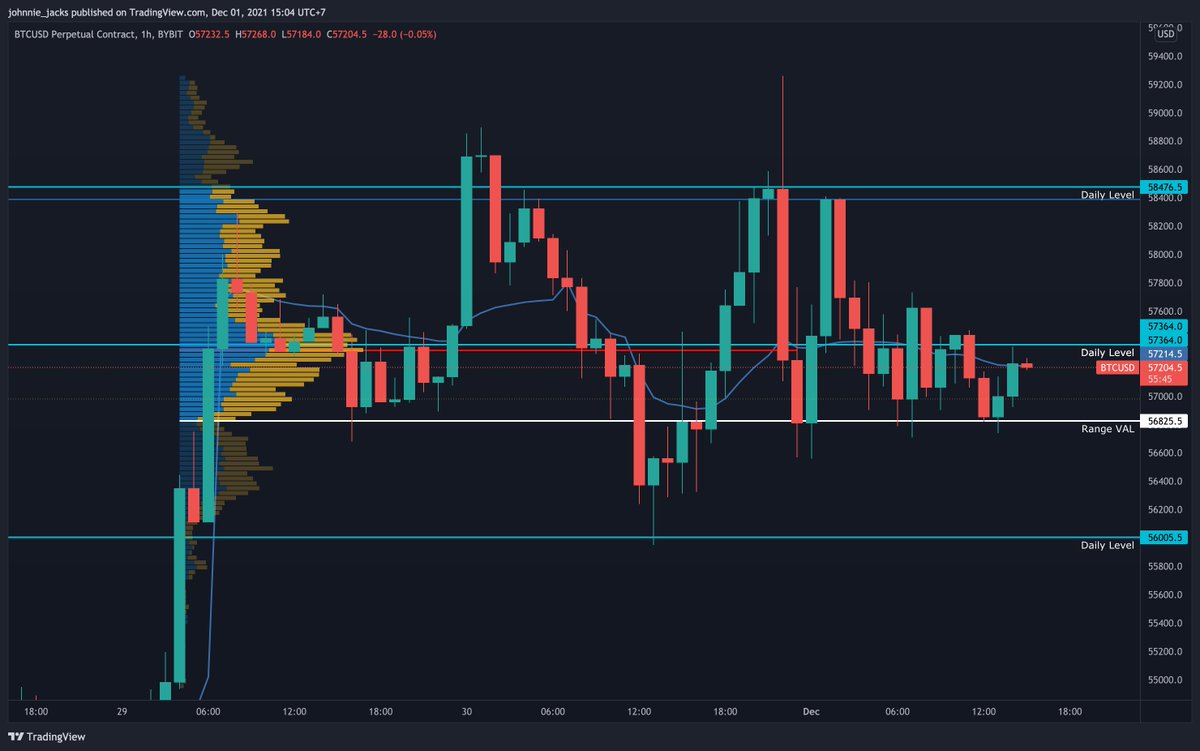

$BTC

Let's do a bit of hindsight analysis on the SFP last night and see -

Assuming you were aware of the level, how could you have entered the trade intelligently?

Where could you have taken profits?

And learn - how can I do better next time?

1/

Let's do a bit of hindsight analysis on the SFP last night and see -

Assuming you were aware of the level, how could you have entered the trade intelligently?

Where could you have taken profits?

And learn - how can I do better next time?

1/

If you'd used a hard stop right at the top of that first wick, you would have got stopped out

I would usually put a hard stop with some space ($100-200) or a soft stop (WAY more advanced)

Because we often see what happened; a second attempt followed by a bigger rejection

6/

I would usually put a hard stop with some space ($100-200) or a soft stop (WAY more advanced)

Because we often see what happened; a second attempt followed by a bigger rejection

6/

These are just suggestions, there are so many ways to play this kind of trade but I wanted to talk through a simple and replicable way you could do it

Now, next time you see a similar set of PA playing out, you can try it for yourself and see what happens!

/end

Now, next time you see a similar set of PA playing out, you can try it for yourself and see what happens!

/end

UPDATE

I know there's a lot of advanced order flow stuff in here

You can strip that out and just look at the volume on a LTF when approaching the level and watch the PA develop

Both entries would have been possible without order flow, the safer entry doesn't need it at all

I know there's a lot of advanced order flow stuff in here

You can strip that out and just look at the volume on a LTF when approaching the level and watch the PA develop

Both entries would have been possible without order flow, the safer entry doesn't need it at all

Loading suggestions...