Based on this the key factors that create wealth by applying the concept/ mental model "scalability":

1. Size of the market/ addressable external opportunity.

If we look at history, the big wealth creation happens in a few sectors.

Technology.

Financials.

Healthcare. (2/n)

1. Size of the market/ addressable external opportunity.

If we look at history, the big wealth creation happens in a few sectors.

Technology.

Financials.

Healthcare. (2/n)

Discretionary consumption.

Why?

Because the size of the market is huge.

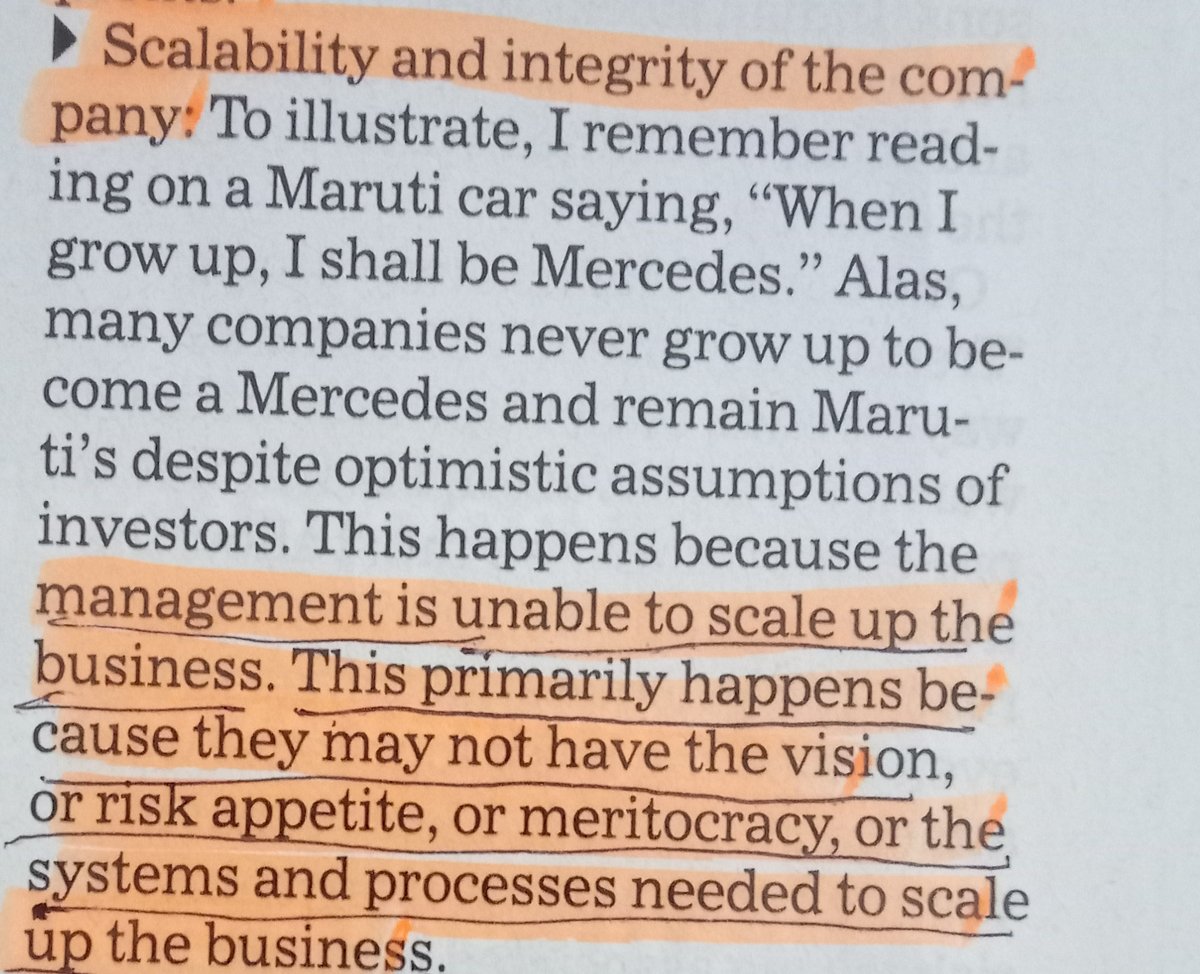

2. The most important factor is "management", as RJ said:

Ability to scale up the business in bigger market size.

Vision & risk appetite and

The system/ process needed to scale up the business (3/n)

Why?

Because the size of the market is huge.

2. The most important factor is "management", as RJ said:

Ability to scale up the business in bigger market size.

Vision & risk appetite and

The system/ process needed to scale up the business (3/n)

Without the "management" factor, the big size of the addressable market can't create💰

We can see so many 30-40 years old Tech, health care, financials companies are still small in size, the main reason is management.

Btw, I forgot to mention the "Integrity" of management (4/n)

We can see so many 30-40 years old Tech, health care, financials companies are still small in size, the main reason is management.

Btw, I forgot to mention the "Integrity" of management (4/n)

Here RJ mentioned "systems & processes needed to scale up the business".

These systems/ processes lead to creating the "sustainable competitive advantage" if the systems/ process aren't creating moats continuously, long term wealth can't be generated (5/n)

These systems/ processes lead to creating the "sustainable competitive advantage" if the systems/ process aren't creating moats continuously, long term wealth can't be generated (5/n)

So, three factors are important:

1. Size of the market.

2. Management.

3. Building a sustainable moat.

There are so many cases that proved this "pattern" worked everywhere, not only in India 🇮🇳

(6/n)

1. Size of the market.

2. Management.

3. Building a sustainable moat.

There are so many cases that proved this "pattern" worked everywhere, not only in India 🇮🇳

(6/n)

However, I would like to mention the 3 cases in the Indian context:

1. Titan.

2. Bajaj Finance.

3. TCS.

First, look at Titan: Size of the jewellery market in the early 2000s + management (Bhaskar Bhat and team) + building a sustainable moat continuously (7/n)

1. Titan.

2. Bajaj Finance.

3. TCS.

First, look at Titan: Size of the jewellery market in the early 2000s + management (Bhaskar Bhat and team) + building a sustainable moat continuously (7/n)

Investing in brands, designs, trust factor, supply chain, cost-effectiveness etc.,

Second: Bajaj Finance.

Size of the market ( still it is big) + management ( Sanjiv Bajaj & team) + building sustainable moats (investment in technology and human resources ) (8/n)

Second: Bajaj Finance.

Size of the market ( still it is big) + management ( Sanjiv Bajaj & team) + building sustainable moats (investment in technology and human resources ) (8/n)

Finally: TCS.

The size of the market and is still growing in different ways + management (FC Kohli, Ramadorai & N Chandrasekaran) + building moats by investing in Technology, brand, HR.

These 3 factors are very essential, even you can look at the leading companies in US (9/n)

The size of the market and is still growing in different ways + management (FC Kohli, Ramadorai & N Chandrasekaran) + building moats by investing in Technology, brand, HR.

These 3 factors are very essential, even you can look at the leading companies in US (9/n)

This "pattern" created enormous wealth.

End (10/n)

The stock names mentioned here are only for academic purpose, not a recommendation to buy/sell.

Thank you @soicfinance because of your tweet I shared some of my observations on the concept of "scalability"

#EQTlearnings

End (10/n)

The stock names mentioned here are only for academic purpose, not a recommendation to buy/sell.

Thank you @soicfinance because of your tweet I shared some of my observations on the concept of "scalability"

#EQTlearnings

Loading suggestions...