#WeeklyIndexCheck CW40/2021

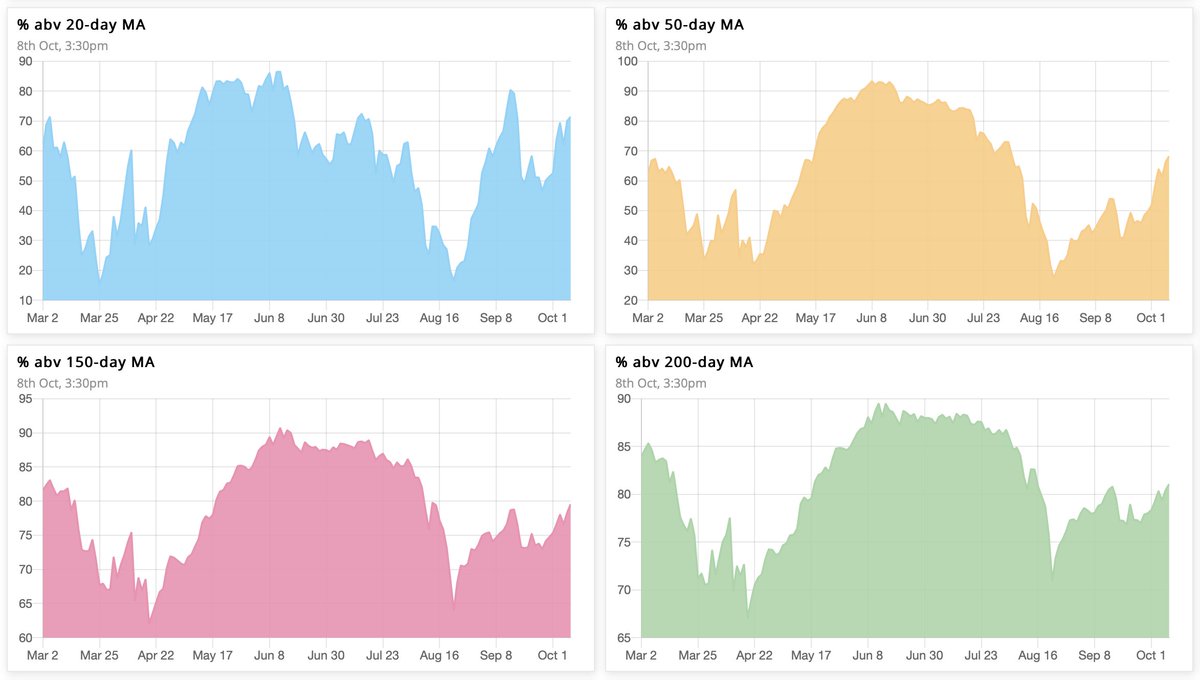

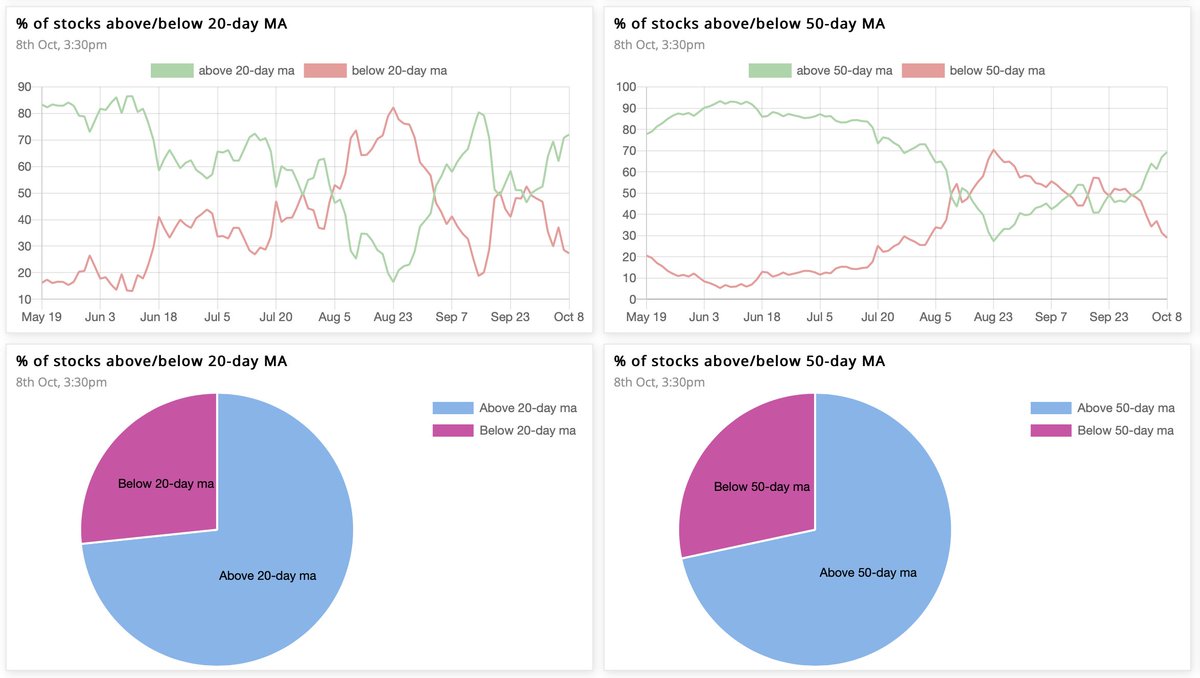

Uptrend intact. Broader markets momentum sustained. Market breadth nearing overbought on short term charts.

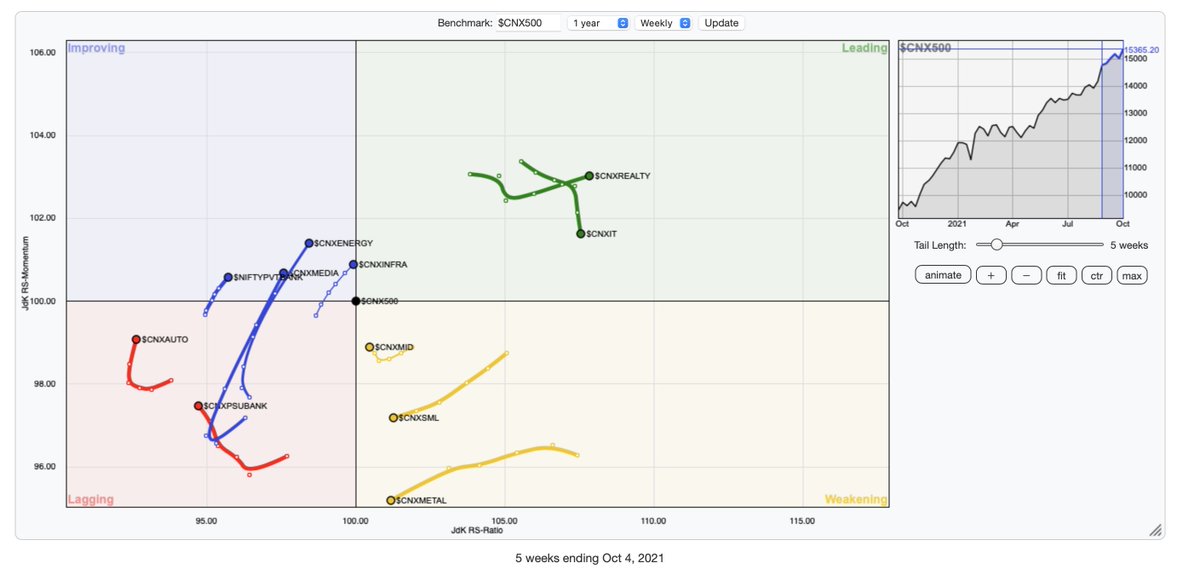

Midcaps & smallcaps still outperforming NIFTY. Smallcaps & Auto index have regained momentum.

Uptrend intact. Broader markets momentum sustained. Market breadth nearing overbought on short term charts.

Midcaps & smallcaps still outperforming NIFTY. Smallcaps & Auto index have regained momentum.

Loading suggestions...