1/ #Tokenomics are essential when researching a project. You can eliminate 50% of projects on tokenomics alone. In this tokenomics MEGA-THREAD I'll break down BEGINNER tokenomics. In this one, I'll break down vesting and presale investors.

Keep reading below.

Keep reading below.

2/ -CIRCULATING VS. TOTAL-

Most #cryptos will not release their total supply at launch. Supply will be released slowly over time. Bitcoin is an example of this. It has a total of 21m and a circulating supply of 18.89m.

Most #cryptos will not release their total supply at launch. Supply will be released slowly over time. Bitcoin is an example of this. It has a total of 21m and a circulating supply of 18.89m.

3/ -TIME TO TOTAL (TTT)-

TTT is the time it will take for the total supply to be reached. If you see a new project with a total supply of 10m, a circulating supply on release of 500k, you know there are 9.5m tokens unreleased.

When will they release? This is important to know.

TTT is the time it will take for the total supply to be reached. If you see a new project with a total supply of 10m, a circulating supply on release of 500k, you know there are 9.5m tokens unreleased.

When will they release? This is important to know.

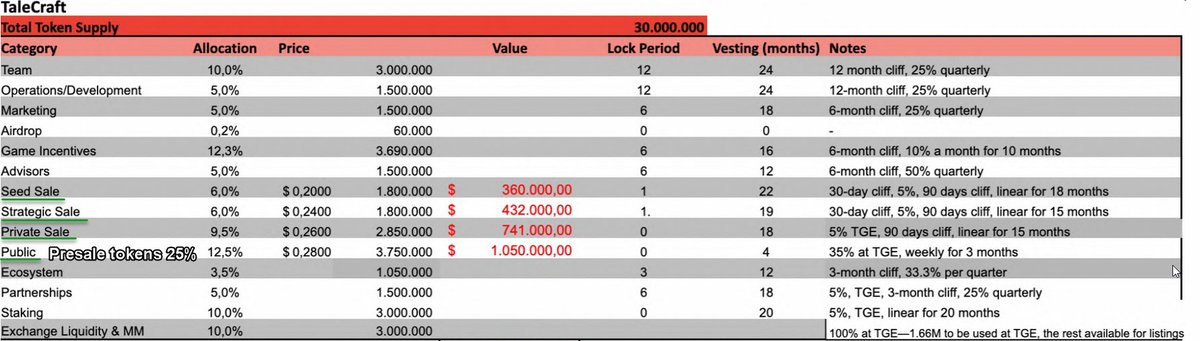

4/ -DISTRIBUTION-

The first info I look for when assessing token release is distribution. Normally you'll find a chart or table in the whitepaper that explains token distribution. In this thread, we will focus on presale distribution.

The first info I look for when assessing token release is distribution. Normally you'll find a chart or table in the whitepaper that explains token distribution. In this thread, we will focus on presale distribution.

6/ -DISTRIBUTION cont-

Presales generally account for 5%-30% of tokens. My rules are the less, the better. If a project dedicates over 30% of tokens to presale, I question their long term goals. It's not a straight-up pass, but it is concerning. This is where vesting comes in.

Presales generally account for 5%-30% of tokens. My rules are the less, the better. If a project dedicates over 30% of tokens to presale, I question their long term goals. It's not a straight-up pass, but it is concerning. This is where vesting comes in.

7/ -VESTING SCHEDULES-

Presale prices are usually 3-5 times lower than release prices. On release day a hyped token can easily do a 5x meaning presale investors (PIs) could be up 20x or more. To prevent massive dumps, PIs are vested.

Presale prices are usually 3-5 times lower than release prices. On release day a hyped token can easily do a 5x meaning presale investors (PIs) could be up 20x or more. To prevent massive dumps, PIs are vested.

8/ -VESTING cont-

Vesting means their tokens are released slowly over weeks, months or years. Using the 10m token example above, imagine 30% of the 10m is for PIs (3m).

That 3m is subject to vesting with 10% at TGE and 90% released monthly over 2 years.

Vesting means their tokens are released slowly over weeks, months or years. Using the 10m token example above, imagine 30% of the 10m is for PIs (3m).

That 3m is subject to vesting with 10% at TGE and 90% released monthly over 2 years.

9/ -VESTING cont-

TGE means token generation event. Upon the initial token release, PIs are given 10% (300k) of tokens.

The rest of their tokens are released monthly over 2 years. You calculate the amount released monthly like this:

90 / 24 = 3.75% per month.

TGE means token generation event. Upon the initial token release, PIs are given 10% (300k) of tokens.

The rest of their tokens are released monthly over 2 years. You calculate the amount released monthly like this:

90 / 24 = 3.75% per month.

10/ -VESTING cont-

This is an example of a good vesting schedule because PIs will only be able to dump 3.75% of tokens per month, which won't have a significant impact on price. Furthermore, it won’t be in their interests to dump and hurt price because they are in for 2 years.

This is an example of a good vesting schedule because PIs will only be able to dump 3.75% of tokens per month, which won't have a significant impact on price. Furthermore, it won’t be in their interests to dump and hurt price because they are in for 2 years.

11/ -VESTING cont-

If influencers are in the presale, it is in their interest to continue making videos and tweets about the project for two years to keep it trending.

If influencers are in the presale, it is in their interest to continue making videos and tweets about the project for two years to keep it trending.

12/ -BAD VESTING-

If the 3m vested tokens were done like this:

30% at TGE and 70% released linear over 2 months.

This would scare me. PIs would get 30% of their tokens on release day. If they invested $1k and the token was up 20x they would have $6k worth, dumping is likely.

If the 3m vested tokens were done like this:

30% at TGE and 70% released linear over 2 months.

This would scare me. PIs would get 30% of their tokens on release day. If they invested $1k and the token was up 20x they would have $6k worth, dumping is likely.

13/ -BAD VESTING cont-

The rest are released linear over 2 months, which means they get a % per day. Imagine 60 days in the 2 months, 70% of tokens are released over 60 days, which is 1.16% per day.

This could have a detrimental impact on token prices as PIs would be dumping.

The rest are released linear over 2 months, which means they get a % per day. Imagine 60 days in the 2 months, 70% of tokens are released over 60 days, which is 1.16% per day.

This could have a detrimental impact on token prices as PIs would be dumping.

14/ -CLIFFS-

Sometimes you'll see a cliff period. This is a period in which the PI gets no tokens. EG

10% at TGE, 3 month cliff, and 90% released linear over 1 year.

The cliff here means the PI gets 10% at release, nothing for 3 months, then vesting begins.

Sometimes you'll see a cliff period. This is a period in which the PI gets no tokens. EG

10% at TGE, 3 month cliff, and 90% released linear over 1 year.

The cliff here means the PI gets 10% at release, nothing for 3 months, then vesting begins.

15/ -WHAT TO LOOK FOR-

The best projects have long vesting periods and less than 30% of tokens sold presale. Sometimes a project will sell 40% presale and have 3-year vesting, this is okay too because large amounts sold presale can be offset by long vesting.

The best projects have long vesting periods and less than 30% of tokens sold presale. Sometimes a project will sell 40% presale and have 3-year vesting, this is okay too because large amounts sold presale can be offset by long vesting.

16/ -WHAT TO LOOK FOR cont-

There are no hard rules, you need to apply common sense. What you don't want is huge amounts of tokens being released on a monthly basis to presale investors who are up 50x. The incentive for them to dump is far too high.

There are no hard rules, you need to apply common sense. What you don't want is huge amounts of tokens being released on a monthly basis to presale investors who are up 50x. The incentive for them to dump is far too high.

17/ -CONCLUSION-

A calculator will be your best friend when dealing with tokenomics. Vesting and presales are the most important part, but it is just the start of tokenomics. In future threads, I will break down things like burning, reflect, and other more complex topics.

A calculator will be your best friend when dealing with tokenomics. Vesting and presales are the most important part, but it is just the start of tokenomics. In future threads, I will break down things like burning, reflect, and other more complex topics.

@BloodyCNL Pay me

Loading suggestions...