#WeeklyIndexCheck CW46/2021

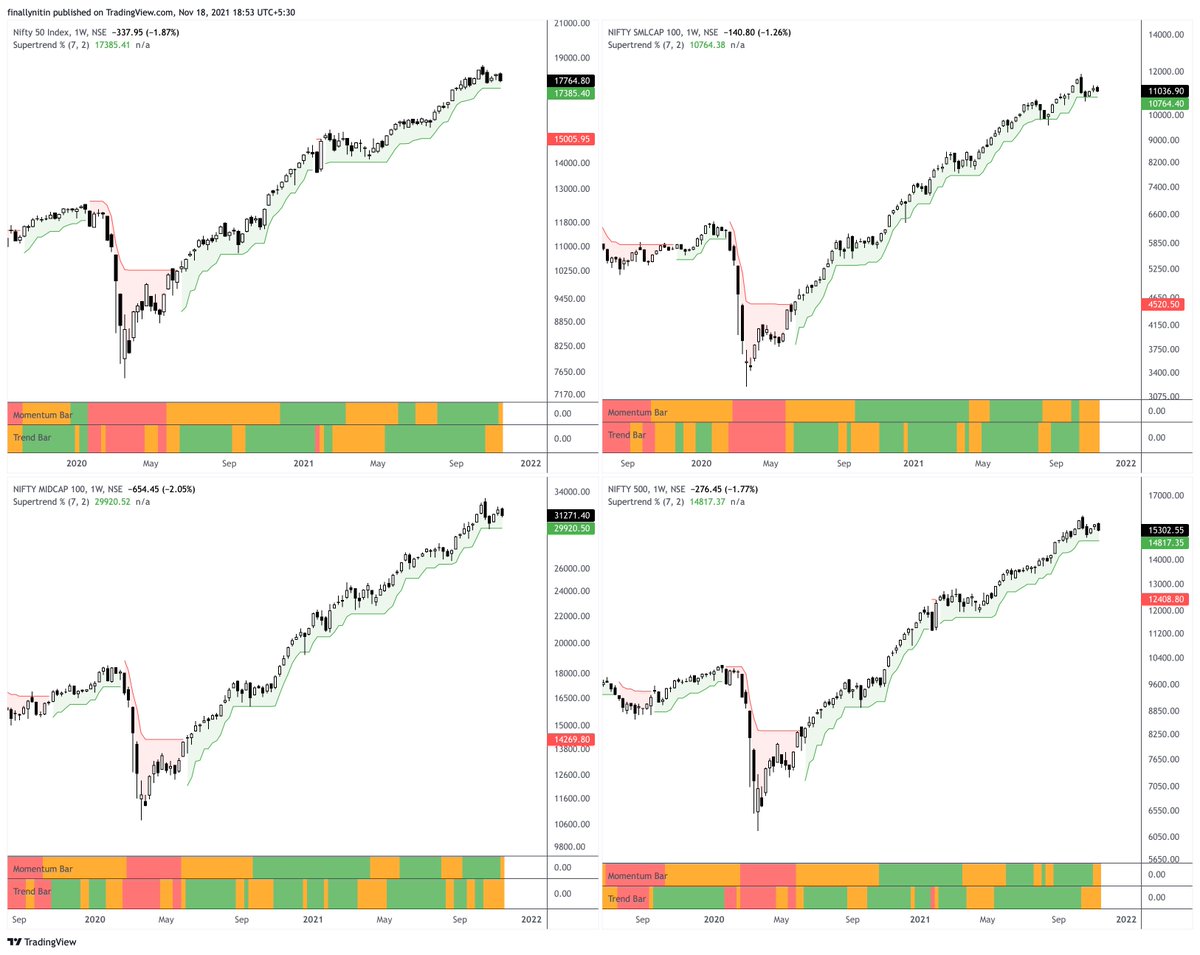

Uptrend under pressure.

Momentum lost in most major indices, including Nifty, Midcaps, Smallcaps, CNX500, Banknifty.

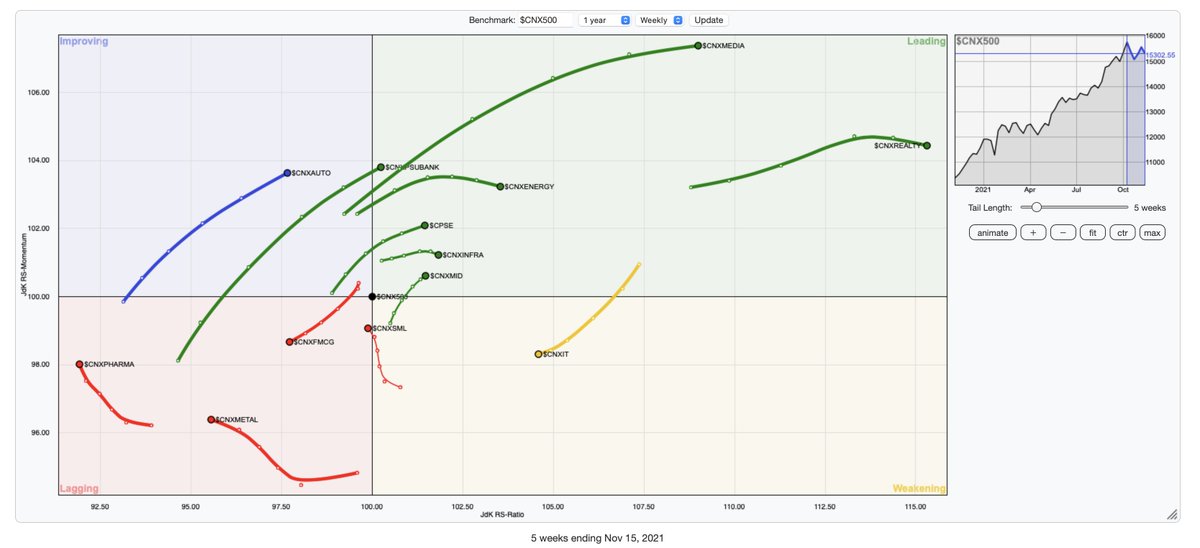

Pharma, FMCG, consumption are in downtrend.

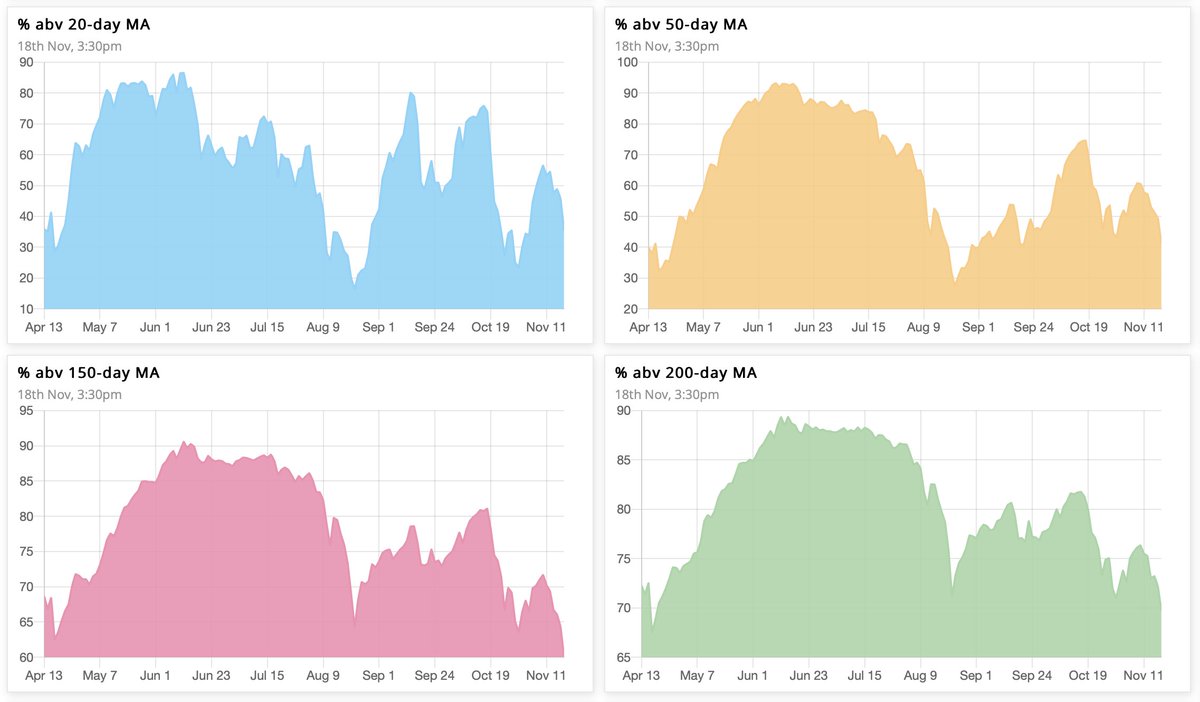

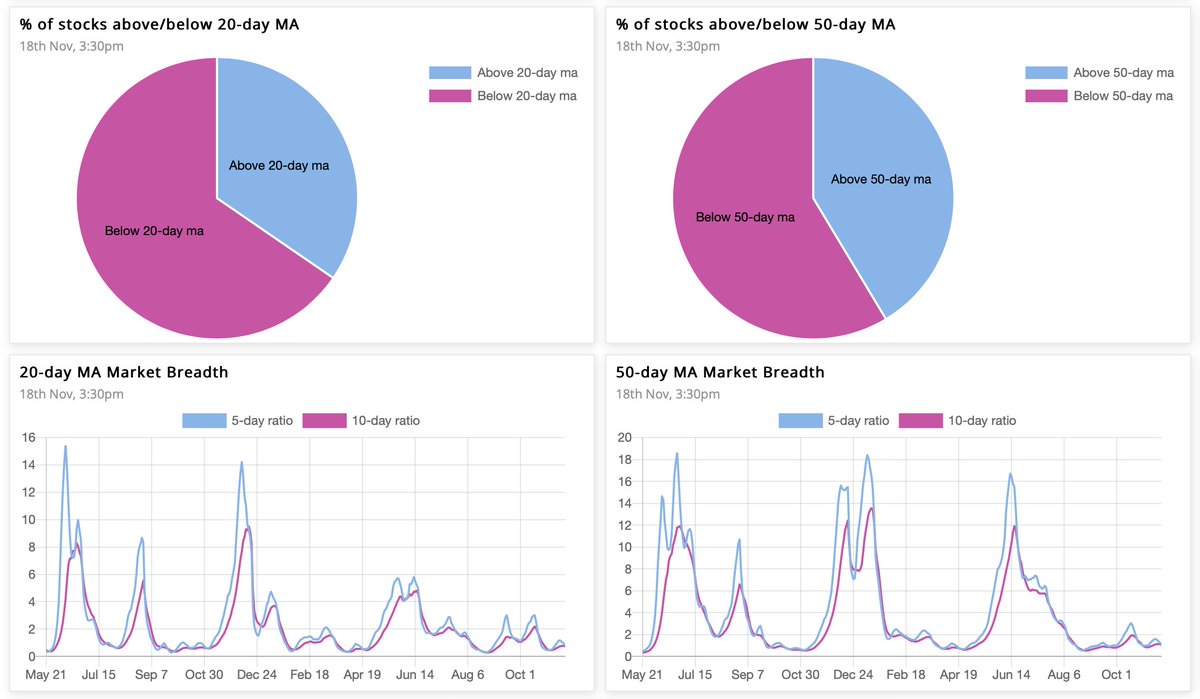

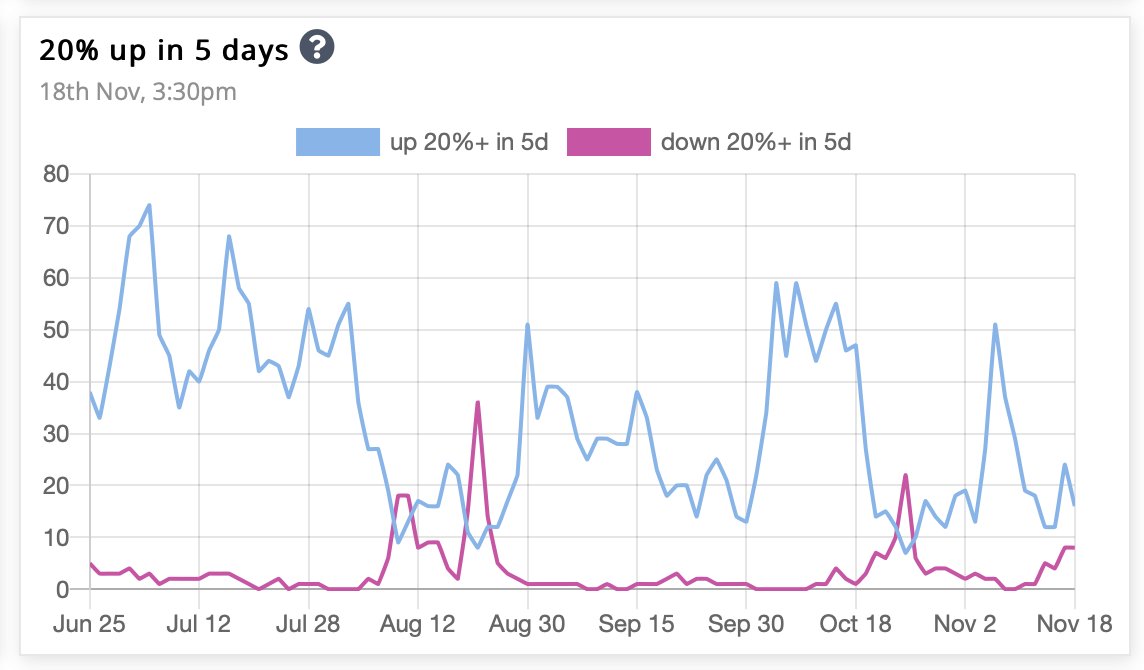

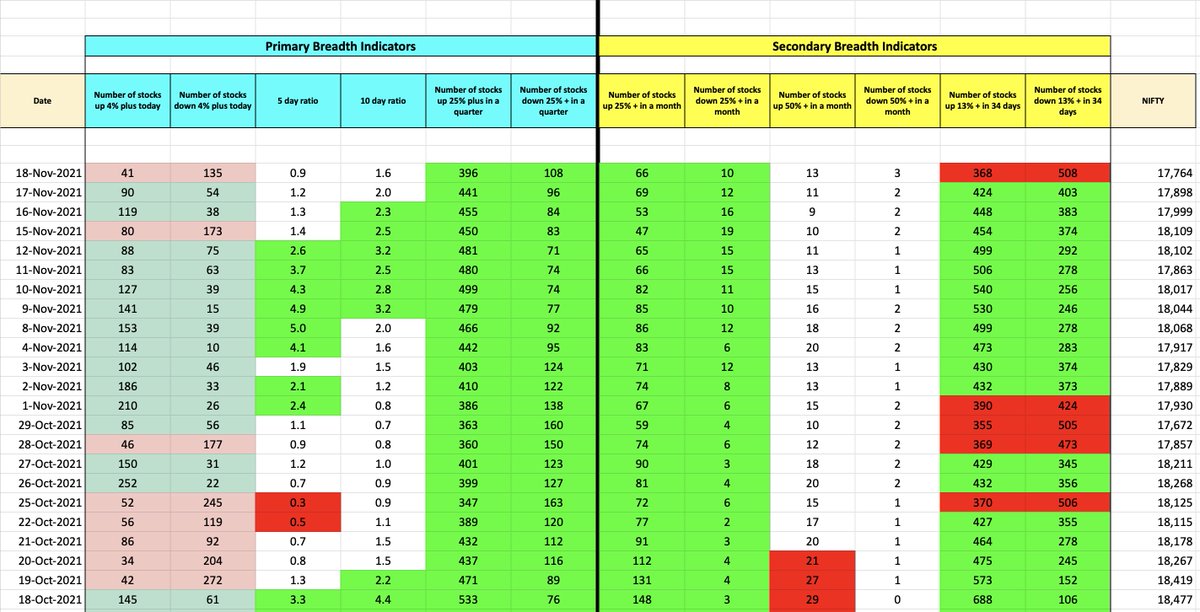

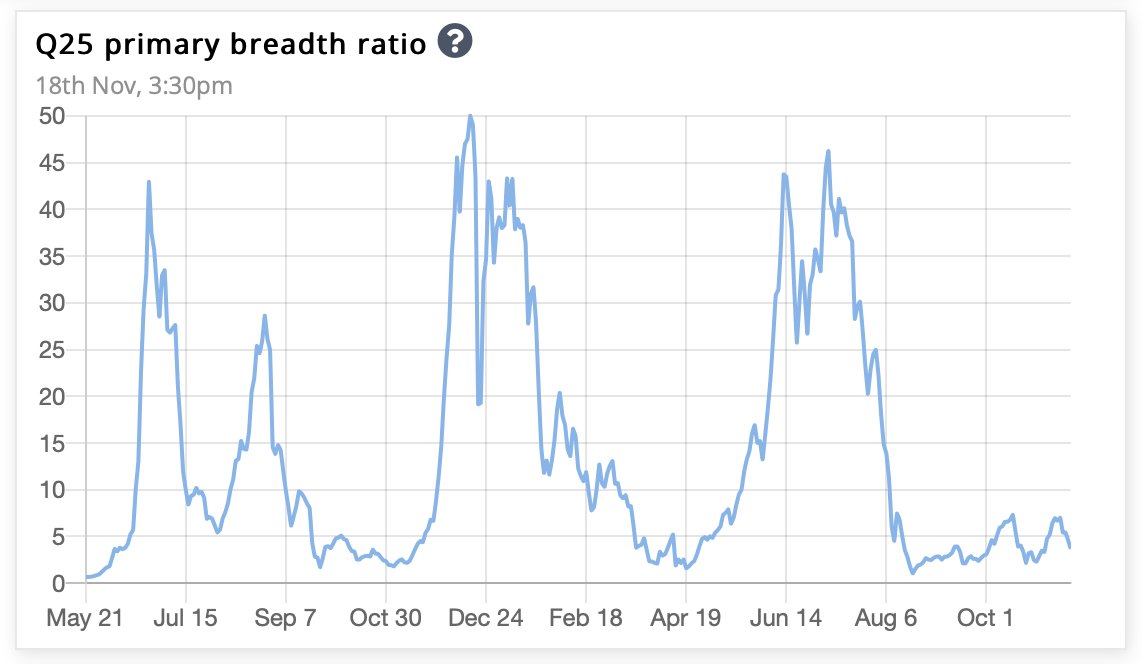

Market breadth worsening.

Uptrend under pressure.

Momentum lost in most major indices, including Nifty, Midcaps, Smallcaps, CNX500, Banknifty.

Pharma, FMCG, consumption are in downtrend.

Market breadth worsening.

Loading suggestions...