A beginner's guide to Technical Analysis (PART 4)📈📉

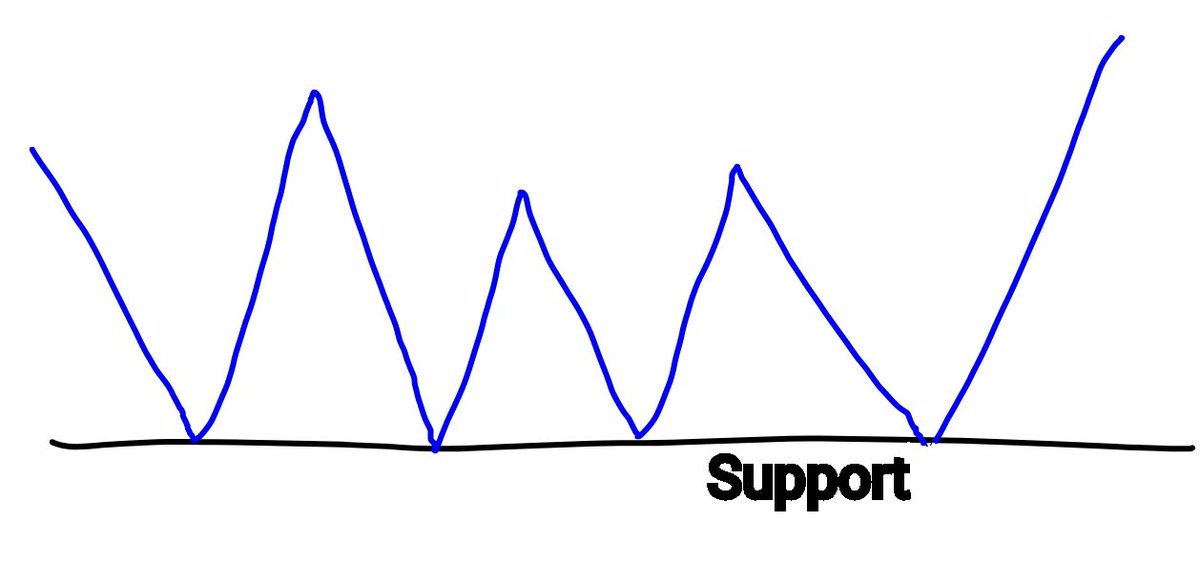

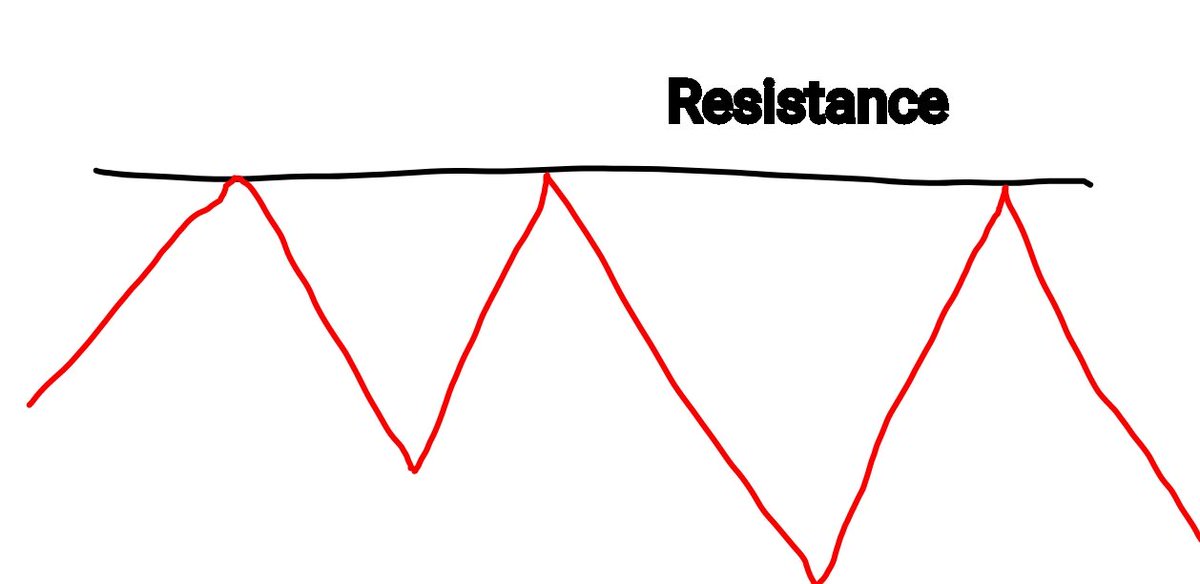

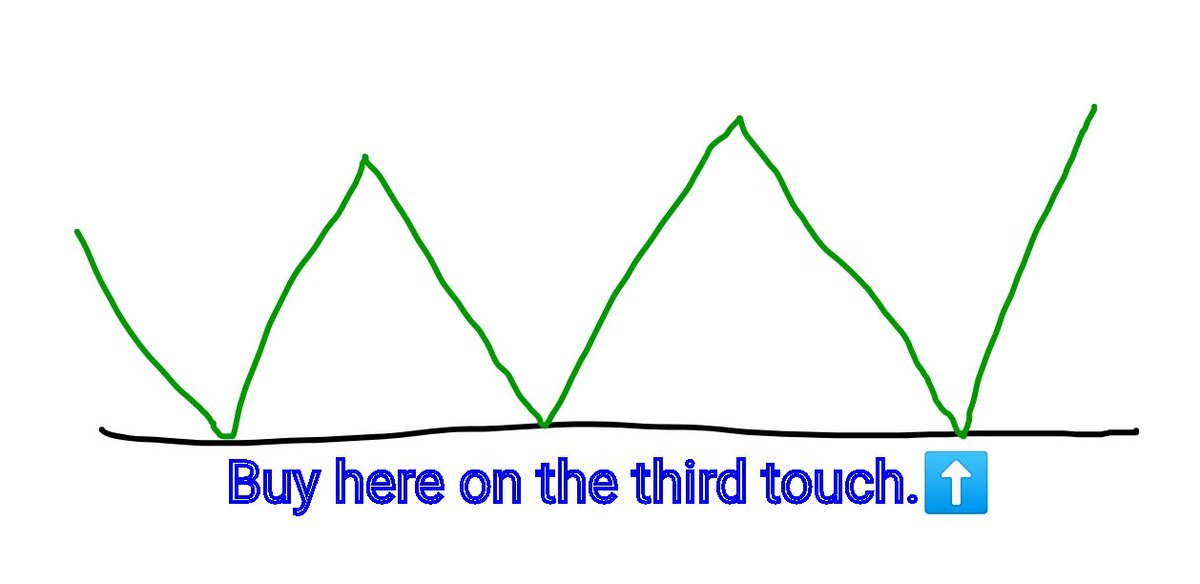

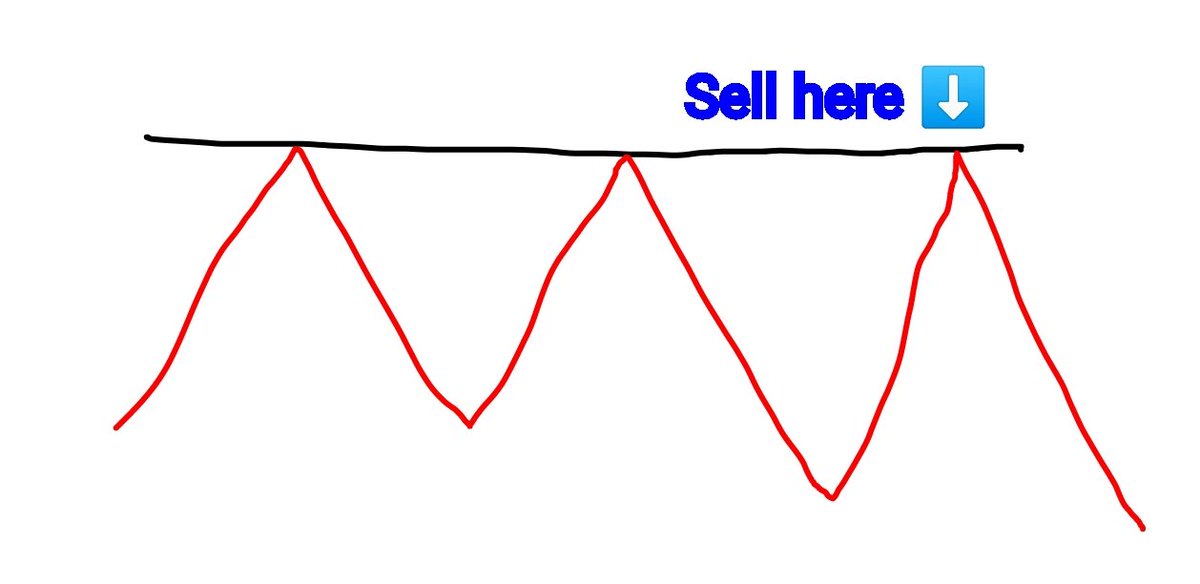

In the last part I taught how to trade using 'Support and Resistance', now I'll be teaching you another trading strategy which is using 'Trendlines'.

I'll make this as simple as possible for beginners.

A thread. #RETWEET 🔥

In the last part I taught how to trade using 'Support and Resistance', now I'll be teaching you another trading strategy which is using 'Trendlines'.

I'll make this as simple as possible for beginners.

A thread. #RETWEET 🔥

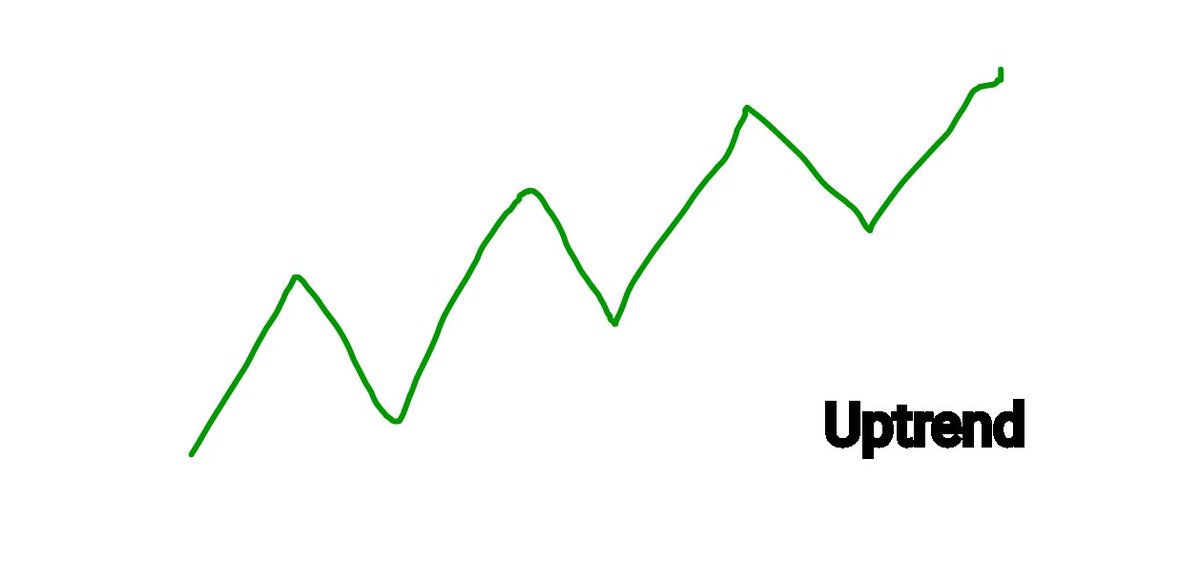

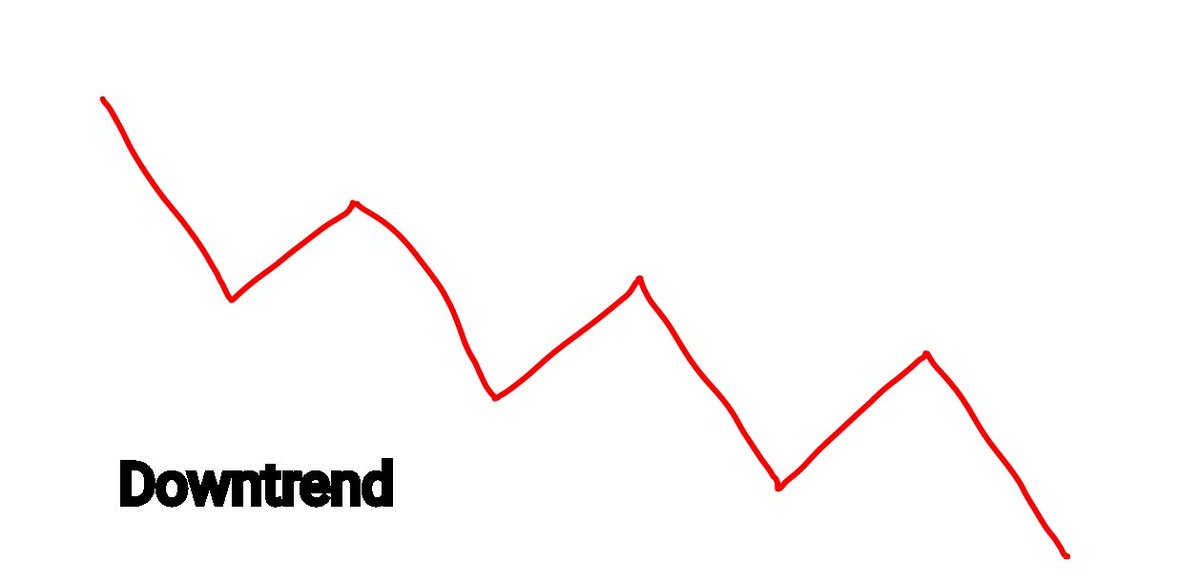

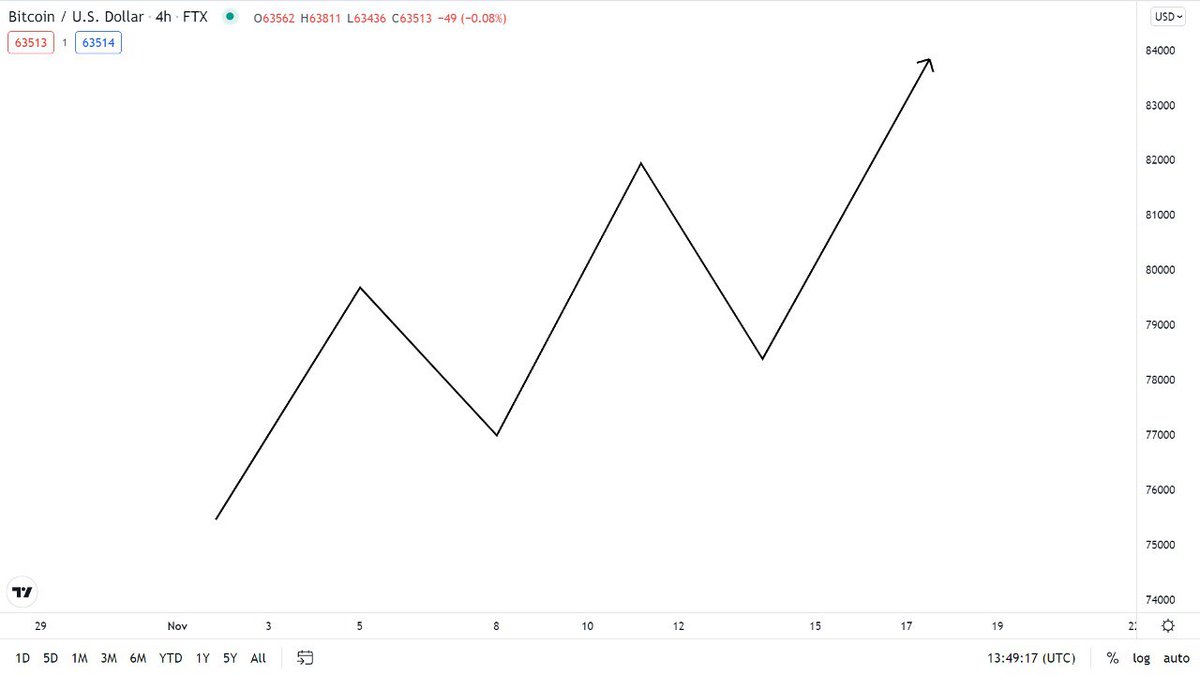

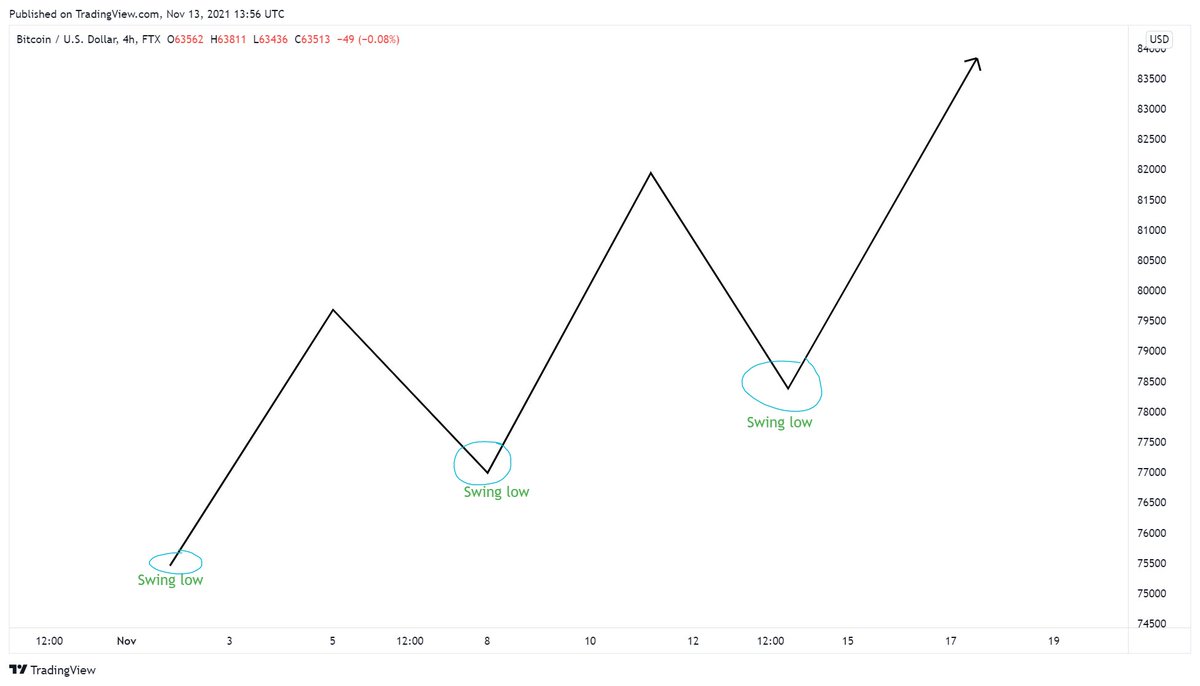

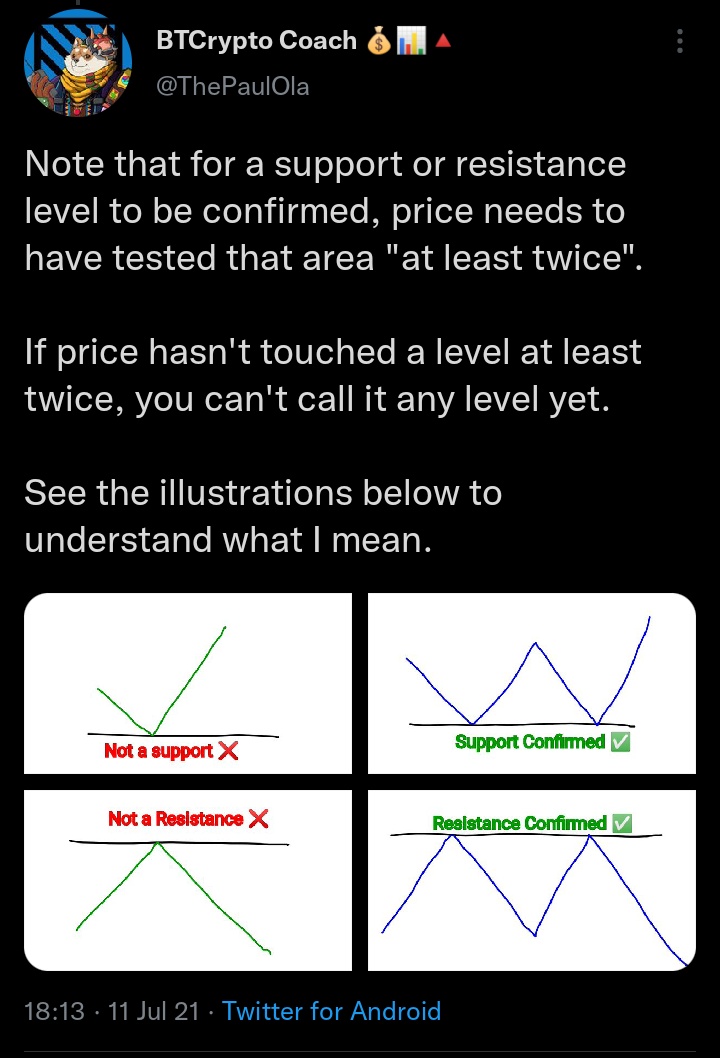

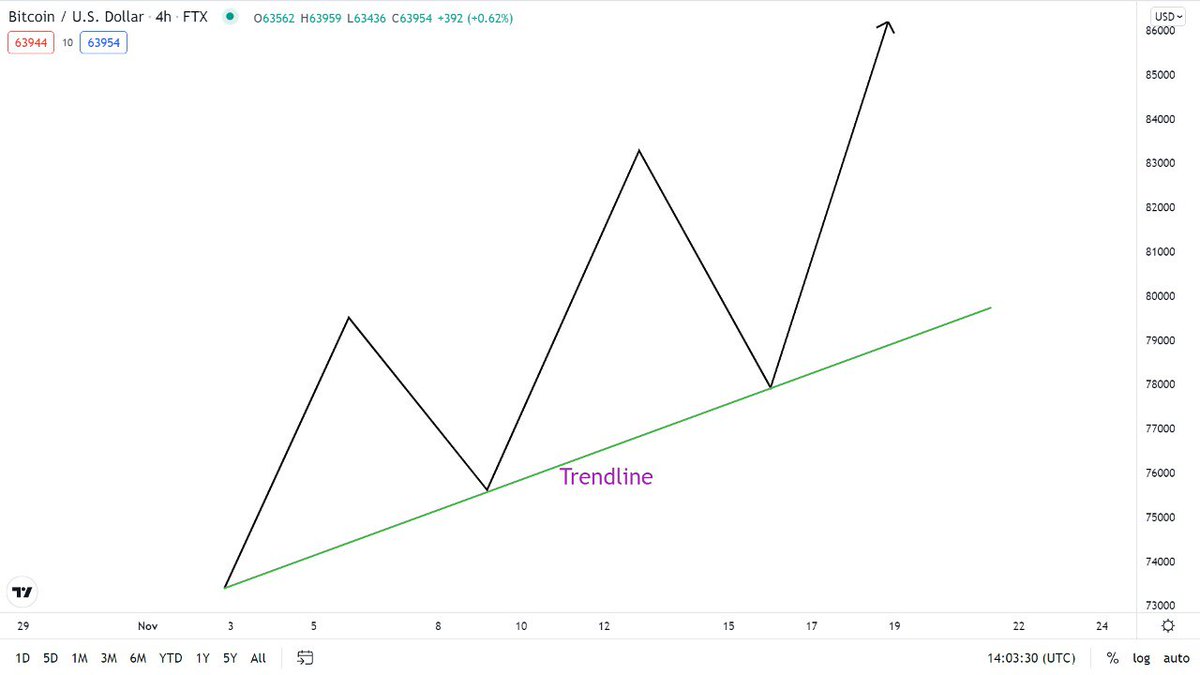

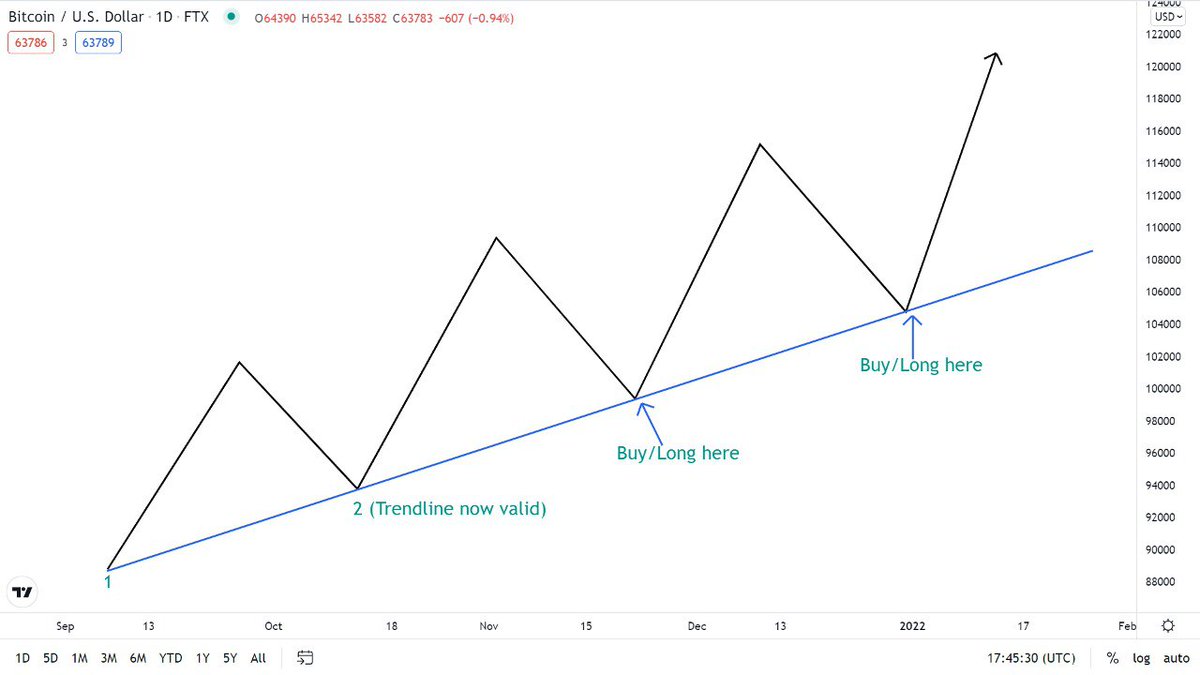

Now what is a Trendline?

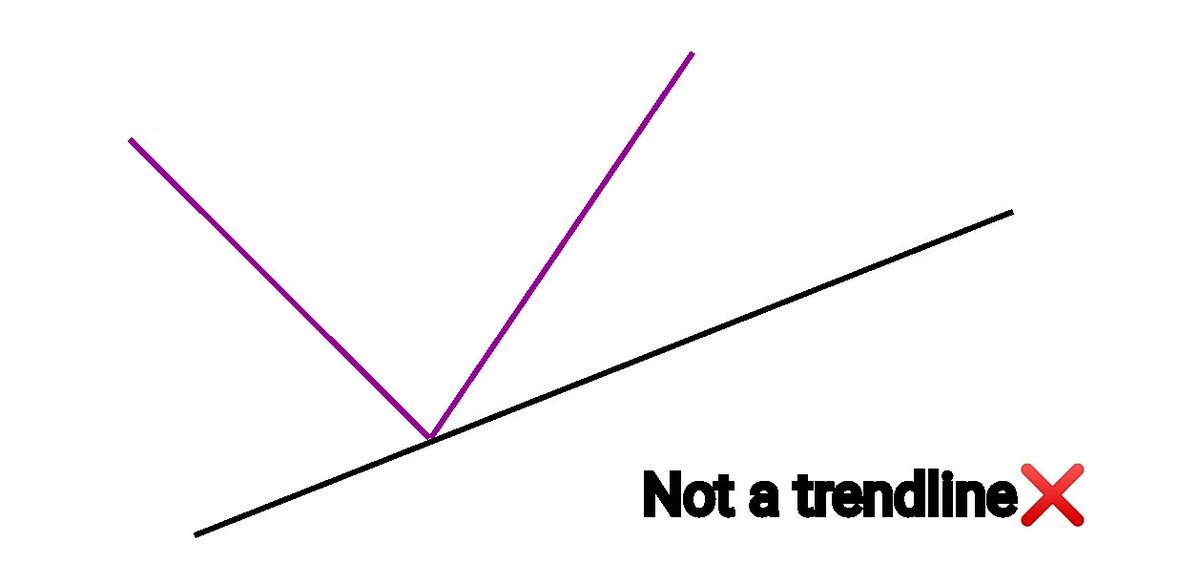

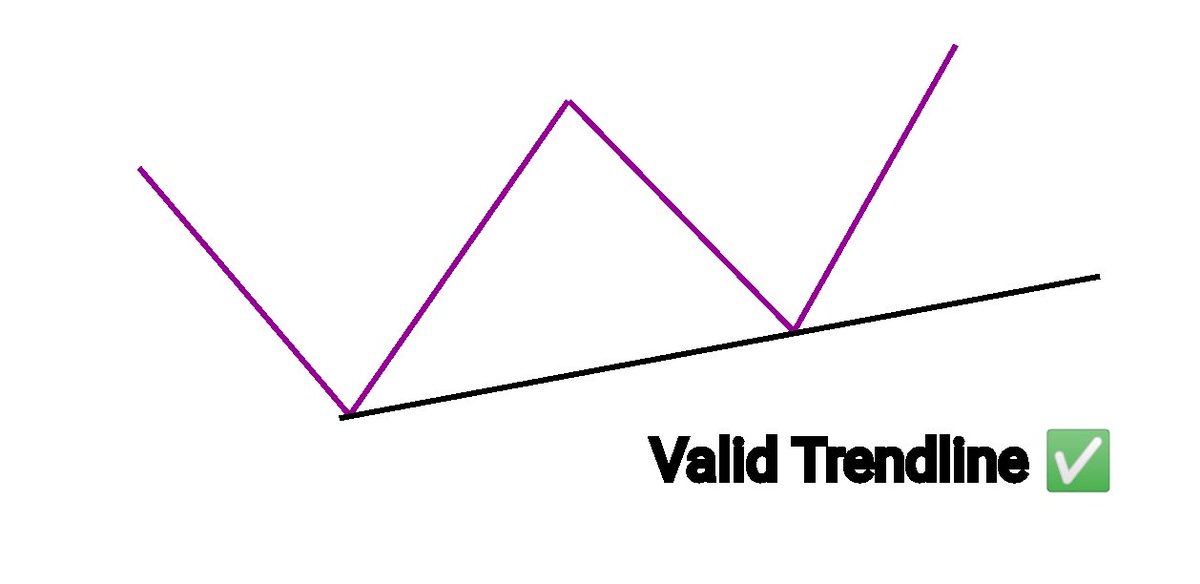

A Trendline is simply a line that connects significant highs and lows of price in a trending market.

Trend = Market direction

Line = Pointer.

You get that simple explanation.

Remember Support & Resistance are Horizontal while Trendlines are Vertical.

A Trendline is simply a line that connects significant highs and lows of price in a trending market.

Trend = Market direction

Line = Pointer.

You get that simple explanation.

Remember Support & Resistance are Horizontal while Trendlines are Vertical.

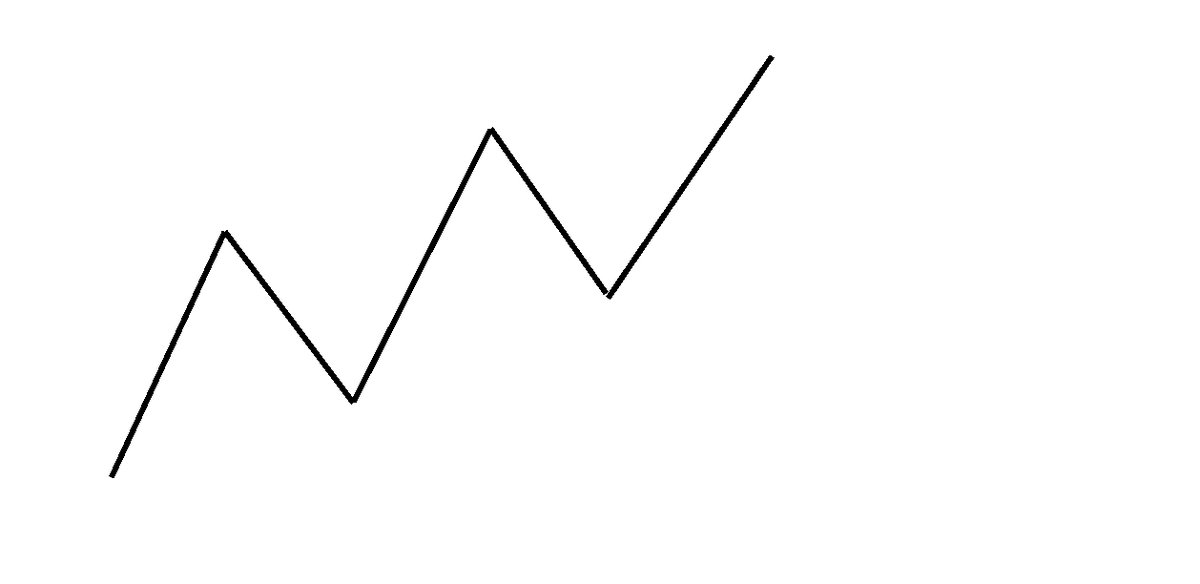

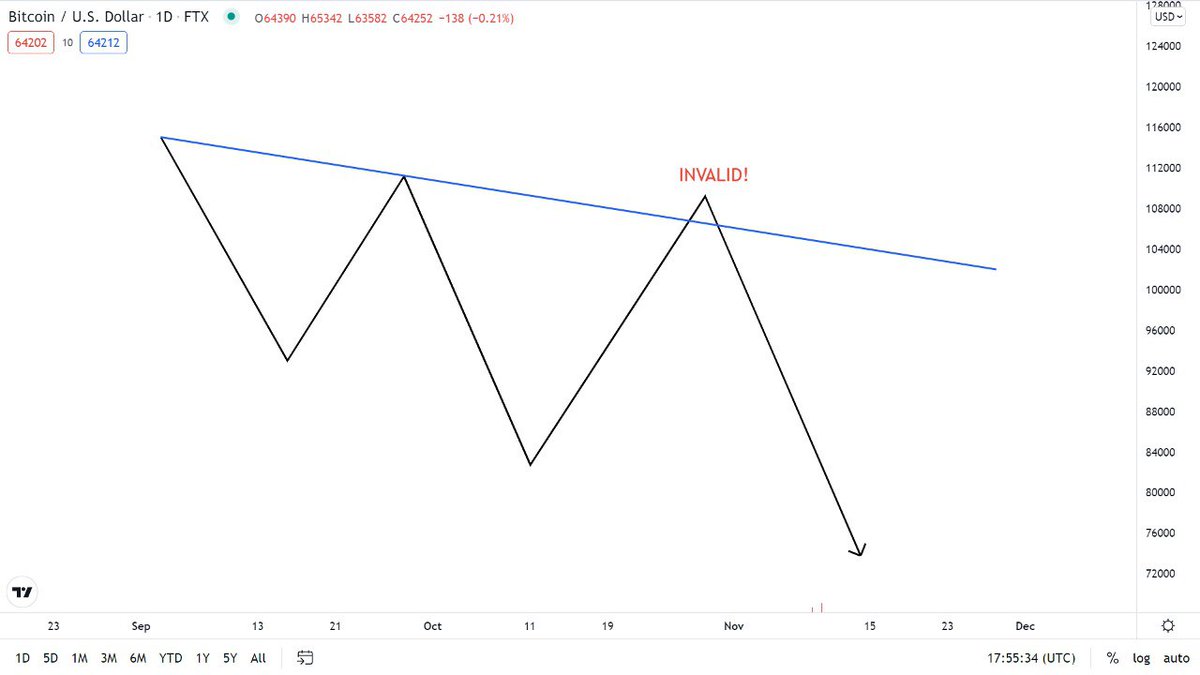

If your trendline isn't valid, you won't trust your trade because it's not justified, and if you play "too smart" and try to cut corners, you'll pay for it.

Trading humbles everyone, so it's better you're true to yourself and disciplined.

You can't outsmart the market. 👉😏

Trading humbles everyone, so it's better you're true to yourself and disciplined.

You can't outsmart the market. 👉😏

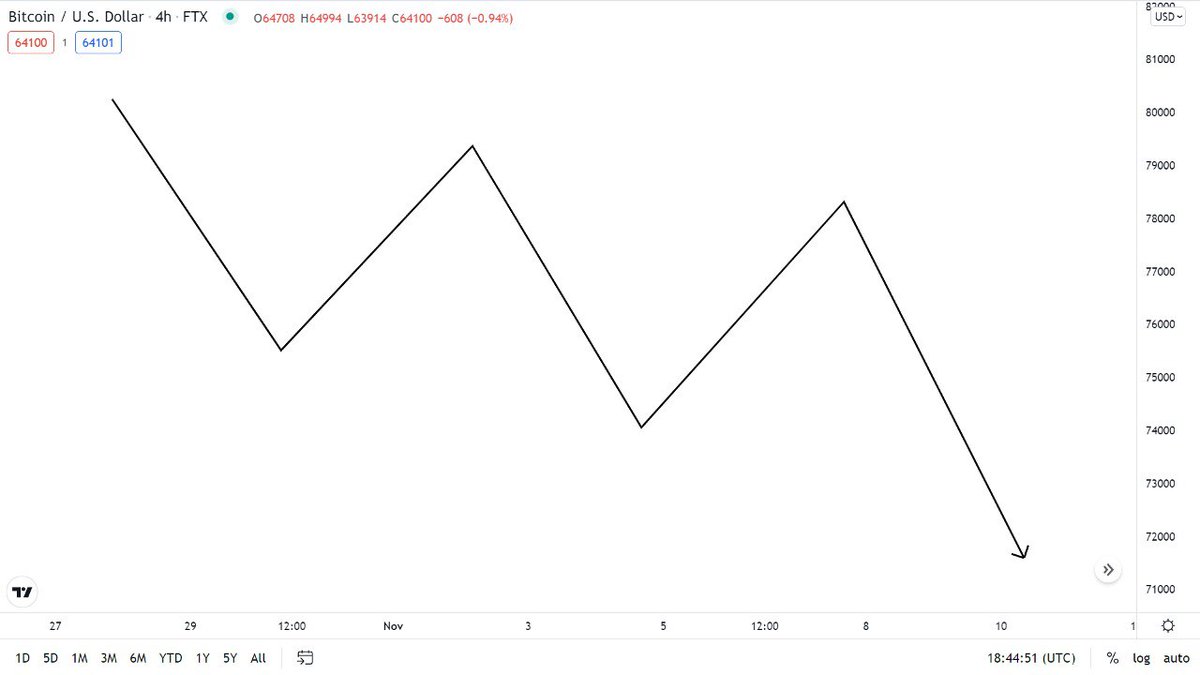

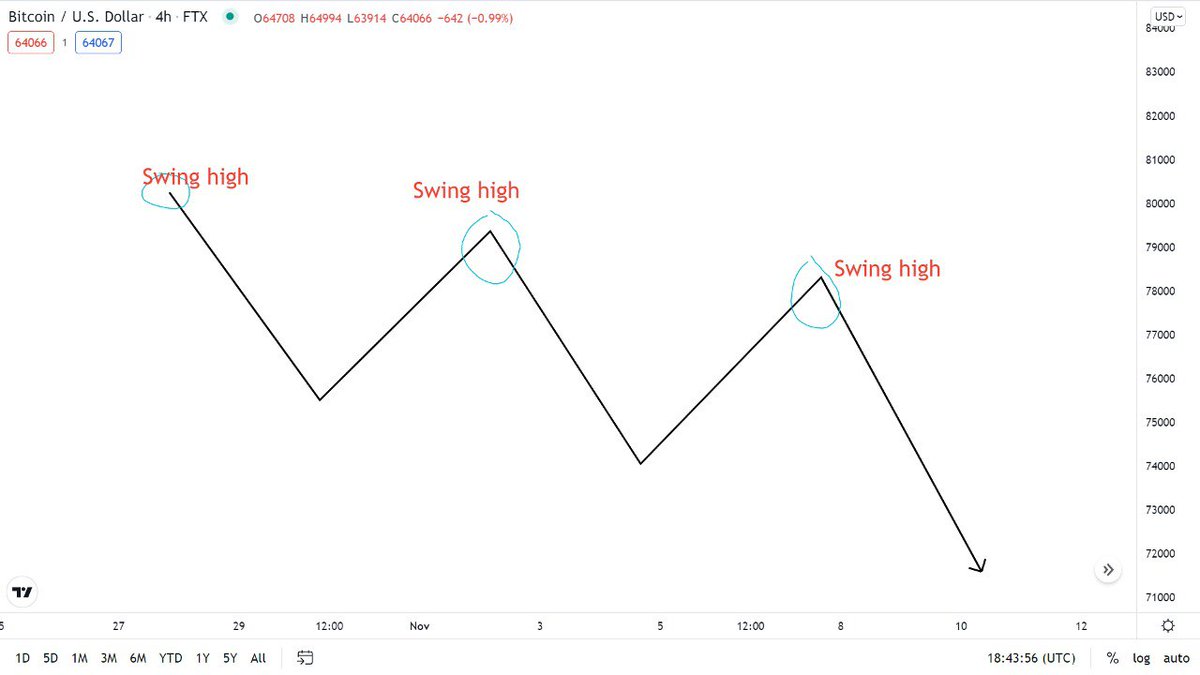

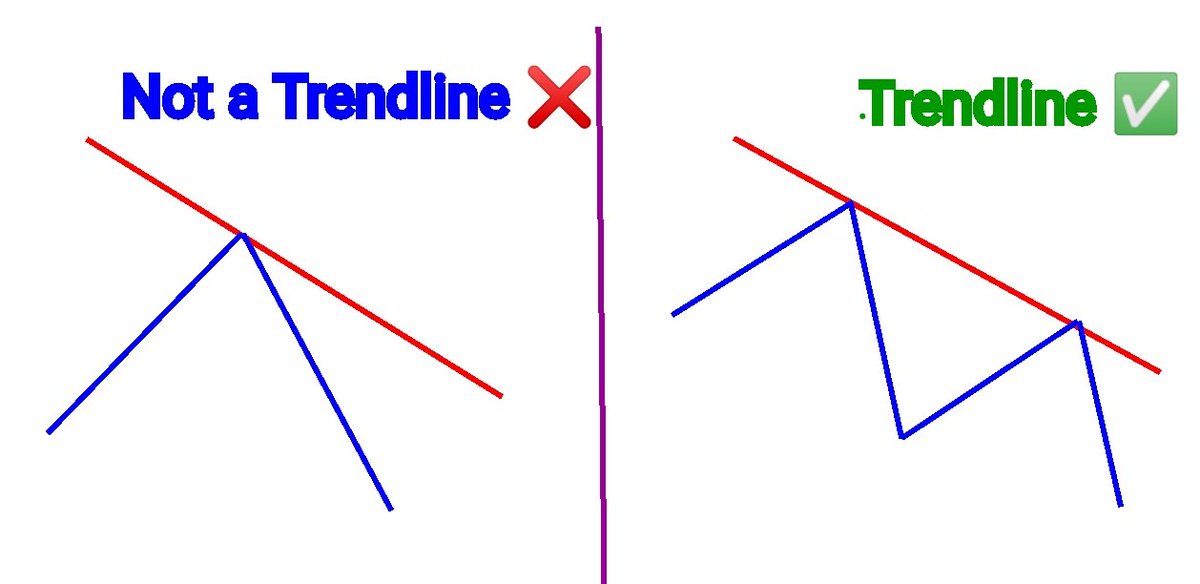

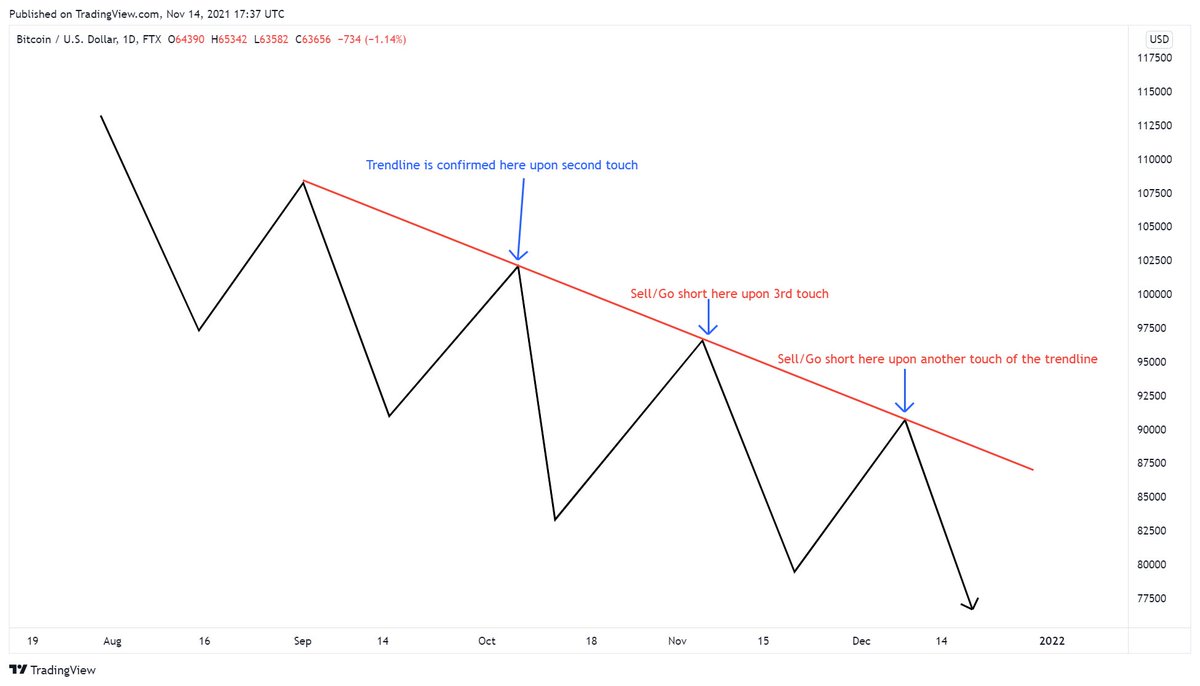

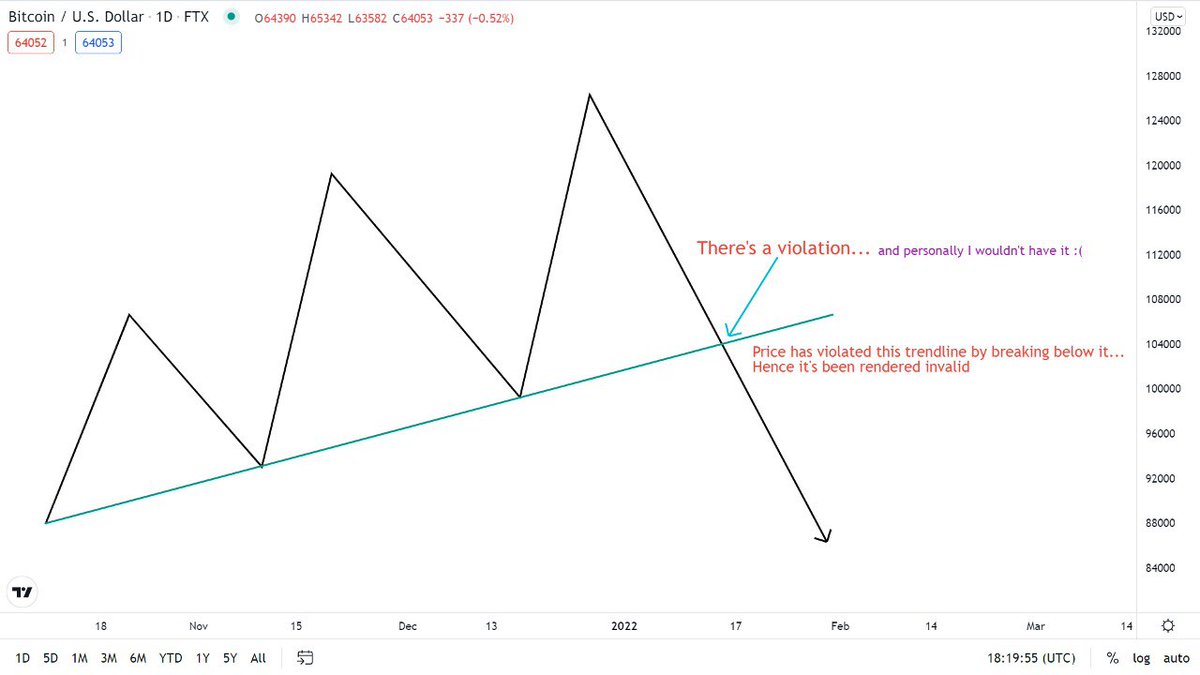

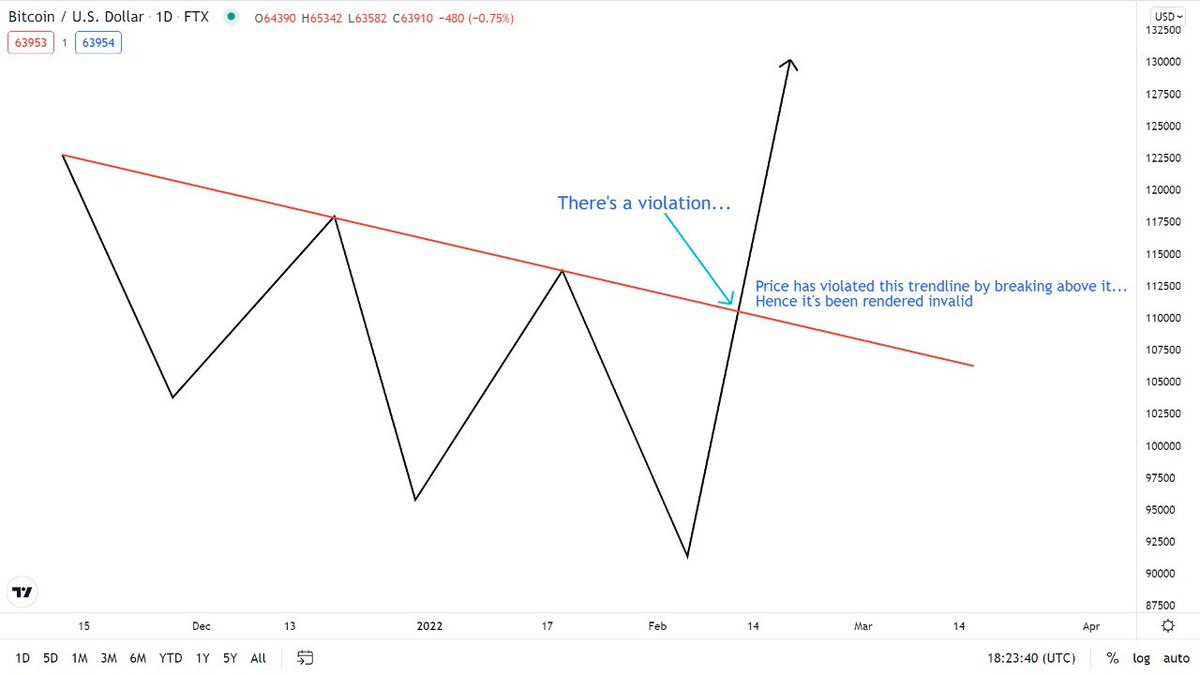

Remember once a trendline is violated, it can be an early indication for a change in market direction though this isn't always the case.

A violated trendline can still serve as a counter-trading pointer.

Eg A violated bullish trendline can help you execute a sell or short..

A violated trendline can still serve as a counter-trading pointer.

Eg A violated bullish trendline can help you execute a sell or short..

position, and a violated bearish trendline can assist in executing a buy or long position.

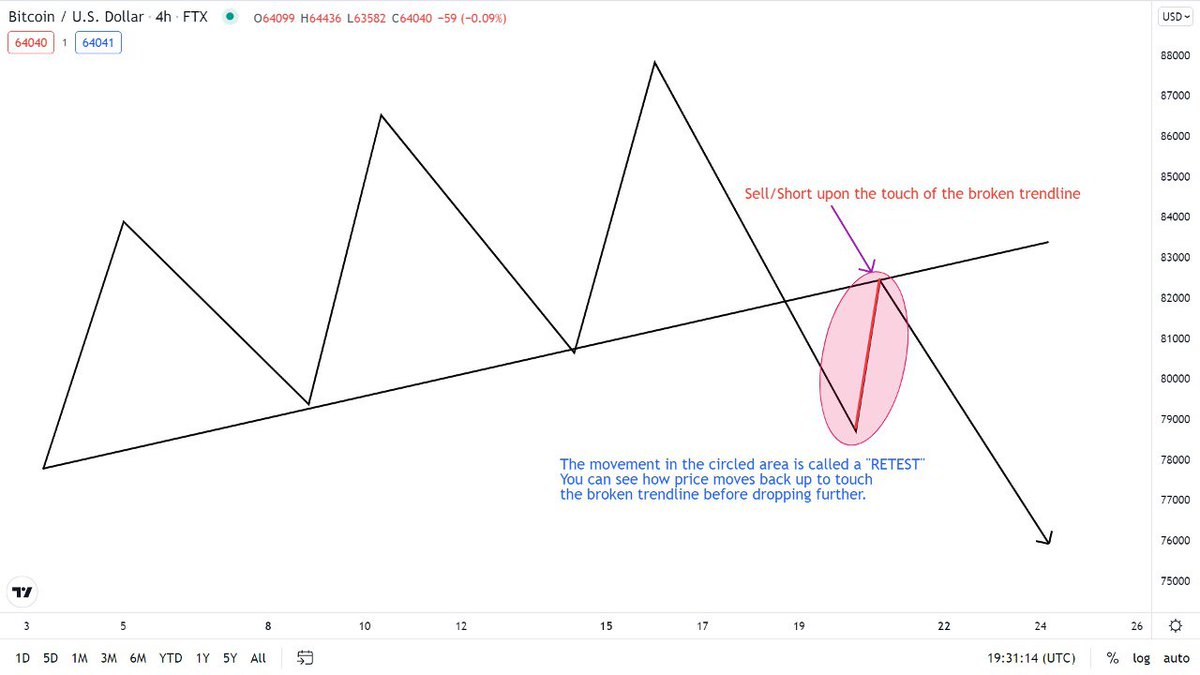

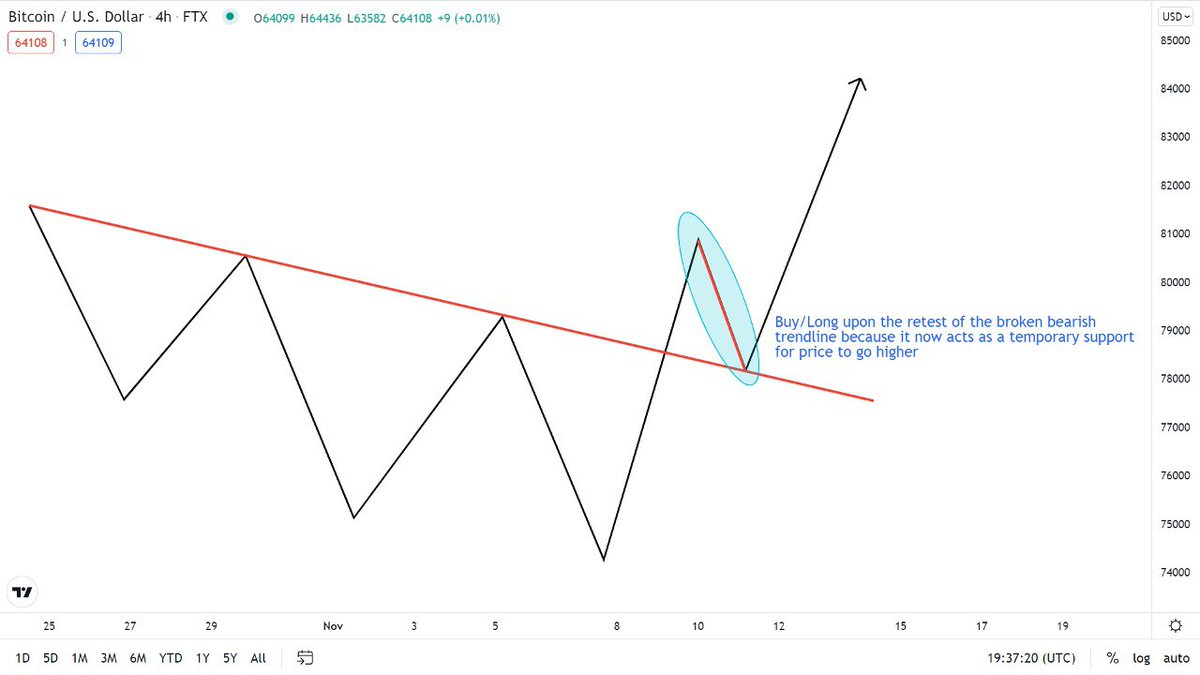

Remember how supports get broken and turns to resistance and vice versa? The same applies to bullish and bearish trendlines too, when they're violated, there is usually a retest of that...

Remember how supports get broken and turns to resistance and vice versa? The same applies to bullish and bearish trendlines too, when they're violated, there is usually a retest of that...

Now these are different strategies inside a single strategy lol.

There are several trading strategies out there but you don't need to complicate things by trying to know them all, you'll suffer from information paralysis as you'd be stuck on what decision to make due to knowing

There are several trading strategies out there but you don't need to complicate things by trying to know them all, you'll suffer from information paralysis as you'd be stuck on what decision to make due to knowing

"too much".

Achieving consistent results with just a trading strategy can put you ahead of millions of traders, so many claim to know how to trade when in fact they can't and all they do is copytrade others.

There's no need to have complicated charts, simple and easy does it!

Achieving consistent results with just a trading strategy can put you ahead of millions of traders, so many claim to know how to trade when in fact they can't and all they do is copytrade others.

There's no need to have complicated charts, simple and easy does it!

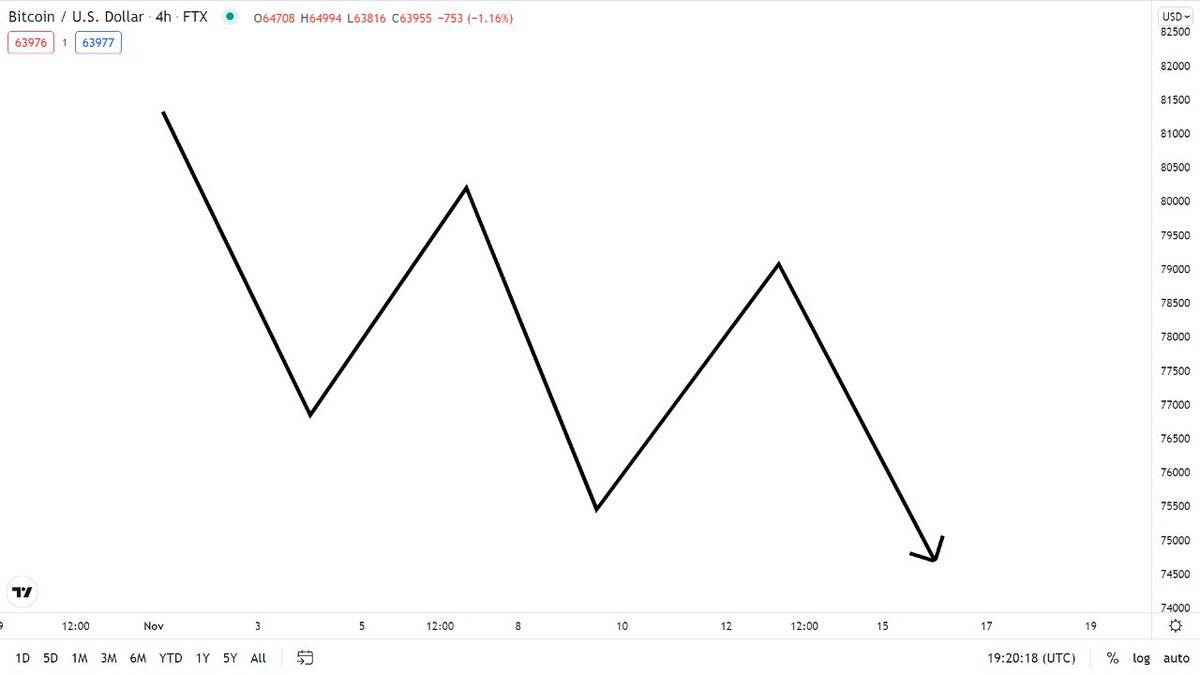

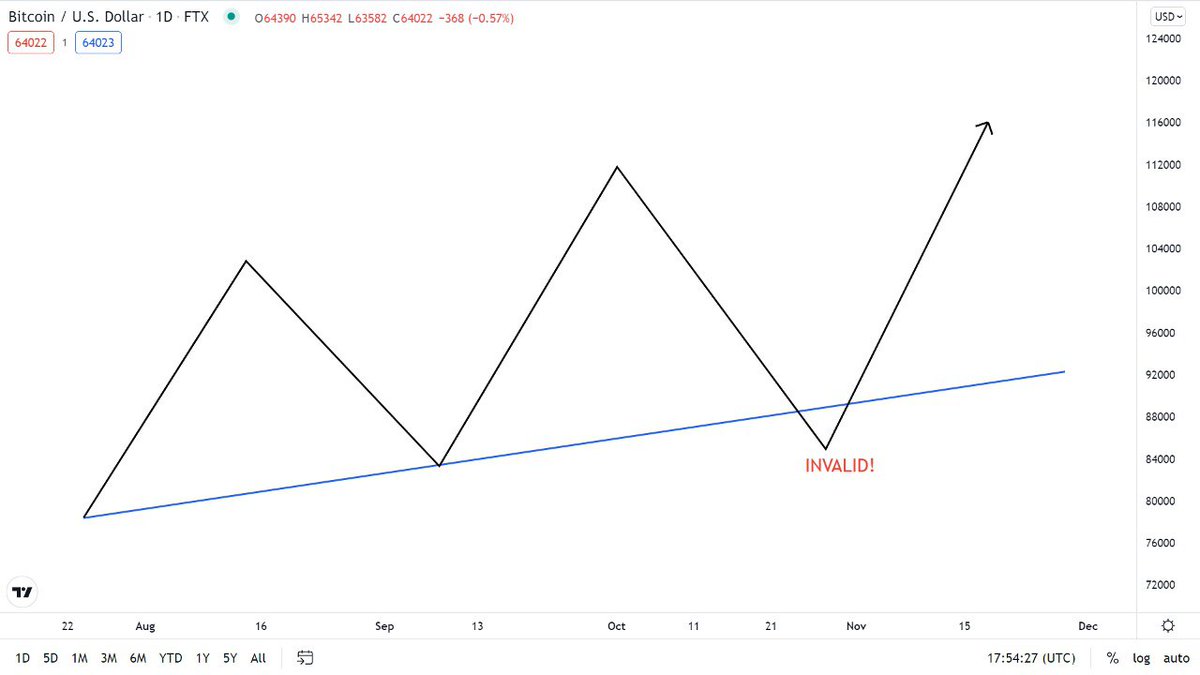

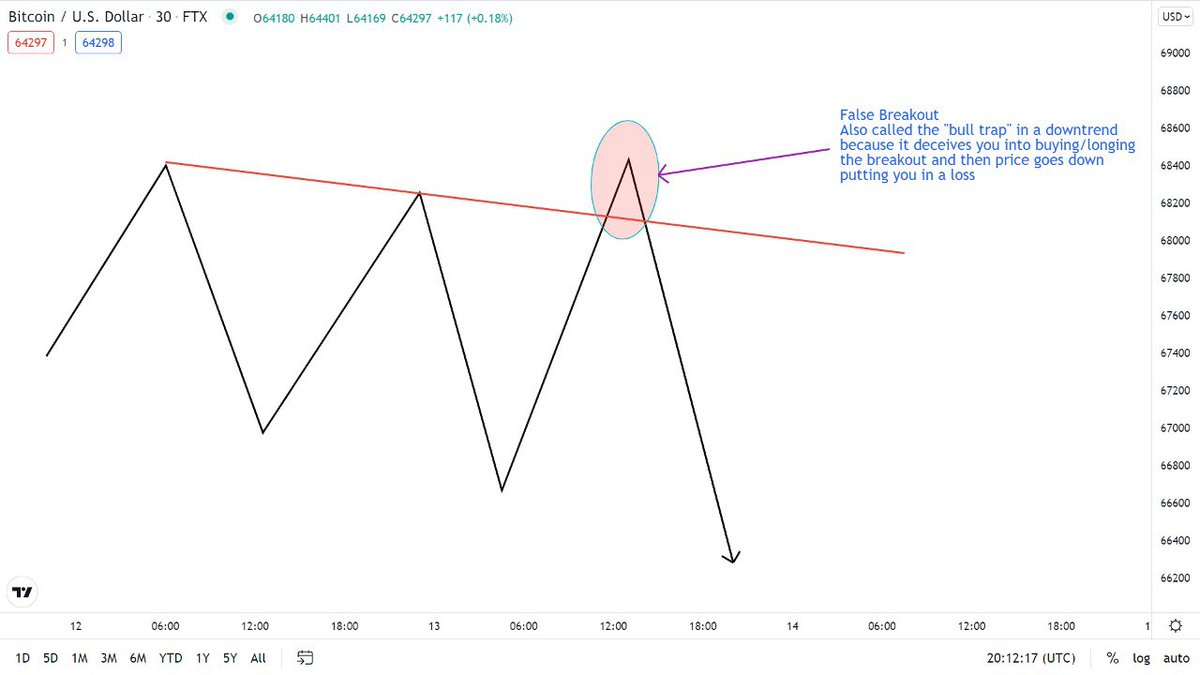

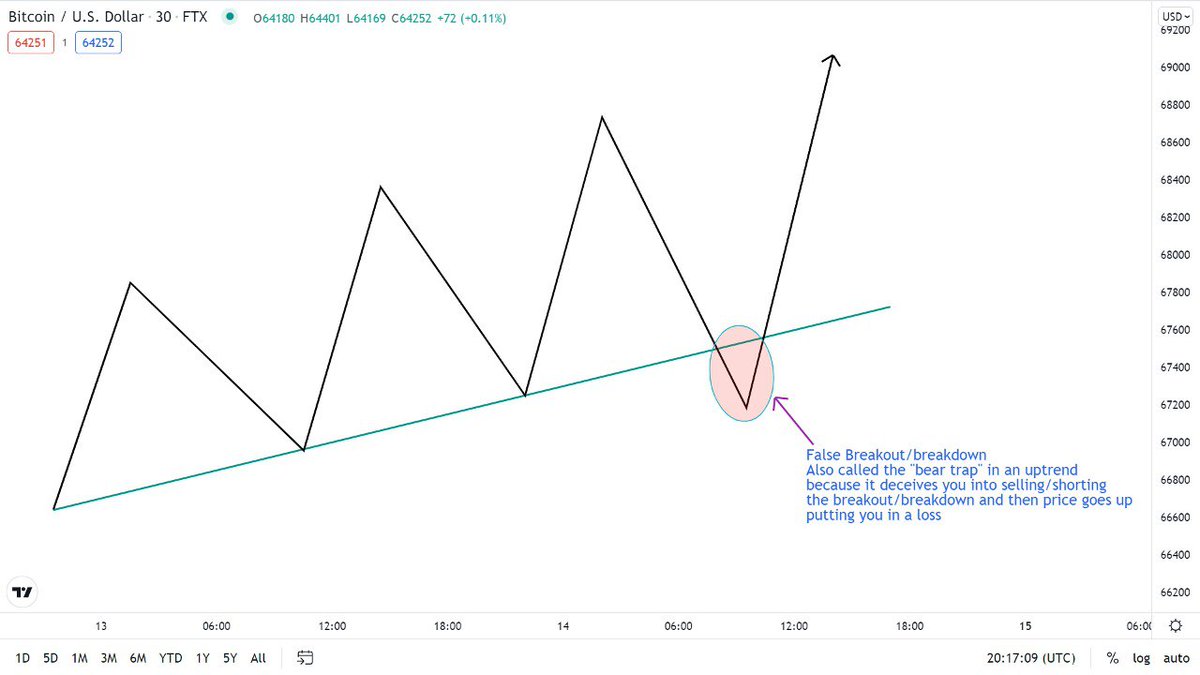

With that being said, let's proceed to the last part of this lecture which is "False breakouts".

Your decision can fail you when it comes to trading, it's all 50-50 hence you must be versatile.

Remember you're not in the market to be right, you're in the market to make money!

Your decision can fail you when it comes to trading, it's all 50-50 hence you must be versatile.

Remember you're not in the market to be right, you're in the market to make money!

How do you trade Fakeouts?

You never really can because you don't control price, but your best bet is to wait for a retest of the trendline before you execute & if the action turns out to be false, you take your "L" and move. You can't win always, no strategy is 100% guaranteed.

You never really can because you don't control price, but your best bet is to wait for a retest of the trendline before you execute & if the action turns out to be false, you take your "L" and move. You can't win always, no strategy is 100% guaranteed.

Now I want you to pick some pairs on your trading app and analyze them.

Look for these things I've taught you in the charts, and trade with this strategy over and over again, you may not get it all right at first but with consistency it'll all become clearer and you'll be better

Look for these things I've taught you in the charts, and trade with this strategy over and over again, you may not get it all right at first but with consistency it'll all become clearer and you'll be better

We've come to the end of this lecture, I'll still teach more strategies on this especially How to integrate Support and Resistance with Trendline trading to give you a clearer understanding of the chart and getting clean trades.

That'll be our next topic.

That'll be our next topic.

Till then I remain your favorite Crypto Coach and Analyst @ThePaulOla

Follow & turn on post notifications for more trading updates and lectures.

You can also Join my Telegram channel where we discuss crypto and drop gems.👇

T.me

To your trading success.💙

Follow & turn on post notifications for more trading updates and lectures.

You can also Join my Telegram channel where we discuss crypto and drop gems.👇

T.me

To your trading success.💙

Loading suggestions...