond program. In $OHM's bond program, users deposit LP tokens or other tokens into the Olympus treasury to receive discounted $OHM tokens.

In $APOLLO's auto-compounder vault program, users deposit LP tokens and 30% of the yield generated is deposited into Apollo’s Warchest, in return, the user receives $APOLLO tokens.

So, let’s look at how the Warchest is going.

As of the 6th of Jan, the protocol’s performance fees have added ~$1.28m to the Warchest since launch (73 days). While the assets within the Warchest (including $2.25m from the CFE) have grown to a total value exceeding $7.5m.

As of the 6th of Jan, the protocol’s performance fees have added ~$1.28m to the Warchest since launch (73 days). While the assets within the Warchest (including $2.25m from the CFE) have grown to a total value exceeding $7.5m.

So why should you be interested in $APOLLO’s Warchest?

1. Accrues platform fees

2. Run by $APOLLO holders

3. Participates in private sales

1. Accrues platform fees

2. Run by $APOLLO holders

3. Participates in private sales

4. May become a big player if a situation similar to the curve wars occurs on Terra (fighting for $ASTRO). The $APOLLO Warchest already holds ~1% of $ASTRO's circulating supply, I only expect this to increase over time.

5. Builds an $APOLLO floor price.

5. Builds an $APOLLO floor price.

$APOLLO also offers additional products including:

- Apollo Farmer’s Market: A method for projects to raise capital. The yield earned on deposited LP tokens is used to purchase allocated project tokens.

- Apollo Safe: A multi-sig front end built for terra.

- Apollo Farmer’s Market: A method for projects to raise capital. The yield earned on deposited LP tokens is used to purchase allocated project tokens.

- Apollo Safe: A multi-sig front end built for terra.

In comparison to $APOLLO's plan of building out a treasury, @SpecProtocol is aimed at being the best available yield optimizer on Terra with low fees of ~5%. Through doing so, they have been able to capture majority of the market with $125m in Total Value Locked (TVL).

They provide value to their $SPEC token through distributing fees (3%) directly to stakers. They have also been extending their auto-compounding vaults to products such as @pylon_protocol’s liquid pools which increases their addressable market substantially.

These factors alone could prove to bring great value to the $SPEC token especially due to the fact that its total supply is only 22.8m, at current prices this equates to a fully diluted valuation of ~$55mil. This is tiny in the crypto/finance space.

Hope you all enjoyed the thread!

My next thread will likely be on $FTM. I'm thinking it may be on $TOMB, unless anyone has any other preferences?

My next thread will likely be on $FTM. I'm thinking it may be on $TOMB, unless anyone has any other preferences?

جاري تحميل الاقتراحات...