▪️ What is it?

Book explanation:

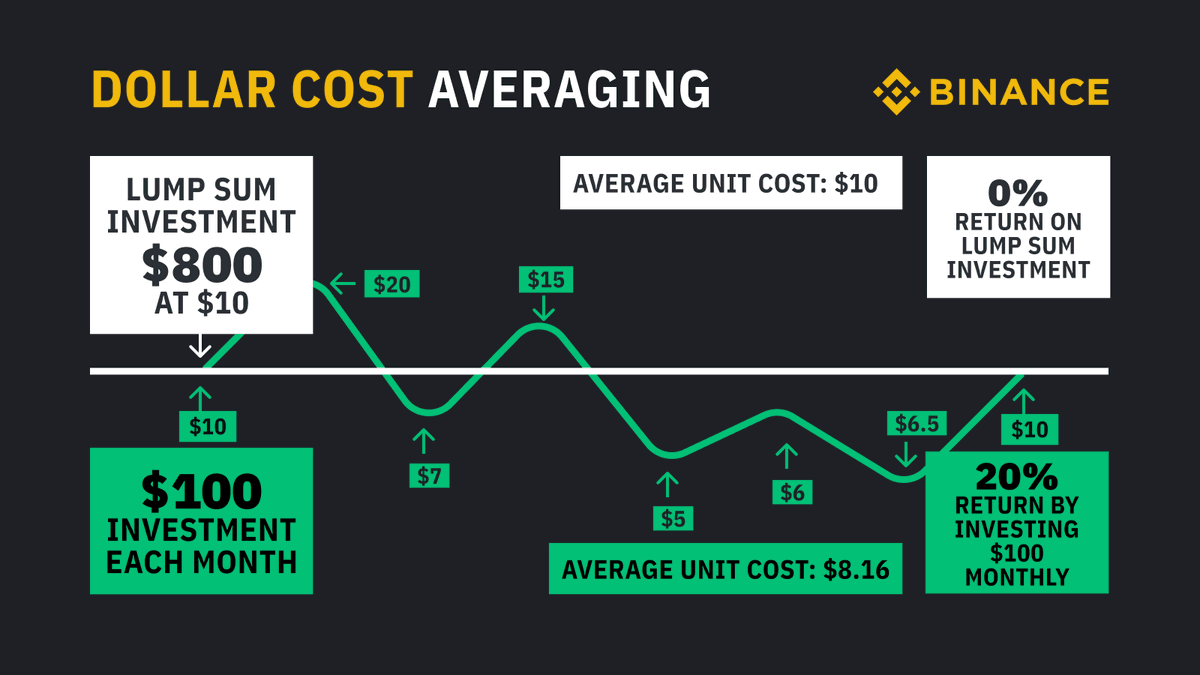

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across multiple purchases in an effort to reduce the impact of volatility on the overall purchase

2/25

Book explanation:

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across multiple purchases in an effort to reduce the impact of volatility on the overall purchase

2/25

In my own simple words, the trick is, we ain't trying to catch the precise bottom or the top.

We are merely trying to build an average price at a logical place with multiple buys or sell orders while being very close to it and still gaining immense profits.

3/25

We are merely trying to build an average price at a logical place with multiple buys or sell orders while being very close to it and still gaining immense profits.

3/25

▪️ Why is it so effective?

Because for most people catching the exact bottom or the top is a mission close to impossible.

This way we can get very close to buying the bottom & very close to selling the top and all of that with very little stress. Win-Win.

4/25

Because for most people catching the exact bottom or the top is a mission close to impossible.

This way we can get very close to buying the bottom & very close to selling the top and all of that with very little stress. Win-Win.

4/25

Most people don't have the resources to understand how bottoming structures look like.

It's also very hard to handle, both the bottoms & the tops psychologically and actually make the buys & then take the profits.

This method solves all of those problems

5/25

It's also very hard to handle, both the bottoms & the tops psychologically and actually make the buys & then take the profits.

This method solves all of those problems

5/25

▪️ Three types

There are three types to do DCA-in/out based on:

1) Percentage

2) Round numbers

3) Time

8/25

There are three types to do DCA-in/out based on:

1) Percentage

2) Round numbers

3) Time

8/25

1) Percentage-wise

This type we have described in the example above.

You merely layer your orders in a price range you wanna buy. Could be -40% to -80% for example.

2) Round numbers

You set buys at each round number

Can look like this: 40K - 35K - 30K - 25K and so on

9/25

This type we have described in the example above.

You merely layer your orders in a price range you wanna buy. Could be -40% to -80% for example.

2) Round numbers

You set buys at each round number

Can look like this: 40K - 35K - 30K - 25K and so on

9/25

A monthly period is the best for smaller amounts used for pension saving.

Yearly is better for higher investments.

For example, if you own a company and wanna safely store your profits somewhere safe for a longer period of time and avoid inflation. A good one is #Bitcoin

11/25

Yearly is better for higher investments.

For example, if you own a company and wanna safely store your profits somewhere safe for a longer period of time and avoid inflation. A good one is #Bitcoin

11/25

Let's use #Bitcoin as an example.

We understand its core values, we understand how halving works, and so on and therefore we expect it to continue to grow in Price & Value in time.

In such a market, this is one of the most effective stress-free tools you can use.

13/25

We understand its core values, we understand how halving works, and so on and therefore we expect it to continue to grow in Price & Value in time.

In such a market, this is one of the most effective stress-free tools you can use.

13/25

▪️ DCA out

Not only is this a great tool to be buying the bottoms, but it's also a great one to be selling the tops, or very close to them 😉

It works in the same way, as getting in

You set multiple layers of sell orders and make an avg sell price. Then you DCA-in again

15/25

Not only is this a great tool to be buying the bottoms, but it's also a great one to be selling the tops, or very close to them 😉

It works in the same way, as getting in

You set multiple layers of sell orders and make an avg sell price. Then you DCA-in again

15/25

This tool is good if you wanna make sure you have a position in the asset and then keep adding the rest.

Positives: It makes sure you have a big position in the asset

Negatives: Higher avg price

19/25

Positives: It makes sure you have a big position in the asset

Negatives: Higher avg price

19/25

You do not need to exit with everything you can always leave a moonbag or move some part into a longer-term hold (for many years).

You then apply the same DCA-in strategy to get into the market again when it starts dropping again into that -40 to -90% territory

23/25

You then apply the same DCA-in strategy to get into the market again when it starts dropping again into that -40 to -90% territory

23/25

This way you can outperform the market with a stress-free ride or get into a new one with a calm mind and good avg price

I highly recommend for most newcomers with less than 1-2 years experience to mainly follow this strategy until they learn about the price behavior more

24/25

I highly recommend for most newcomers with less than 1-2 years experience to mainly follow this strategy until they learn about the price behavior more

24/25

I hope you have found this thread valuable and easy to apply.

If you did, as always, please consider sharing it with your friends as they might find it helpful as well and it helps to spread the awareness

Thank you 😉🙌

#DCA #DollarCostAveraging #Strategy #Investment

25/25

If you did, as always, please consider sharing it with your friends as they might find it helpful as well and it helps to spread the awareness

Thank you 😉🙌

#DCA #DollarCostAveraging #Strategy #Investment

25/25

جاري تحميل الاقتراحات...