#MACD is a common indicator which most of us use in the stock market.

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝑴𝑨𝑪𝑫"

Like👍 & Retweet🔁for wider reach and for more such learning thread in the future.

Also, a trading strategy is shared in the end.

1/16

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝑴𝑨𝑪𝑫"

Like👍 & Retweet🔁for wider reach and for more such learning thread in the future.

Also, a trading strategy is shared in the end.

1/16

Before going ahead, those who want to understand what MACD indicator is and what was its history?

They can read about this in the link below👇

investopedia.com

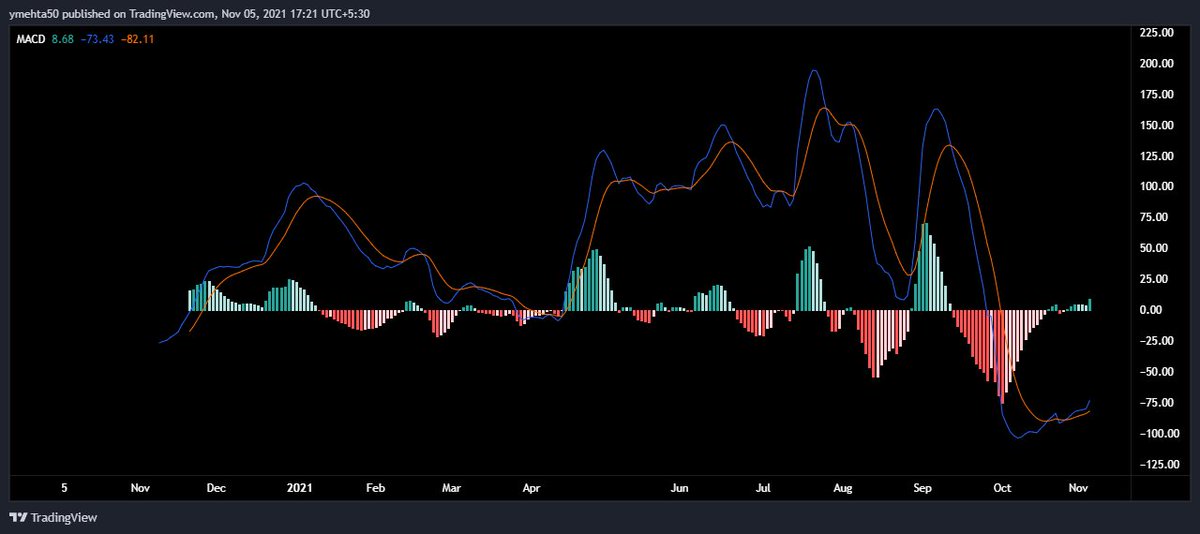

An image of how MACD indicator looks like is shared.

2/16

They can read about this in the link below👇

investopedia.com

An image of how MACD indicator looks like is shared.

2/16

It is not recommended to use MACD as a single indicator. It can be used as a supporting indicator for confirmation.

One can add some more additional rules in MACD like:

Buy a stock if MACD crosses above 0 and sell/exit a stock if MACD crosses below 0.

6/16

One can add some more additional rules in MACD like:

Buy a stock if MACD crosses above 0 and sell/exit a stock if MACD crosses below 0.

6/16

MACD can be used in any time frame (1 minutes to Monthly time frame). Lesser the time frame there would be more noise.

If one uses higher time frame like Monthly or Weekly chart, then one would get less noise and a smooth move in price.

7/16

If one uses higher time frame like Monthly or Weekly chart, then one would get less noise and a smooth move in price.

7/16

Another Setup is Divergence, and it is similar to the RSI Divergence that we have studied.

There are same two types of common Divergence:

1. Bullish Divergence

2. Bearish Divergence

Divergence is used by the traders who like to take contra trade.

8/16

There are same two types of common Divergence:

1. Bullish Divergence

2. Bearish Divergence

Divergence is used by the traders who like to take contra trade.

8/16

Now sharing a last setup which I use sometime for short-term trading.

Following things is used:

1. Heiken Ashi Candle (Reduces Noise from chart)

2. MACD Indicator

Those who want to understand about Heiken Ashi Candles can go through this link👇

investopedia.com

11/16

Following things is used:

1. Heiken Ashi Candle (Reduces Noise from chart)

2. MACD Indicator

Those who want to understand about Heiken Ashi Candles can go through this link👇

investopedia.com

11/16

Buying Setup:

1. Price should be in Downtrend.

2. Three Consecutive Bullish Heiken Ashi Candle should be formed.

3. MACD bullish Crosssover and that too below 0 line.

4. Bullish Divergence is a bonus (This is optional)

All condition must satisfy in buying setup.

12/16

1. Price should be in Downtrend.

2. Three Consecutive Bullish Heiken Ashi Candle should be formed.

3. MACD bullish Crosssover and that too below 0 line.

4. Bullish Divergence is a bonus (This is optional)

All condition must satisfy in buying setup.

12/16

Exit Setup:

1. MACD Bearish Crossover happens above 0 line or if MACD goes below 0 line.

2. Three consecutive Bearish Heiken Ashi Candles

One can customise exit setup as:

1. If all condition satisfy then exit or If anyone condition satisfies then exit

13/16

1. MACD Bearish Crossover happens above 0 line or if MACD goes below 0 line.

2. Three consecutive Bearish Heiken Ashi Candles

One can customise exit setup as:

1. If all condition satisfy then exit or If anyone condition satisfies then exit

13/16

Same setup for short-term trading can be used in Daily or Monthly Time Frame as well.

Avoid using it Intraday setup as it will give whipsaws because of noise.

This is not a holy grail strategy so follow exit strategy.

Book loss immediately if exit strategy is satisfied.

15/16

Avoid using it Intraday setup as it will give whipsaws because of noise.

This is not a holy grail strategy so follow exit strategy.

Book loss immediately if exit strategy is satisfied.

15/16

I hope everyone got an essence of how MACD can be used.

These are not a universal rules one must follow. One can create their rule, tweak it or follow someone else rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

16/16

These are not a universal rules one must follow. One can create their rule, tweak it or follow someone else rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

16/16

Loading suggestions...