There are 2 forms one can start investing in Gold

- Digital Gold (#SGB, #mutualfunds , ETFs, Mining funds)

- Physical Gold (Gold coins, bars)

I am not considering jewelry ornaments as an investment due to various charges & reduced purity of Gold (not 24 ckt)

2/n

- Digital Gold (#SGB, #mutualfunds , ETFs, Mining funds)

- Physical Gold (Gold coins, bars)

I am not considering jewelry ornaments as an investment due to various charges & reduced purity of Gold (not 24 ckt)

2/n

Option 3:

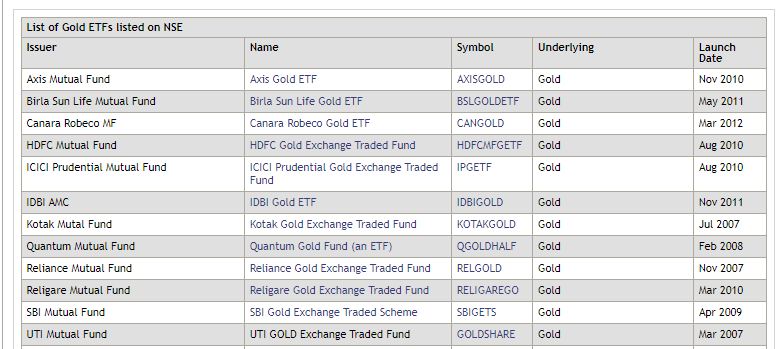

Gold Mutual Funds

Like ETFs, gold mutual funds offer flexibility to buy value of gold online & sell online. You do not own the gold, but you can get similar returns of physical gold.

Benefit of Gold mutual funds is it offers SIP investment as low as 500 rupees

5/n

Gold Mutual Funds

Like ETFs, gold mutual funds offer flexibility to buy value of gold online & sell online. You do not own the gold, but you can get similar returns of physical gold.

Benefit of Gold mutual funds is it offers SIP investment as low as 500 rupees

5/n

Option 4:

Physical Gold

Gold bars & coins have always been dearest option for traditional Indian households

One way of investing is by buying them during online sales through e-commerce sites

With bank discounts etc. one can get 200-400 discount/gm from the market price

6/n

Physical Gold

Gold bars & coins have always been dearest option for traditional Indian households

One way of investing is by buying them during online sales through e-commerce sites

With bank discounts etc. one can get 200-400 discount/gm from the market price

6/n

Option 4:

Physical Gold

Pros:

No additional charges - only the gold price

No Demat account is needed

Hypothecated for taking loans

Cons:

Need to check and verify quality

Risk of theft

7/n

Physical Gold

Pros:

No additional charges - only the gold price

No Demat account is needed

Hypothecated for taking loans

Cons:

Need to check and verify quality

Risk of theft

7/n

Option 5:

Gold Mining funds

These are some what new & relatively different form of investing. Often gold mining value co-relates to the price of actual gold. If we cannot invest directly into mines like that, one can use the mutual funds to start investing from Rs. 1000

8/n

Gold Mining funds

These are some what new & relatively different form of investing. Often gold mining value co-relates to the price of actual gold. If we cannot invest directly into mines like that, one can use the mutual funds to start investing from Rs. 1000

8/n

Loading suggestions...