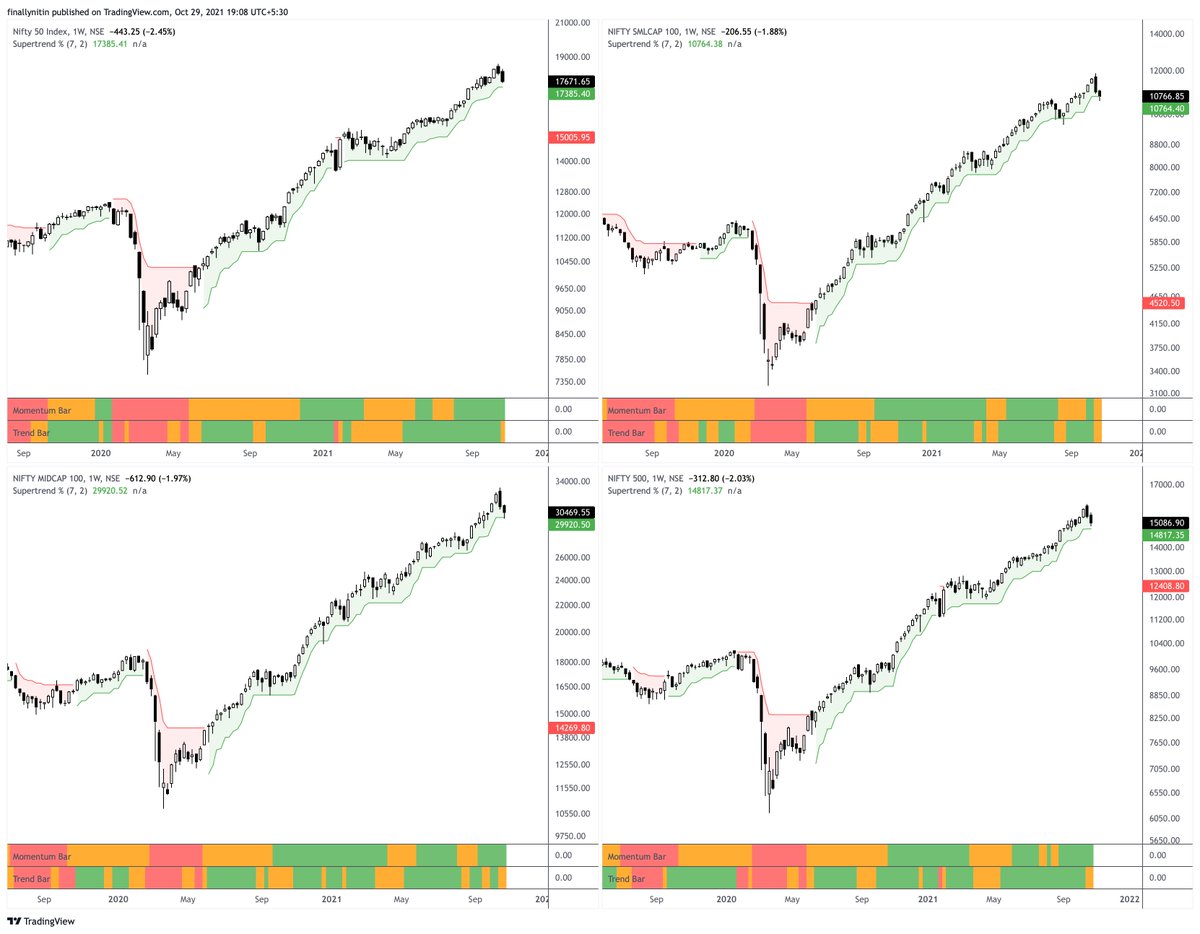

#WeeklyIndexCheck CW43/2021

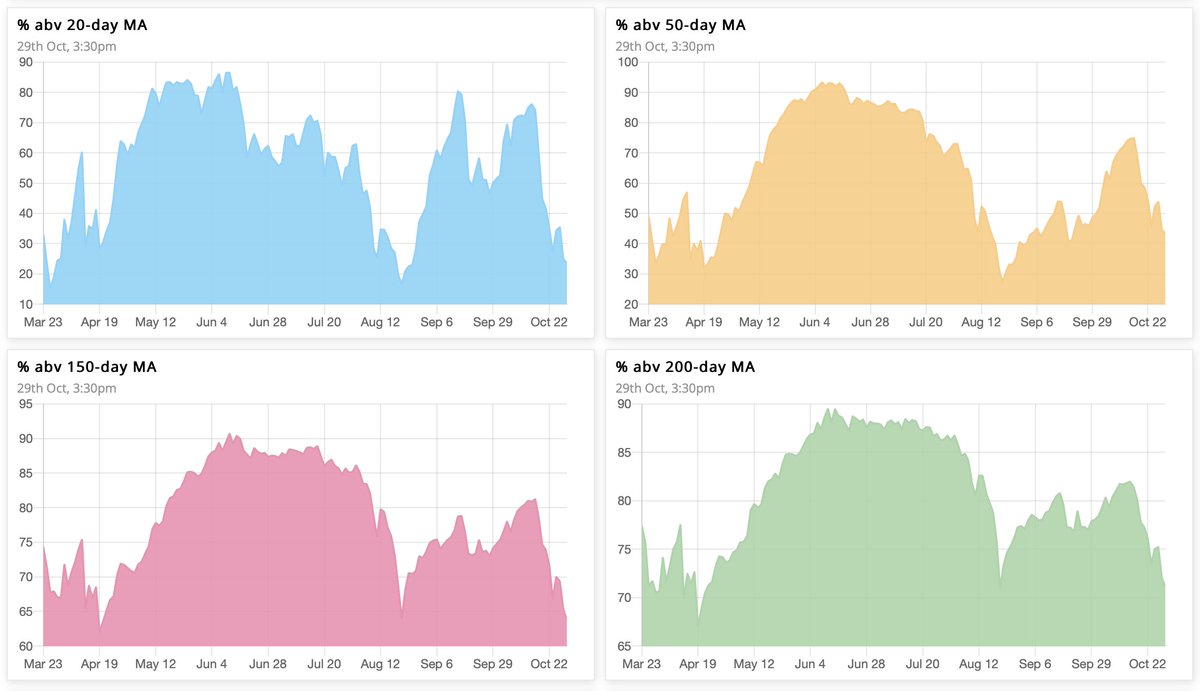

Uptrend under pressure. Smallcap, IT & Next-50 index losing momentum. FMCG & Consumption indices no longer in uptrend. Market breadth is quite weak.

Uptrend under pressure. Smallcap, IT & Next-50 index losing momentum. FMCG & Consumption indices no longer in uptrend. Market breadth is quite weak.

Loading suggestions...