WTF is @anchor_protocol and how it pays its depositors 20% APY on $UST.

A fundamental overview on how Anchor Protocol works $ANC, $UST and $LUNA 🧵 👇

A fundamental overview on how Anchor Protocol works $ANC, $UST and $LUNA 🧵 👇

I've been asked this question way too often recently and I find that I keep repeating myself.

Anchor is the heart and soul of #TerraLUNA and every #LUNAtic should know it inside out.

So here's what you need to know.

Anchor is the heart and soul of #TerraLUNA and every #LUNAtic should know it inside out.

So here's what you need to know.

1 / WTF is @anchor_protocol?

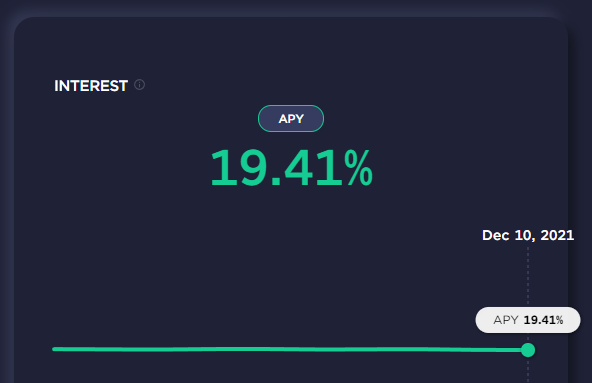

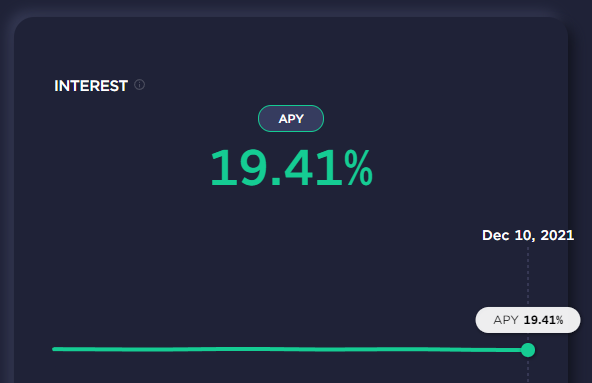

Anchor is a savings protocol that offers low-volatility yields on Terra stablecoins like $UST.

Currently, Anchor Earn's yield consistently hovers around 19.41% APY.

This makes your bank's fixed deposit rates look like some kind of sick joke.

Anchor is a savings protocol that offers low-volatility yields on Terra stablecoins like $UST.

Currently, Anchor Earn's yield consistently hovers around 19.41% APY.

This makes your bank's fixed deposit rates look like some kind of sick joke.

But the biggest question you must be asking is:

"How does @anchor_protocol pay depositors such a high interest rate?"

"How does @anchor_protocol pay depositors such a high interest rate?"

@anchor_protocol derives its deposit yield from two main sources:

(A) Staking rewards from Proof-Of-Stake (POS) blockchains.

(B) Borrowing interest from loans given out.

Still confused? Let me explain.

(A) Staking rewards from Proof-Of-Stake (POS) blockchains.

(B) Borrowing interest from loans given out.

Still confused? Let me explain.

A // Staking rewards from Proof-Of-Stake blockchains.

To understand what this means, we should understand how Proof-of-Stake (PoS) works vs Proof-of-Work (PoW) as a blockchain's consensus mechanism.

The @ethereum's docs explains it in great detail:

ethereum.org

To understand what this means, we should understand how Proof-of-Stake (PoS) works vs Proof-of-Work (PoW) as a blockchain's consensus mechanism.

The @ethereum's docs explains it in great detail:

ethereum.org

To draw comparisons, in a Proof-of-Work (PoW) blockchain, miners are incentivized to validate transactions and secure the network.

On Ethereum, miners spend computational power to solve algorithms (blocks) and are rewarded in the blockchain's native token $ETH.

On Ethereum, miners spend computational power to solve algorithms (blocks) and are rewarded in the blockchain's native token $ETH.

Instead of spending energy, stakers in a Proof-of-Stake (PoS) blockchain are incentivized to 'stake' or lock up their tokens, which are then randomly selected by the protocol to create blocks.

Similarly, stakers are rewarded with staking rewards in the blockchain's native token.

Similarly, stakers are rewarded with staking rewards in the blockchain's native token.

So how does @anchor_protocol pay depositors with staking rewards?

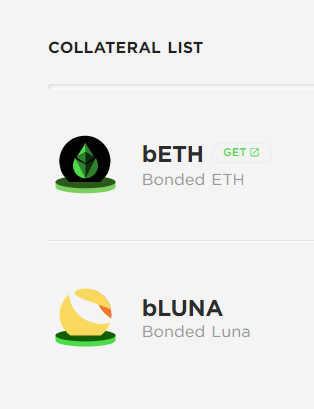

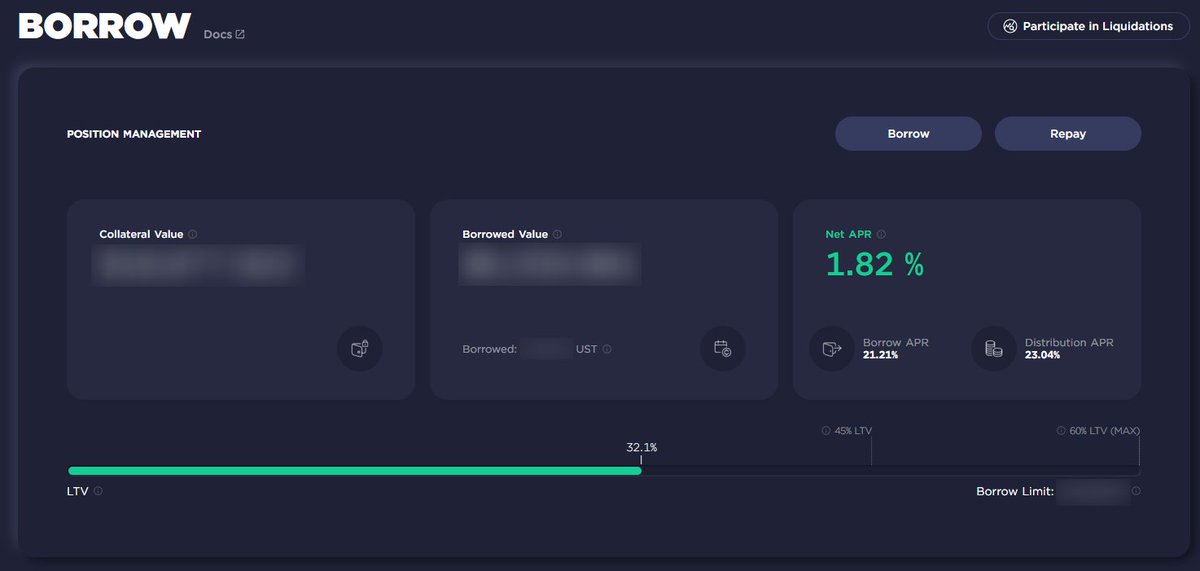

Anchor's money market allows users to borrow $UST on their bonded yield bearing PoS assets in the form of bAssets, up to 60% Loan-To-Value (LTV) before the protocol liquidates their collateral.

Anchor's money market allows users to borrow $UST on their bonded yield bearing PoS assets in the form of bAssets, up to 60% Loan-To-Value (LTV) before the protocol liquidates their collateral.

"But ser, aren't staked assets illiquid and locked in the PoS blockchain's protocol??"

Yes, that is correct. However, bAssets are liquid, tokenized representations of staked assets in a PoS blockchain. This allows stakers to gain liquidity over their staked assets.

Yes, that is correct. However, bAssets are liquid, tokenized representations of staked assets in a PoS blockchain. This allows stakers to gain liquidity over their staked assets.

Holders of bAssets are also entitled to receive the staking rewards of the underlying staked assets.

You can find more information in @anchor_protocol's docs: docs.anchorprotocol.com

You can find more information in @anchor_protocol's docs: docs.anchorprotocol.com

By staking our bAssets in @anchor_protocol, the protocol receives the staking rewards instead.

In other words, Anchor redirects staking rewards from these bAssets to pay its depositors in $UST.

In other words, Anchor redirects staking rewards from these bAssets to pay its depositors in $UST.

B // Borrowing interest from loans given out.

Similar to a bank in traditional finance where there are lenders and borrowers, when a user takes a loan on their collateral, they will be charged an interest on their borrowings.

Similar to a bank in traditional finance where there are lenders and borrowers, when a user takes a loan on their collateral, they will be charged an interest on their borrowings.

However, unlike a traditional bank where loans have fixed loan durations and monthly repayments; loans on @anchor_protocol simply accumulate on top of your borrowing position at a variable interest rate based on borrowing demand.

All loans on @anchor_protocol are overcollateralized as borrowers will need to deposit bAssets as collateral up to a maximum of 60% LTV.

Essentially this removes the risk of loan default as the protocol is able to liquidate the borrower's collateral.

docs.anchorprotocol.com

Essentially this removes the risk of loan default as the protocol is able to liquidate the borrower's collateral.

docs.anchorprotocol.com

Thus, on top of staking rewards, @anchor_protocol also generates yield from borrowers who pay interest on their loans.

This borrowing yield is then also redirected to depositors in $UST.

This borrowing yield is then also redirected to depositors in $UST.

2 / The Math behind @anchor_protocol's high APY on $UST.

Now knowing how @anchor_protocol redirects yield from borrowing interest and bAsset staking rewards, we can roughly calculate how it pays its depositors a juicy 19.41% APY on their $UST.

Now knowing how @anchor_protocol redirects yield from borrowing interest and bAsset staking rewards, we can roughly calculate how it pays its depositors a juicy 19.41% APY on their $UST.

DISCLAIMER: All figures below are rough estimates based on information displayed on Anchor's dashboard and PoS bAsset staking rewards at the time of writing, and are by no means 100% accurate.

Lets first consider how much interest Anchor will need to generate.

Taking the total $UST deposits in Anchor of $3.312 billion earning 19.45% APY, @anchor_protocol will need to pay its depositors a total of $644 million $UST per annum.

Taking the total $UST deposits in Anchor of $3.312 billion earning 19.45% APY, @anchor_protocol will need to pay its depositors a total of $644 million $UST per annum.

Now lets determine the Annual Percentage Return (APR) coming from bAsset staking rewards.

bLUNA = 8.29% (Terra Station)

bETH = 5.05% (stakingrewards.com)

bLUNA = 8.29% (Terra Station)

bETH = 5.05% (stakingrewards.com)

From the collateral dashboard, we can see there is $4.302 billion bLUNA and $381 million bETH locked in @anchor_protocol.

Multiplied by the staking APR above, we can calculate that a total of $375 million worth of staking rewards per annum is redirected to depositors as $UST.

Multiplied by the staking APR above, we can calculate that a total of $375 million worth of staking rewards per annum is redirected to depositors as $UST.

$715 mil - $644 mil = $71 million $UST excess yield per annum.

Excess yield generated is also accumulated in @anchor_protocol's yield reserve which can be deployed through governance when borrowing demand and staking yield is low, in order to subsidize the depositors' interest.

Excess yield generated is also accumulated in @anchor_protocol's yield reserve which can be deployed through governance when borrowing demand and staking yield is low, in order to subsidize the depositors' interest.

In the event that @anchor_protocol's yield reserve runs dry, the protocol will increase $ANC emissions to borrowers to incentivize users to borrow more.

Literally paying users to borrow more $UST. You can find out how it works here: docs.anchorprotocol.com

Literally paying users to borrow more $UST. You can find out how it works here: docs.anchorprotocol.com

Thus, we can start to see how @anchor_protocol effectively sustains paying its depositors with such high APYs on @terra_money's $UST stablecoin through bAsset staking rewards and borrowing interest.

3 / CLOSING THOUGHTS

Despite being an already long thread, there are still a lot of aspects of @anchor_protocol which I did not cover as that is not the scope of this thread.

Despite being an already long thread, there are still a lot of aspects of @anchor_protocol which I did not cover as that is not the scope of this thread.

Other aspects of @anchor_protocol which were not covered in this thread include (but not limited to) protocol security, the $ANC token, governance and future upgrades to look forward to.

The aim of this thread is to help newcomers and #LUNAtics alike understand the fundamentals of how @anchor_protocol works without diving too deep into the technical aspects of the protocol.

4 / DISCLAIMER

I am in no way related or working with the @anchor_protocol team, however I am personally invested in the $ANC token.

I am in no way related or working with the @anchor_protocol team, however I am personally invested in the $ANC token.

Information written here is purely educational and is my own opinion. Nothing I say should be constituted as financial advice, do your own research, and please consult with a professional before making a particular investment.

5 / REFERENCES

Everything mentioned above can be found in @anchor_protocol's docs, do take a read as it is very comprehensive:

docs.anchorprotocol.com

Everything mentioned above can be found in @anchor_protocol's docs, do take a read as it is very comprehensive:

docs.anchorprotocol.com

I hope you found this insightful, thanks for reading!

Tagging some chads below to spread the word to reach the newbies:

@stablekwon @sjpark_TFL @NicolasFlamelX @AlphaSeeker21 @TheMoonMidas @darrenlautf @lejimmy @WestieCapital @Speicherx @danku_r @Josephliow @terranaut3

Tagging some chads below to spread the word to reach the newbies:

@stablekwon @sjpark_TFL @NicolasFlamelX @AlphaSeeker21 @TheMoonMidas @darrenlautf @lejimmy @WestieCapital @Speicherx @danku_r @Josephliow @terranaut3

جاري تحميل الاقتراحات...