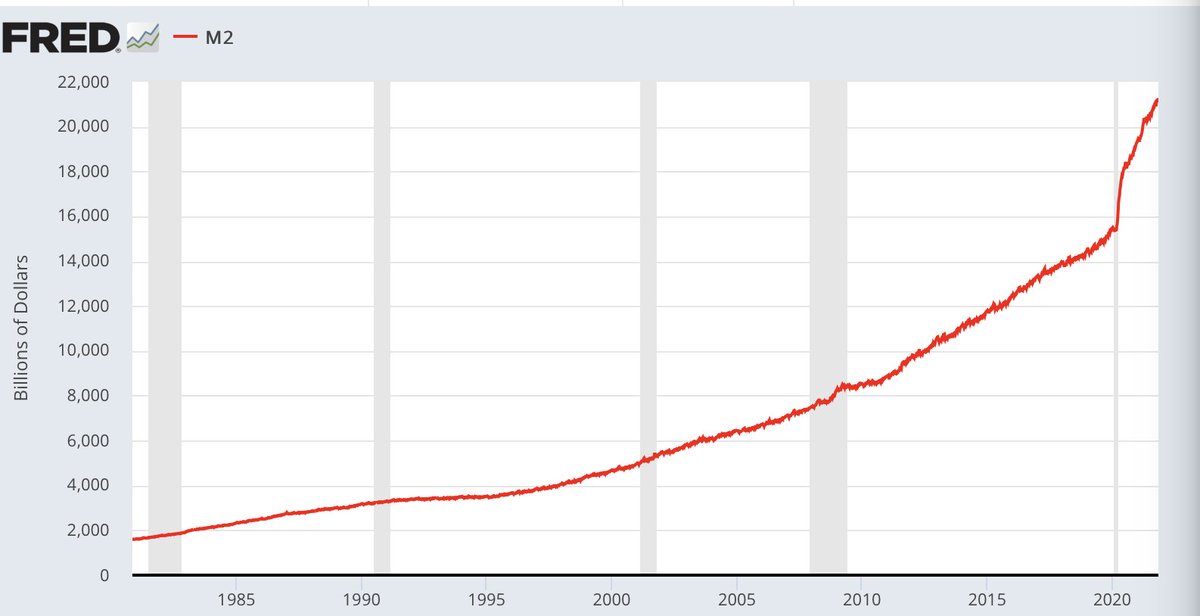

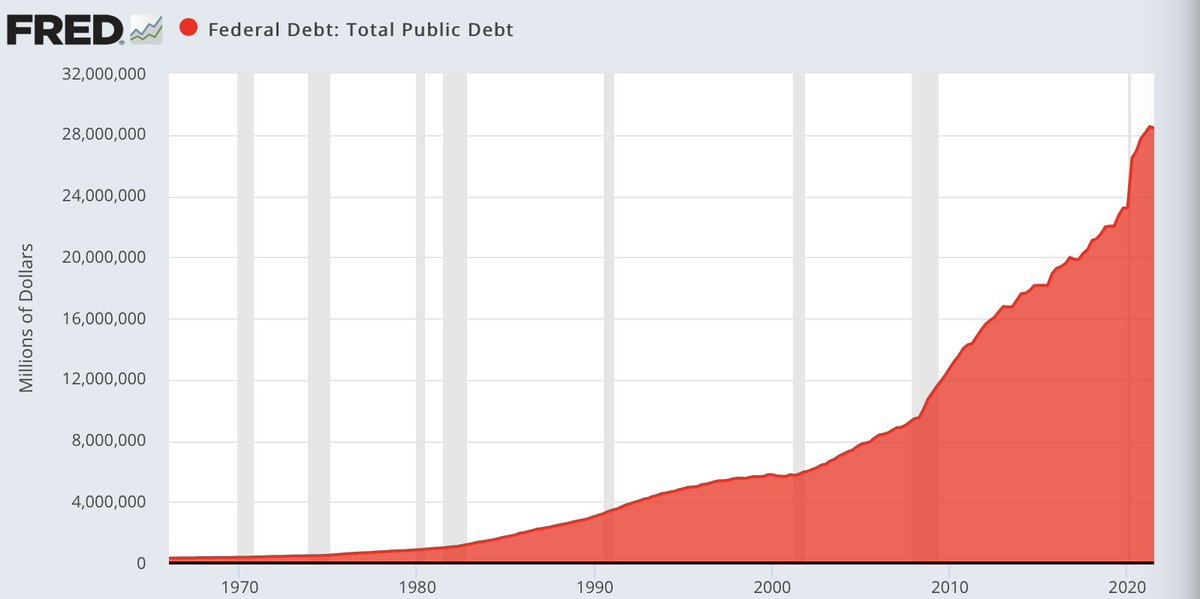

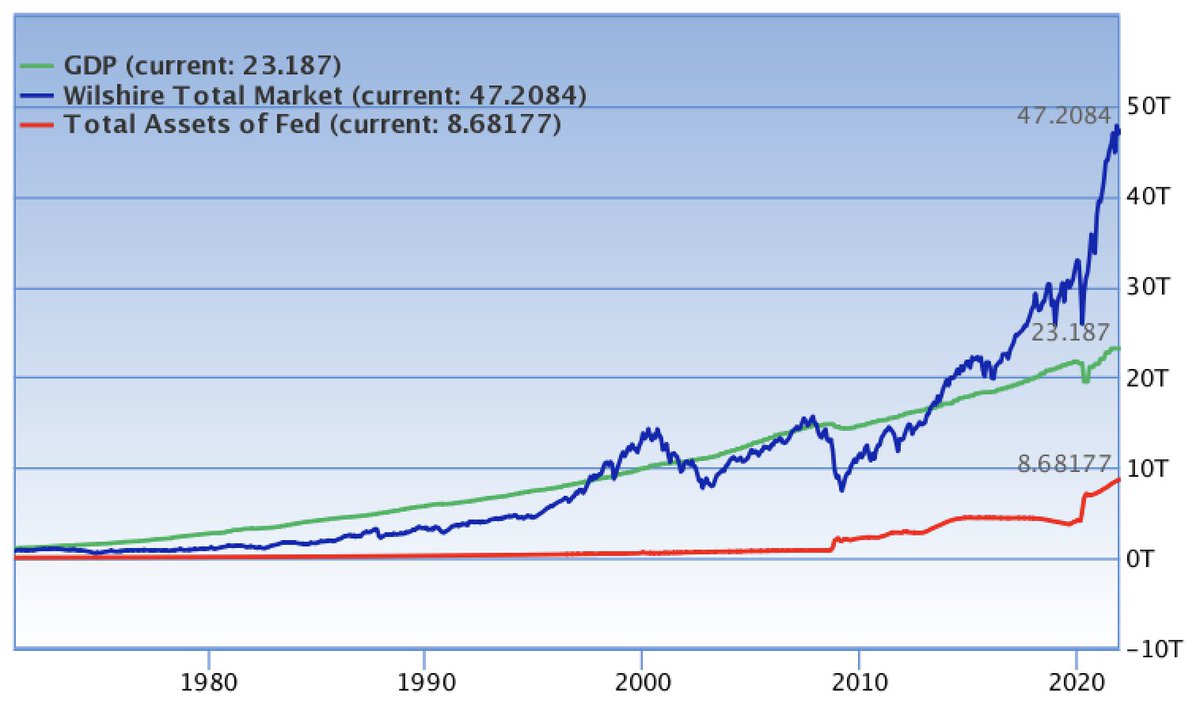

The illusion of prosperity & growth is entirely debt financed & brought about by a radical process of financial engineering made possible by low rates & a price insensitive buyer with unlimited pockets buying over $8 trillion in assets during the same time frame.

And if anyone thinks these type of disconnects & distortions can be sustained without continued intervention of this magnitude I welcome you to your fantasy. But recognize for what it is.

How this all rebalances at some point is the undiscovered journey we are all on.

How this all rebalances at some point is the undiscovered journey we are all on.

The greatest trick the devil ever pulled is convince people that the very extreme is the new normal.

It's not.

The world has gone down a rabbit hole. It can only be maintained by intervention.

The free market finally died in 2009.

It's been a central bank subsidy since then.

It's not.

The world has gone down a rabbit hole. It can only be maintained by intervention.

The free market finally died in 2009.

It's been a central bank subsidy since then.

And I'm not saying this will all collapse in an instant. Far from it, indeed to this day we still see central bank control/intervention. We're just at the beginning of a process.

But the extremes inform of risk/reward & we need to navigate through it as realistically as possible.

But the extremes inform of risk/reward & we need to navigate through it as realistically as possible.

From my perch the charts/technicals & signals continue to tell a larger story & they help guide us in the journey.

I'll outline in more detail in early January.

I'll outline in more detail in early January.

Loading suggestions...