#WeeklyIndexCheck CW44/2021

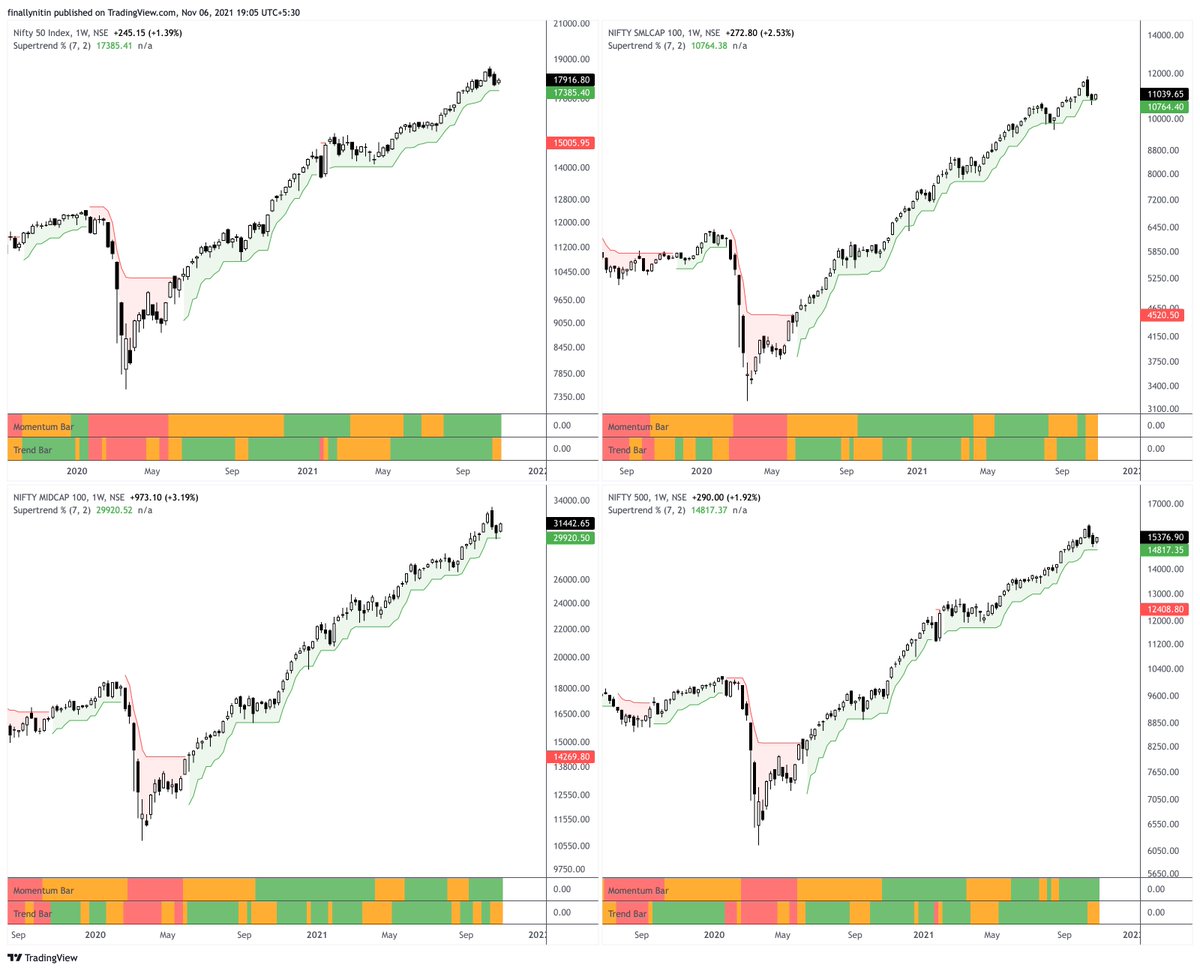

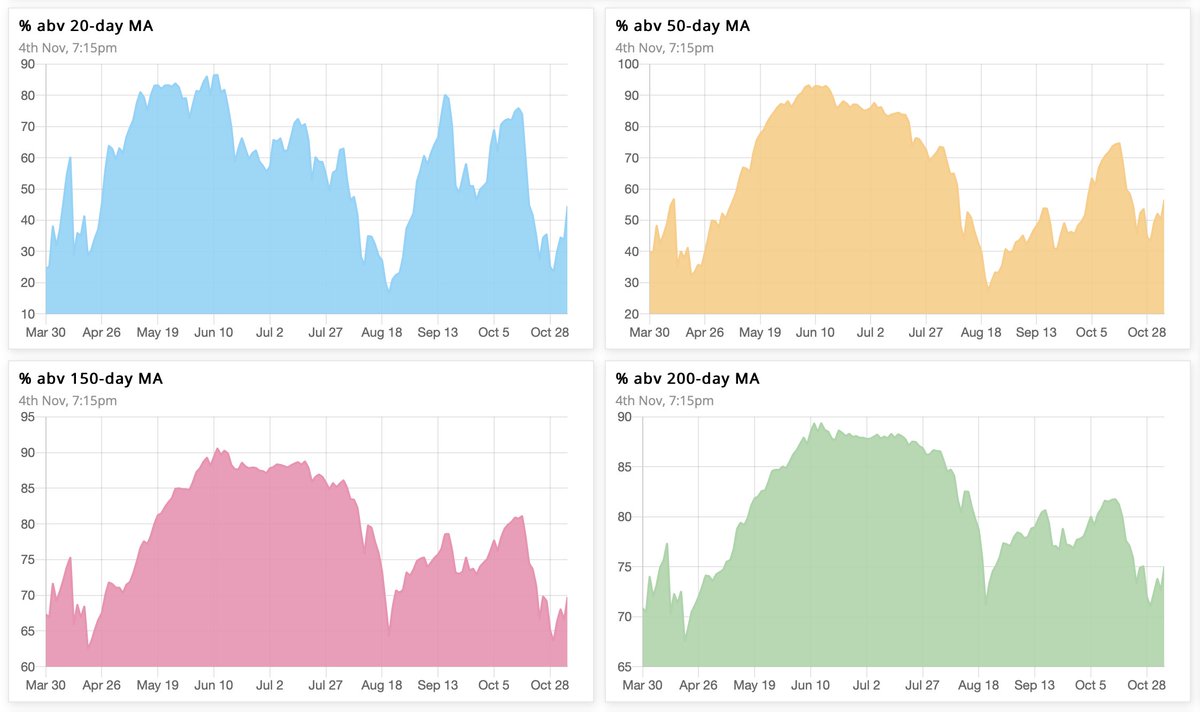

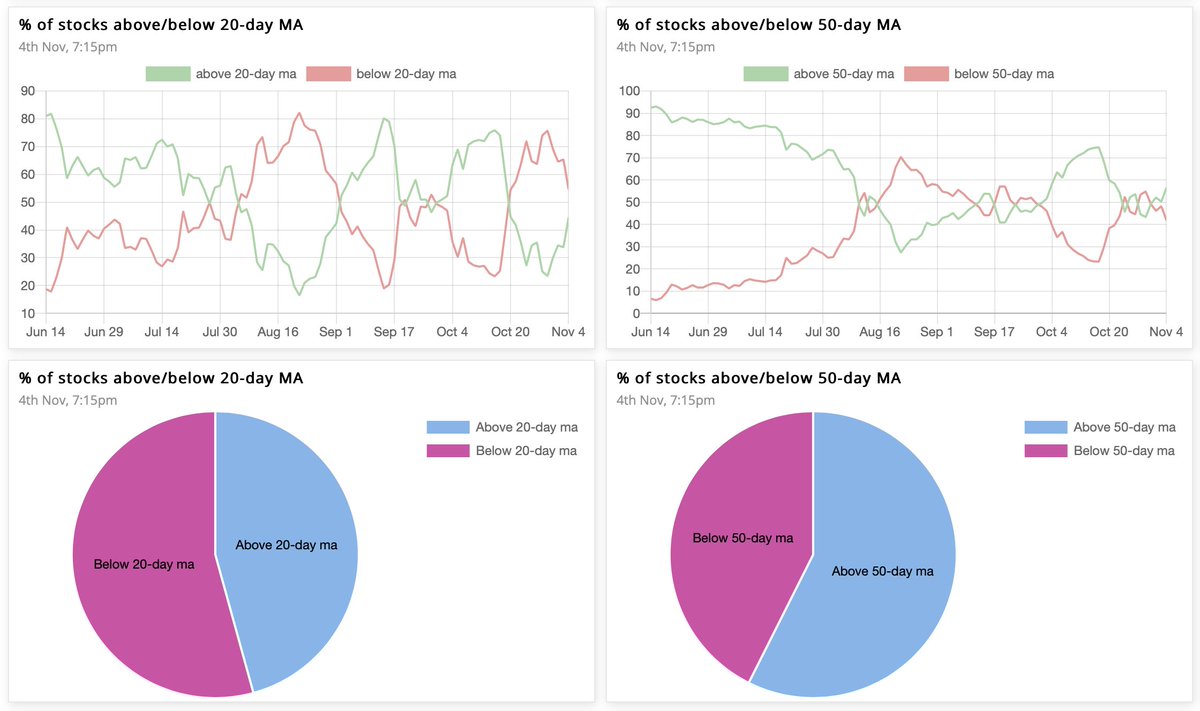

Uptrend under pressure. Momentum still lost in Smallcaps, pharma, metal, IT, MNC, Next-50, Commodities & FMCG. Consumption index joins this red list this week. Market breadth still a bit weak, but recovering.

Uptrend under pressure. Momentum still lost in Smallcaps, pharma, metal, IT, MNC, Next-50, Commodities & FMCG. Consumption index joins this red list this week. Market breadth still a bit weak, but recovering.

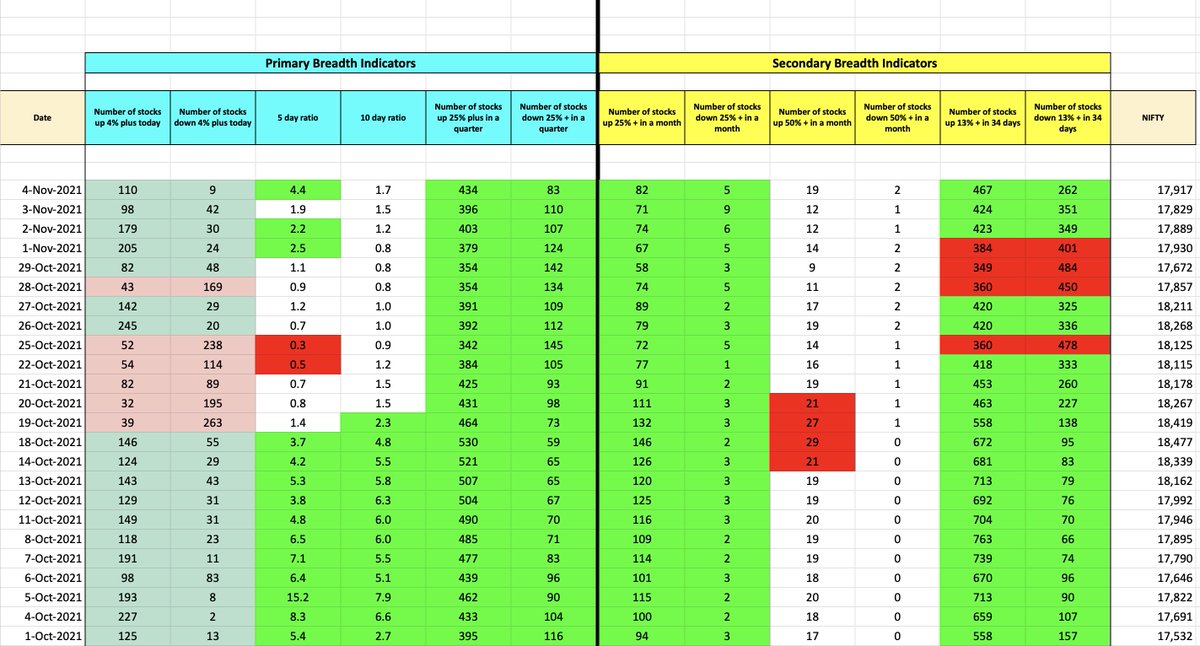

On a modified Stockbee market monitor, The 10-day ratio is 1.7. Value >2 will signal beginning of a bull move. Overall, market is bullish as Q25bull is >Q25bear

Many thanks to @PradeepBonde

for allowing me to adapt this for Indian markets.

Please consider this still in ‘beta’

Many thanks to @PradeepBonde

for allowing me to adapt this for Indian markets.

Please consider this still in ‘beta’

Loading suggestions...