#WeeklyIndexCheck CW47/2021

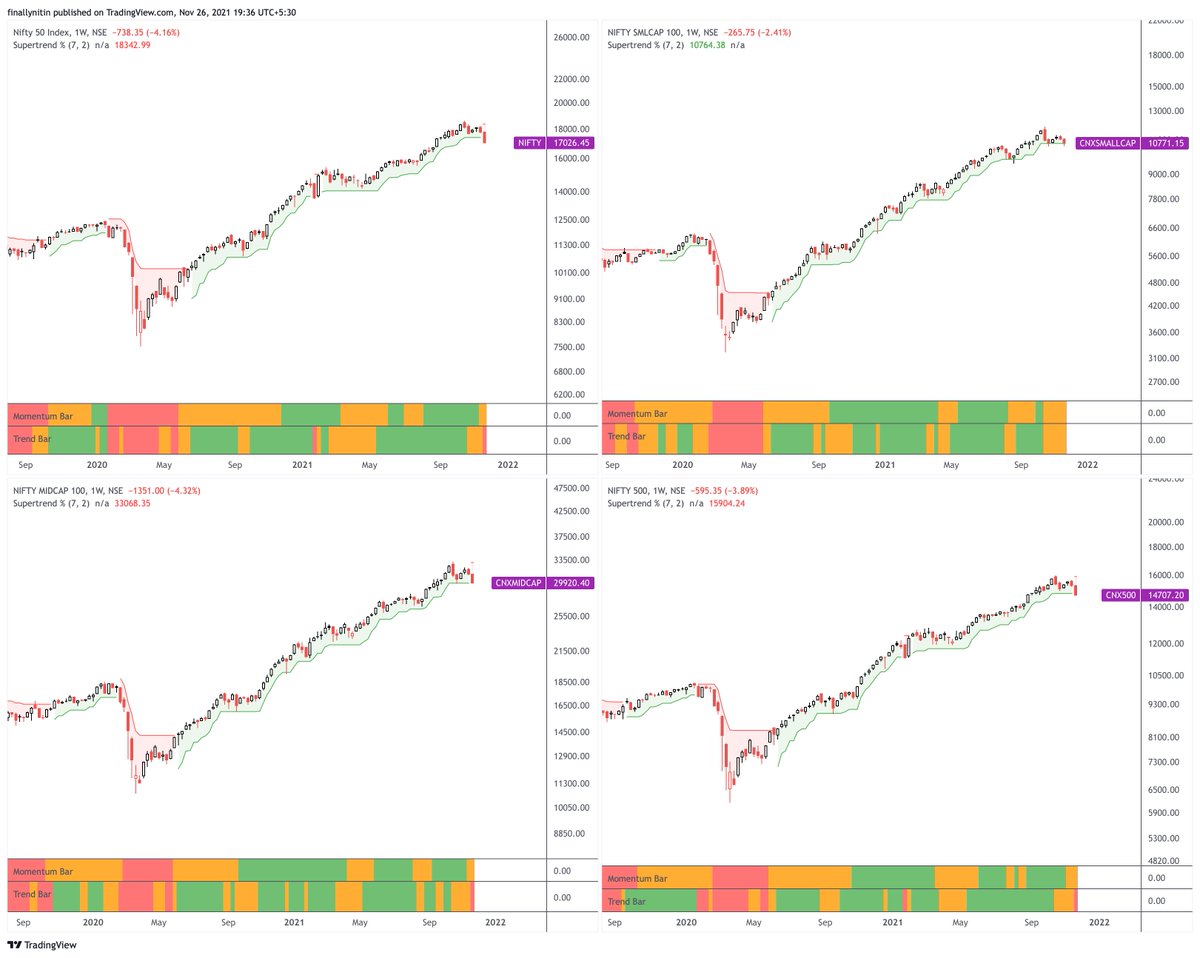

Market status changed to Downtrend.

Momentum already lost in most major indices. At the end of this week, most of them are no longer in uptrend also.

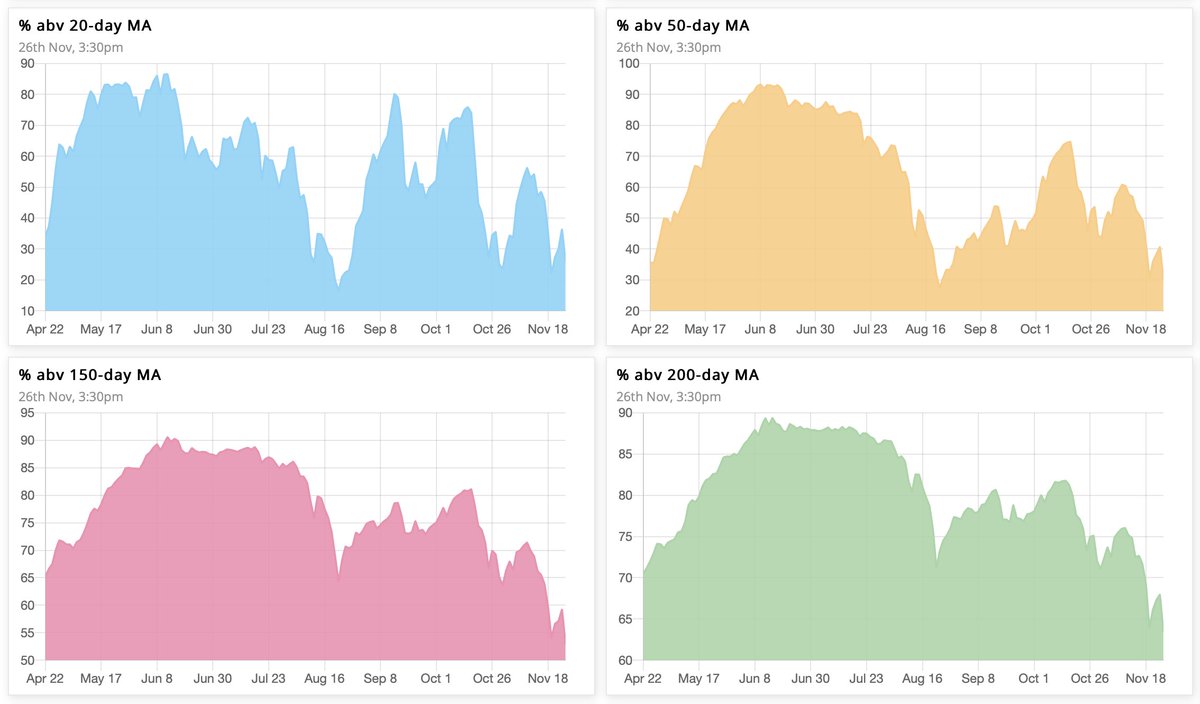

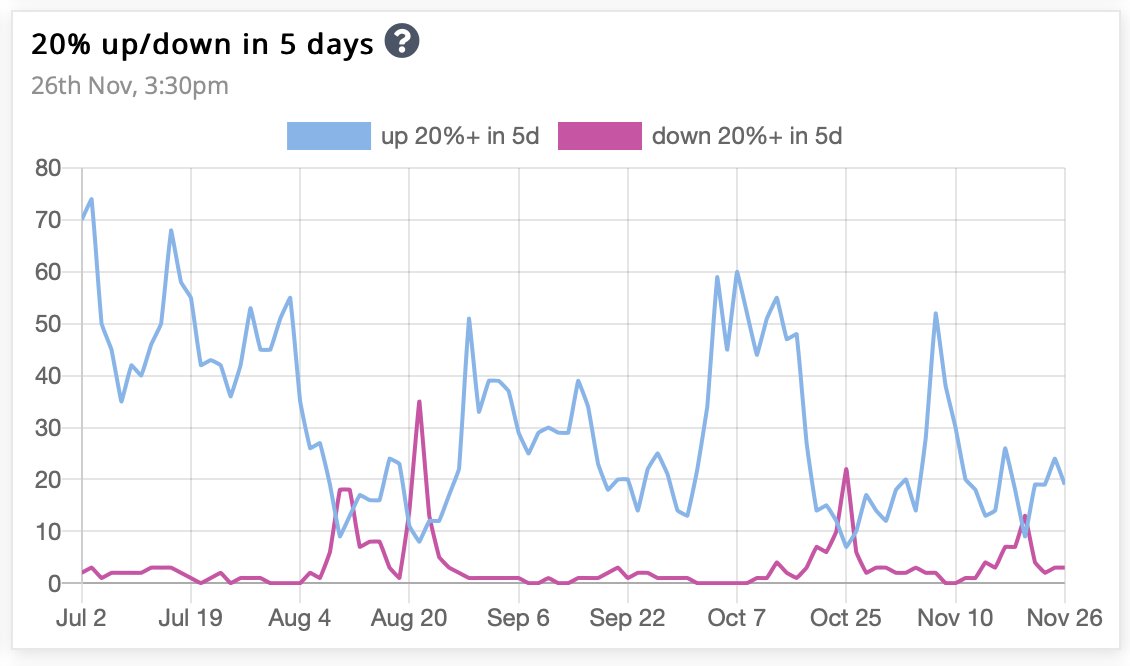

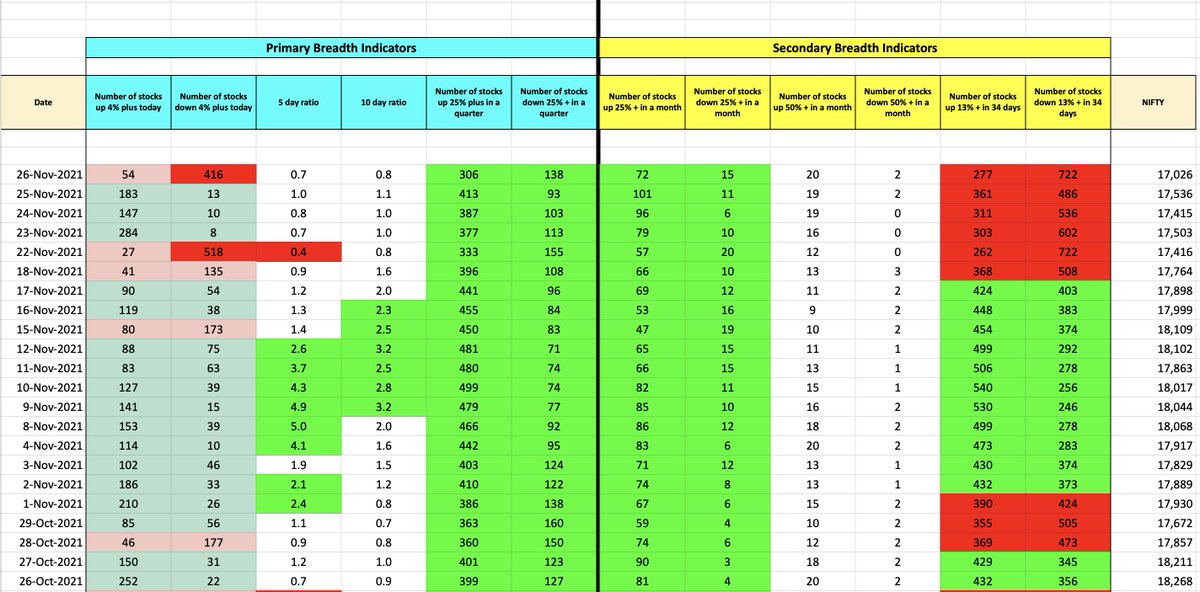

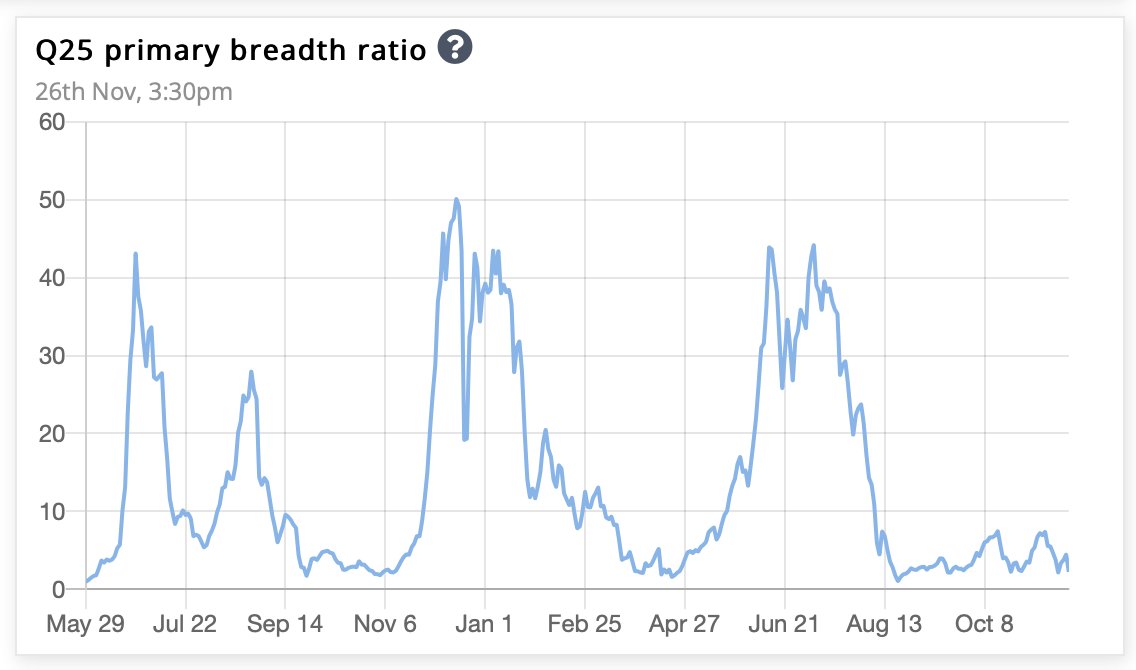

Market breadth worsening, but nearing oversold.

Market status changed to Downtrend.

Momentum already lost in most major indices. At the end of this week, most of them are no longer in uptrend also.

Market breadth worsening, but nearing oversold.

Loading suggestions...