1/ Traditional Banking System

Before we understand #defi lets talk about Centralized Finance (CeFi) our current financial system where the authorities control and set the rules for the industry. So when you use CeFi, you put your trust in the authorities like banks or the Govt.

Before we understand #defi lets talk about Centralized Finance (CeFi) our current financial system where the authorities control and set the rules for the industry. So when you use CeFi, you put your trust in the authorities like banks or the Govt.

2/ This model worked well in the last century but the Global Recession revealed its flaws. The balance sheet problems of a few large over leveraged financial institutions resulted in a global recession through which millions were impacted and huge bailouts resulted in inflation

3/ Enter #Defi

Decentralized finance is a term for financial services using blockchains rather than centrally controlled institutions. With DeFi, you can do most of the things that banks support - earn interest, lend, insurance rather than going through banks its peer to peer

Decentralized finance is a term for financial services using blockchains rather than centrally controlled institutions. With DeFi, you can do most of the things that banks support - earn interest, lend, insurance rather than going through banks its peer to peer

4/ In DeFi, there is no central point of control. There is no authority governing how the system functions. It democratizes the system by giving all the power to the community. This is powered by Smart contracts ensuring #defi does not have any thirdparty interference and is fair

5/ History of Defi

Term DeFi, short for decentralized finance, was born in an Aug'18 chat between #Ethereum devs and entrepreneurs including Inje Yeo of Set Protocol, Blake Henderson of 0x and Brendan Forster of Dharma. Henderson said DeFi worked well, as it “comes out as DEFY.”

Term DeFi, short for decentralized finance, was born in an Aug'18 chat between #Ethereum devs and entrepreneurs including Inje Yeo of Set Protocol, Blake Henderson of 0x and Brendan Forster of Dharma. Henderson said DeFi worked well, as it “comes out as DEFY.”

6/ While #Defi was in existence from much earlier, 2020 became the starting point of the modern DeFi market as Covid raged across the globe and CeFi system buckled. DeFi apps like lending, yield farming, insurance gave people who lost their jobs another way to earn passive income

8/ #Defi has become a massive industry with over 270 billion locked with most blockchains supporting Defi and newer more sophisticated ones coming up every day with more services and functionality being introduced regularly

8/ Important DeFi Concepts

A/ Decentralized Exchanges (DEX's)

A decentralised exchange (DEX) is one through which crypto trxns are made without the involvement of a middleman and this is where the #defi trxns mostly happen, they use smart contracts and are peer to peer

A/ Decentralized Exchanges (DEX's)

A decentralised exchange (DEX) is one through which crypto trxns are made without the involvement of a middleman and this is where the #defi trxns mostly happen, they use smart contracts and are peer to peer

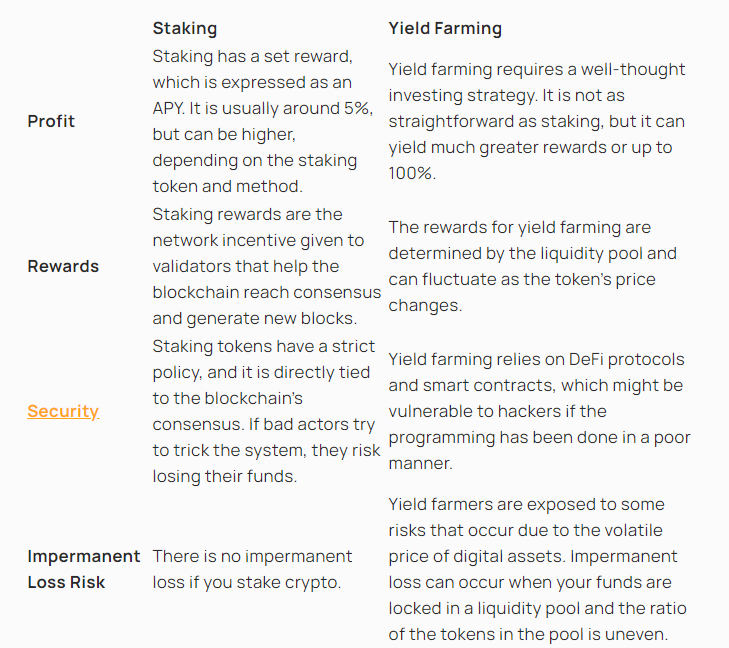

C/ Staking

Staking is the process of locking your crypto for a period of time in exchange for fixed rewards, this works like a fixed deposit in a bank. These locked funds help Proof of Stake based blockchains like #ada to support trxn. validation, security and maintenance etc.

Staking is the process of locking your crypto for a period of time in exchange for fixed rewards, this works like a fixed deposit in a bank. These locked funds help Proof of Stake based blockchains like #ada to support trxn. validation, security and maintenance etc.

D/ Yield Farming

Yield farming is a newer concept than staking through which we can lend our funds using liquidity pools and receive rewards which are usually higher than staking. this started in 2020 when #Compound launched it but today there are many projects offering this

Yield farming is a newer concept than staking through which we can lend our funds using liquidity pools and receive rewards which are usually higher than staking. this started in 2020 when #Compound launched it but today there are many projects offering this

E/ TVL, APY and APR

TVL is the total value locked, basically the dollar value of the crypto locked in a #defi protocol.

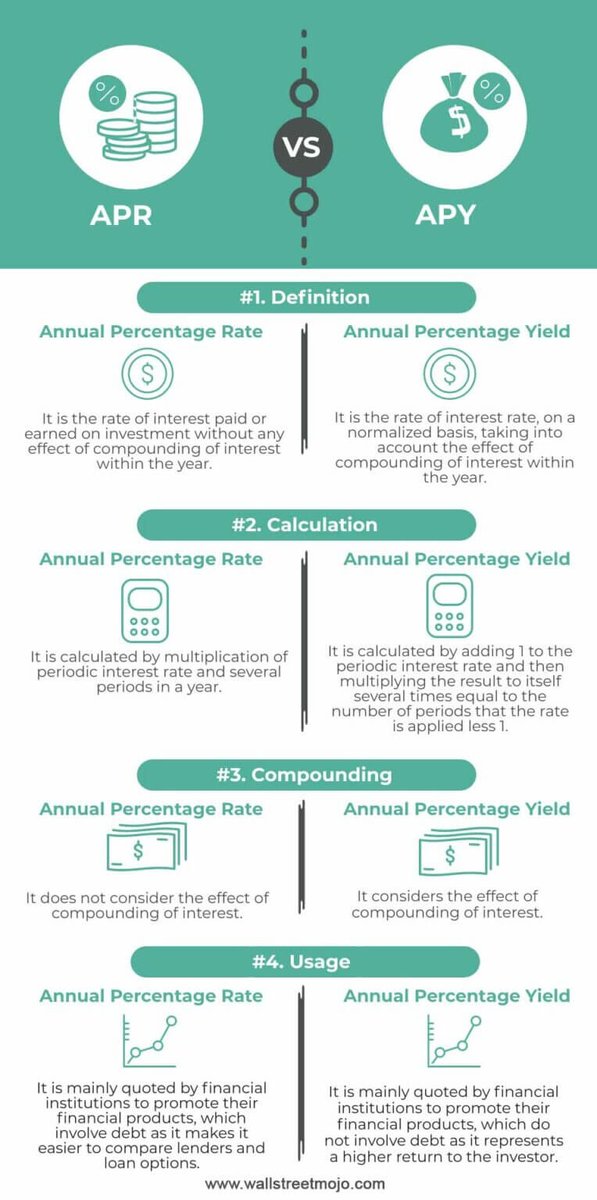

APR is the annual percentage rate which is the interest you earn for depositing your crypto in a farm.

TVL is the total value locked, basically the dollar value of the crypto locked in a #defi protocol.

APR is the annual percentage rate which is the interest you earn for depositing your crypto in a farm.

F/ Impermanent Loss

One of the biggest risk with farming. IL means that a liquidity provider would have been better off holding their tokens rather than depositing them to a pool, basically opportunity cost. Detailed article below

medium.com

One of the biggest risk with farming. IL means that a liquidity provider would have been better off holding their tokens rather than depositing them to a pool, basically opportunity cost. Detailed article below

medium.com

11/ How to Get Started in DeFi?

To access Defi you need to setup a crypto wallet like metamask, trustwallet etc, then decide which protocol you would like to invest in ...do see my videos to get an understanding of how you can setup a crypto wallet and access farming protocols

To access Defi you need to setup a crypto wallet like metamask, trustwallet etc, then decide which protocol you would like to invest in ...do see my videos to get an understanding of how you can setup a crypto wallet and access farming protocols

12a/ Benefits of #Defi

A/ Inclusive and Open: All you need is a cryptowallet to get started, no paperwork required

B/ Anonymous: You don’t need to provide your name, email address, or any personal information to access the Defi Protocols

A/ Inclusive and Open: All you need is a cryptowallet to get started, no paperwork required

B/ Anonymous: You don’t need to provide your name, email address, or any personal information to access the Defi Protocols

C/ No middlemen: #Defi purely works on smart contracts, there are no middle parties like banks and brokerages thus saving you lot of expensive fees and hassles

D/ Transparent: Everyone involved can see the full set of transactions (Banks rarely grant that kind of transparency)

D/ Transparent: Everyone involved can see the full set of transactions (Banks rarely grant that kind of transparency)

B/ Regulatory Uncertainty - there is a lot of regulatory uncertainly especially after the US infra bill passed whether #defi will be allowed to operate anonymously and its clear that stricter regulations will impact the sector negatively

C/ Volatility - Defi protocols can sometimes become very volatile as seen during the "Black Thursday" on 12 Mar 2020, when millions got liquidated due to $Eth falling 30% in a day. One of the most impacted was #Maker which lost significant value resulting in losses for millions

14/ Final word:

DeFi takes the basic premise of Bitcoin and provides an alternative to the traditional banking system but in a decentralized way. This has the potential to create more open, free, fair financial markets that are accessible to anyone with an internet connection

DeFi takes the basic premise of Bitcoin and provides an alternative to the traditional banking system but in a decentralized way. This has the potential to create more open, free, fair financial markets that are accessible to anyone with an internet connection

Even though events like Black Thursday can be quite severe the whole DeFi ecosystem is becoming more robust each day. Defi is filled with opportunities to reap huge rewards and presents a great opportunity to earn passive income if you understand the risks & plan for the risks

And if you liked this thread do like and retweet so that we more people can understand #defi just a little bit more :)

جاري تحميل الاقتراحات...