#WeeklyIndexCheck CW50/2021

Uptrend under pressure.

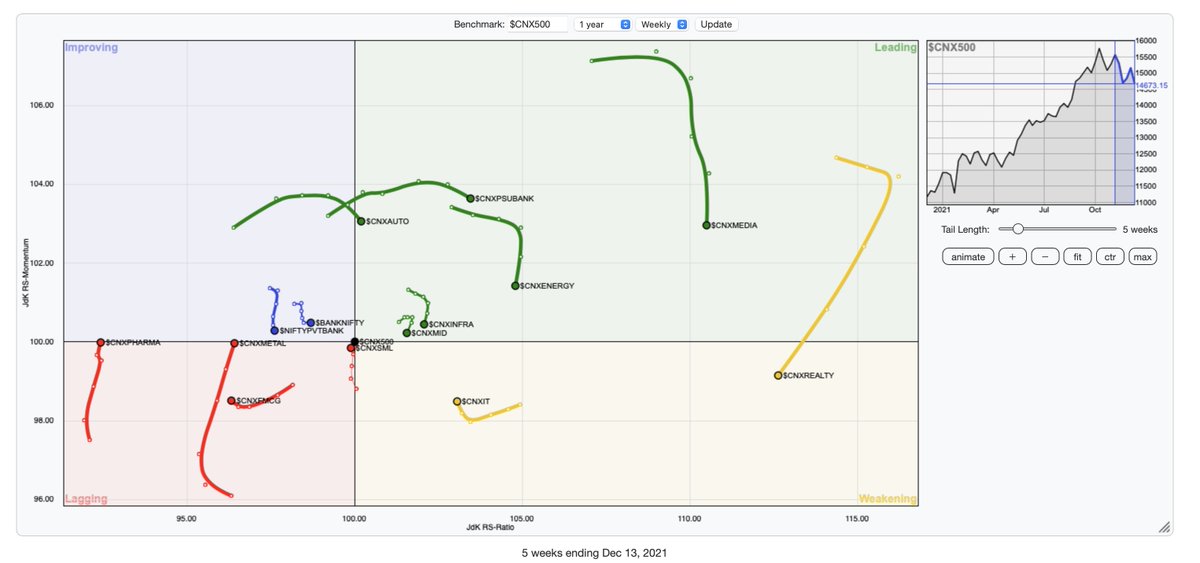

Except Power & Media, none of the indices in confirmed uptrend or with positive momentum.

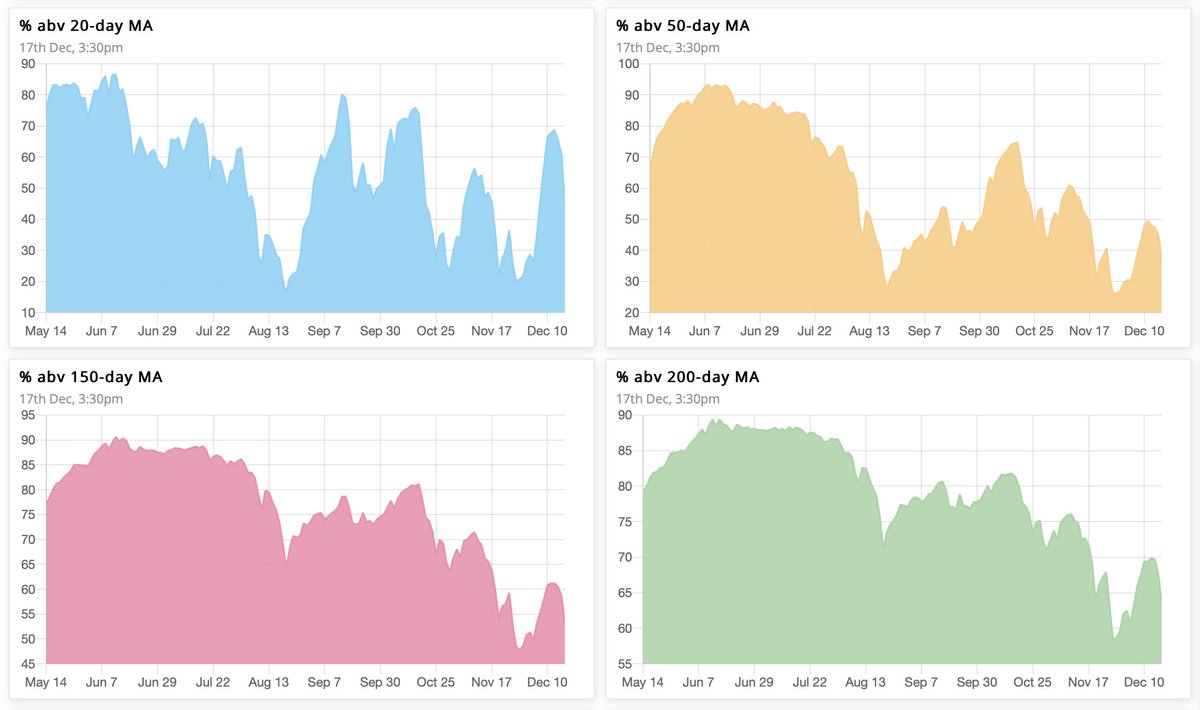

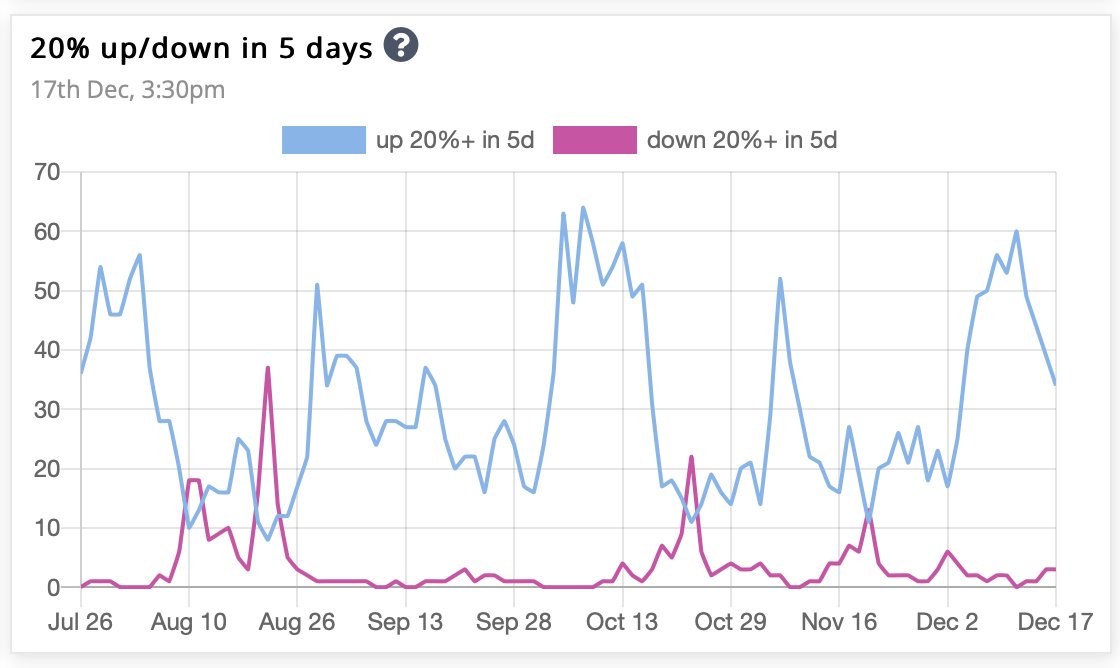

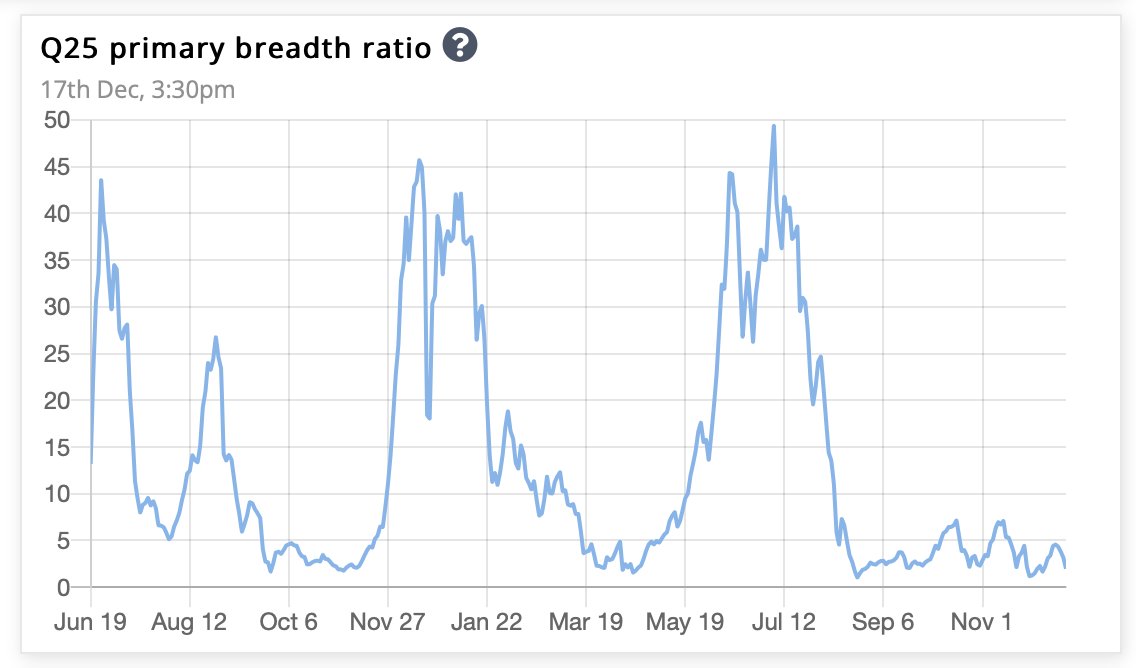

Market breadth weakening. Last week’s buying signal on short-term charts turned out to be a bull trap.

Uptrend under pressure.

Except Power & Media, none of the indices in confirmed uptrend or with positive momentum.

Market breadth weakening. Last week’s buying signal on short-term charts turned out to be a bull trap.

Loading suggestions...