Lets breakdown the business of #RACLGeartech

An In-Depth Thread 🧵

An In-Depth Thread 🧵

Their customer are very sticky in nature , That means that they don't leave RACL Geartech due to its Moats

Its Moats are -

1⃣ R&D

2⃣ Tech Innovation

3⃣ Product Quality

Lets discuss them -

Its Moats are -

1⃣ R&D

2⃣ Tech Innovation

3⃣ Product Quality

Lets discuss them -

1⃣ R&D -

15% of their Employee Costs is R&D with the customer

2⃣ Tech Innovation-

Initially they started Focusing on Technology

For the next 7-8 years they only grew for 4-5%

Since then have grown highly

15% of their Employee Costs is R&D with the customer

2⃣ Tech Innovation-

Initially they started Focusing on Technology

For the next 7-8 years they only grew for 4-5%

Since then have grown highly

Electric Vehicle Impact -

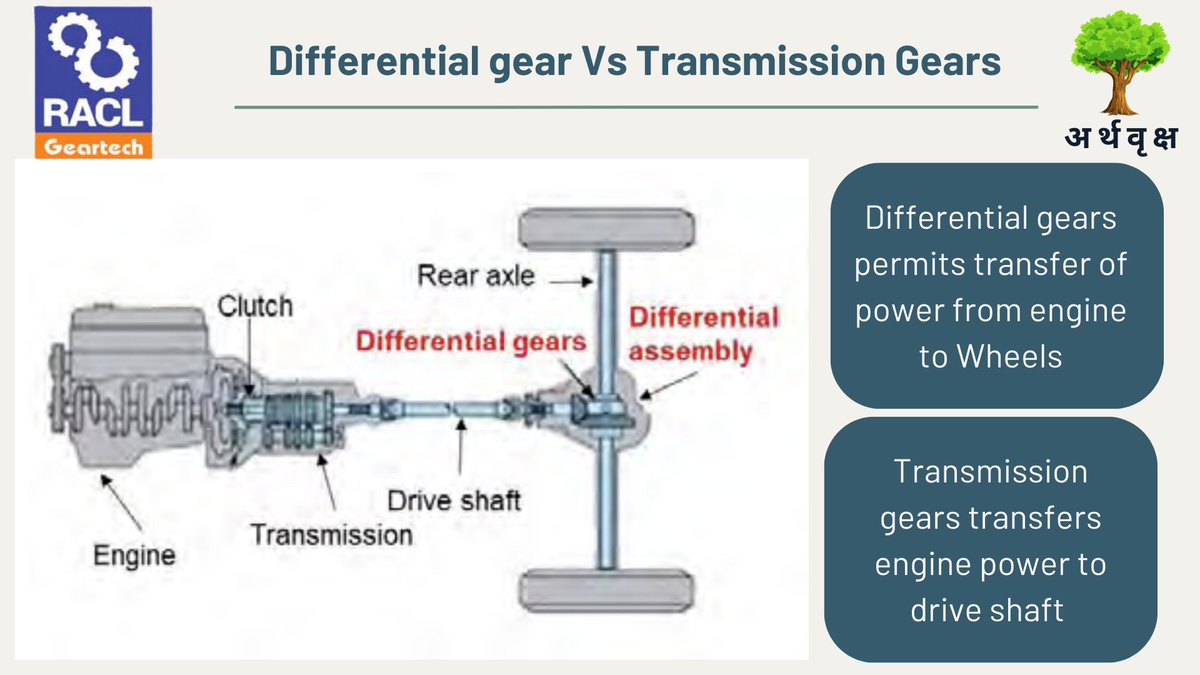

As RACL Geartech manufacturers Gears , Less Gears are used in Electric Vehicles

Due to that their Volume will be down in this segment of EV but the margin will be high as

Making Gears for EV Requires very high precision

As RACL Geartech manufacturers Gears , Less Gears are used in Electric Vehicles

Due to that their Volume will be down in this segment of EV but the margin will be high as

Making Gears for EV Requires very high precision

The Reasons behind this high OPM% are -

1⃣ In-House Raw Material Manufacturing

Earlier 100% of Forging Work was from outside now 40% is done In-House only

2⃣ Exports Also improve Margins of the company ie. 70% of revenue comes from Exports

3⃣ Pricing Power is also a reason

1⃣ In-House Raw Material Manufacturing

Earlier 100% of Forging Work was from outside now 40% is done In-House only

2⃣ Exports Also improve Margins of the company ie. 70% of revenue comes from Exports

3⃣ Pricing Power is also a reason

Loading suggestions...