#WeeklyIndexCheck CW38/2021

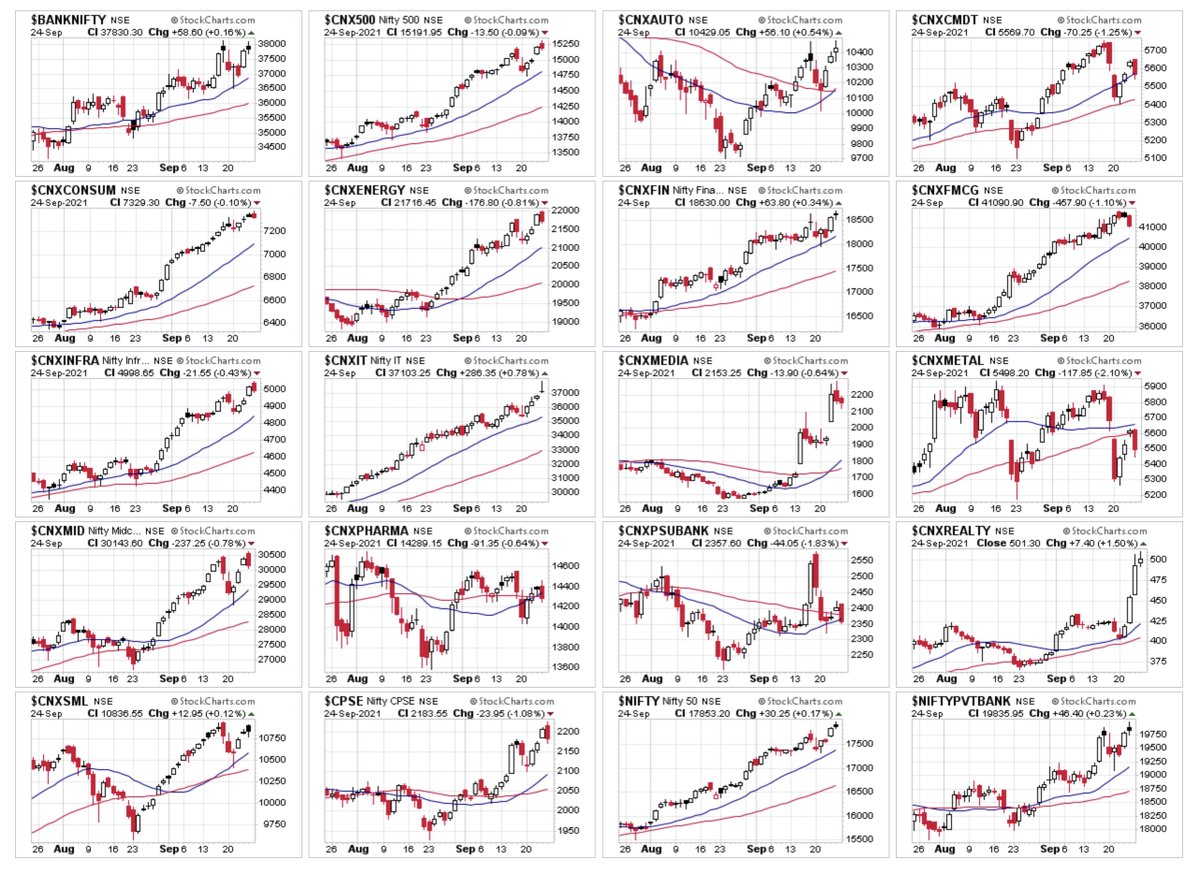

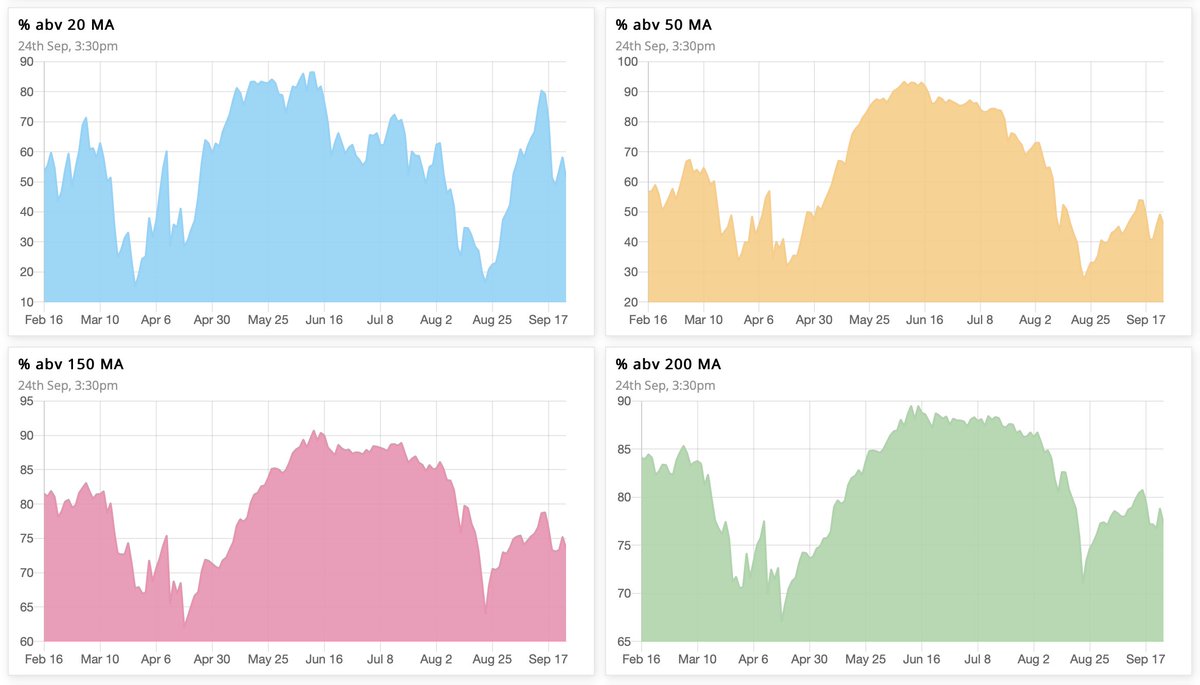

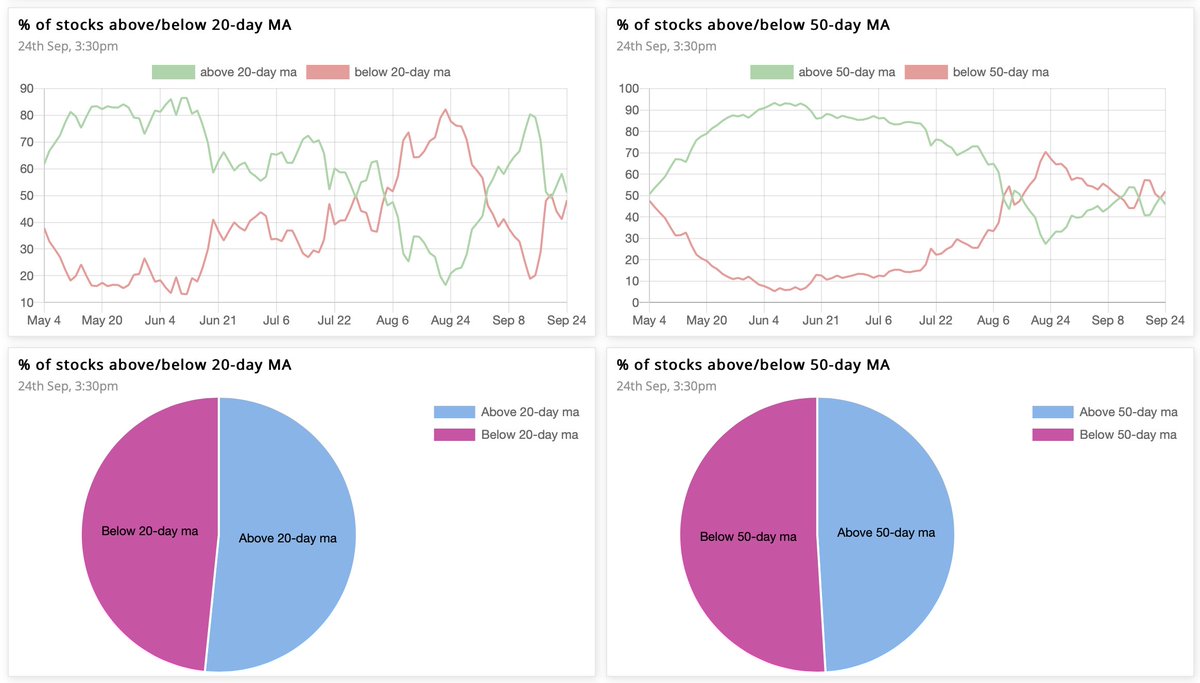

Uptrend intact. Broader markets momentum improving, but market breadth slightly worsening.

With the margin of outperformance decreasing, midcaps & smallcaps still outperforming Nifty. Smallcaps trying to regain momentum.

Uptrend intact. Broader markets momentum improving, but market breadth slightly worsening.

With the margin of outperformance decreasing, midcaps & smallcaps still outperforming Nifty. Smallcaps trying to regain momentum.

Loading suggestions...