Some other key numbers:

Revenue FY21 - 4,157 cr

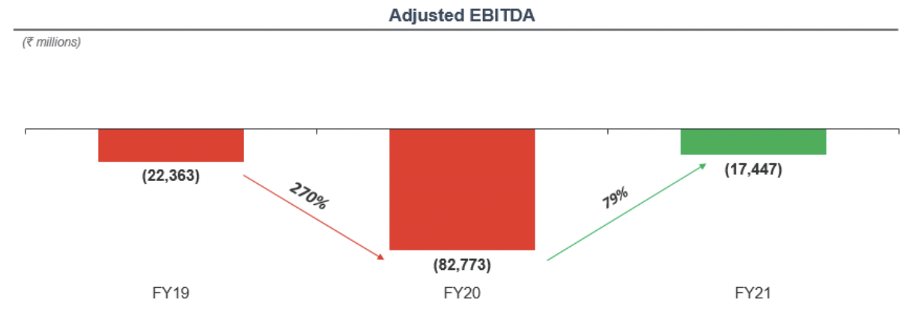

Loss FY21 - 4,102 cr

Loss FY20 - 11,080 cr

Total debt - 4,891 cr

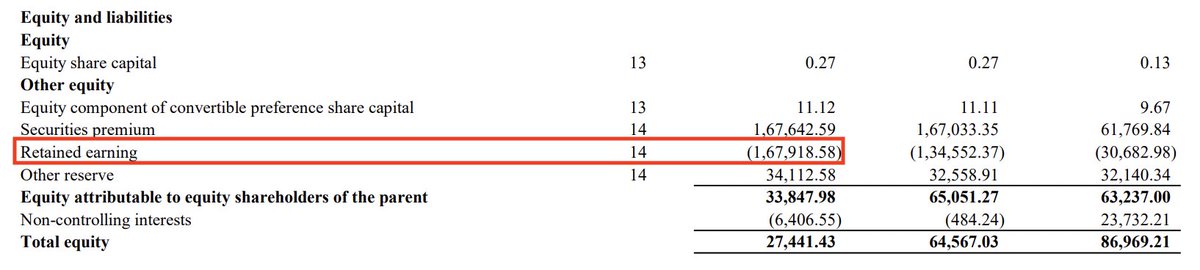

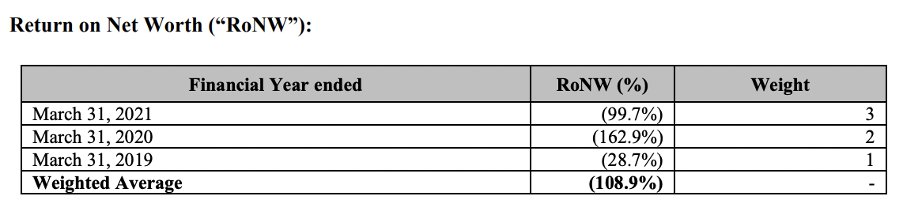

Net worth - 2,744 cr

Cash balance - 2,799 cr

3/n

Revenue FY21 - 4,157 cr

Loss FY21 - 4,102 cr

Loss FY20 - 11,080 cr

Total debt - 4,891 cr

Net worth - 2,744 cr

Cash balance - 2,799 cr

3/n

Pretty complex corporate structure

Total subsidiaries - 80

Total JVs - 40

7/n

Total subsidiaries - 80

Total JVs - 40

7/n

Yogababble

# of times mentioned in DRHP

-Technology 580

-Platform 455

-Covid 184

-Software 57

-Flywheel 8

8/n

# of times mentioned in DRHP

-Technology 580

-Platform 455

-Covid 184

-Software 57

-Flywheel 8

8/n

In summary:

- #Oyo wants to raise $ 1.2b

- At a $12b valuation

- With revenues/losses of ~$580m

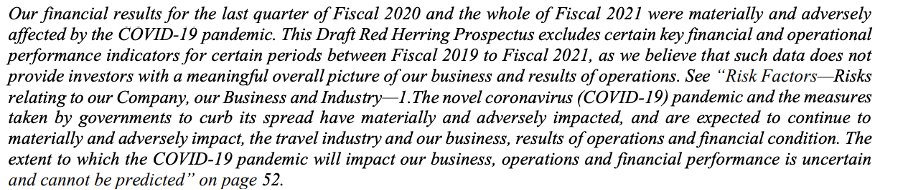

- At a time it says business has been rekt

- After burning all its investor capital

- And laying off a large % of its workforce

- And taking on large amounts of debt

/end

🦄💩🔴

- #Oyo wants to raise $ 1.2b

- At a $12b valuation

- With revenues/losses of ~$580m

- At a time it says business has been rekt

- After burning all its investor capital

- And laying off a large % of its workforce

- And taking on large amounts of debt

/end

🦄💩🔴

Please share if you found this interesting/useful!

@contrarianEPS @deepakshenoy @akm1410 @andymukherjee70

@contrarianEPS @deepakshenoy @akm1410 @andymukherjee70

Loading suggestions...