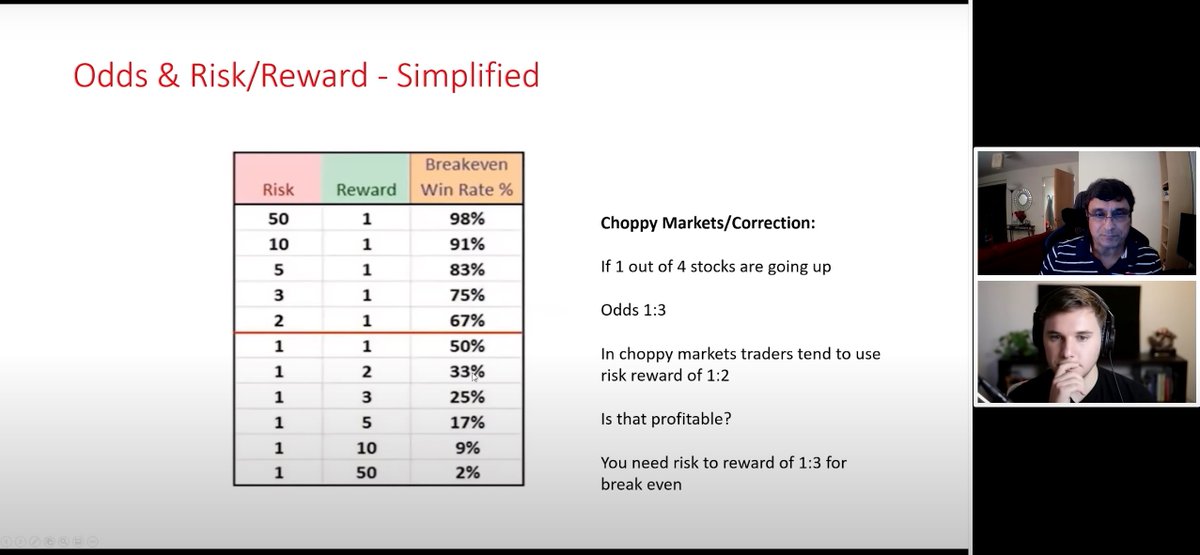

"In choppy or bad markets not only are the odds against you, but also risk/reward is against you."

A study of Shahid Saleem (@SSalim0002)

(1/x)

A study of Shahid Saleem (@SSalim0002)

(1/x)

2/ In Saleem's interview with Richard Moglen he discusses the math of trading through probability and odds.

One part that is drastically misunderstood by many swing traders is how the odds change to be mathematically against you when the market is bad.

One part that is drastically misunderstood by many swing traders is how the odds change to be mathematically against you when the market is bad.

3/ Profitable trading is composed of two aspects:

1. Risk:Reward — how much you profit when you are right vs. how much you lose when you are wrong

2. Win Rate — how often you are right

Ideally, you want a high R:R and a high win rate.

1. Risk:Reward — how much you profit when you are right vs. how much you lose when you are wrong

2. Win Rate — how often you are right

Ideally, you want a high R:R and a high win rate.

4/ During bad markets, many traders will try to:

1. Decrease win rate (more selective) & increase R:R (hold longer)

2. Increase win rate (less selective) & decrease R:R (lock in faster)

But, in bad markets, win rate and R:R both decrease.

1. Decrease win rate (more selective) & increase R:R (hold longer)

2. Increase win rate (less selective) & decrease R:R (lock in faster)

But, in bad markets, win rate and R:R both decrease.

5/ A few examples —

$F on 12/10/21:

• peaked at 3-4R

• stopped out two days later (12/14/21)

$GDYN on 12/09/21:

• peaked at ~2R

• stopped out same day

$SOXL on 12/07/21 [my trade]:

• peaked at 5R

• stopped out two days later (12/09/21)

$F on 12/10/21:

• peaked at 3-4R

• stopped out two days later (12/14/21)

$GDYN on 12/09/21:

• peaked at ~2R

• stopped out same day

$SOXL on 12/07/21 [my trade]:

• peaked at 5R

• stopped out two days later (12/09/21)

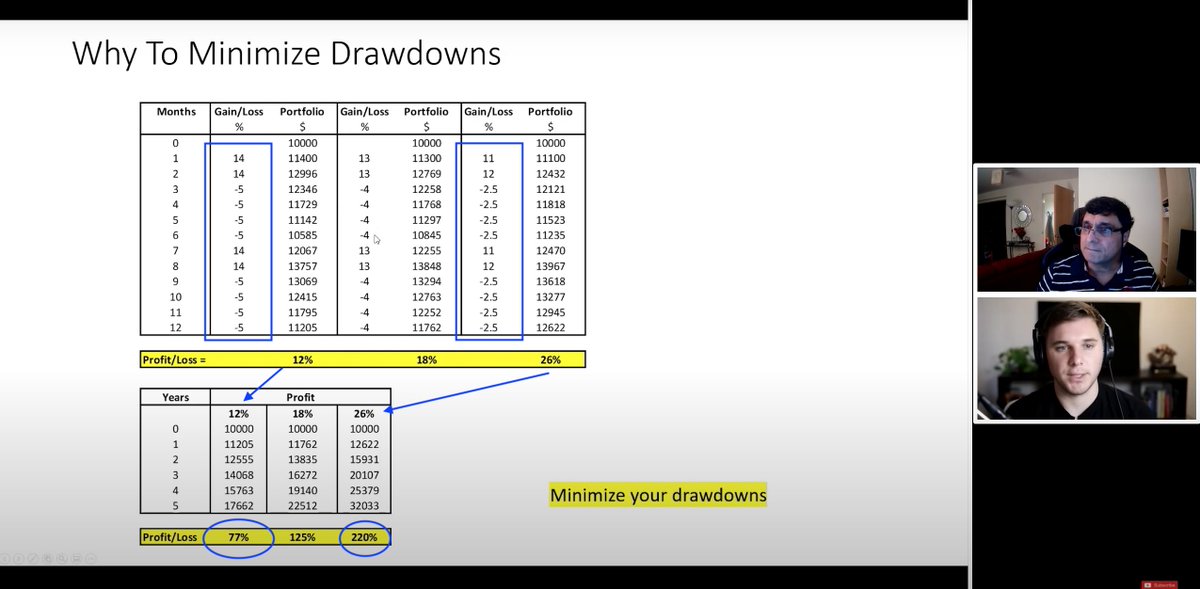

6/ Saleem explains that in a good market environment your R:R and win rate will both be *better* than in a bad market environment.

He even suggests comparing your stats to confirm this.

Example Stats:

Good Mkt —

R:R = 4:1

Win Rate = 30%

Bad Mkt —

R:R = 2:1

Win Rate = 20%

He even suggests comparing your stats to confirm this.

Example Stats:

Good Mkt —

R:R = 4:1

Win Rate = 30%

Bad Mkt —

R:R = 2:1

Win Rate = 20%

8/ Breaking down the original statement:

"Bad markets... the odds are against you"

= lower win rate

= fewer breakouts

"Bad markets... risk/reward is against you"

= lower R:R

= higher likelihood of failures/reversals

"Bad markets... the odds are against you"

= lower win rate

= fewer breakouts

"Bad markets... risk/reward is against you"

= lower R:R

= higher likelihood of failures/reversals

9/ How do you know when the market is bad?

• Moving averages are above price

• Recent trades pullback/fade/stop out aggressively

• Fewer good setups are available

• No easily identifiable leadership/theme

• Moving averages are above price

• Recent trades pullback/fade/stop out aggressively

• Fewer good setups are available

• No easily identifiable leadership/theme

10/ So what can you do about it?

1. Sit out and study (look for leadership and relative strength)

2. Adjust your strategy

1. Sit out and study (look for leadership and relative strength)

2. Adjust your strategy

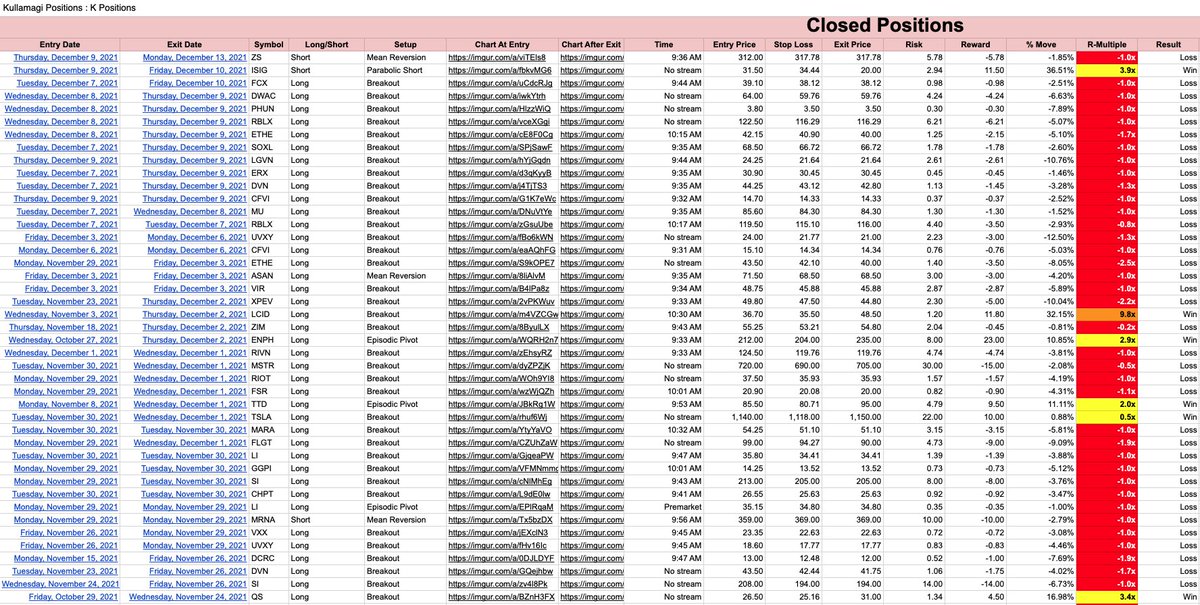

12/ @Qullamaggie's simple market situational awareness rule is to sit out when the 10MA is below the 20MA.

According to the #KPositionsTracker, his performance has changed in November and December, which is aligned with this rule.

According to the #KPositionsTracker, his performance has changed in November and December, which is aligned with this rule.

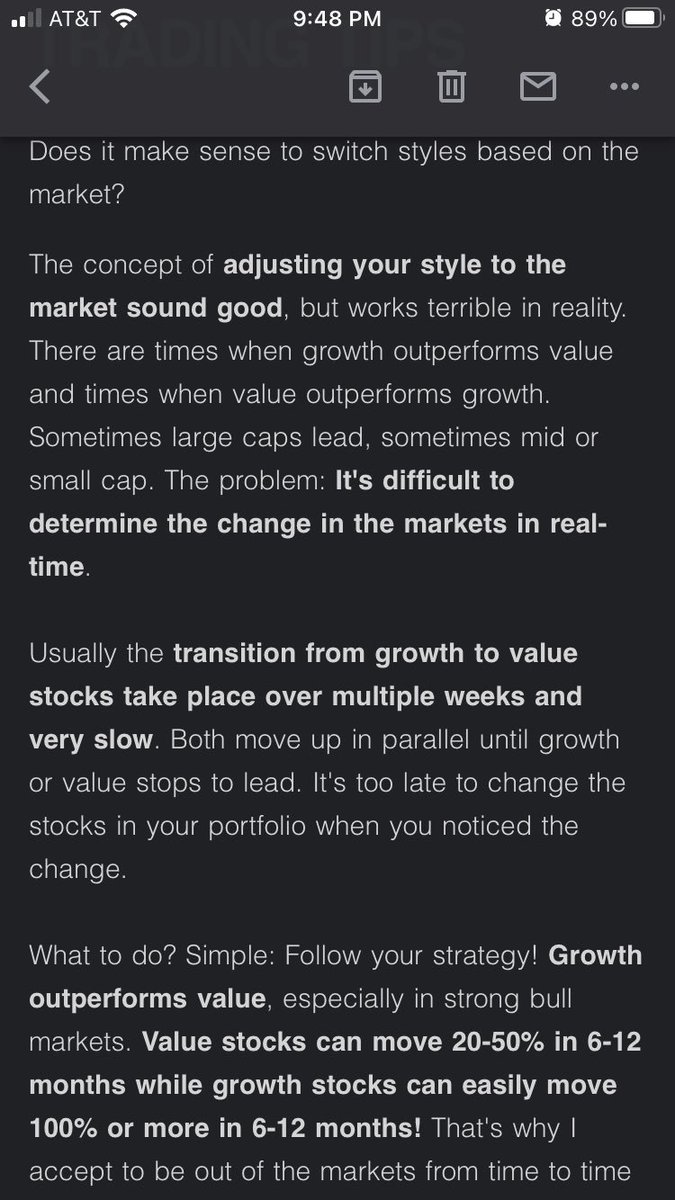

13/ @BlogJulianKomar explains the problem of adjusting your strategy in his newsletter from 12/12/21:

14/ @MarkMinervini has adjusted his strategy by taking profits faster in 2021.

But, he is a pro-trader.

Unlike the rest of us who are learning.

But, he is a pro-trader.

Unlike the rest of us who are learning.

15/ Summarized & Simplified:

1. Swing trading is mathematically harder in bad market environments

→ There are fewer winning trades

→ Winning trades profits are smaller

2. Sitting out is the best option for most swing traders

1. Swing trading is mathematically harder in bad market environments

→ There are fewer winning trades

→ Winning trades profits are smaller

2. Sitting out is the best option for most swing traders

16/ Thank you for reading.

Follow @rahuldmehta7 for insights like this to become a great swing trader.

Share this with a fellow trader to help them trade less and profit more. ↓

Follow @rahuldmehta7 for insights like this to become a great swing trader.

Share this with a fellow trader to help them trade less and profit more. ↓

17/ Thank you to Shahid and Richard for this incredible interview.

To watch Saleem's explanation of this in his interview with @RichardMoglen, you can find the bookmarked clip here:

youtu.be

To watch Saleem's explanation of this in his interview with @RichardMoglen, you can find the bookmarked clip here:

youtu.be

18/ Create a back-watchlist of your own trades to best gauge the market environment through your own performance.

Download my Trading Journal today.

Etsy.com

Download my Trading Journal today.

Etsy.com

19/ If you found this thread helpful, then check out my others too:

Threadsby.me

Threadsby.me

20/ As always, if I have misspoken or am incorrect in my synthesis, then I more than welcome any criticism/clarification from the traders mentioned.

Loading suggestions...