#WeeklyIndexCheck CW48/2021

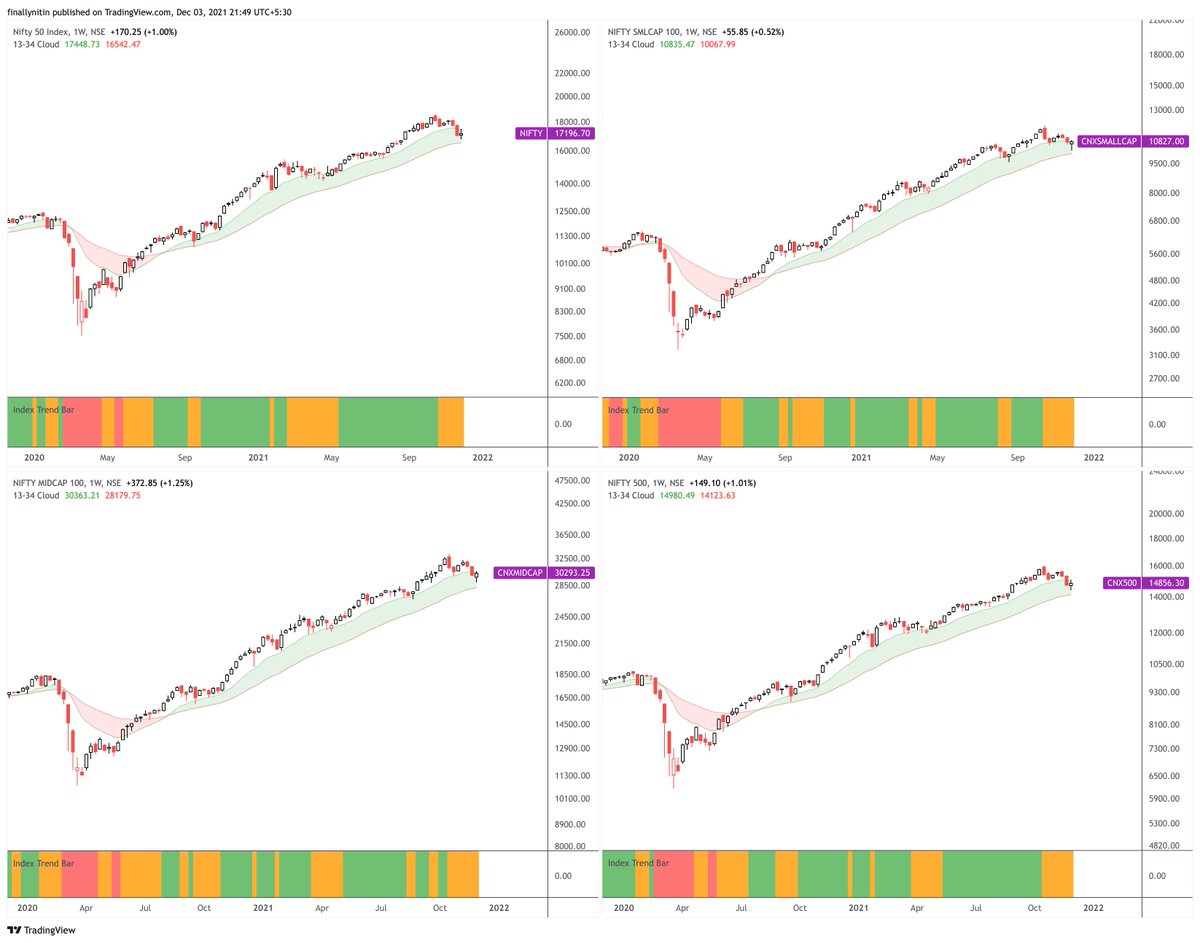

Short-term downtrend / Correction.

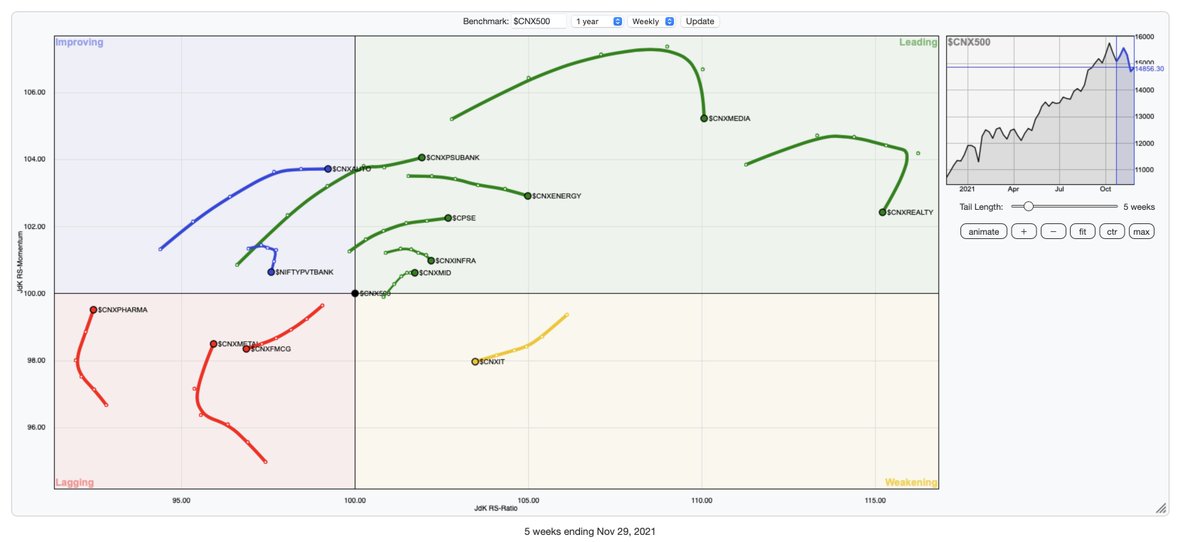

Momentum lost in most major indices, except Power & Media.

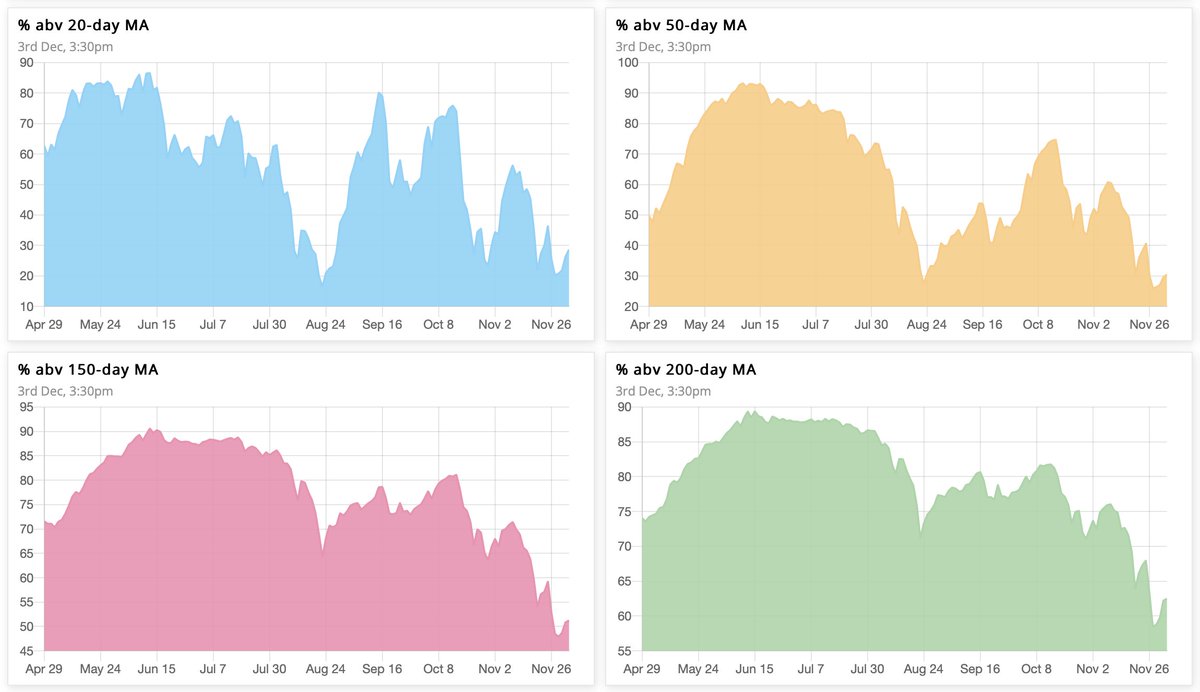

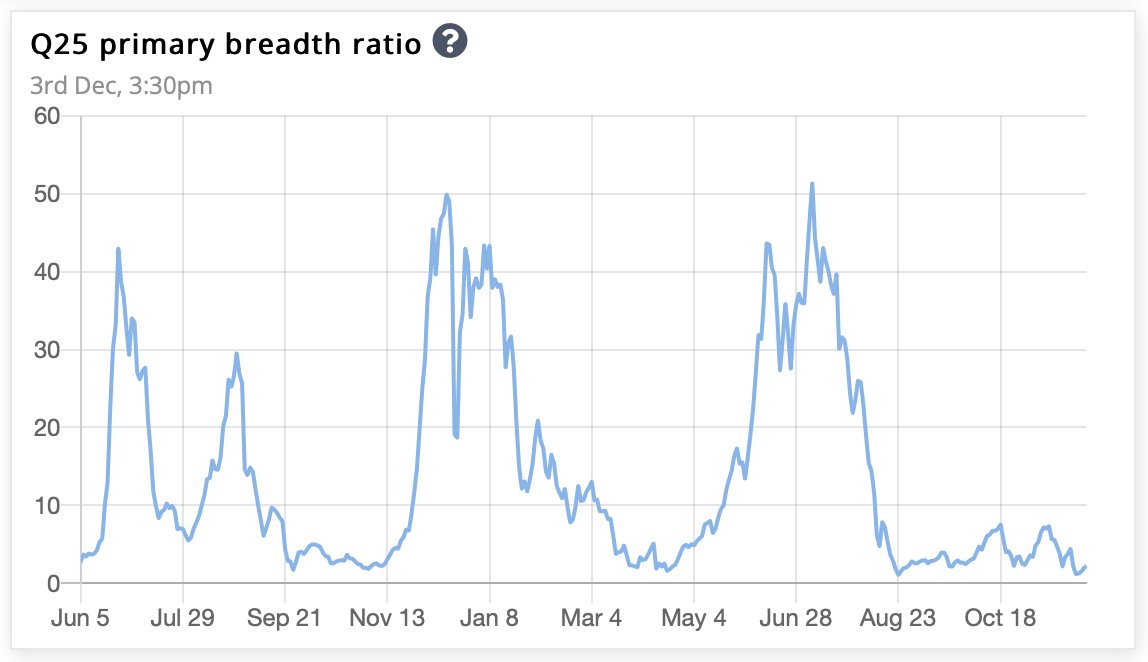

Market breadth worsening & nearing oversold.

Short-term downtrend / Correction.

Momentum lost in most major indices, except Power & Media.

Market breadth worsening & nearing oversold.

Loading suggestions...