#WeeklyIndexCheck CW01/2022

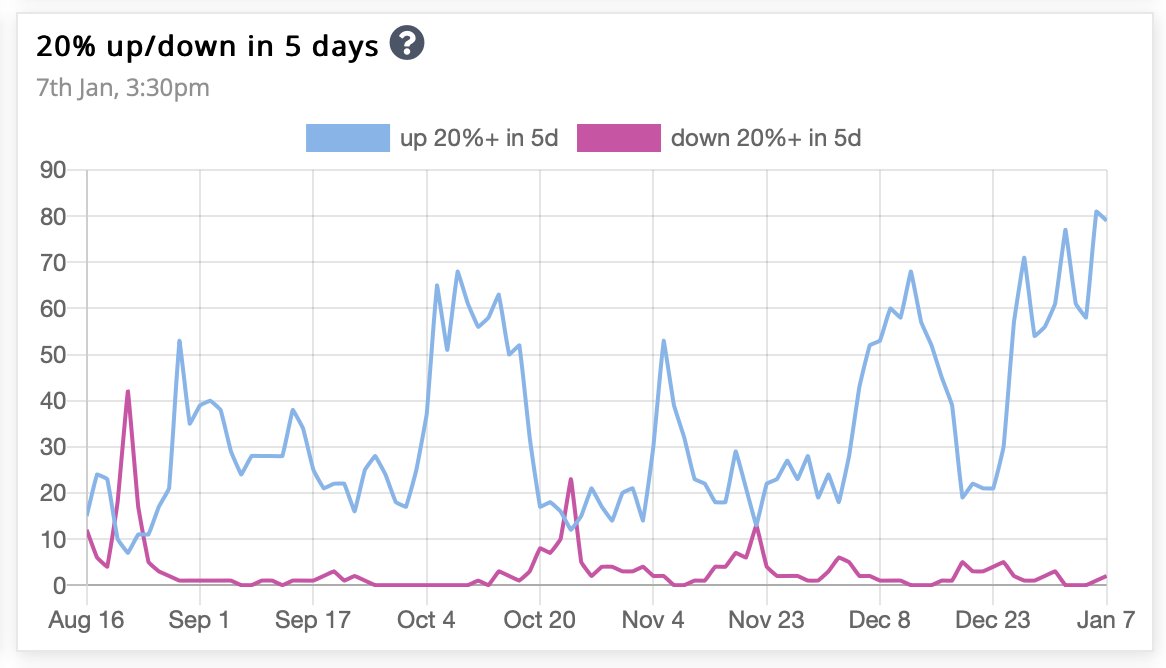

Market status changed to Confirmed Uptrend. Momentum still negative but improving.

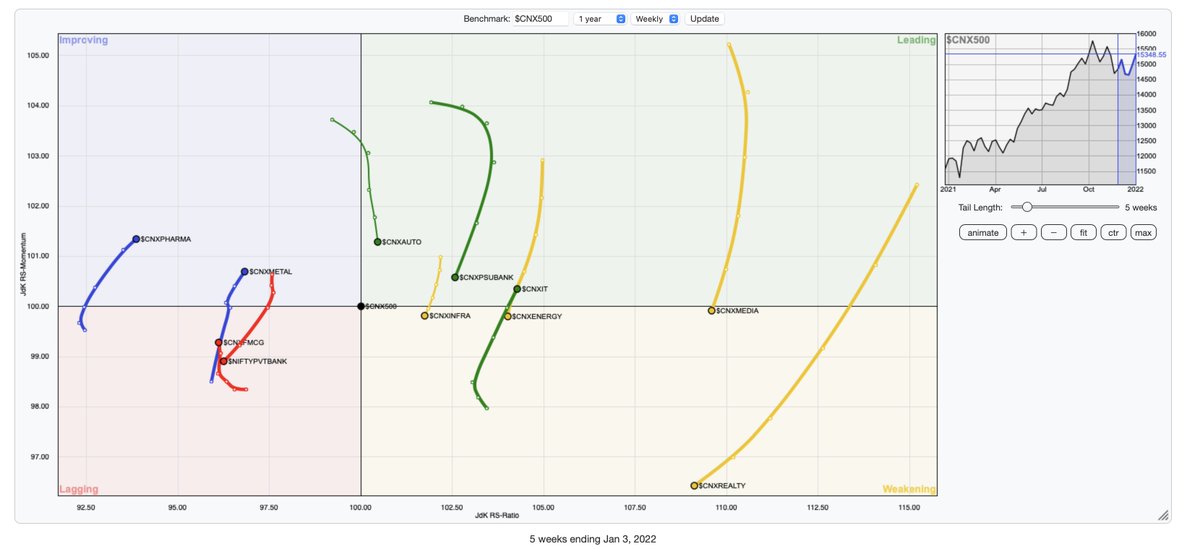

Most indices back in confirmed uptrend. Pharma & Banknifty in rally attempt. No index in downtrend.

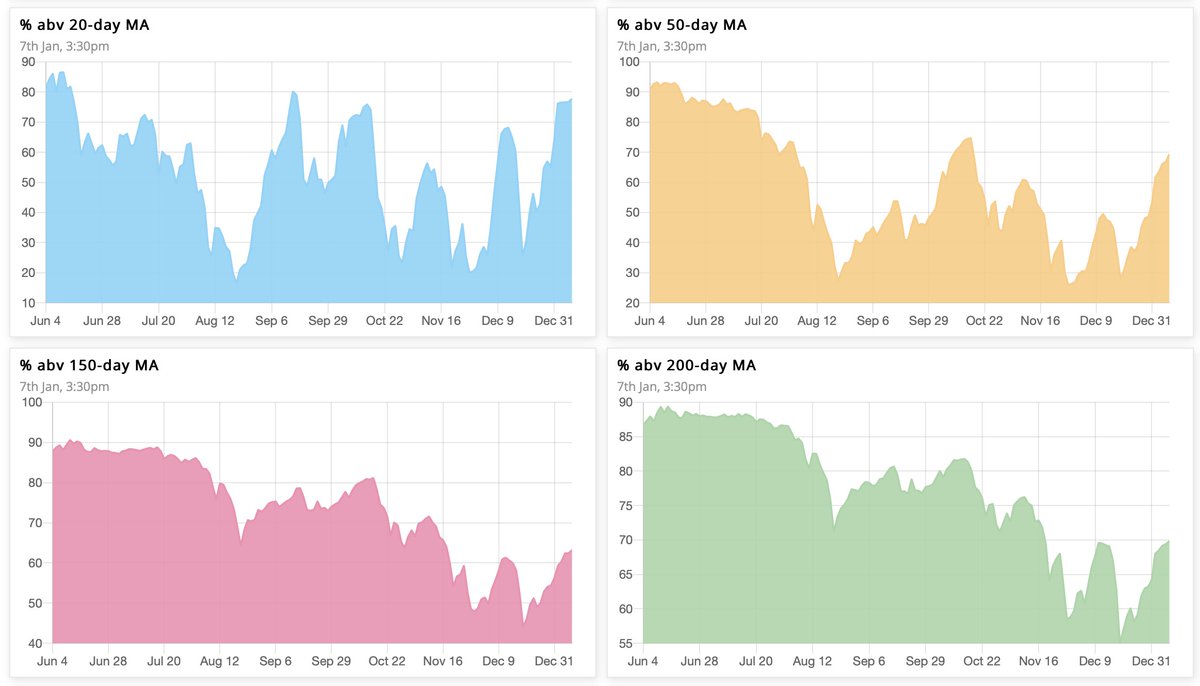

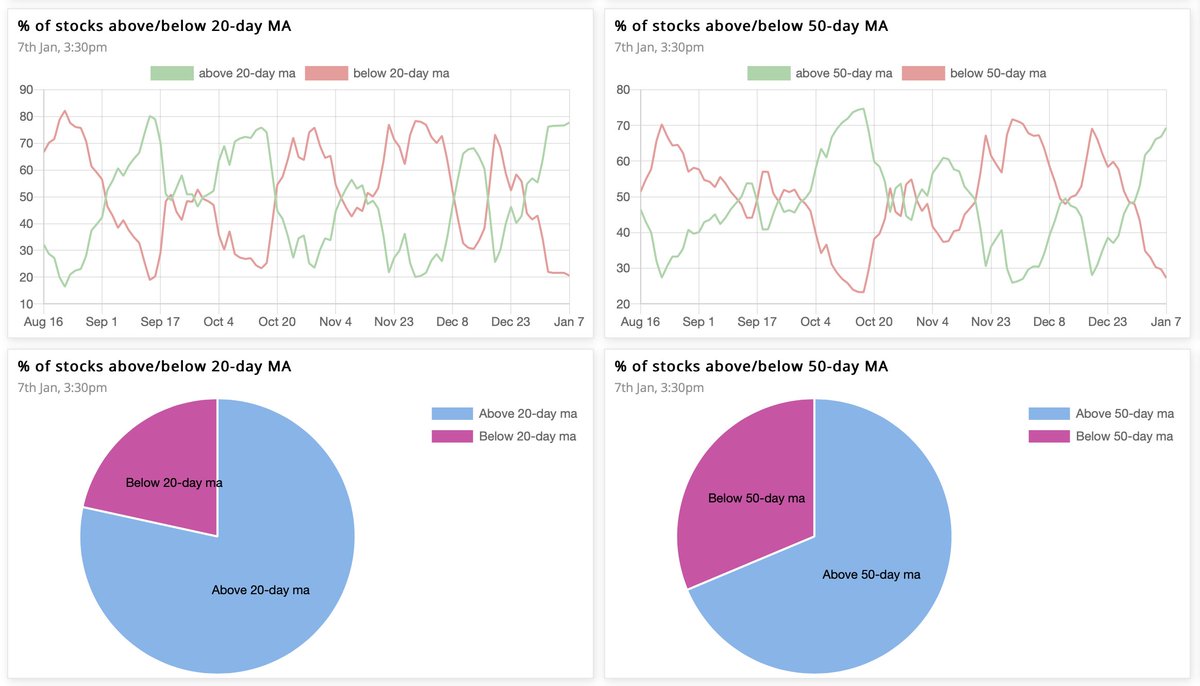

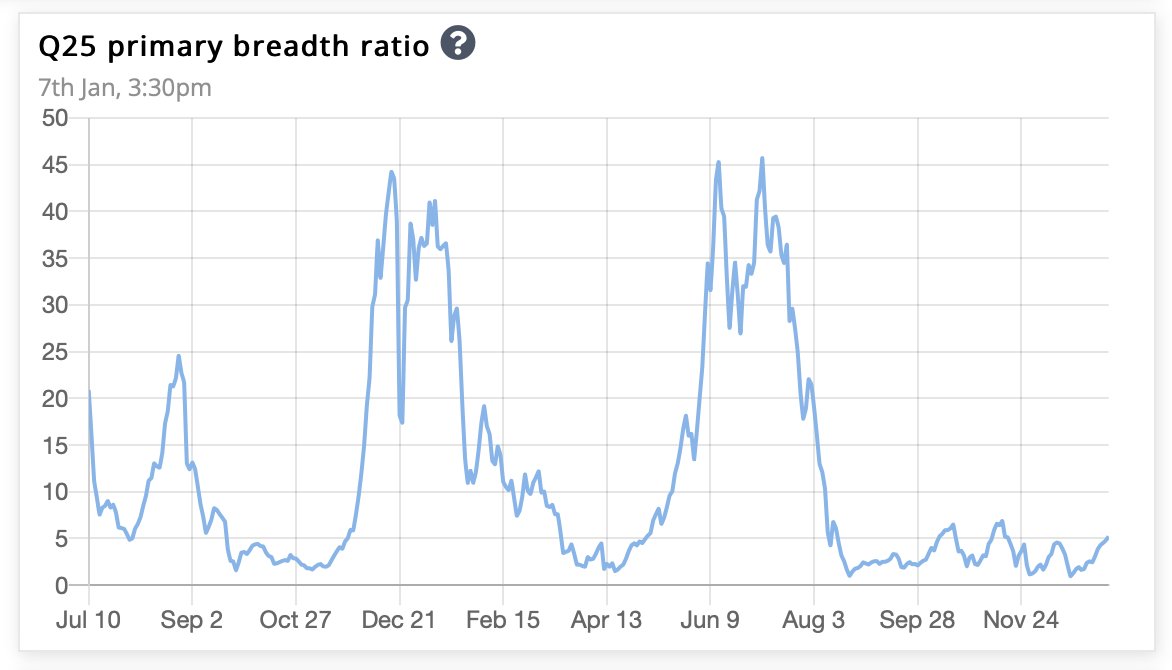

Market breadth improving on all timeframes. Nearing overbought.

Market status changed to Confirmed Uptrend. Momentum still negative but improving.

Most indices back in confirmed uptrend. Pharma & Banknifty in rally attempt. No index in downtrend.

Market breadth improving on all timeframes. Nearing overbought.

Loading suggestions...